- Workflows for accounts receivable: With workflows, you set the system up to send out the reminders on the due date and when the invoice is overdue. You can filter it down using the client types, or just specific customers. It’s very flexible. Once the system is set up to work for you, another manual process is swept away by automation.

- Set up a policy and procedures with the accounts receivable staff: What happens when a customer doesn’t pay after a predetermined amount of time? Get the entire staff on the same page, with written policies and procedures for your firm.

- Consider customer payment plans: Depending on the firm, if their practice area includes family law, the funds to pay the attorney may be slim. But, if you create a workflow with a flat fee and progress billing, this is a doable system.

- Collections and write downs: We all know this is the last resort. Work with the attorney of record on how this should be handled. Attorneys are notorious for not following up on late payers. This is where we can assist the team. There are also firms out there that specialize in collections. Some are automated, such as the app CollBox, and some outside firms can provide a more personalized, softer touch.

The strategy meeting

When we have that initial strategy meeting on accounts receivable, we always start here. We talk to the staff to learn how it was being done, and see where we can make improvements to the system.

I often find that the clients’ staff is struggling with antiquated systems, and are often doing work that is redundant and clunky. The accounts receivable staff has trouble just finding the time to keep up with entering payments and bank deposits.

With the accounting team’s assistance at our firm, we can typically set goals, such as no invoices outside of 30 days in six months. We help collect, clean up, and streamline the processes with QuickBooks Online Advanced automation features. We implement these new workflows that include automation, which will also result in fewer errors. The staff is often delighted that we are there to assist and take the initiative.

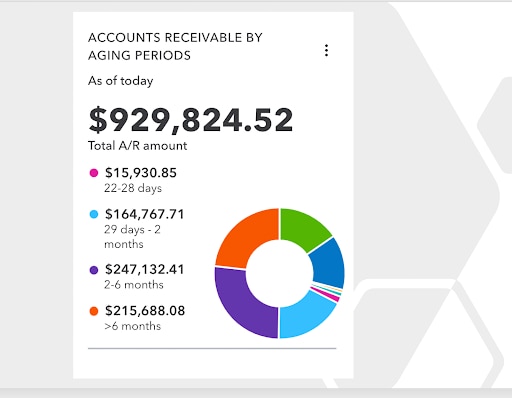

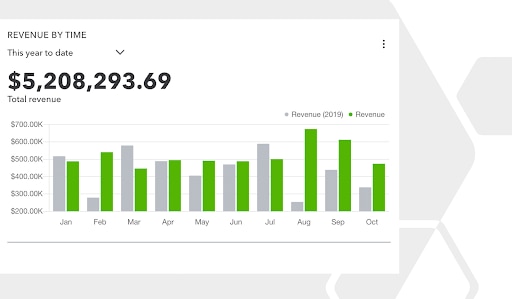

The significant win here is improved cash flow and increased revenue. And, who wouldn’t want that for your client? Hey, we even have a widget for that in QuickBooks Online Advanced.

This is just one area where you can add a more advisory role to your customers. Having a plan and setting goals is the number one way to motivate the entire staff.

Want a deeper dive? Check out these resources and tips

Would you like to learn more about how to have that advisory conversation, using tools like QuickBooks Online Advance’s Performance Center? Join us at Scaling New Heights, where we do a session called “Role Play Your Way to Advisory.” I’ll be teaching it along with my sidekick, Matthew Fulton. We hope you join us for more on this very important topic.