Editor’s note: This article was updated with new content on Aug. 19, 2020.

Speaking to accountants and bookkeepers like you, we’ve learned about the challenges of creating and following a consistent process for closing your clients’ books on a monthly basis. Ensuring the books are accurate and complete is time consuming and stressful.

For those of you managing a team of bookkeepers, you have the added challenge of creating an easy-to-replicate process that maintains a consistent quality of work, without feeling like you are constantly breathing down your bookkeepers’ necks!

To help you spend more time focused on your client’s growth and success, and less time worrying about administrative tasks, we’re excited to share month-end review, a new accountant-only feature found exclusively through QuickBooks® Online Accountant that we’ve built to help you and your teammates close your clients’ books with more accuracy – and in less time.

What can it do?

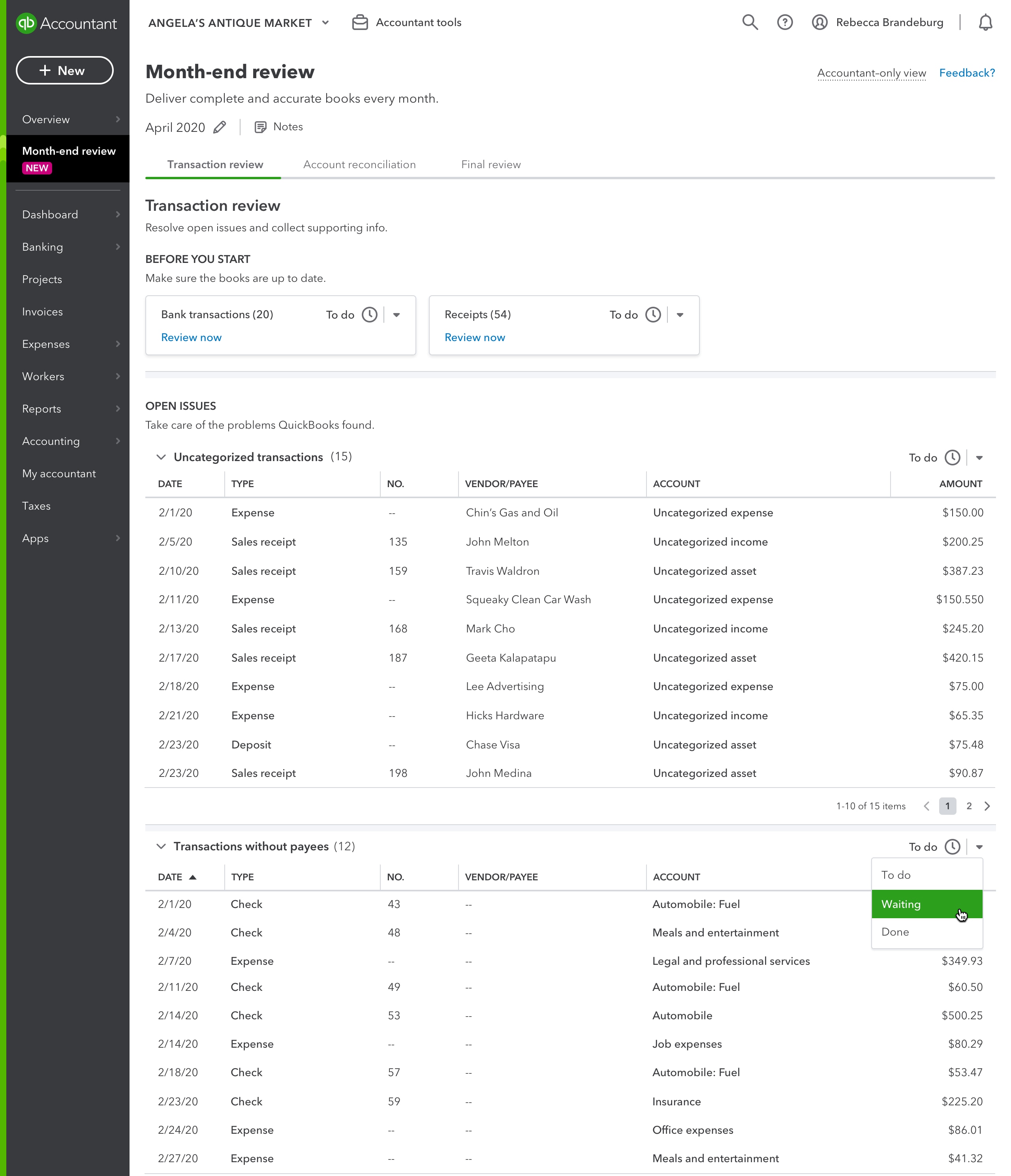

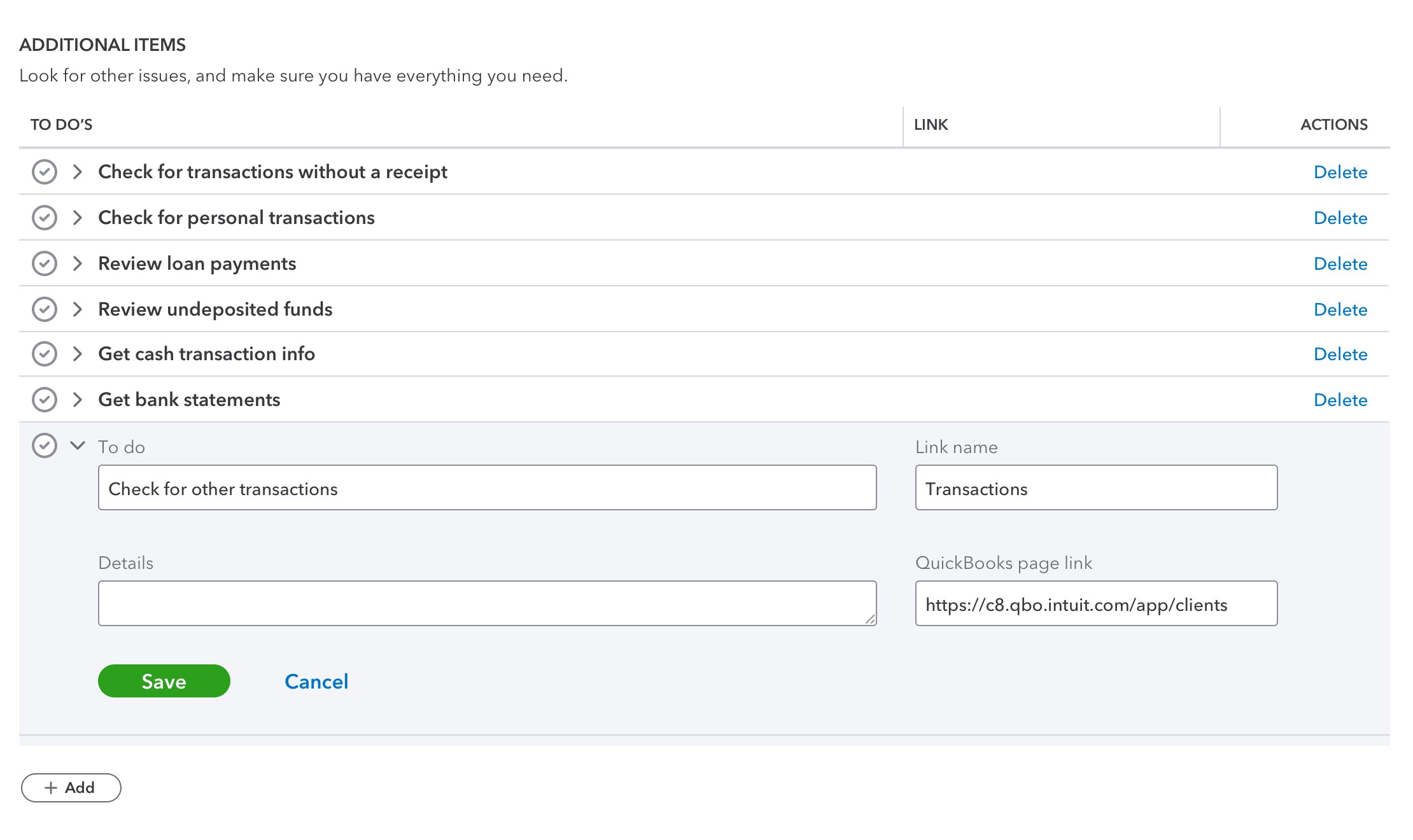

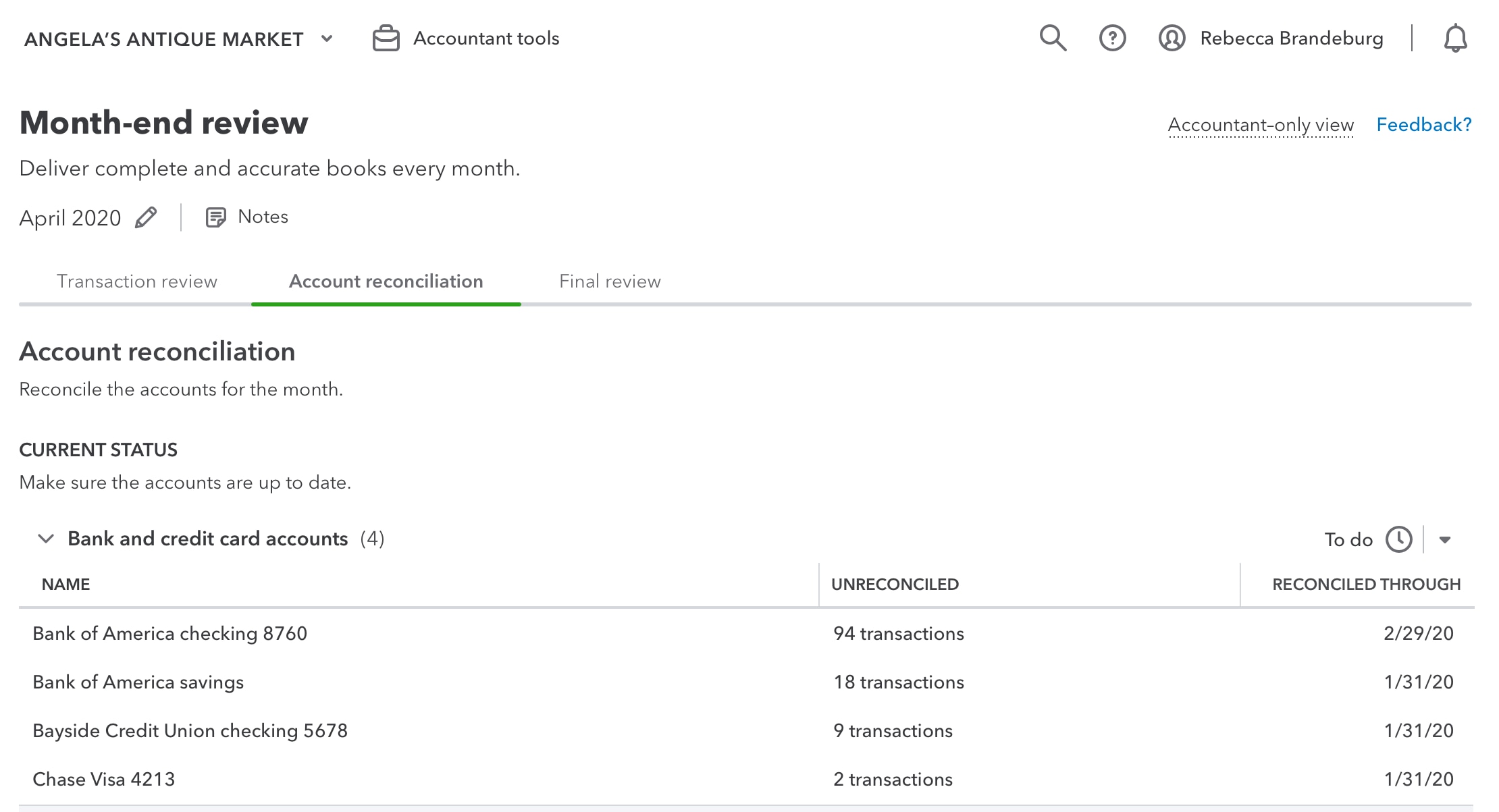

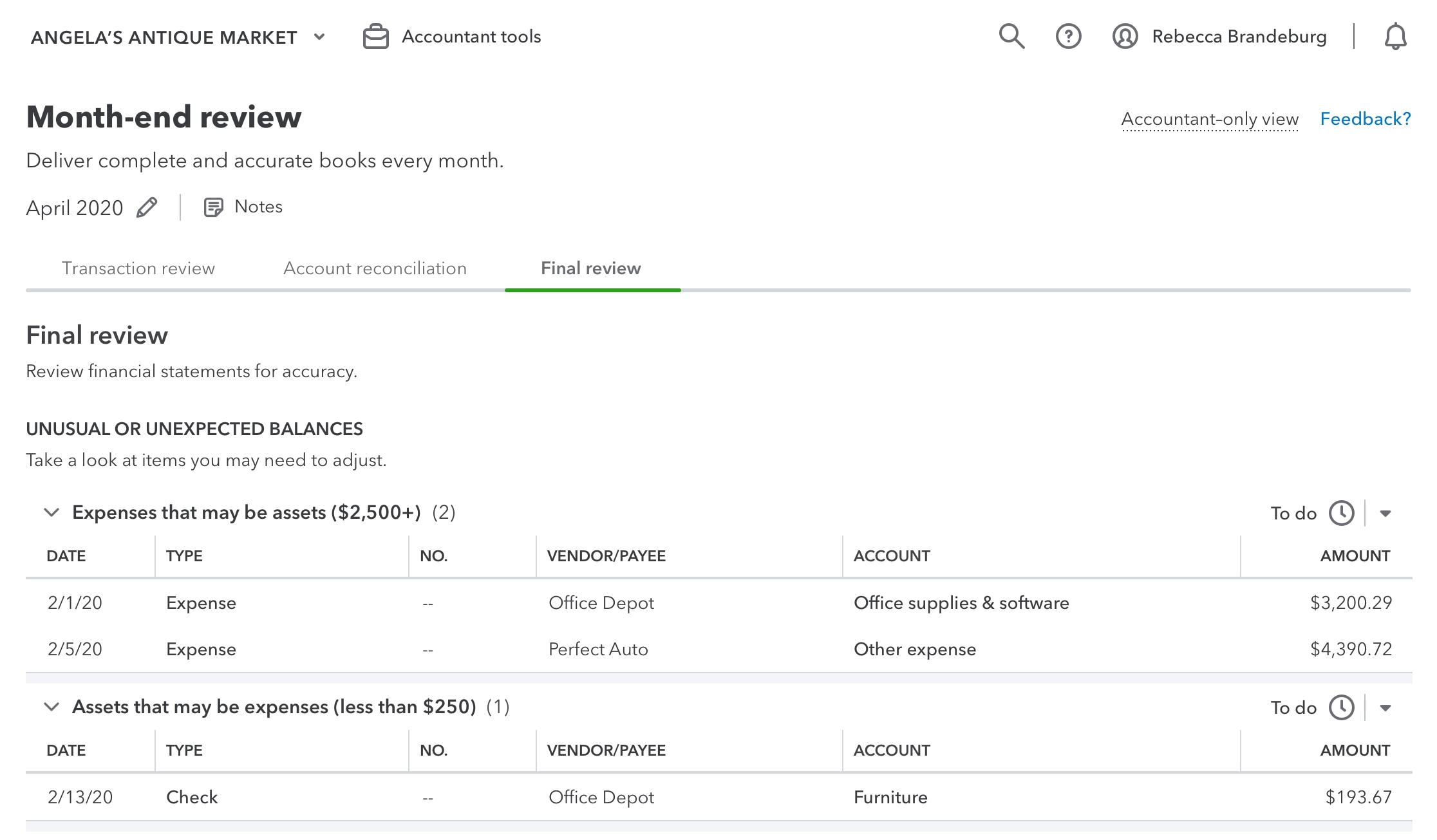

When designing month-end review, we first spoke with accountants and bookkeepers who have successfully implemented a monthly books-closing process in their firms. We then combined these best practices with the power of QuickBooks to create an easy-to-follow workflow. Throughout the process, month-end review automatically identifies and helps you resolve incomplete transactions, unreconciled accounts, and other common – and not so common – bookkeeping issues. Along the way, month-end review also provides recommended checklists that you can customize for the specific needs of each client.

To help you stay organized, we’ve added progress tracking, making it easy for you to check off your tasks as you go and see the monthly status of each client on your client list. For those managing a team, you’ll also be able to track progress at the bookkeeper level, making it easier to identify roadblocks before the end of the month and provide additional support to bookkeepers who need it (see how it works).

Where do I find it?

To access month-end review, sign in to your client’s books through QuickBooks Online Accountant. You’ll see month-end review on the left-hand navigation bar. You can also access it from the books tab in your client list.

How do I use it?

Inside month-end review, you’ll find three tabs that will walk you through the process.