Gift cards are much beloved by the giver and the receiver. Shoppers love the convenience of simply plucking a card off a rack at the store and ta-da — shopping is done. Who doesn’t like picking out something you really like when you receive a gift card?

Yet, for businesses that sell them, determining the amount that shows up on a tax return can be a challenge. Accounting for the actual sales and redemptions is pretty straightforward, as I describe in this article. As gift cards are sold, the sale is booked to a deferred revenue liability. That liability is extinguished and revenue is recognized as the cards are redeemed.

The IRS prefers that taxpayers recognize revenue, and pay tax on that revenue, as soon as possible. When a gift card is sold, the business has already received the cash, so the IRS would like to have its piece of that income.

For cash basis clients, this isn’t a problem since they have to recognize revenue as they sell the cards, but for accrual-basis taxpayers, the IRS offers two methods: full recognition and deferral.

Full Recognition

This is exactly what it sounds like: the business recognizes taxable gift card revenue as cards are sold. The simplicity of this method can make it a winner, especially for clients who lack a robust tracking system. However, it does mean the business recognizes all current year gift card sales as revenue, even if those cards are never redeemed.

Deferral

The IRS allows a limited period of deferral, which was first described in Revenue Procedure 2004-34, and later modified by Revenue Procedures 2011-18 and 2013-29. Unlike the GAAP rules that allow deferral until the card is actually used, the IRS only allows gift card sellers to defer the income until the end of the next tax year, or in some circumstances, until the end of the second year after the cards are sold.

This means that in the year of sale, a business recognizes revenue from the cards sold that year that are also redeemed that year. By the end of the next year, the remaining revenue must be recognized, whether those cards were used or not. The one-year deferral applies to gift cards that can be redeemed for goods or services, or a combination of both.

If the cards will be redeemed chiefly for goods, a two-year deferral period is allowed. This means that all the revenue for gift cards must be recognized on the tax return by the end of the second year after they’re sold. If services are provided as an incidental to the sale of the goods, for example, on installation fees for sales of televisions, that portion of the overall redemption must be estimated and recognized in the first year.

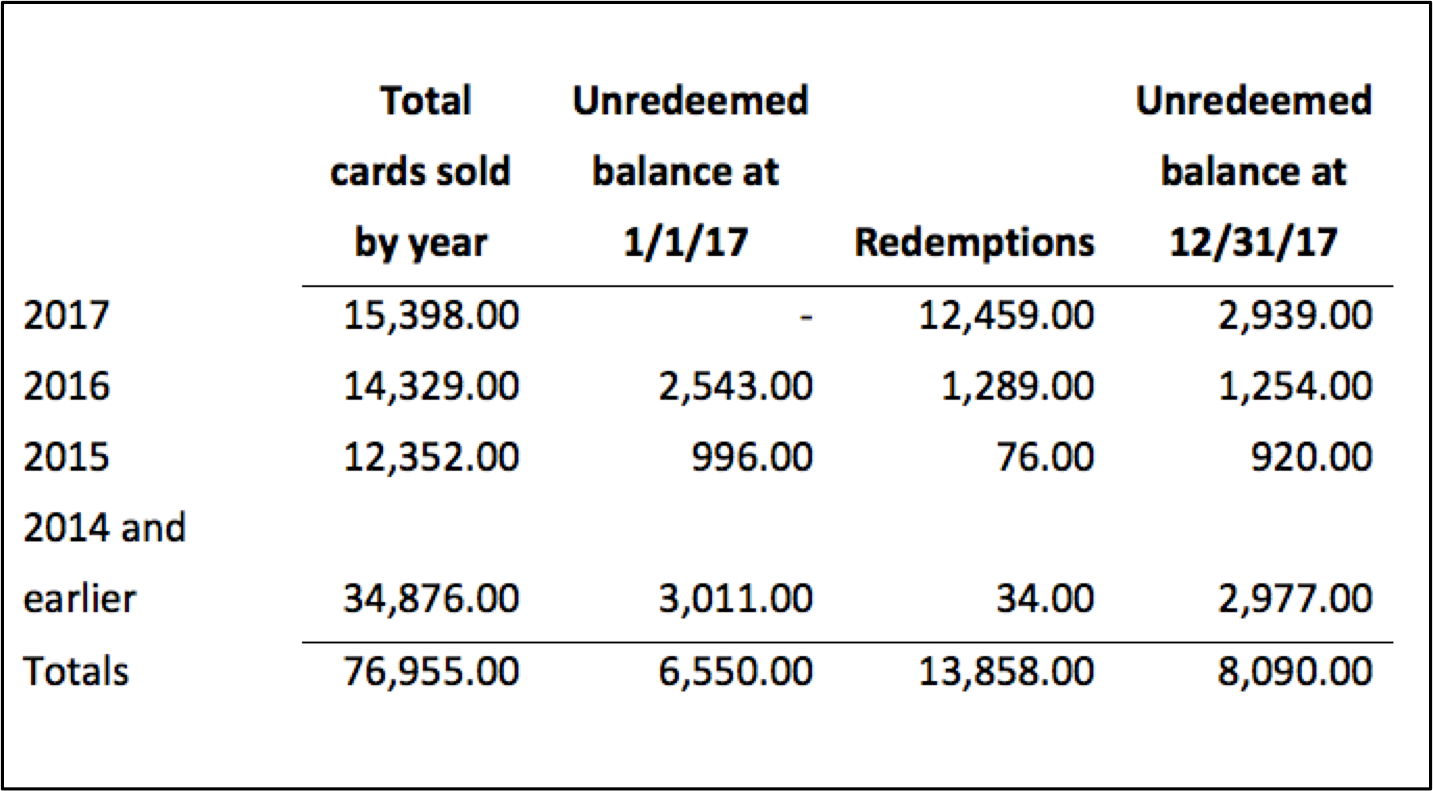

To use the deferral method, your client needs to be able to track gift card sales and redemptions by year. Because the timing will likely differ between the actual use and the required recognition date for tax, there will be a book-tax difference in gift card revenue on your clients’ tax returns.

Let’s look at an example of how this works.

Lesley’s Books sells gift cards that can be used for books and other items sold at the store. Here are their sales and redemptions of cards for the last several years: