“It’s axiomatic: You’re as good – or as bad – as the character of your Client List. In a very real sense, you are your Client List!” – Tom Peters, The Professional Service Firm 50

I was recently asked, “How can a firm be sure that it is accepting the right type of customers?” It’s an excellent question. Many years ago, I coined Baker’s Law: Bad customers drive out good customers, a situation you definitely want to avoid.

It has become common for firms to grade customers and focus attention on the “A” and “B” customers, and even hold out incentives to the “C” customers to upgrade to higher status

Along with your human capital selection, your customer capital criteria are the most important aspect of crafting your firm’s success. The traditional customer grading criteria are most likely familiar to you; they usually include:

- Amount of annual revenue

- Prompt payment history

- Potential for growth

- Potential for future referrals

- Actual referrals

- Profitability of customers

- Risk of having customer in portfolio

- Timing of work (fiscal or calendar year)

- Reasonable expectations

- Willing to take advice

- Profitable and not undercapitalized

Certainly, these are important criteria and should be made part of any firm’s pre-qualifying process. Ric Payne, chairman and CEO of Principa, advocates the following 12-point criteria for grading customers:

- In business for at least three years.

- Pleasant, outgoing personality.

- Willing to listen to advice.

- Positive disposition.

- Technically competent.

- Business is profitable.

- Business is not chronically undercapitalized.

- Business is not dominated by a small number of customers or suppliers.

- Clearly established demand for the product or service.

- Business has a scope for product or service differentiation through innovative marketing.

- Business has scope for improved productivity through innovative management planning and control.

- Business has a strategic plan.

These are also good criteria to judge potential new customers, as there is no point in working for, and with people, whom you do not like, or are indifferent about.

When a firm accepts a new customer, it is not merely closing a sale; it is beginning a lifelong relationship. We select our spouses, friends and other important relationships very carefully, so why would we not perform a proper amount of due diligence before selecting a customer? If the customer is worth having, he or she is worth investing some time and resources in, determining if he or she is a good fit for your firm.

It is no longer wise to accept new customers simply because they have a checkbook and are alive. The most successful firms in the world all have very rigorous pre-qualifying standards, and they do not accept all comers (In fact, they report that they turn away more business than they accept). This is not out of arrogance, but rather, from the recognition that the firm cannot be all things to all people.

It is not possible to value price the wrong customer. Most of the time, the price isn’t wrong; the customer is! The essence of strategy is choosing what not to do. Saying no to a new customer is not necessarily easy, but it is vital if you want to accept only those customers who are pleasant to work with, have interesting work and enhance your firm’s intellectual capital.

Complexity kills a business, and by accepting any customer – especially those that do not fit your purpose, strategy and value proposition – you are adding a layer of bureaucracy that will starve your best customers and put them at risk of going elsewhere.

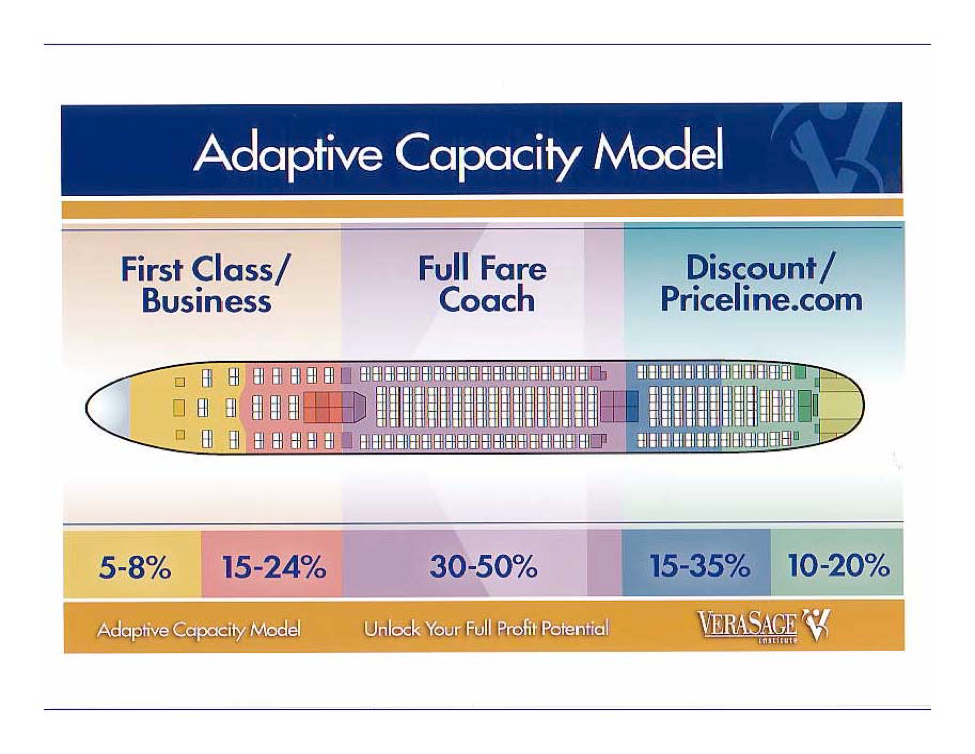

To manage this inevitable effect, let us now explore the Adaptive Capacity Model.

The Adaptive Capacity Model

Think of your firm as a Boeing 777 airplane, similar to Figure 1 below. When United Airlines places a Boeing 777 in service, it adds a certain capacity to its fleet. However, it goes one step further by dividing up that marginal capacity into five segments (the percentages shown are suggested capacity allocations for a professional firm):

A. First class (5 to 8 percent)

B. Business class (15 to 24 percent)

C. Full fare coach (30 to 50 percent)

D. Coach (15 to 35 percent)

F. Discount/Priceline.com (10 to 20 percent)