It’s time to celebrate the season of frights with good old-fashioned spooks, treats, and costumed shrieks. Plus, to sweeten things up, we’ve added some product updates this month.

New! Share QuickBooks® updates with your clients – send them this link for QuickBooks Innovations.

What’s new in October

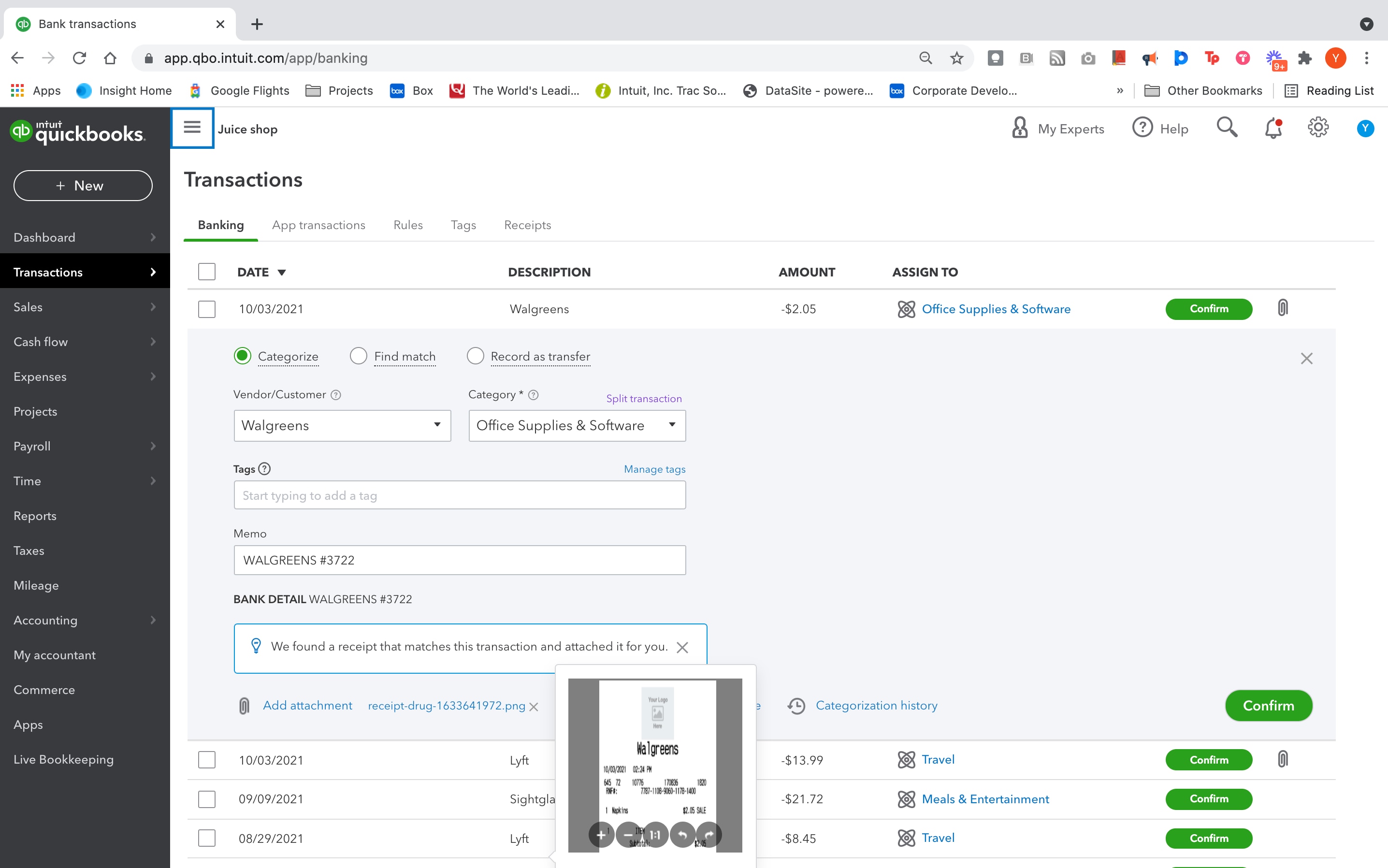

