Can you imagine your clients’ QuickBooks® accounts reconciled before tax season? In one of our recent articles, we shared a personal story of using automation to not only reconcile QuickBooks throughout the year, but to also turn a business loss into a profit within only two months.

In this article, we compare Connex’s two automatic reconciliation features in QuickBooks that help accountants grow their firms.

Many firms still rely on manual data entry and reconciliation to do their clients’ books. There are so many apps and automations out there that it is difficult to parse out which ones are reliable and a good fit for your firm.

Unfortunately, manual data entry is slow, and it also leads to errors that need to be reconciled via journal entries. Other disadvantages of manual reconciliation are that it slows down your turnaround time, and makes it difficult for you to take on more clients and scale your firm.

Could automation help your firm to provide your customers with faster turnaround time, more accurate books, and lower costs?

Based on our experience with more than 5000 e-commerce businesses and accountants, the answer is a resounding yes.

Syncing orders into QuickBooks is not enough

There are several automation platforms that sync orders to QuickBooks. Many e-commerce platforms have a native integration to QuickBooks Online so you don’t need to double enter orders.

However, getting the data into QuickBooks is only part of the solution. If your clients have a flash sale with thousands of orders, the data can be synced to QuickBooks, but matching them to payouts is a whole other story.

CEO & Founder of Sync with Connex, Joseph Anderson, founded his company in 2010 with a vision to free people from manual data entry into QuickBooks. He successfully built integrations between QuickBooks and the most popular e-commerce platforms. Although he saved his customers hundreds of hours of data entry each year, he noticed that they were overwhelmed with reconciling their books after a surge in sales.

“The week after Black Friday was always the busiest time for my team to help customers,” Joseph recalled. He also struggled with keeping his own QuickBooks Online account reconciled. Joseph paid hundreds of dollars a month for a bookkeeper, but he still had to manually create journal entries. “We must have spent 20 hours a month with QuickBooks, but sometimes we just couldn’t find a missing sale,” he said.

With its core value being “growth,” Sync with Connex has freed businesses and accountants from manual data entry so they could grow. Joseph realized that as long as he relied on manually reconciling his own books, his own company’s growth would be limited. “We already had the code to automatically bring orders into QuickBooks. I wondered if we could automatically match them to payouts.”

