This is one of the toughest times in history to find and hire new talent to support your accounting or bookkeeping firm.

In the last year, nearly 4 million people quit their jobs every month. And a recent survey found that 44% of people who quit their jobs have little to no interest in returning to traditional jobs.

This has fueled what some people are calling “The Great Resignation,” a situation that has made it difficult for firms to find new employees. Without a growing team, it becomes increasingly difficult to serve new clients, which then limits work capacity and revenue growth.

The last thing you want to do when trying to grow your firm is send away new business because you can’t support it.

Thankfully, there’s a way to overcome this challenge—and many firms are already doing it. In turn, they are taking on new businesses without hiring new employees.

How are they doing it, you may ask? By automating time-consuming processes in their firms.

Most firms manually do the same repetitive and time-consuming tasks every week, month, quarter, and year. This makes accounting firms a great prospect for automation.

If you automate just one process that was taking you two hours every single week, then you will save eight hours every month and 106 hours every year. Imagine how much time you’ll save if you start automating all of your manual and repetitive processes.

We have seen some firms more than double their work capacity by automating the main time-consuming processes across their firms. This gives them the ability to double the size of their client base and revenue without having to go through the painful process of finding new employees in this tight market.

However, that is not the only benefit of implementing automation in your accounting firm. There are others:

It increases firm work capacity. This is the biggest benefit and the core focus of this article. Implementing automation will remove you and your team from time-consuming processes. This will increase your firm’s work capacity and give each team member more time to support more clients.

It improves overall work quality and results in consistent client deliverables. We are all human, which means we all make mistakes. This becomes a problem as you hire new employees who are less experienced because they are prone to making mistakes. This has a negative impact on your firm’s overall work quality and results in poor client satisfaction. Implementing automation will remove human error from your process, which results in consistently high-quality deliverables for each client no matter who works on it. This improves client retention, drives client referrals, and accelerates overall firm growth.

It increases firm profitability. The biggest expense for accounting firms is payroll. If you have the ability to handle more clients (grow revenue) without having to increase payroll (your biggest expense), you will drastically increase your firm’s bottom line. This gives you more money to reinvest back into the business for growth or earn a healthy salary.

The ability to scale faster. The biggest limiting factor for growth with firms is finding, hiring and onboarding new employees to support your growing client base. Even with automation, at some point, you will have to hire new employees to continue to meet the demands of your growing client base. However, it will increase the overall capacity each employee can handle. This means you won’t have to hire as frequently and it will give you the ability to overcome this bottleneck.

So if automation can have such a huge impact on firm growth, revenue, and profitability, then why doesn’t every firm implement automation? Mainly it is not as easy as it looks and they fail to properly implement automation because:

They overthink it and never get started. As we mentioned earlier, there are a lot of automation opportunities in accounting firms. This can cause the implementation process to be overwhelming because you don’t know where to start. Even if you know, you don’t know how to implement automation efficiently. You think it will be a long process that takes weeks or months to execute which causes you to delay the process or never get around to it.

Their team doesn’t adopt the new processes and technologies. Even if you find a way to implement technology and automation in your firm, there is no guarantee that your team will adopt it. Change is hard and most employees will push back on change which will result in a failed implementation.

Here’s a step-by-step process that hundreds of firms just like yours have used to overcome these challenges and successfully implement automation.

Step 1: Identify where you’re spending your time

You would be surprised to know that you spend hours on even the simplest repetitive tasks such as:

- Chasing down clients for information.

- Scheduling meetings and calls.

- Responding to emails.

That is why you first need to spend a week tracking where you are spending your time. This will help you identify your most time-consuming activities and the biggest opportunities for automation.

You can write down where you spend your time on a piece of paper or even use a time tracking tool such as QuickBooks® Time. Whichever option you choose, be sure to be as detailed as possible and outline each activity.

For example, don’t just label your time as emails, meetings, or work, but label them as client emails, staff emails, client meetings, staff meetings, bookkeeping, or tax work.

We recommend that you only do this for a week, and then summarize your results with each activity. If your weeks drastically differ from week to week, you can track time over several weeks and summarize the results. However, the goal is to quickly get a general idea so you can start implementing automation. It doesn’t have to be perfect.

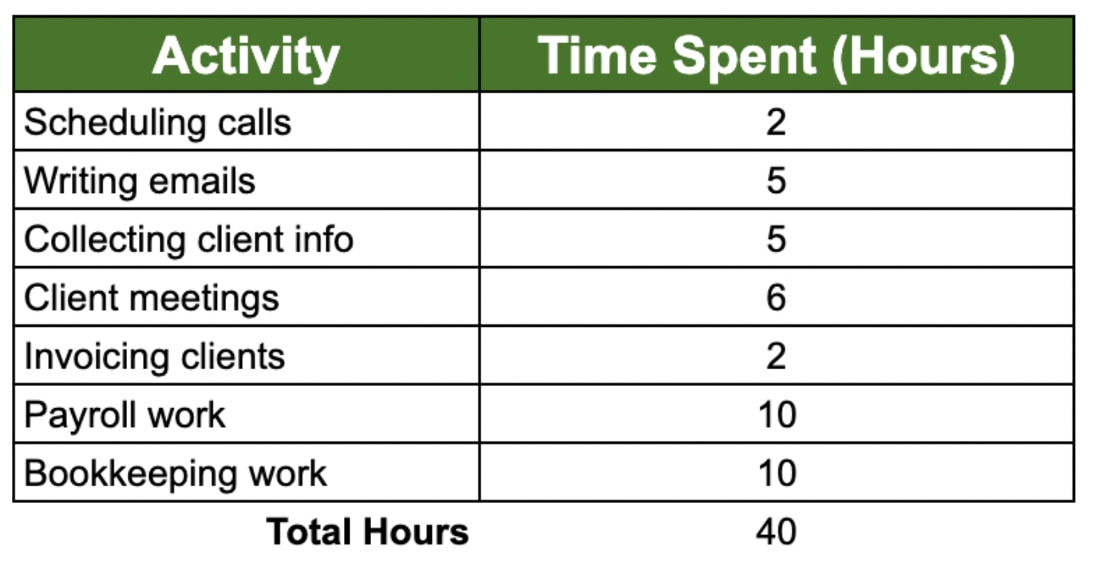

Once done, you should have an outline of your typical work week that looks like this.