Matching receipts to reviewable bank transactions on QuickBooks Online

Changes to Intuit Online Payroll/Intuit® Full Service Payroll subscription

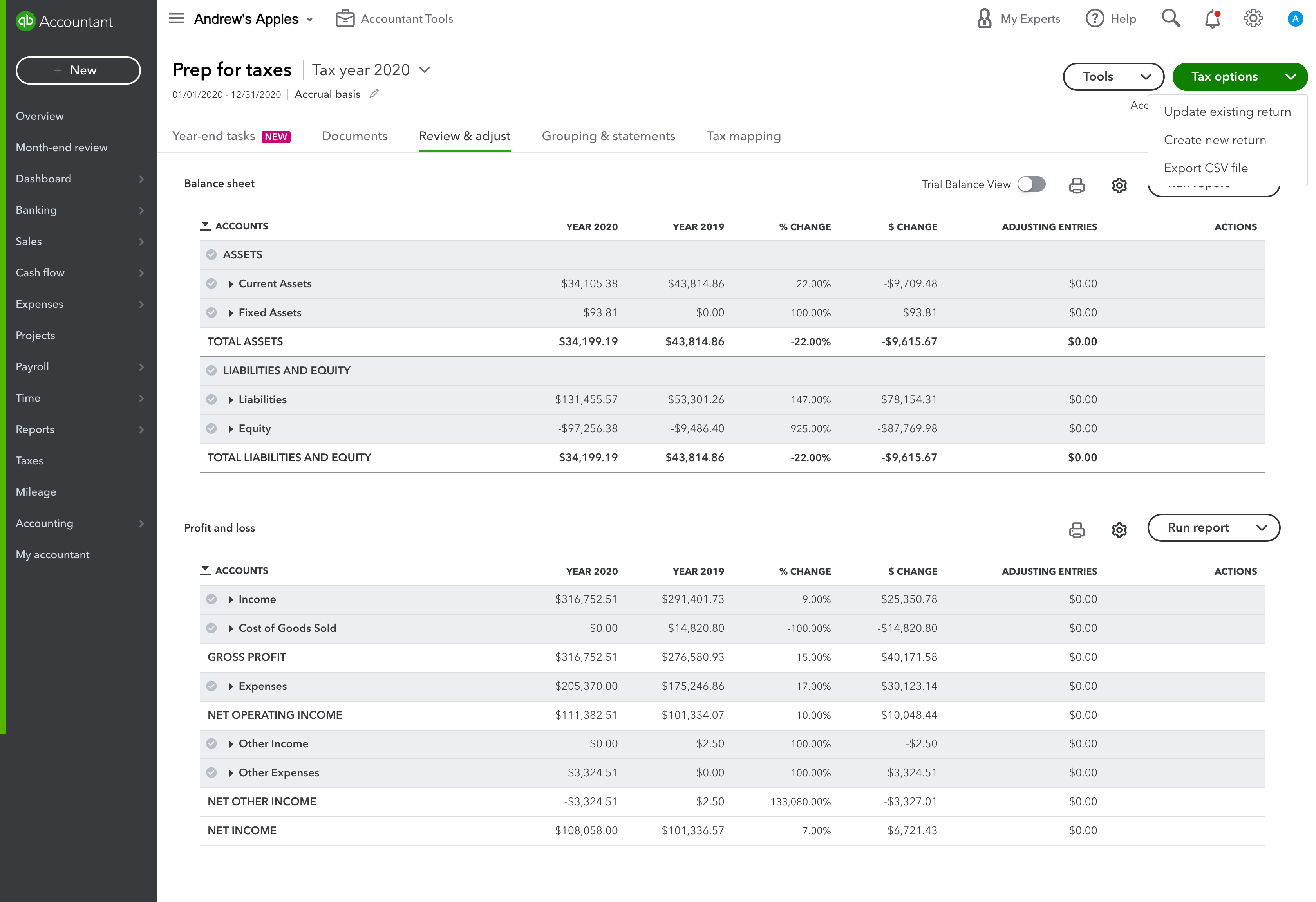