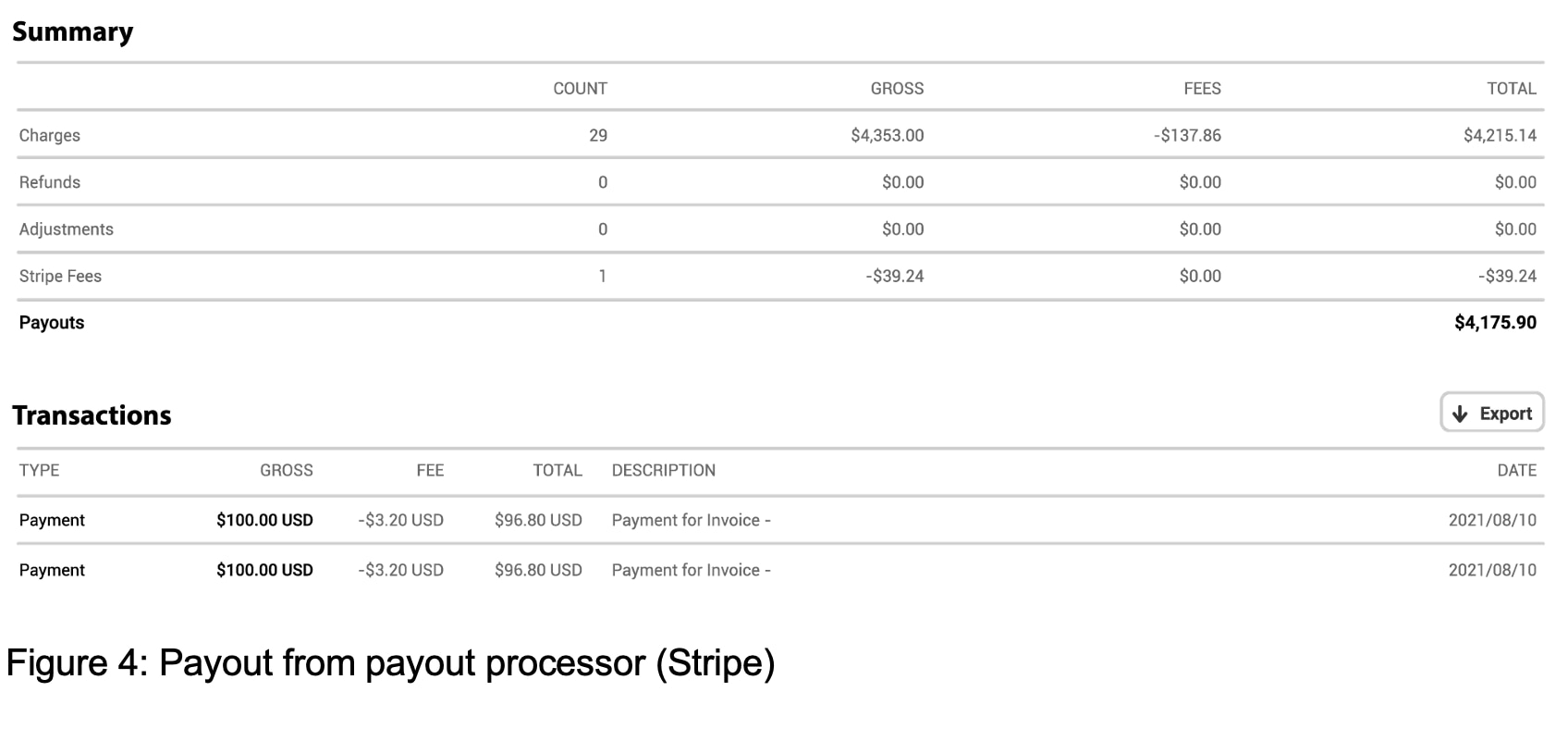

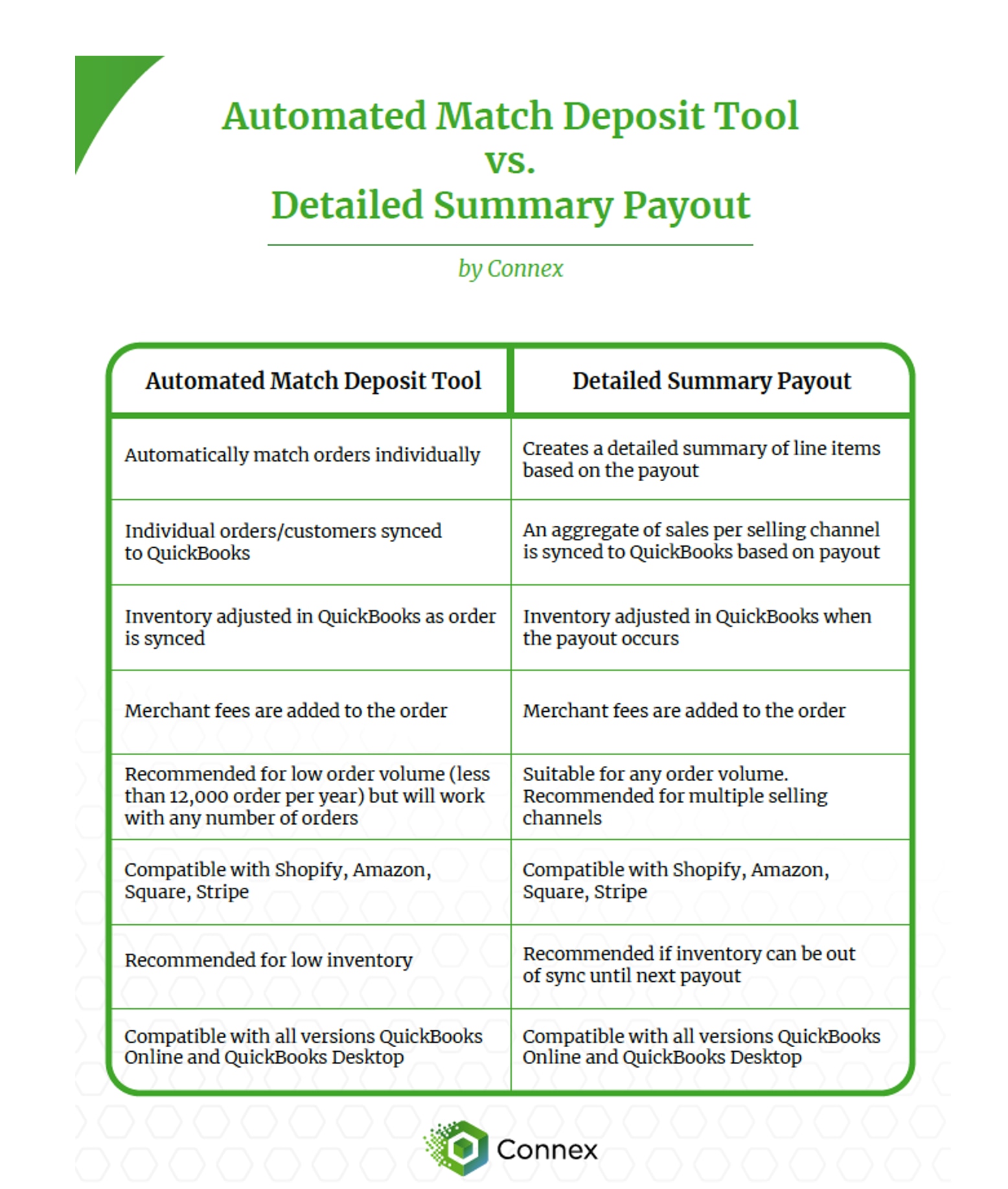

Using his own QuickBooks Online account for testing, Joseph wrote the code to automatically match orders to payouts from Amazon, Stripe, Shopify, and Square. In this article we will cover the two options of automated reconciling: the automated match deposit tool and the detailed summary payout.

Option #1: automated match deposit tool

This tool alleviates the burden of hand matching each sale to the payout by automatically downloading the payout from the payment processor, matching the sales, and recording the fees.

The match deposit tool:

- Automated the process of matching deposits, saving time and money.

- Eliminates human data entry errors.

- Helps detect errors or missed payments.

- Manages your accounting records more efficiently.

During the pandemic, one of Connex’s customers, Animals Matter, saw a spike in their sale of luxury dog beds. Not sure how they could manually keep up with the orders, they reached out to Connex.

“The automated match deposit tool blew me away,” said Scott Avera, co-founder of Animals Matter. “Now, I can’t even imagine entering orders from Shopify by hand. Before, we used to cut and paste orders into emails, and send them over to the fulfillment team. Now, Connex automatically syncs ShipStation with QuickBooks for us, and it saves us at least 2 hours a day.”

Connex also provides the automated match deposit tool to accountants, who then pass on the savings in time, money, and energy to their clients.

