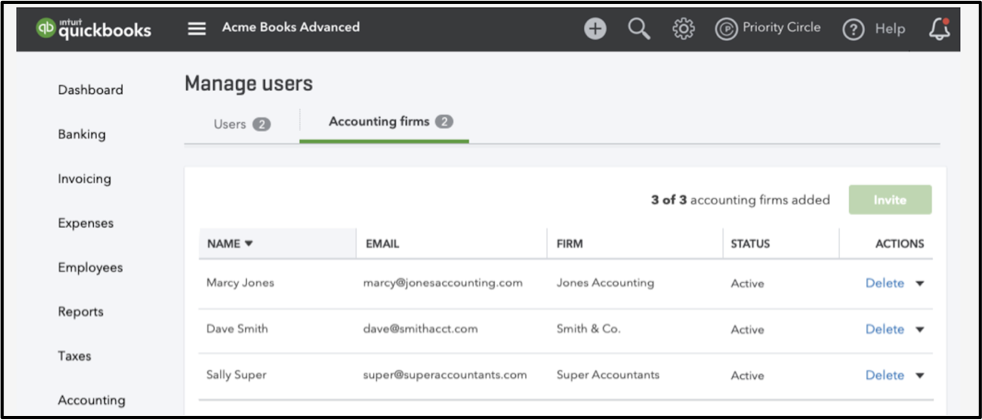

Select the Invite button to add a new accounting firm (up to 3). Or remove users in the Actions column on the right.

With these added resources, your thriving clients can get the help they need to spur their growth—such as seasonal tax support, temporary consultants, external CFOs, and more.

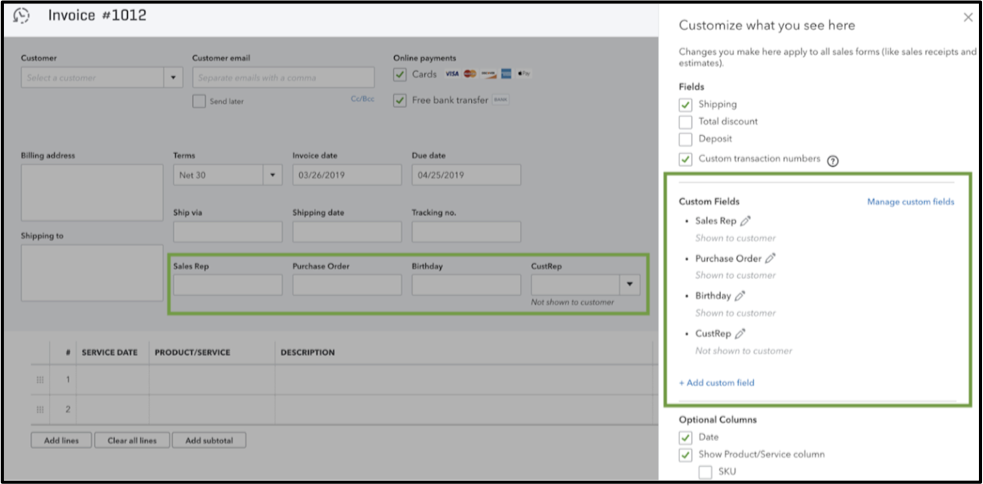

New! Track what’s most important to your clients’ business with custom fields

In a nutshell: The more your clients know about their customers, the more they can cater business to their needs.

With our new custom fields in QuickBooks Online Advanced, you can track more granular data than ever across sales reports, purchase orders, customer profiles, and more. Plus use custom fields to organize and filter financial reports to easily surface the biggest details.

How it works: Your clients can create as many custom fields as they want, with up to 10 fields active at a time.

Custom fields are entirely up to you and your clients, and can be virtually anything that’s unique to their industry that you want to track. Get ideas on custom fields here.

Once you’ve created custom fields, you’ll be able to see and manage them on financial forms, like invoices, for example.