QuickBooks Online Accountant Prep for Taxes

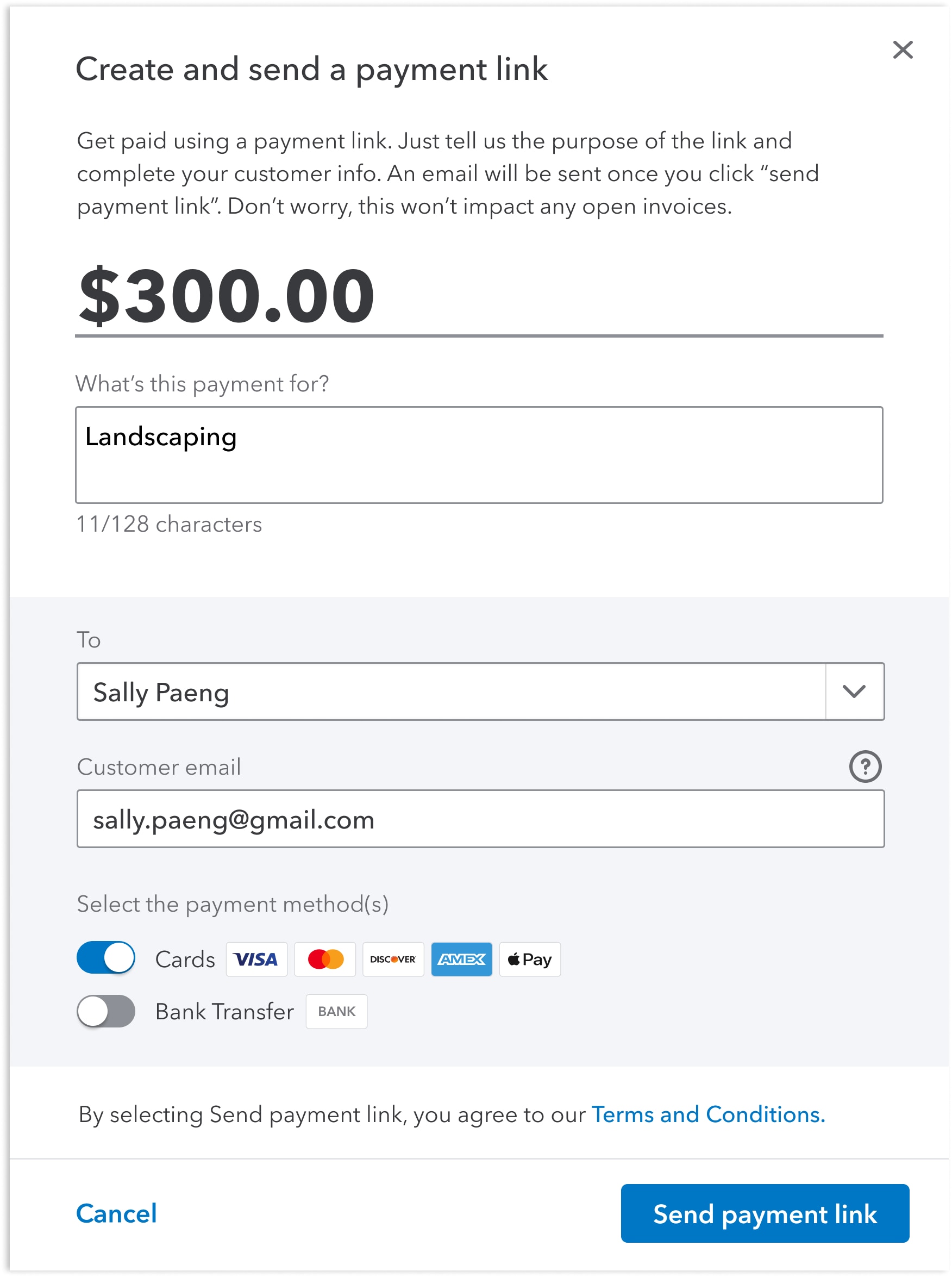

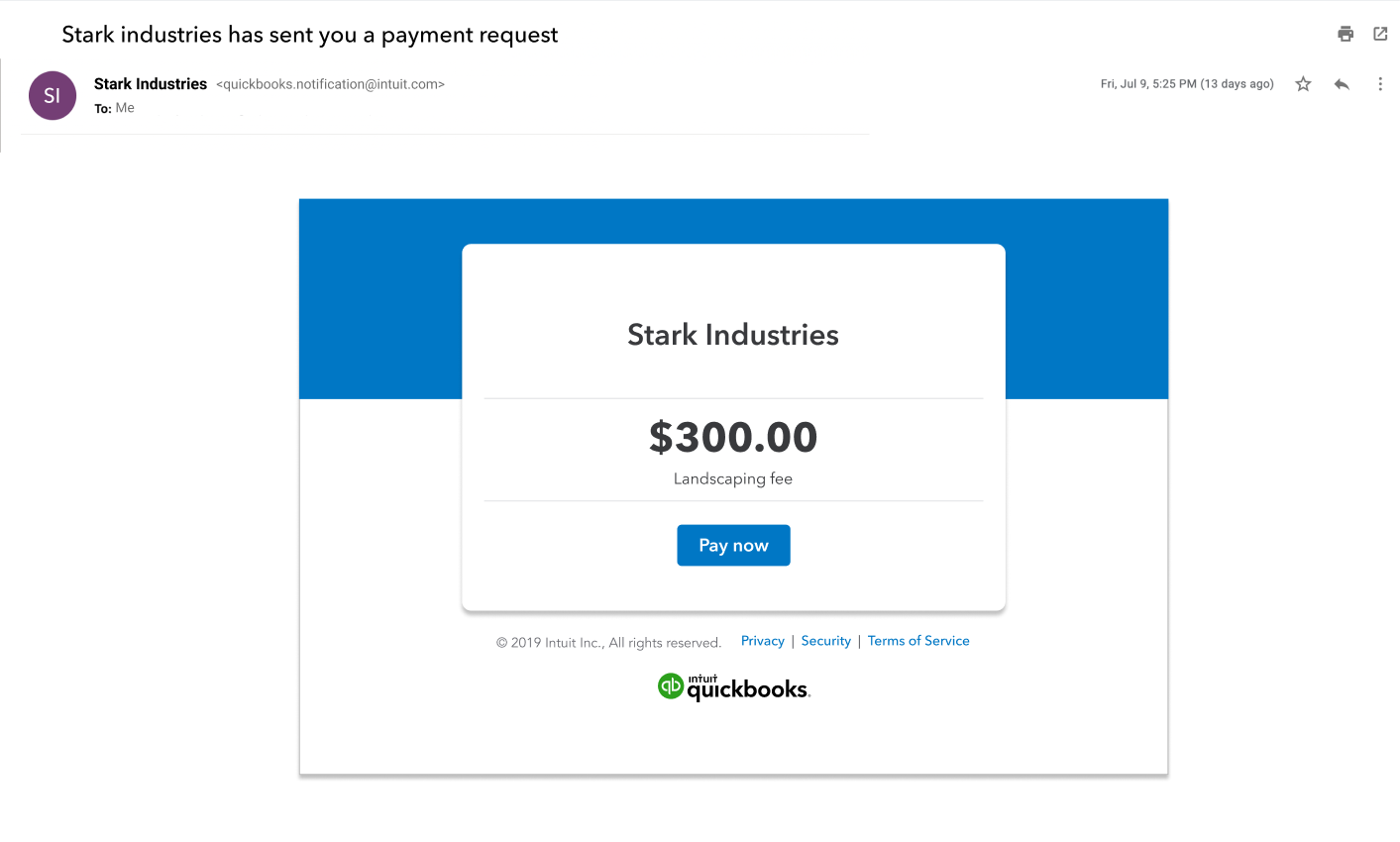

Payment links in QuickBooks Desktop

