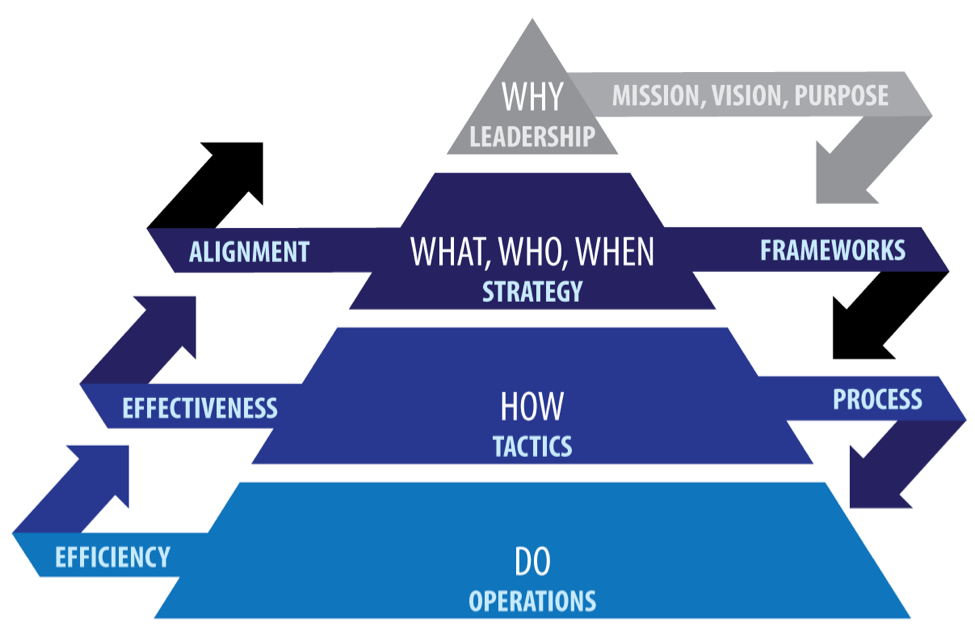

A business dedicated to making a positive impact on the world, following this framework, would never consciously choose to pursue a strategy that conflicts with its purpose. To do so would make no sense – a quick look at the chart above would confirm this!

However, when you’re in the midst of growing a business and developing it from words on a page into a fully functional profit-generating machine, the “right way” to do things is often abandoned in favor of processes that bulk up the bottom line. This doesn’t arise from a deliberate choice on the part of the business, but instead arising from neglecting to consider context.

And, the mission of a business isn’t merely hampered by a focus on profit over purpose; it also suffers when management, having determined the best way forward (in their eyes), becomes too enamored with the metrics of success. Management requires measurement – that much is true. Nevertheless, if you forget what you’re measuring (and why), and instead focus merely on the numbers themselves, you can lose the valuable perspective you need and drift into dangerous waters. This mistake has been the death of many promising, successful businesses. If you hope to avoid the same fate, then you could do a lot worse than reading the following passages carefully.

Case study: Lehmann Brothers

We’re only 10 years removed from one of the worst financial crises in history. The collapse of the investment bank Lehmann Brothers triggered an economic downturn that devastated global markets, pushing individuals, businesses and even entire countries to the brink of ruin. The Dow Jones dropped over 500 points the day they filed for bankruptcy, representing the largest single-day drop since 9/11.

Of course, we can’t pinpoint any one reason in particular for the bank’s collapse: regulatory failure, lax reporting standards and an unwillingness to see the good times come to an end were all contributing factors.

In the context of this article, we’re only concerned with one thing – the focus on metrics over purposeful progression.

Lehmann Brothers, like every other bank in history, had a clear mission: they had to make money. Simple enough.

So, how did this bank, like every other bank, intend to make its money?

Once again, simple enough – via investment appreciation, receipt of interest payments and the collecting of fees from its customers. These are the standard revenue-generating activities that all financial institutions make use of. In financial institutions, these measures are employed as metrics, which mean useful barometers of how well the business is doing. As long as these figures show year-on-year improvement, then there’s nothing to worry about.

In hindsight, it’s easy to see the flaws in this thinking. By incentivizing growth in these metrics over safeguarding themselves against the future, Lehmann Brothers consistently found themselves engaging in riskier and riskier deals. Loans were distributed freely to anyone that wanted them, with little attention being paid to the customer’s default risk. Investments were secured at inflated prices, with the purchasers rationalizing the deals with unrealistic expectations of never-ending market growth.

When the prices stopped rising quite so quickly, a lot of bankers became desperate, as serious fraud was an easier option than trying to repair the damage that had already been done. However, even this came to an end, when failure to prepare for the impending crash led to the bank going out of business.

The above is true of dozens, perhaps hundreds of institutions the world over. Lehmann Brothers merely serves as an example. A more recent example (again from the banking sector) is the Wells Fargo fake accounts scandal.

Like Lehmann Brothers, Wells Fargo understood that one of their primary revenue generation activities was opening and maintaining customer accounts. The more customers you have, and the more accounts each customer has, the more money the bank will make.

Opening lots of accounts is one route to success, but for a business aiming to succeed in the long term, growth must be driven by the provision of better products and services. Fraudulently establishing customer accounts (i.e. without their express consent) is an obvious crime. But, what drove these actions?