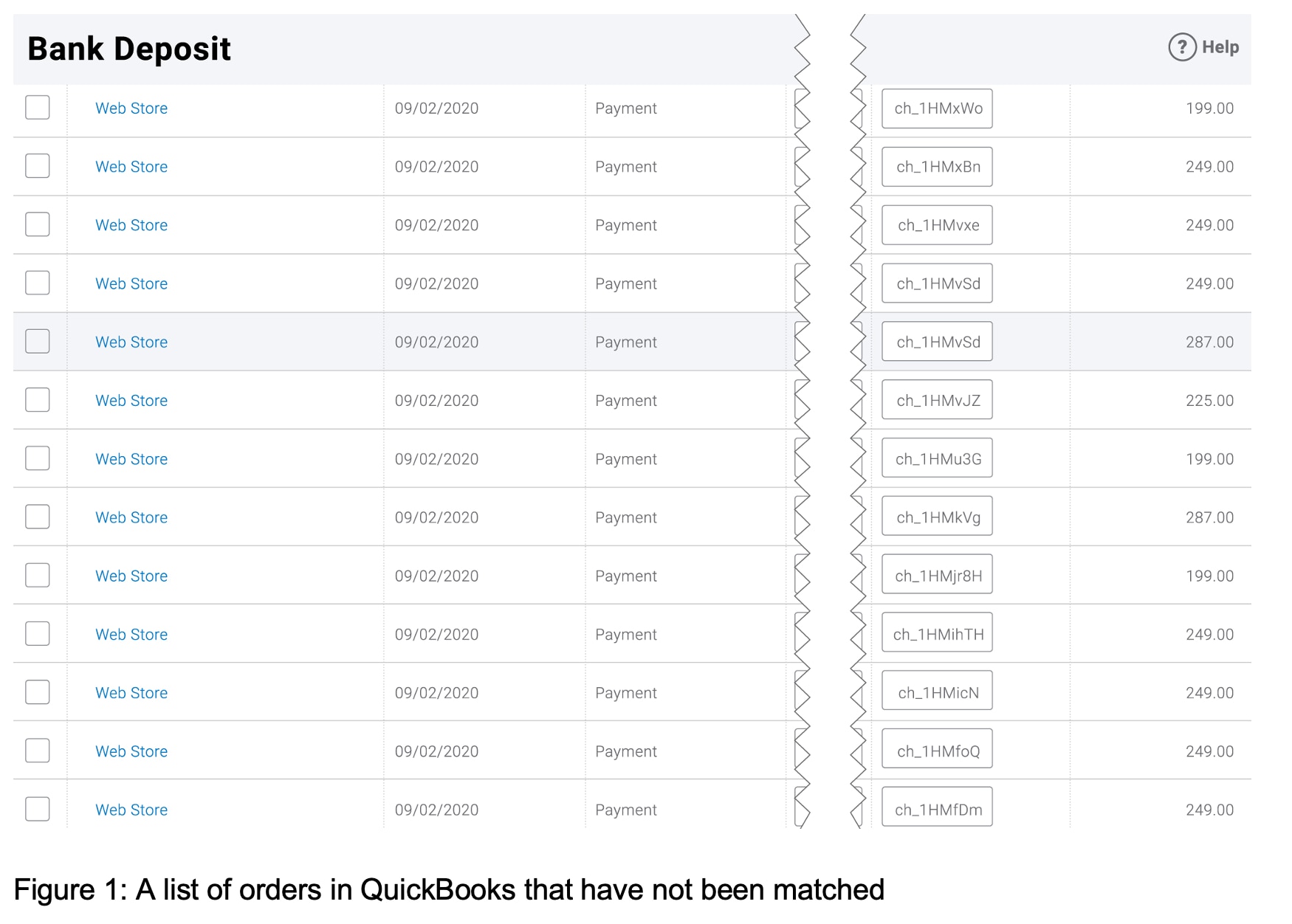

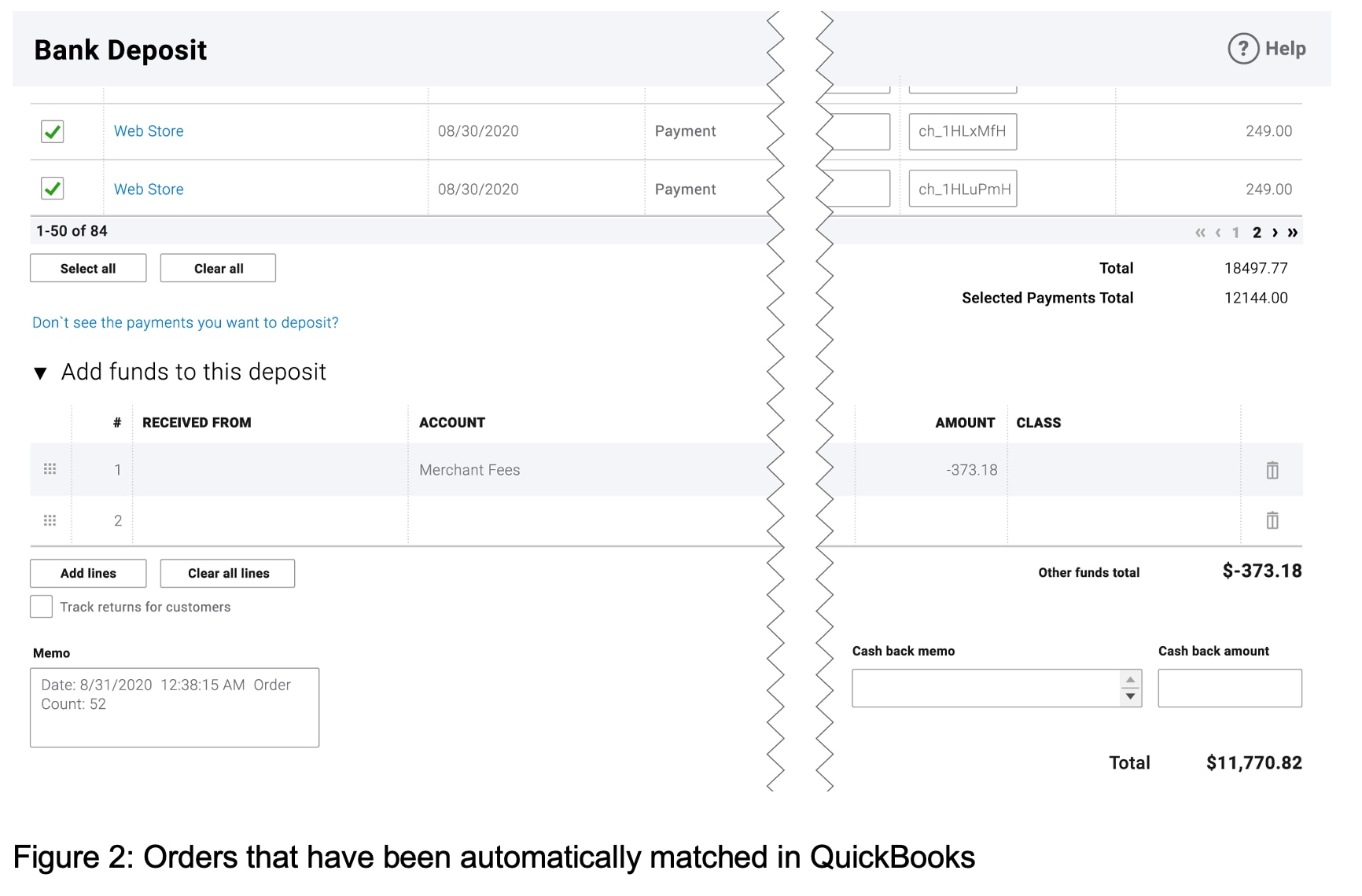