QuickBooks Enterprise with cloud access

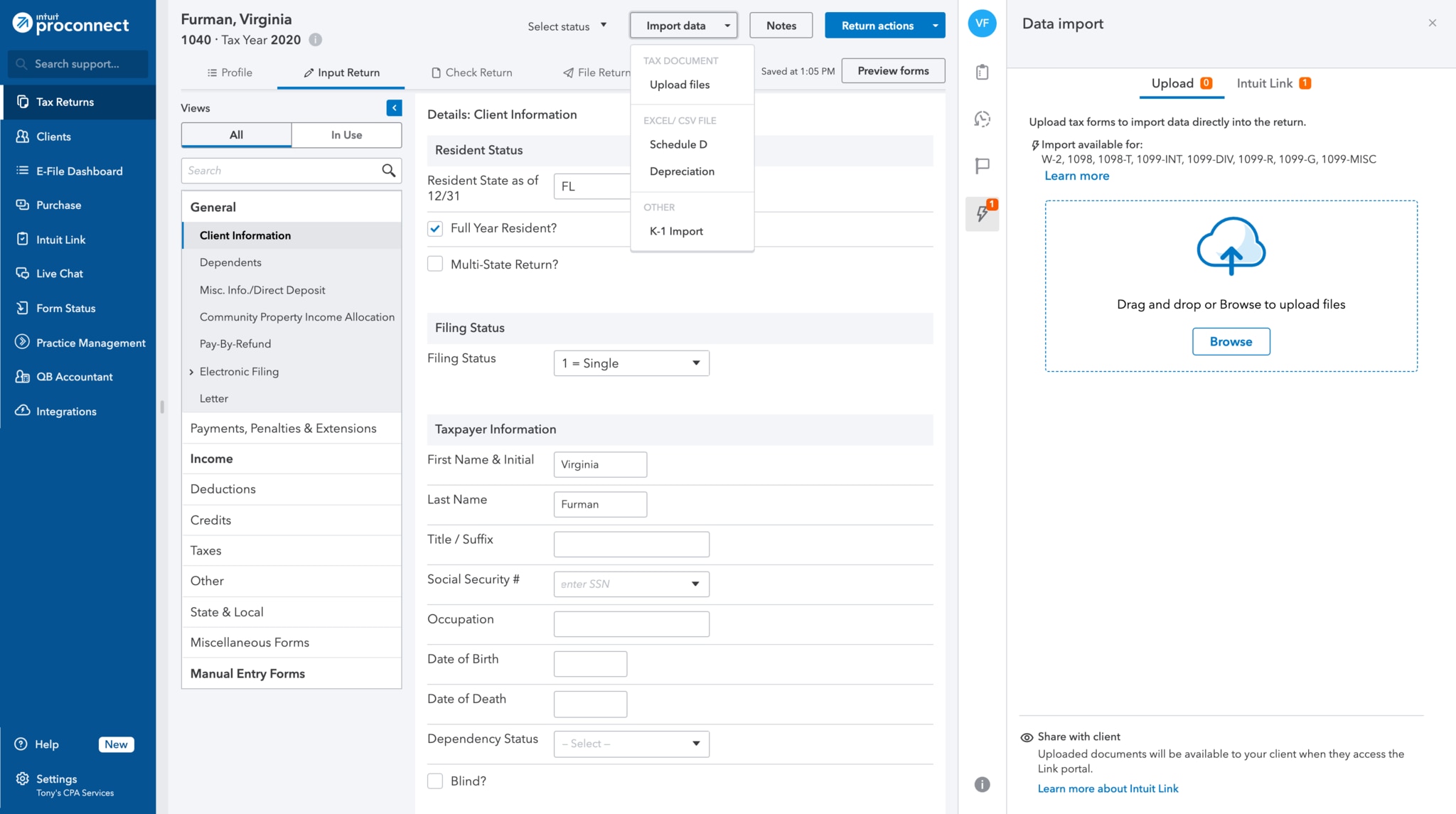

Import data directly to ProConnect Tax via QuickBooks Online Accountant

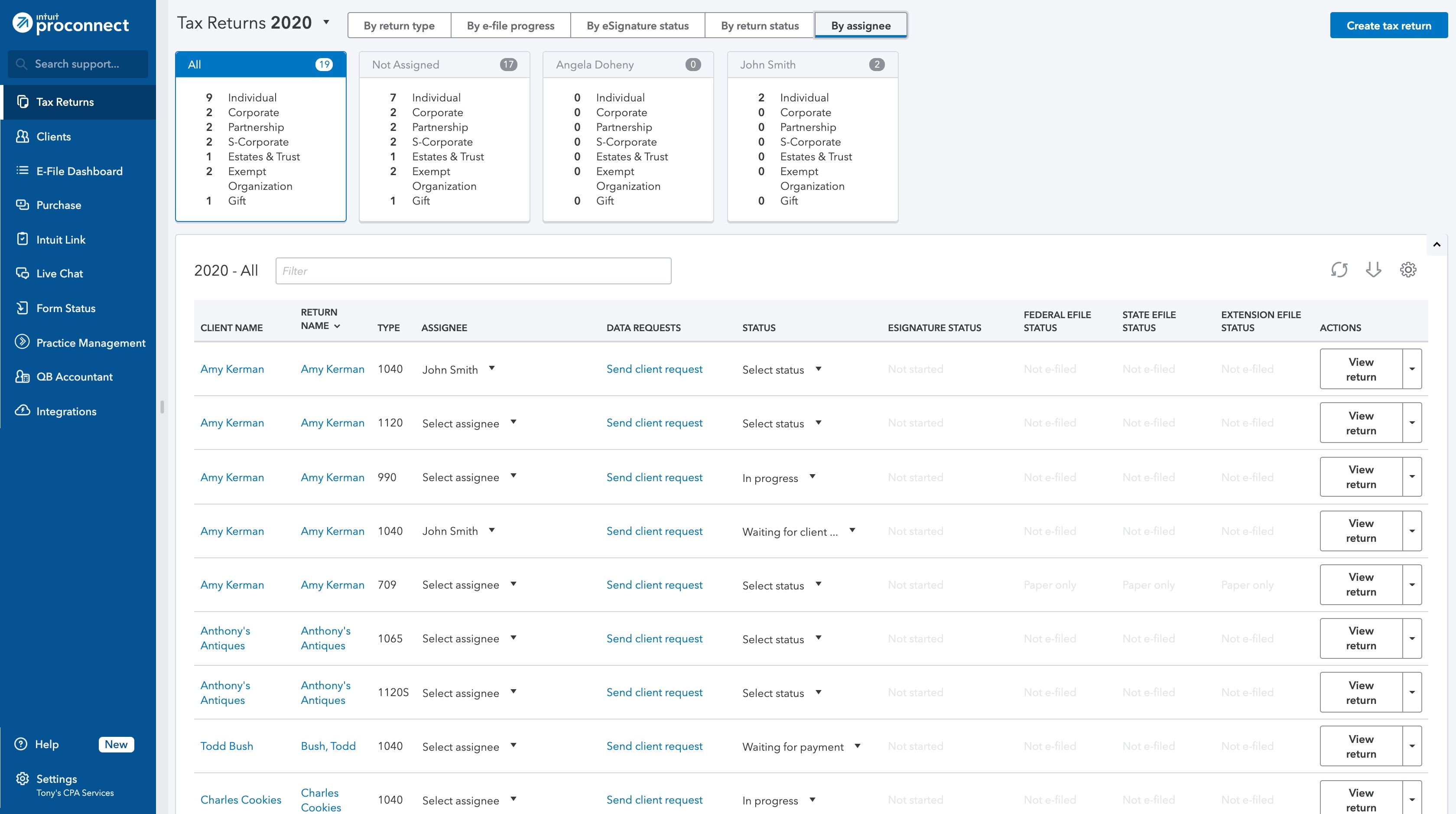

Assign and manage your team in ProConnect Tax via QuickBooks Online Accountant

Simplify payroll tasks: Add Intuit as your Third-Party Agent