Accounting is changing—fast. Generative AI has already started to streamline tasks like data analysis and reporting. But the next wave is here: agentic AI. These tools don’t just assist; they act. They can plan, take initiative, and handle entire workflows on their own. For accountants, that means more than just new tech. It’s a shift in how services get delivered, how firms run day to day, and how value gets created for clients.

What is agentic AI?

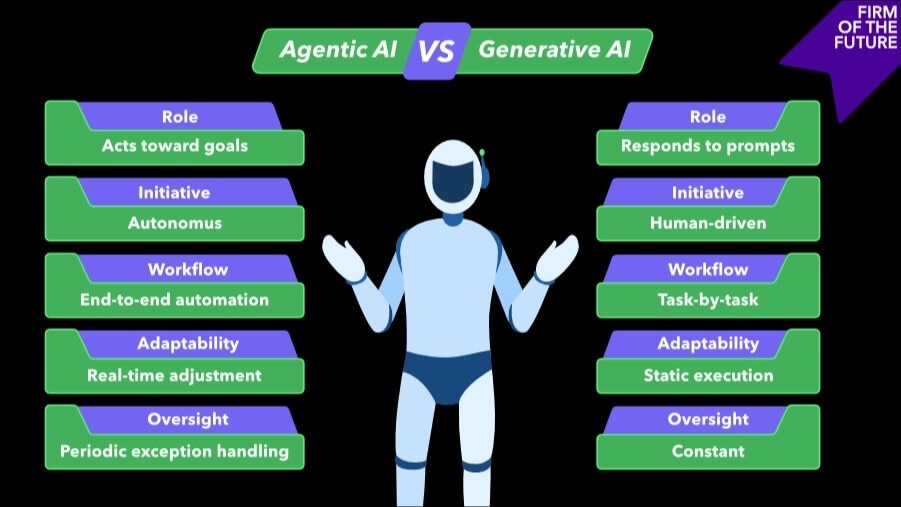

Agentic AI is the next step beyond generative AI. While generative models create content and insights based on past data, agentic AI can actually act on that information somewhat autonomously. With a bit of human direction upfront, it can make decisions, take action, and work toward goals on its own. It stays aware of its environment, adjusts as needed, and keeps moving forward without needing additional prompting or someone to guide it every step of the way.

Agentic AI vs. generative AI: Key differences for accounting professionals

Generative AI has already become a core part of the accounting toolkit, going beyond productivity gains to help accounting professionals forecast cash flow, detect anomalies, and manage risk.

These generative AI applications have proven valuable, but they still require human initiation and oversight, functioning primarily as tools that respond to specific prompts rather than autonomous systems.

Agentic AI takes this a step further, offering capabilities that push beyond generative AI’s foundation:

- From reactive to proactive: Agentic AI continuously monitors financial data, identifies potential issues, and initiates responses without the need for human prompting.

- From manual steps to seamless workflows: It handles entire processes—from data collection through analysis to deliverables—without needing human-driven transitions between phases.

- From rule-based to adaptive execution: These systems adjust their approach in real-time based on new information and evolving contexts, making them more flexible and responsive to changing conditions.

The unique value of agentic AI lies in its ability to drive seamless, autonomous operations. By reducing manual oversight and eliminating bottlenecks in workflows, it allows accountants to focus on the most complex, judgment-intensive aspects of their work, like strategic advising, without having to manage routine tasks or friction in their processes.

The practical impact of agentic AI on accounting workflows

By taking on proactive, end-to-end responsibilities, agentic AI allows firms to shift from focusing on routine tasks to providing more strategic oversight in three key areas:

- Continuous audit and compliance: Instead of checking financial data at set intervals, agentic AI enables always-on auditing. These systems monitor transactions in real time; flag anomalies; and categorize them by severity, regulatory relevance, and impact so issues can be addressed before they escalate. For accountants, this means less time spent combing through compliant data and more time resolving exceptions that require expertise.

- Intelligent financial forecasting: Agentic AI turns forecasting into a living process. By continuously tracking market shifts, internal metrics, and macroeconomic indicators, it updates projections dynamically and explains the reasoning behind those changes. Accountants can then offer timely, insight-backed recommendations rather than waiting for quarterly or annual reviews to act.

- Smarter client communication: Agentic systems handle routine client queries instantly, from tax questions to compliance checks. When a human response is needed, they prepare relevant context and supporting data so accountants can jump straight into strategic conversations. The result is faster, more responsive service that strengthens relationships, while reserving human bandwidth for high-value advisory work.

Implementing agentic AI in accounting & CAS practices

For accounting firms, adopting agentic AI isn’t just about automation; it’s about rethinking how work gets done. Successful implementation depends on identifying the right use cases, strengthening technical foundations, and evolving the way professionals and AI systems collaborate.

Identify use cases

While agentic AI can handle increasingly complex tasks, a lot of the early use cases usually stick to areas where mistakes are low-risk, but the impact is meaningful. Some of these primary applications include:

- Automated reconciliations and journal entries: AI agents process transactions, match data, and update ledgers continuously, reducing manual errors and freeing up time for more complex tasks.

- Continuous audit readiness: Agentic AI continuously scans financial data, flags anomalies, and organizes documentation without manual intervention, ensuring compliance is always up to date and audit-ready.

- Month-end close support: Routine steps such as posting accruals, variance analysis, and managing close checklists are automated, significantly reducing delays and errors in the process.

Focusing on these applications at first is ideal for two main reasons:

- Risk tolerance: Firms understandably start with areas where errors are less costly.