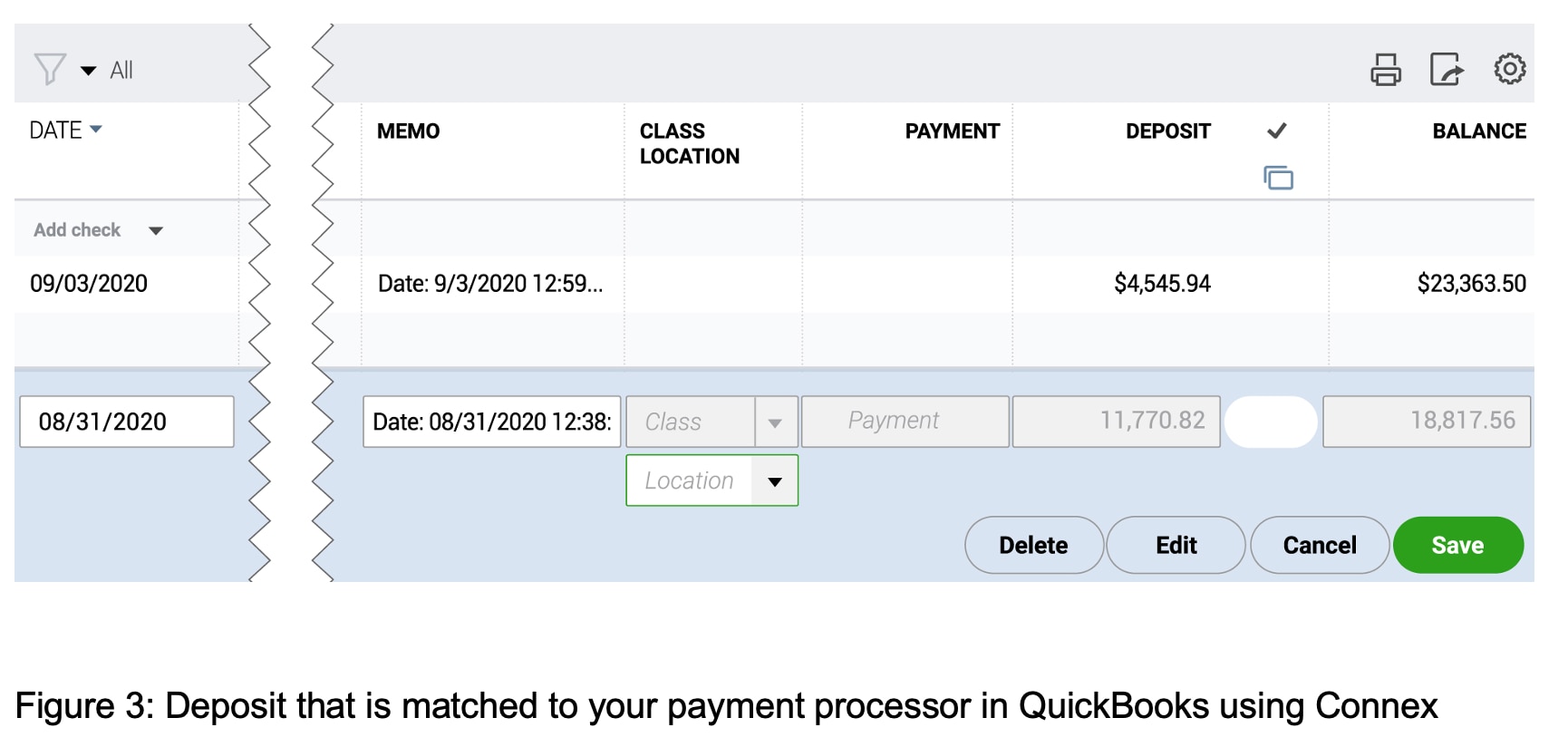

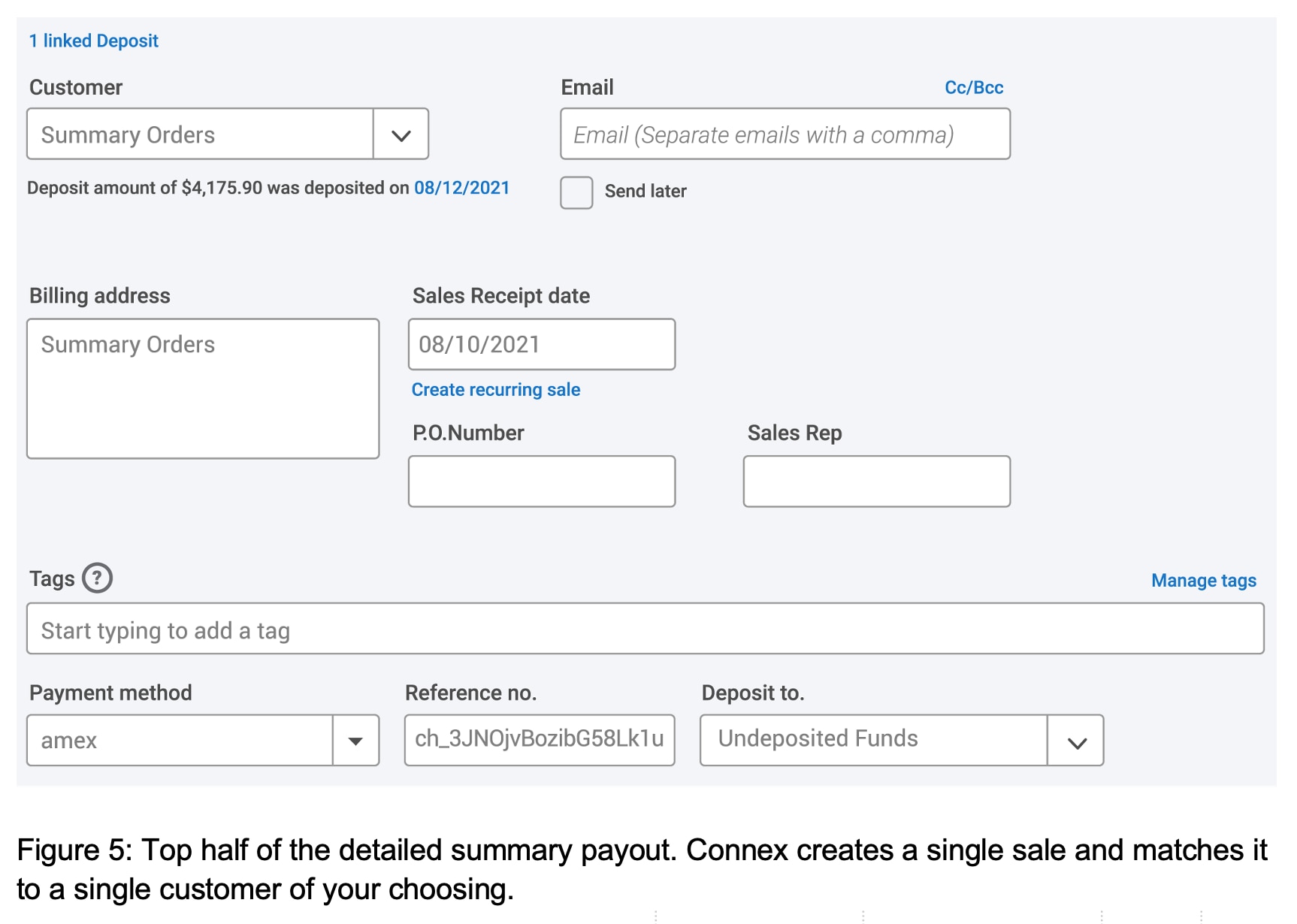

