APY on QuickBooks Checking Envelopes is increasing to 1.75%

In a nutshell: The Annual Percentage Yield (APY) on all QuickBooks Checking account Envelopes will be increasing to 1.75%, effective November 17, 2022. There’s no action needed from you or your clients if they’re already using Envelopes.

Envelopes are a feature within QuickBooks Checking that let you set aside cash for expenses and keep your budgets organized. Your clients can create up to 9 Envelopes depending on their business needs, such as payroll, taxes, rainy day funds, or equipment. In order to spend this money, it must be moved to the main account. This can be done instantly. Learn more

**Product Information

Annual percentage yield: The annual percentage yield (“APY”) is accurate as of Nov. 17, 2022 and may change at our discretion at any time. An interest rate of 1.75% will be paid on the average daily available balances distributed across your created envelopes within your primary QuickBooks Checking account. Balances held outside an Envelope, will not earn interest. At the close of each statement cycle, interest is calculated based on the average daily balance in your Envelopes. The average daily available balance is calculated by adding the available balance in your Envelopes and dividing that figure by the number of days in the statement cycle. The interest earned will be distributed to each Envelope in proportion to the average daily balance of each Envelope. See Deposit Account Agreement for terms and conditions.

Envelopes: You can create up to 9 Envelopes. Money in Envelopes must be moved to the available balance in your primary account before it can be used. Envelopes within your primary account, will automatically earn interest once created. At the close of each statement cycle, the interest earned on funds in your Envelopes will be distributed to each Envelope in proportion to the average daily balance of each Envelope.

QuickBooks Checking account: Banking services provided by and the QuickBooks Visa® Debit Card is issued by Green Dot Bank, Member FDIC, pursuant to license from Visa U.S.A., Inc. Green Dot Bank operates under the following registered trade names: GoBank, GO2bank and Bonneville Bank. All of these registered trade names are used by, and refer to, a single FDIC-insured bank, Green Dot Bank. Deposits under any of these trade names are deposits with Green Dot Bank and are aggregated for deposit insurance coverage up to the allowable limits. Green Dot is a registered trademark of Green Dot Corporation.

©2022 Green Dot Corporation. All rights reserved. QuickBooks products and services, including Instant Deposit, QuickBooks Payments, Cash flow planning / forecasting are not provided by Green Dot Bank.