The problem starts with the metrics. Wells Fargo, like many other thriving Wall Street businesses, boasted a highly pressurized sales culture. From bottom to top, employees were incentivized to open as many accounts as possible. This metric clearly has some strategic benefit, as it can be a very apt measure of how well a bank is doing, when considered in context.

Unfortunately, the attention paid to the overall context of these metrics, even simply why they were being measured in the first place, was absent. Instead of focusing on maintaining good customer relationships and ethical standards first, and revenue second, employees were blindly chasing one isolated metric. The result (as we all know) was disastrous: over 2 million fraudulent accounts opened, over $300 million in combined damages and fines, and a reputational blow that will prove very difficult to shake.

It’s also important to note that there’s nothing wrong with pursuing metrics as a mark of success. With a keener eye to the future prospects of the business, and a more balanced approach to the pursuit of growth, things could have played out very differently.

Sadly, lacking this critical context, Lehmann Brothers was doomed and Wells Fargo’s reputation took an enormous hit, one which may take years to recover from.

If you think that the lessons learned from these massive banks aren’t applicable to you and your situation, then think again. While you may not be dealing in billions of dollars in turnover, focusing on metrics over mission will doom your business to failure, just as it doomed countless other entrepreneurs before you.

How this relates to you

Now, enough theory … let’s talk about something practical.

Imagine a cleaning company operating in New York City. They’ve been in business for three years, and they’ve established themselves a solid base of clientele. At their quarterly review, management have decided that increasing revenue 10 percent by the end of the year is a realistic target.

These managers have been in the business for a while, and they understand that their customers are king. Without clients, there is no revenue. Therefore, they have to focus on the customers!

So, what can they do?

Well, as you can probably guess, they have a few main options:

- They can sign on more customers.

- They can get more money out of their existing customers, either by providing a more expensive service or providing the same service more frequently.

- They can sign a small number of large clients.

All three of these are viable options for a business gunning for a 10 percent bump in revenue, and smart managers will carefully analyze which of these choices is the best fit for their particular situation.

Now, this is where things get dangerous. If the business forgets its core objective (to satisfy its customers), then they risk losing everything.

If they decide to pursue new clients, a subsequent decline in the level of service provided will inevitably drive away some old customers. This can lead to the business “running to stand still,” acquiring new clients as fast as they’re losing old ones. In this case, focusing simply on the number of total clients, without regard to churn rate or customer satisfaction levels, can spell the end for the company. No business can hope to get away with providing a poor level of service in this day and age. Thirty years ago, a disgruntled customer might tell a handful of their friends about a poor experience. Today, their displeasure can reach anyone with an internet connection via Yelp, Facebook, Twitter or anything of the like.

If they decide to focus strictly on getting more out of their existing customers, they may elect to concentrate simply on the metric of “revenue per customer.” Reducing their clients to numbers on a page, although useful in certain contexts, means that they neglect the most important factor in business success: cultivating good relationships with customers. Blindly focusing on upselling and getting clients to agree to deals they don’t really need undermines this goal. Inevitably, the business will suffer – all because they couldn’t see the bigger picture. Customers that may have proven to be extremely profitable in the long term are forfeited in exchange for short-term revenue.

Chasing a few large clients brings its own challenges, much like the first two options. Bigger contracts bring bigger demands, which the business may be unable to meet without overextending. Declining customer satisfaction across the board, loss of disappointed clients and dramatically reduced revenue can soon follow, all stemming from that initial decision to chase a metric, instead of evaluating their capabilities to do so.

There’s many other metrics which can ensnare your attention: Facebook likes, cost per impression, cost per clicks, cost per customer acquisition and more. All of these numbers have a place within a cohesive, well-planned business strategy, but they’re rarely the heart of a winning formula.

Failure to recognize their place in the ecosystem at large will lead you to nothing but stress and inefficiency. You have to understand how everything fits together in the medium/long term, and avoid short-term fixation.

Summary

Metrics matter, that much is true. No matter what your goal is, you need to be able to quantify success in some manner; otherwise, how will you know if/when you’ve achieved it?

However, any particular metric will always pale in comparison to your mission. The only metrics that matter are those that clearly measure your progression towards this vision. Be careful that you’re not getting too wrapped up in numbers that don’t necessarily serve you in the medium/long term.

Complete pictures require complete measurements. A business that values metrics over mission is akin to the farmer loading up his horse and expecting the cart to pull them to town.

The road to success is long and hazardous. Every day you spend chasing some meaningless metric is another day off the right path that is dead time, never to be reclaimed. These detours can be alluring at first, begging to be pursued, but when you finally get up close, you realize you’ve been chasing an illusion. The promised shortcut is nothing but a dead end, leaving you further from your destination than before. In today’s rapidly shifting economy, these mistakes can cost you everything.

Save your time, money and energy. Stay focused on your goal. When you do this, you’ll find that the meaningless noise fades away, drowned out by the sound of your continuing forward progress..

Your next steps

Next, practice the following steps:

- Beginning with your mission and purpose, develop a complete set of metrics to measure your progress towards these pre-defined objectives.

- To avoid the blind pursuit of one indicator above all else, you must ensure that you monitor a number of relevant metrics. If you measure new customer acquisition rate, make sure you also measure churn and customer satisfaction.

- Whenever you share or talk about your metrics, make sure to always include the context for the numbers.

- If you create documentation of your metrics, include a “why” section at the top so that the real meaning behind the numbers is clear to anyone who makes use of them.