We’ve been experiencing a lot of wild weather in 2017 with four category four hurricanes – Harvey, Irma, Jose and Maria – touching down. Similarly, you can’t pick up an industry publication without encountering forbearing headlines that warn of the impending storm in our industry. For example, "Automation will eliminate most of what you do in your practice in the next decade."

They say lightning never strikes in the same place twice, but with our industry, that is not the case.

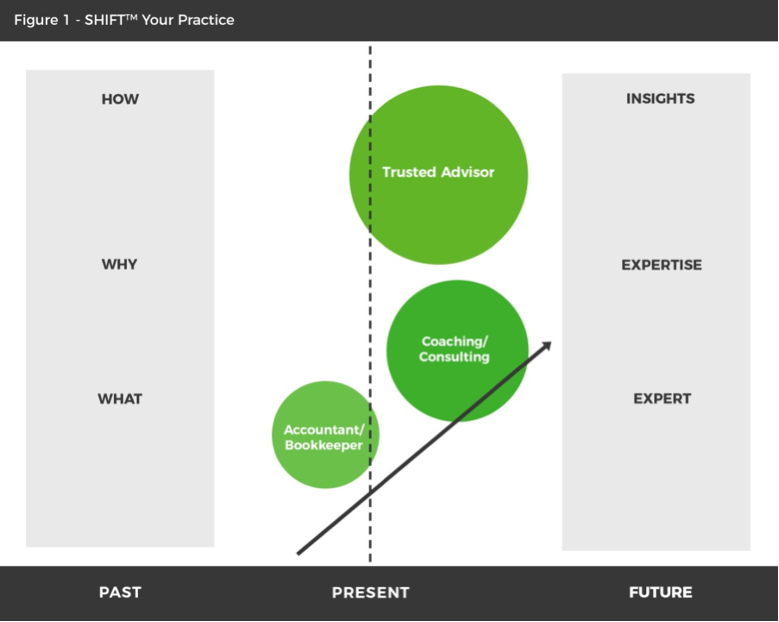

For those of you old enough to be practicing in the early ‘80s, you may recall that the invention of the personal computer allowed, and even encouraged, entrepreneurs, for the first time ever, to do all of their own bookkeeping and financial statements. The PC fundamentally changed the business model for accountants and forever impacted our role as the trusted advisor.

We became isolated from the general ledger and the data, and it moved us further away from our role as a partner in the business and closer toward becoming a servant that only provided a commoditized (i.e., price sensitive) service.

Make no mistake, the cyclonic cloud revolution is very real and equally "practice changing." Disruptive technology, such as machine learning and artificial intelligence, will affect every industry, not just accounting. Proof in point, a 2013 research study estimates that nearly half of employment in America is at high risk of becoming automated in 10 to 20 years, with the accounting profession ranking in the top six of the most automatable occupations.

Many researchers even go so far as to hypothesize that 94 percent of what you do right now as an accountant or bookkeeper will be replaced by machine learning and artificial intelligence by 2030. That is only 13 years from now.

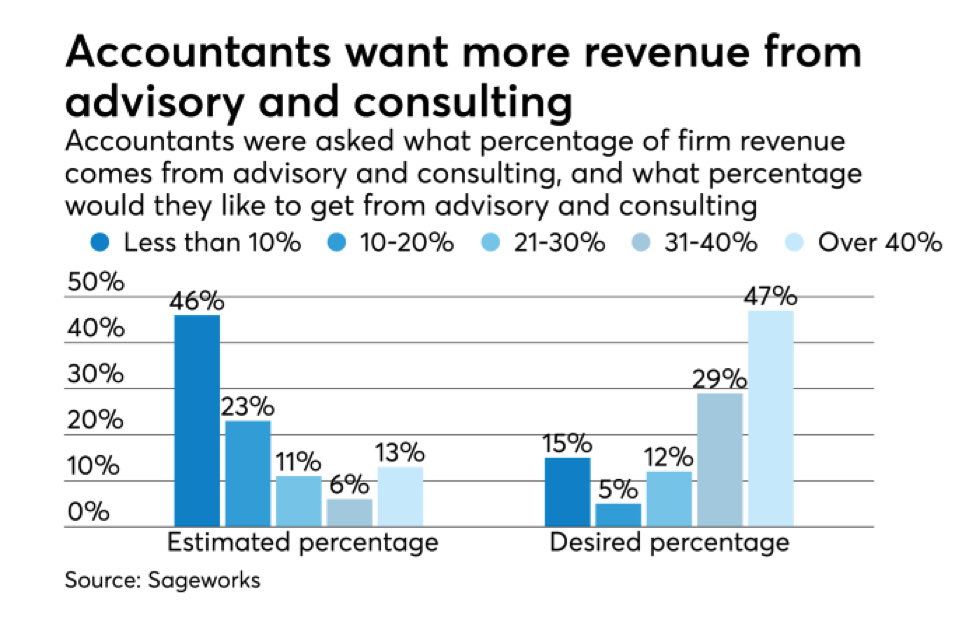

And, it also explains why there is so much focus and emphasis on making the shift to advisory. Many firms are looking to move away from backward-looking compliance work (work that describes WHAT has happened in the past and present), which is increasingly being automated by cloud accounting packages and apps. They are exploring new value-added advisory services that are forward-looking (helping the client to anticipate and deal with change, challenges and opportunities) and not so easily automated.