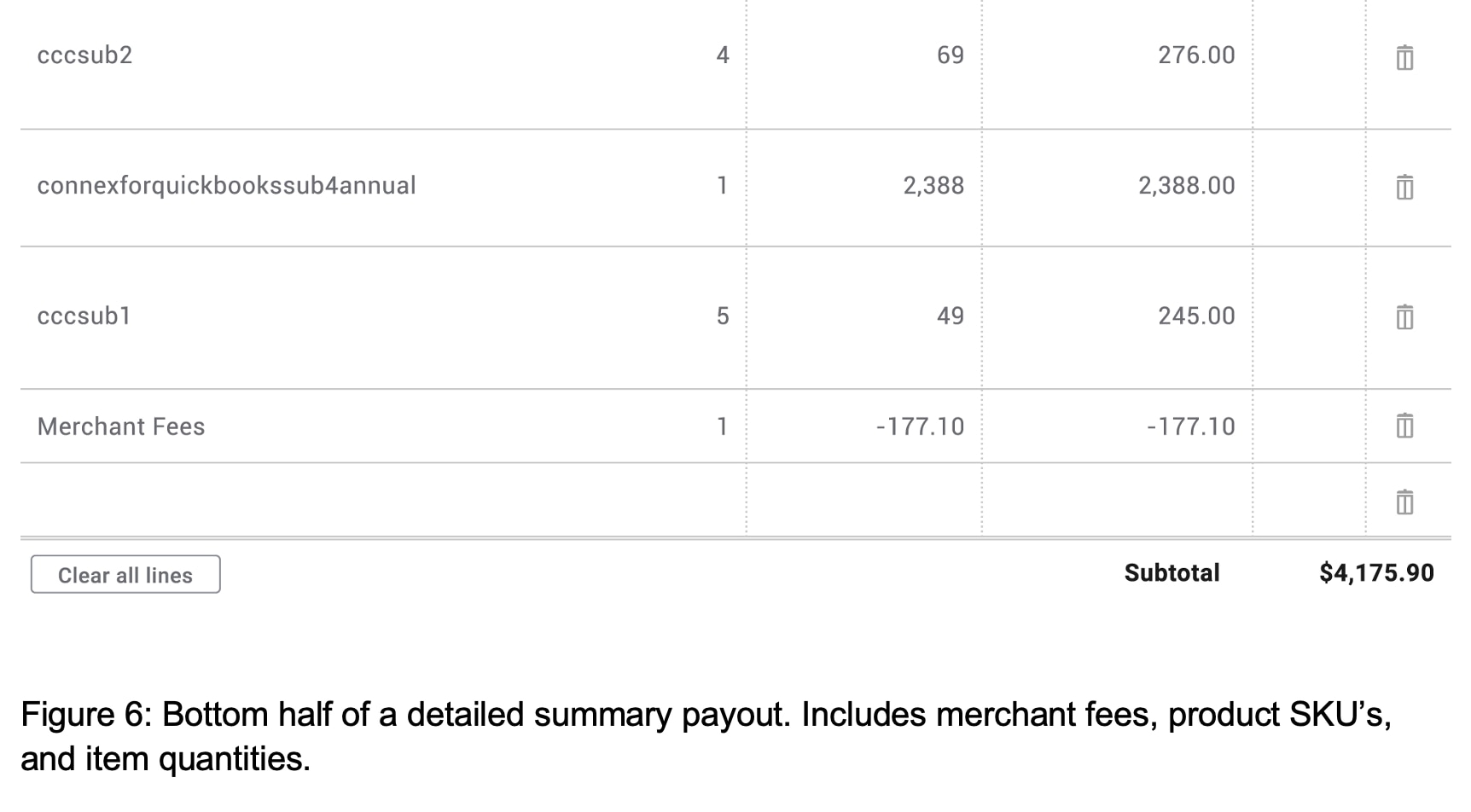