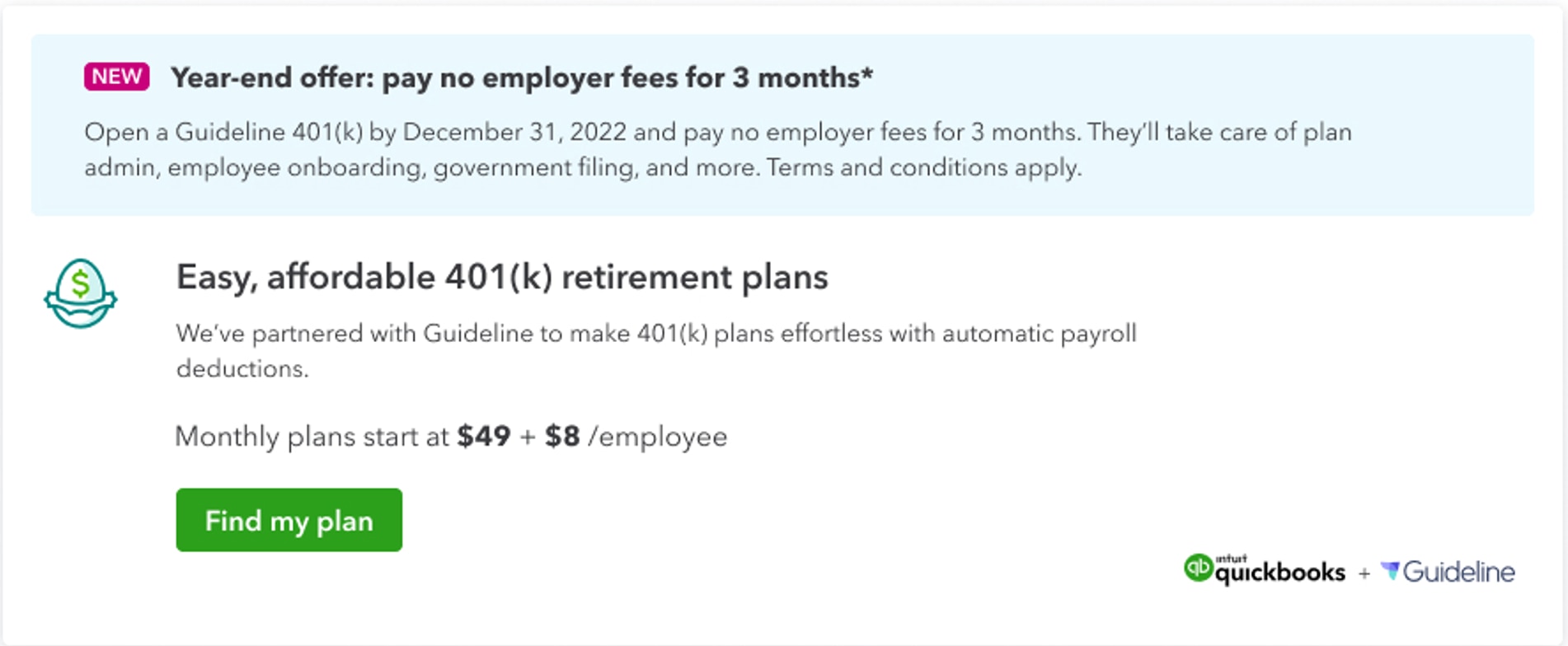

Guideline 401(k): 401(k) offerings are provided and administered by Guideline, an independent third party and not provided by Intuit. Intuit is not a 401(k) plan administrator, fiduciary or other provider. Requires acceptance of Guideline’s Client Relationship Summary and Privacy Policy. Additional 401(k) plan fees will apply. Employees may manage their contributions directly with Guideline. Admin and payroll access required to sign up for a 401(k) plan with Guideline.

1Guideline 401(k) “three months free” promotion: Employer fees include the monthly base fee and the monthly participant fee after the new plan begins. Other participant-paid fees will apply. See our Guideline’s Form ADV 2A Brochure here for more information about our fees. This offer is for the first 3 months of service after the plan begins, followed by the then-current monthly list price. Your employer account will automatically be charged on a monthly basis until you terminate your plan. To be eligible for this offer you must be a new Guideline 401(k) customer. This offer cannot be combined with other offers. Offer available for a limited time only. Guideline reserves the right to modify or discontinue this promotion at any time without prior notice.

2Guideline 401(k) tax credits: “This content is for informational purposes only and is not intended to be construed as tax advice. You should consult a tax professional to determine what types of tax credits or deductions your company is eligible to claim.”

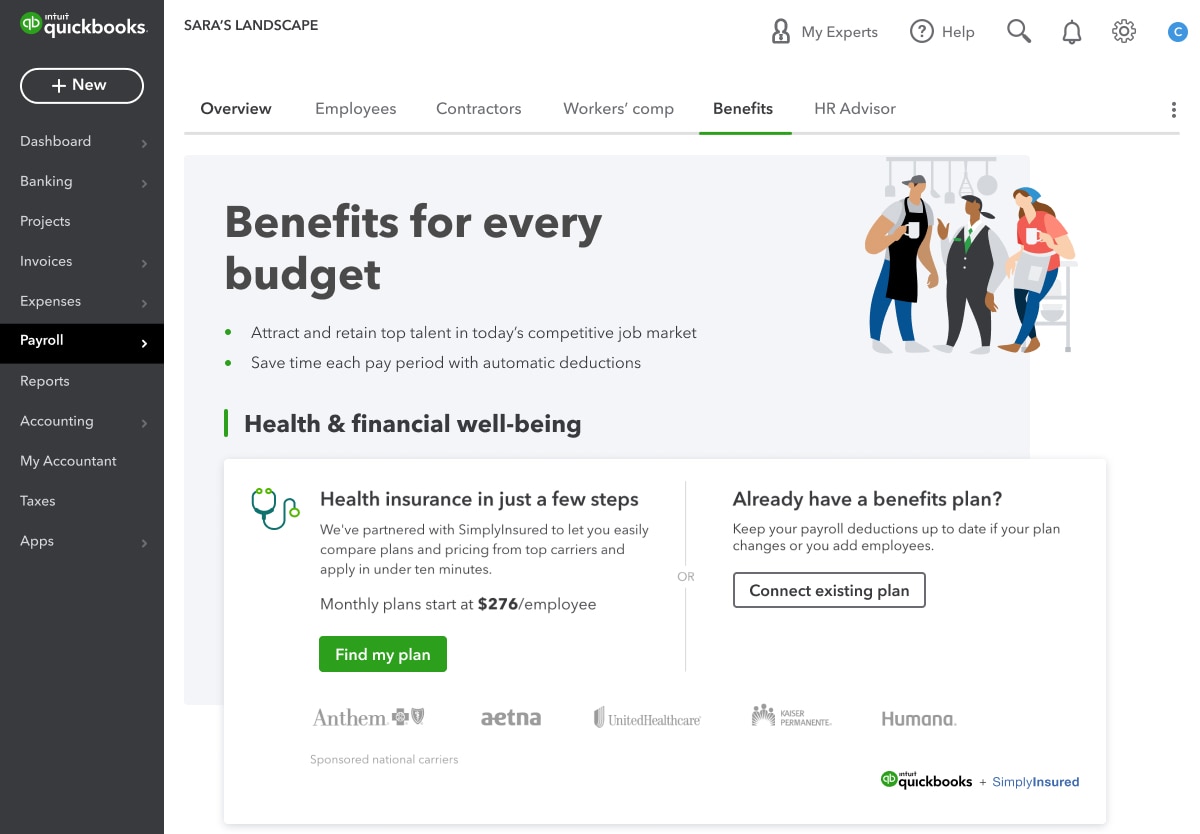

Health benefits: Powered by SimplyInsured and requires acceptance of SimplyInsured’s Privacy Policy and Terms of Use. Additional fees will apply. SimplyInsured does not offer insurance in HI, VT, and DC. Insurance coverage eligibility is not guaranteed, and depends solely on the rules of the insurance carrier. The insurance carrier has sole and final discretion as to the eligibility for health insurance products.