I know most of you are rolling your eyes at the mere mention of 13 periods, getting ready to hard pass swipe left – but hang in there .…

I’ve been using QuickBooks® a LONG time and been kvetching about this almost as long.

In fact, a search on the subject might find me (and others) publicly lamenting the drudgery and excessive excel massaging that is period reporting with QuickBooks.

Which makes this article, first and foremost, rather embarrassing.

See, it turns out QuickBooks CAN do this!

In my defense, they didn’t seem to know it either.

So, I’m putting prior rants (and any resulting sheepishness), aside.

There is, in fact, a fix for 13 period reporting!

But first .…

Is this really a problem?

In short, yes!

If, at this point, you are vigorously nodding in agreement, feel free to skip ahead. For the rest, here’s a little something on Period Reporting from the World Heritage Convention.

So, to sum up:

We think about money in terms of months, quarters, and years.

While they think of money by pay-periods, weeks, and sometimes even days.

Period reporting is vital to hospitality and brick and mortar retail because it bridges that gap. It promotes a common language and gives the books some dimension.

But it can only do this effectively if it is:

- immediately accessible

- easily customizable

- directly integrated with the data

How does this fix work?

Up to now, practitioners have tried to either contort or outsource the native QuickBooks calendar in order to accommodate two points of view – traditional (month/quarter based) and operational (period based).

But, that approach still requires us to regularly choose between those two competing priorities inside QuickBooks. For nearly every transaction. This ends up serving neither very well.

Instead, what we need is a way to shift *between* priorities, kind of like our ability to shift between cash and accrual reporting.

Same data, different perspective.

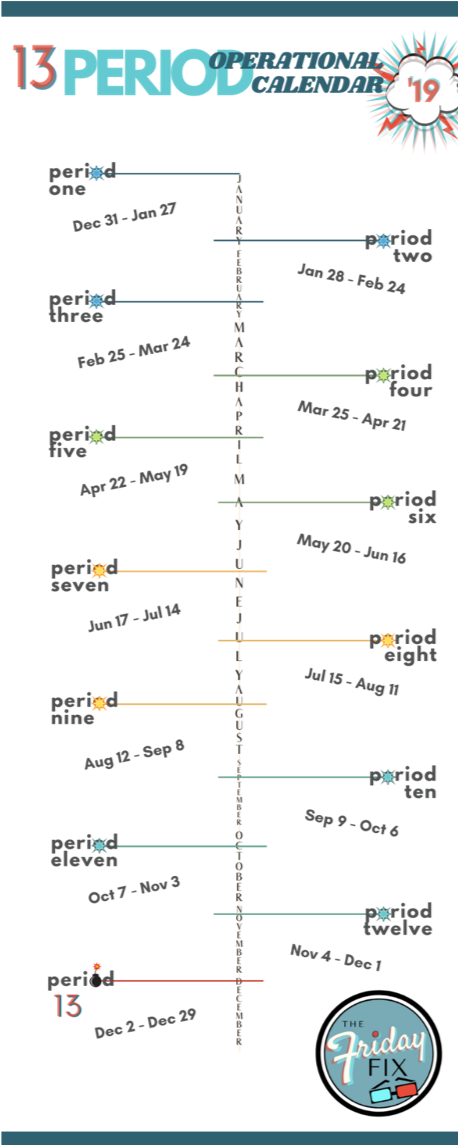

So, we are going to create an *alternate* calendar inside QuickBooks.

And we’re going to do it using QuickBooks features – mainly classes.

The set up

Grab your client notes, a calendar, and some yummy snacks, then:

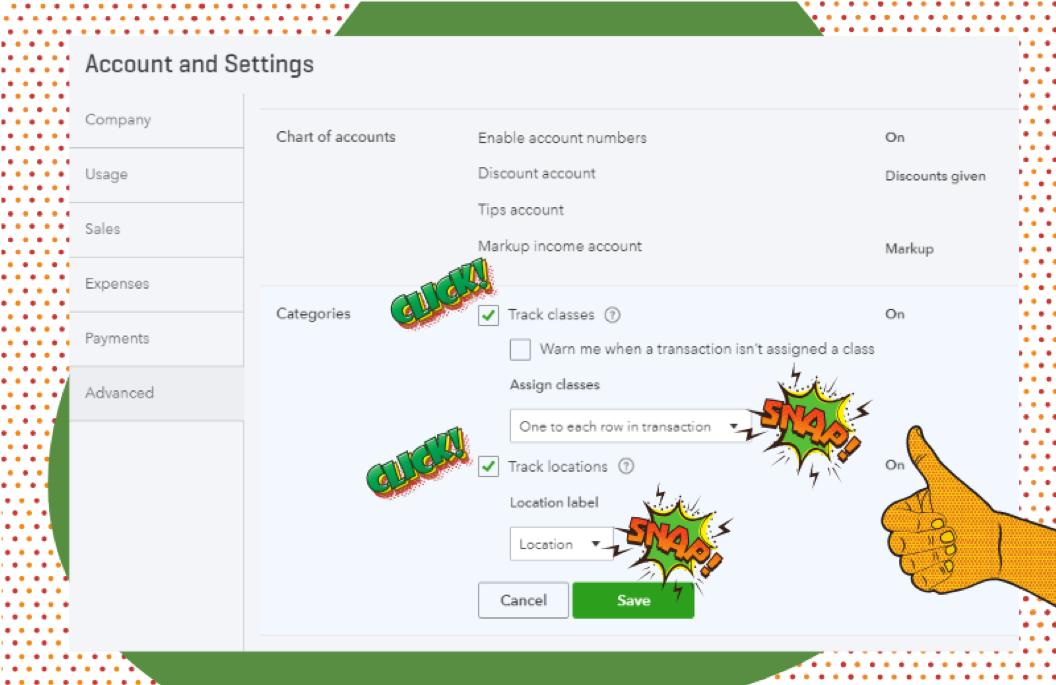

Turn on or adjust class tracking. Make sure you choose to assign classes by row, not just by transaction. Also, save your nerves – turn the ‘warning’ for no class assignment OFF.