- Data maturity: Structured processes tend to have better data quality and clearer success criteria, making them more practical training grounds for autonomous systems.

But limiting agentic AI to repetitive work undersells its potential. As confidence grows, agentic AI gets put to work on more nuanced challenges, including detecting emerging trends or uncovering strategic insights across complex datasets.

Strengthen the data and integration layer

Agentic systems rely on high-quality, connected data. That means firms need to modernize their architecture, ensuring systems are interoperable and data flows are accessible for continuous monitoring and analysis.

Key technical enablers include:

- APIs and integration layers that give AI agents the visibility and permissions they need.

- Secure, compliant data environments that protect client information and enable granular oversight.

- Workflow tools that support autonomous task execution while logging actions for auditability and accountability.

Redefine human-AI collaboration

Perhaps the most important shift isn’t technical—it’s cultural. As AI agents take on more autonomy, firms must redefine what collaboration looks like between humans and machines.

In this new model:

- Agents handle the routine and responsive: They monitor systems, flag anomalies, and execute clearly defined tasks without needing constant instruction.

- Humans handle the ambiguous and interpersonal: They interpret context, navigate tradeoffs, and build client trust, especially in high-stakes or emotionally charged scenarios.

- Oversight remains essential: Accountants don’t just review outputs—it’s about managing exceptions, validating AI-driven decisions, and determining when human judgment must take precedence.

Training is key. Accountants will need to grow their fluency in supervising agentic systems, leveraging their outputs, and knowing when to intervene.

This isn’t about replacement. It’s about refocusing human effort on what matters most: insight, context, and connection. Agentic AI enables accountants and advisors to spend less time executing and more time advising.

Benefits and challenges of agentic AI in accounting

As with any advanced technology, agentic AI brings benefits and challenges. Some key advantages of applying agentic AI to accounting workflows include:

- Increased accuracy: By automating tasks like data processing and transaction reconciliation, agentic AI reduces the risk of human error, providing more reliable financial insights.

- Time savings on repetitive tasks: Tasks such as data entry, compliance checks, and document management are streamlined, allowing accountants to focus on higher-value work like client advisory.

- Informed decision-making: With real-time monitoring and data analysis, agentic AI gives accountants timely, actionable insights, enabling them to make better, data-backed decisions.

On the other hand, there are a few challenges to consider:

- Requires human oversight: Despite its autonomy, agentic AI still requires human judgment to ensure decisions align with strategic goals and handle exceptions that require context.

- Ethical concerns: With autonomous decision-making, firms must address issues around accountability, bias, and transparency to ensure AI systems are aligned with ethical standards.

- Complex integration: Successfully integrating agentic AI into existing systems can be technically challenging and resource-intensive, requiring careful planning and a solid IT infrastructure.

These challenges can be managed with the right strategy. By addressing them thoughtfully, accounting firms can maximize the benefits of agentic AI, improving operational efficiency and enhancing their strategic value.

Agentic AI: The future of accounting workflows

The future of accounting will be defined by seamless integration and real-time intelligence. Picture accounting firms operating in interconnected ecosystems, where AI agents continuously monitor, manage, and optimize financial data across platforms. This allows accountants to focus solely on the strategic aspects of their work. Compliance becomes predictive, not reactive, and financial forecasting evolves into a dynamic, ongoing process rather than static snapshots.

As AI systems evolve, they’ll offer personalized, real-time financial insights tailored to each client’s needs. They won’t just automate; they’ll empower accountants to redefine their roles and elevate the impact they have on their clients' success.

The future of accounting is faster, smarter, and more connected. Agentic AI will be at the heart of it all.

FAQs

What is agentic AI, and how is it different from traditional AI?

Agentic AI refers to artificial intelligence systems that can operate with a degree of autonomy, setting goals, making decisions, and taking action without constant human input. Unlike traditional or even generative AI, which requires prompts and mainly assists with content generation or analysis, agentic AI is proactive. It monitors its environment, adapts in real time, and executes workflows from start to finish.

Why does agentic AI matter for accounting professionals?

Agentic AI can take on entire accounting workflows, such as reconciliations, audits, or forecasting. This frees up accountants to focus on high-value, judgment-based tasks such as advising clients or shaping strategy. It allows firms to move faster, catch issues earlier, and deliver more personalized, insight-rich service without adding headcount at the same rate.

How is agentic AI used in accounting today?

Agentic AI is already being applied in areas such as continuous auditing, where it monitors transactions and flags issues in real time; financial forecasting, where it updates projections based on changing data; month-end close processes, where it automates routine tasks; and client service, where it handles standard queries and preps information for strategic conversations.

What are the main benefits of agentic AI for accounting firms?

It allows firms to operate more efficiently and accurately, scaling their services without adding headcount. By handling repetitive execution, agentic AI frees up accountants to spend more time on complex problem-solving and high-value client advisory work.

What challenges come with implementing agentic AI?

Adoption requires clean, well-integrated data systems, clear oversight structures to ensure accountability, and a cultural shift as teams adjust to working alongside autonomous tools that change how tasks are managed and decisions are made.

Will agentic AI replace accountants?

No. It will change their role, not eliminate it. Agentic AI handles the routine and the repeatable, allowing accountants to focus on what only humans can do: exercising judgment, building trust, and delivering nuanced advice in complex situations. Rather than replacement, it’s about amplification—extending the reach and impact of accounting professionals.

Recommended for you

Get the latest to your inbox

Get the latest product updates and certification news to help you grow your practice.

Thanks for subscribing.

Relevant resources to help start, run, and grow your business.