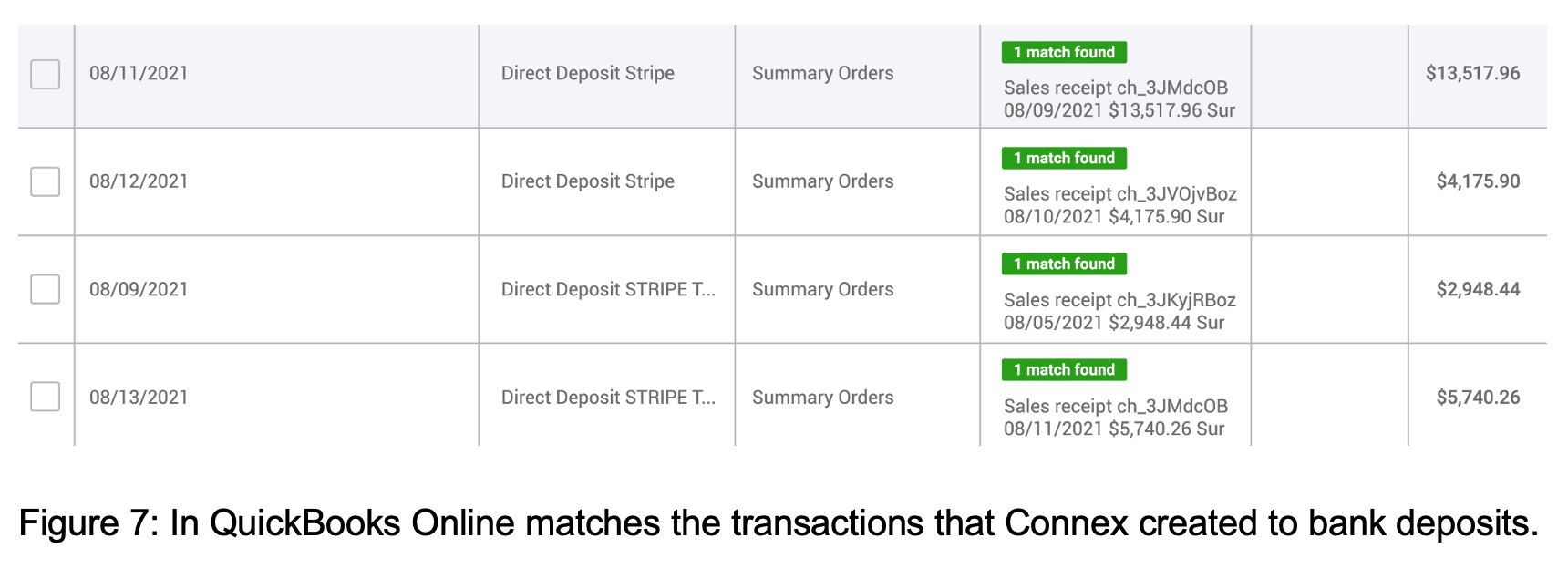

The images below show how the “before” and “after” of unmatched orders, which are then matched automatically by Connex.