In recent years, states across the country have enacted retirement savings programs to help individuals save for retirement. Currently, five states have active programs, with eight other states in process and dozens of others considering legislation. The rules of these programs vary greatly from state to state, but they could help bridge the retirement gap for as many as 55 million U.S. workers who currently don’t have access to an employer-sponsored plan.

As a company that was founded to help close the retirement access gap, we’re incredibly excited by these new developments and the renewed interest in retirement savings. But for accountants, this can be a lot to keep track of. That’s why we created this resource hub to provide you with relevant information and key dates to ensure your clients meet upcoming deadlines and stay compliant.

With one in five Americans having saved nothing for retirement, it’s more important than ever for businesses to help and encourage their employees to save for the future.

Retirement plans, such as 401(k)s and IRAs, may offer significant tax advantages for savers. Employees are 15 times more likely to save for retirement when their company offers a retirement plan. Still, many employers don’t offer retirement plans—leaving over 7.5 million California workers without access to workplace retirement plans.

That’s why the Golden State is taking matters into its own hands. To help encourage more individuals to save for retirement, California introduced a new initiative last year called CalSavers Retirement Savings Program, or CalSavers for short.

The program enables eligible employees to automatically contribute a portion of their paycheck to a Roth IRA—helping employees save up to $6,000 a year, or $7,000 a year if they’re age 50 and over.

With the first adoption deadline quickly approaching, we’ve outlined everything you need to know about the CalSavers program, how it impacts your business, and how you can prepare.

Is the retirement mandate mandatory or optional?

All Golden state employers with 5 or more employees are required to give employees access to CalSavers, unless they offer a company-sponsored retirement plan, like a 401(k) plan.

When will the retirement mandate go into effect?

Any business with 5 or more employees is required to adopt the new program, but adoption deadlines depend on employee headcount and are as follows:

- Businesses with more than 100 employees: September 30, 2020

- Businesses with more than 50 employees: June 30, 2021

- Businesses with 5 or more employees: June 30, 2022

While companies with 5 or more employees have more than two years to make the switch, the deadline for mid-sized businesses is quickly approaching. Although originally June 30, 2020, the deadline for small and mid-sized businesses to adopt CalSavers has been extended to September 30, 2020.

On that date, companies with 100+ employees will have to either give employees access to the CalSavers retirement savings program or offer a company-sponsored alternative.

To opt-in to the program, share employee information, and set up payroll deductions, visit the CalSavers

How much will it cost my business?

Your employees will pay administration fees to participate in the program. Depending on which investment options they select, your employees will be required to pay an annual fee ranging from 0.825 to 0.95%.

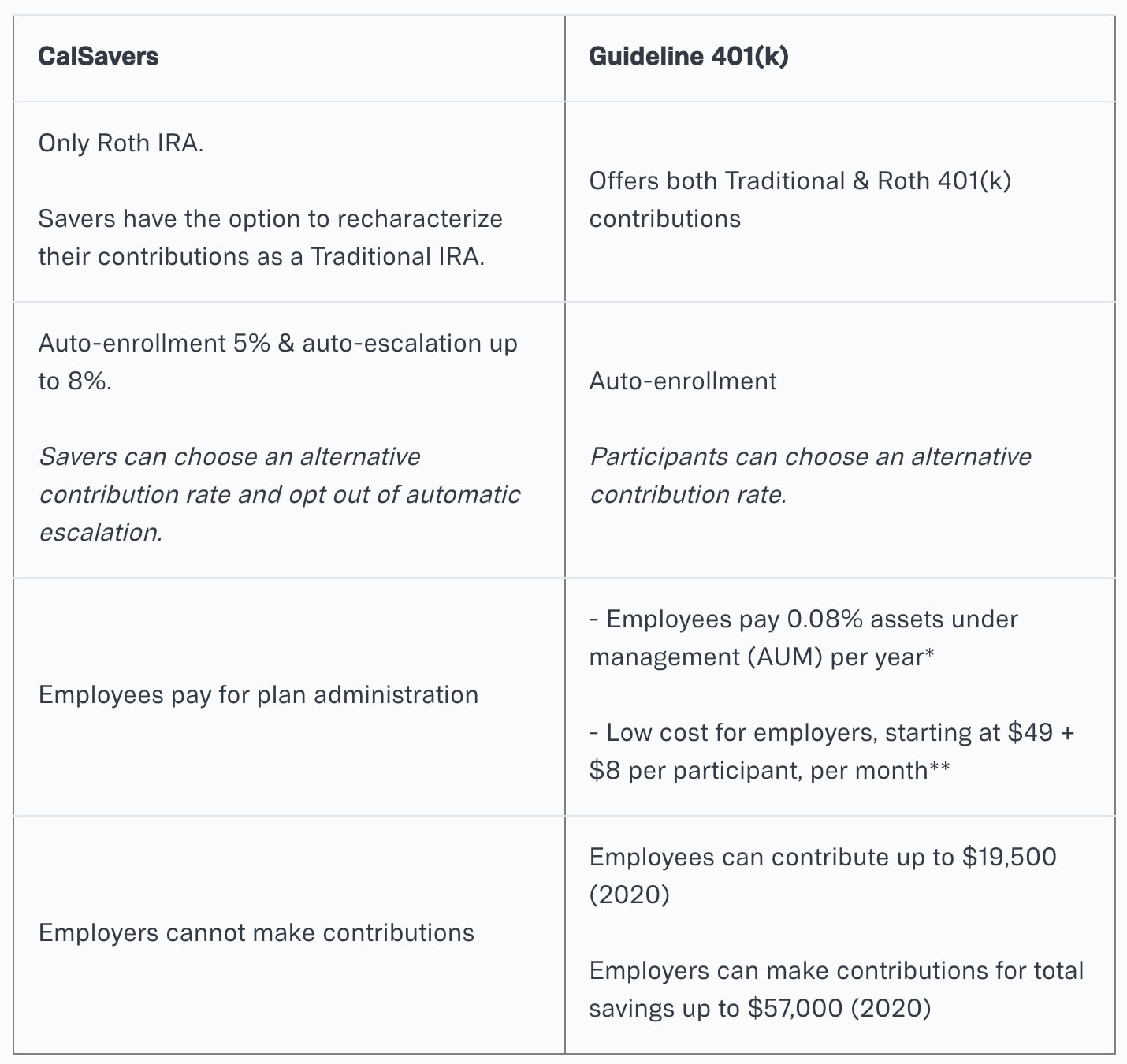

The fee will be pulled directly from the assets in their Roth IRA. CalSavers is completely free for employers. There are no employer fees and CalSavers does not allow for employer match contributions.

What are the alternatives to the CalSavers program?

Employers can also choose to offer private retirement plans. The most common alternative is a 401(k) plan. 401(k) plans have higher contribution limits, allow for matching and profit-sharing, and offer both Traditional and Roth options. As a result, 401(k) plans would allow business owners and employees to potentially save more for retirement.