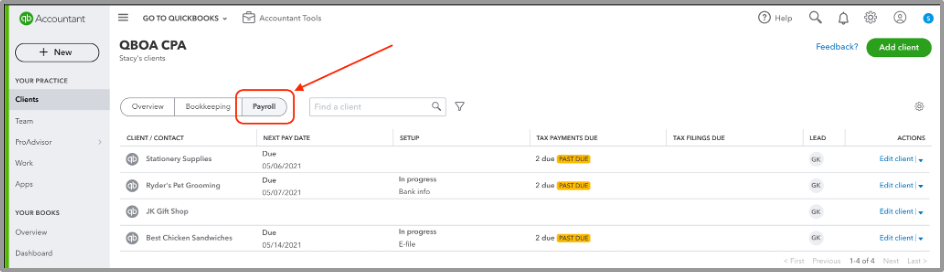

If you haven’t seen it yet, you will soon: it’s a new payroll dashboard in QuickBooks® Online Accountant that shows all of your clients’ payroll status on one screen. It’s available for anyone using QuickBooks Online Accountant who has access rights to clients who are using QuickBooks Online Payroll. This means any accountant with clients on Core, Premium, or Elite will have access to this feature!

Seeing everything in one place can save you time, give you more control over payroll tasks, and allow you to access more information in one place.

What does this dashboard do?

The new payroll dashboard gives ProAdvisors® a view of the most important payroll activities:

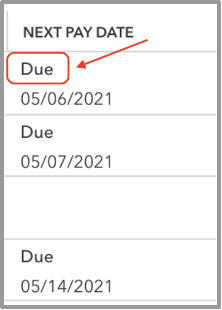

- When payroll needs to be processed.

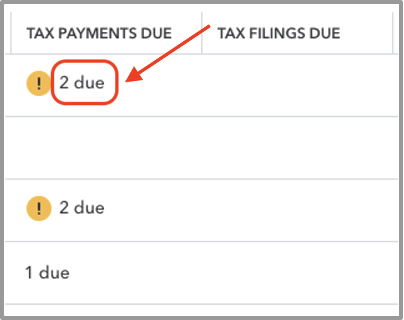

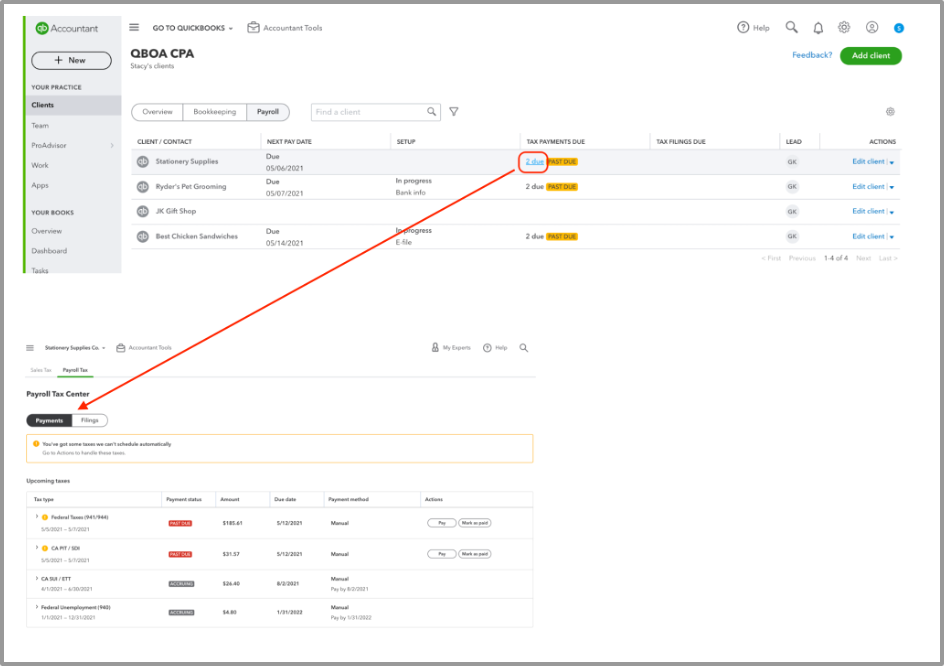

- What taxes/filings are coming up.

- Where the client is in the setup process – my favorite feature!

How will it help accountants?

With these views, you can stay on top of the payroll services you provide, or be proactive on important matters impacting your clients if they are processing their own payroll.

My firm has recently undergone changes in team members and added new clients; so having one place to check the status of all- things payroll is a great way to make sure we stay on top of getting our clients set up in a timely manner, as well as making sure payroll is processed on time.

This dashboard has also been especially helpful with the conversions I’ve been having in moving clients from Intuit® Online Payroll to QuickBooks Online Payroll.

Where can I find the payroll dashboard?

The payroll dashboard is a new tab in the Client list when you log into QuickBooks Online Accountant: