Insights and Advice for Accounting and Bookkeeping Professionals

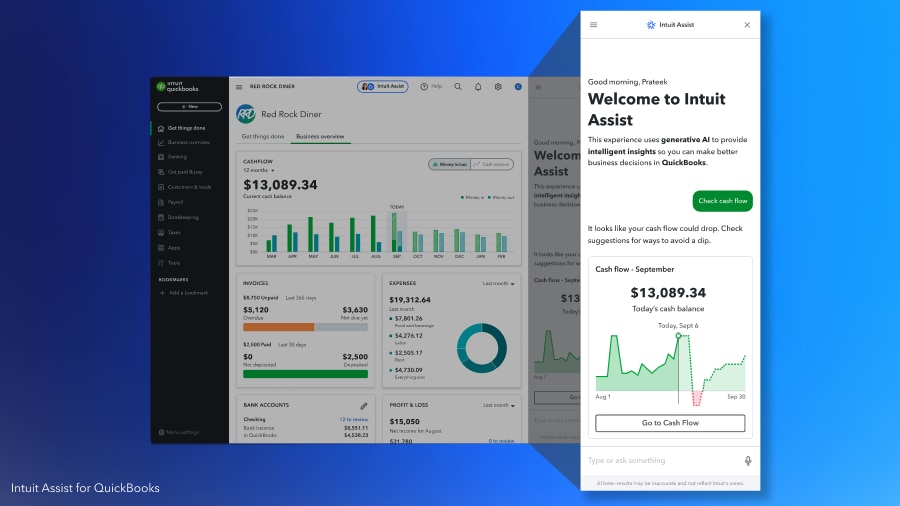

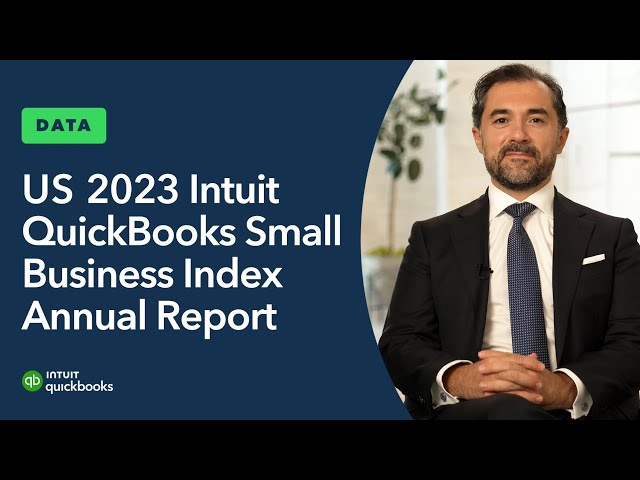

New Product Features & Improvements

Client Advisory Services

Artificial Intelligence

ProAdvisor

Thought Leadership

Talent and Hiring

Just for QuickBooks Pros

Running and Growing Your Firm

The Latest Articles from Firm of the Future

Get the latest product updates and certification news to help you grow your practice.

Thanks for subscribing.

Relevant resources to help start, run, and grow your business.