Flannel season is here and the holidays are right around the corner. So before you get busy with fall hikes, horror movie marathons, or baking treats, make sure you carve out some time for all the wicked good updates we have for you this month.

New! Share QuickBooks® updates with your clients—send them this link for QuickBooks innovations.

Special announcement

QuickBooks ProAdvisors®, accountants, and bookkeepers: We hear you!

Thanks to your feedback, we continue to make improvements to our QuickBooks products. In return, we’re working to organize several forums to share with you the product changes and improvements we’ve made based on your input. This will include several live events throughout the year, so you can hear directly from our leaders on how we are evolving our products to better meet your needs, and how they impact you and your clients.

Stay tuned and watch this spot for more updates.

What’s new in October

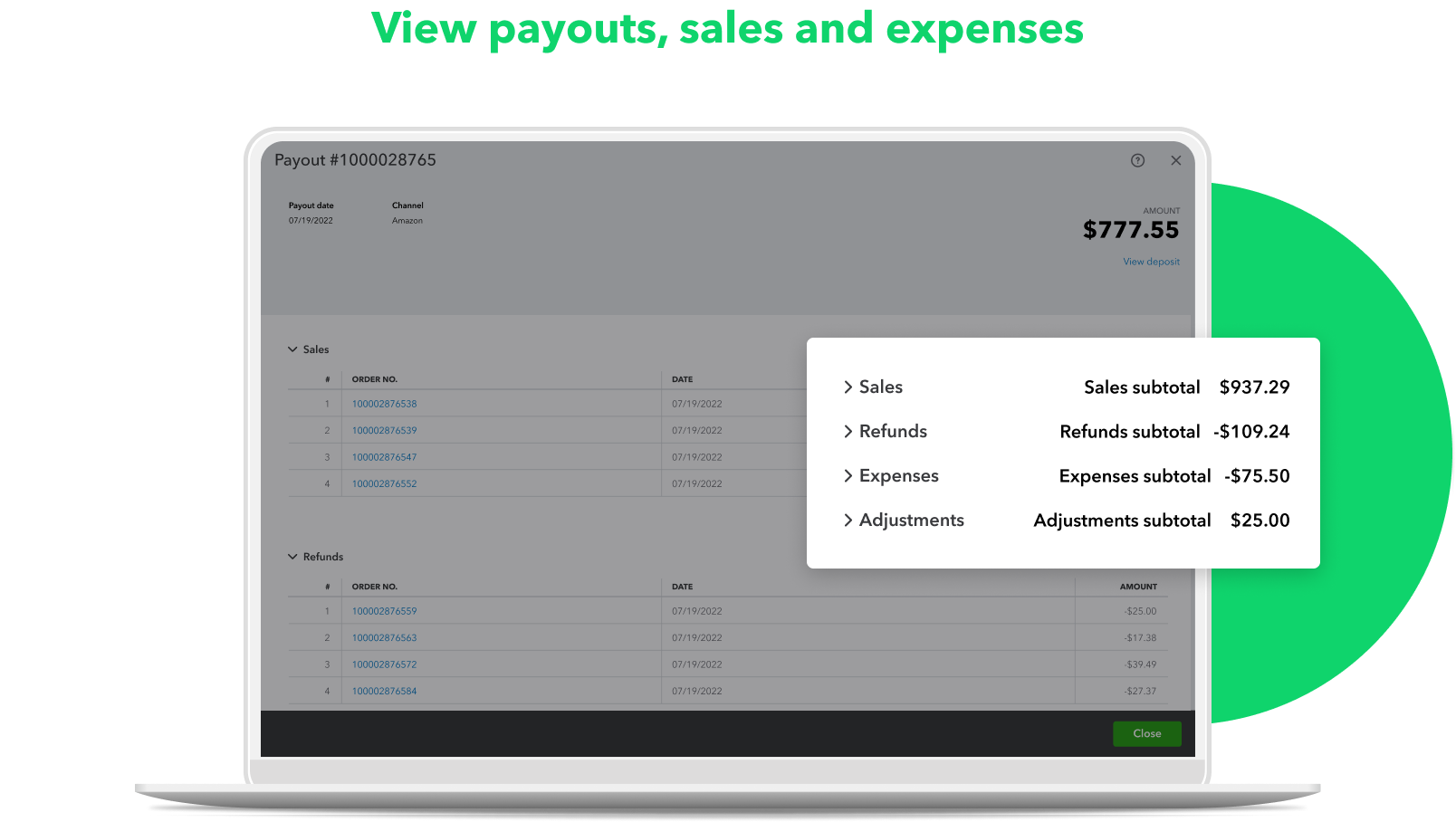

Now available: Commerce accounting in QuickBooks Online

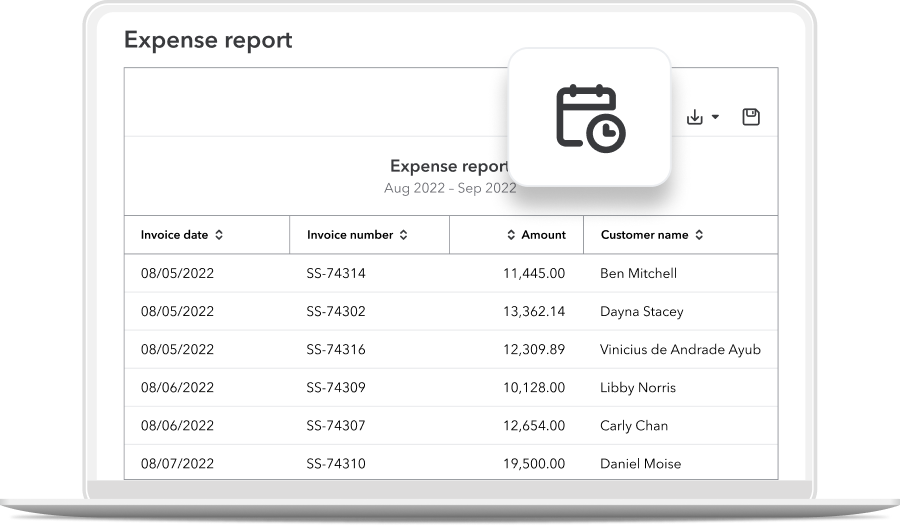

Custom reports scheduling in QuickBooks Online Advanced

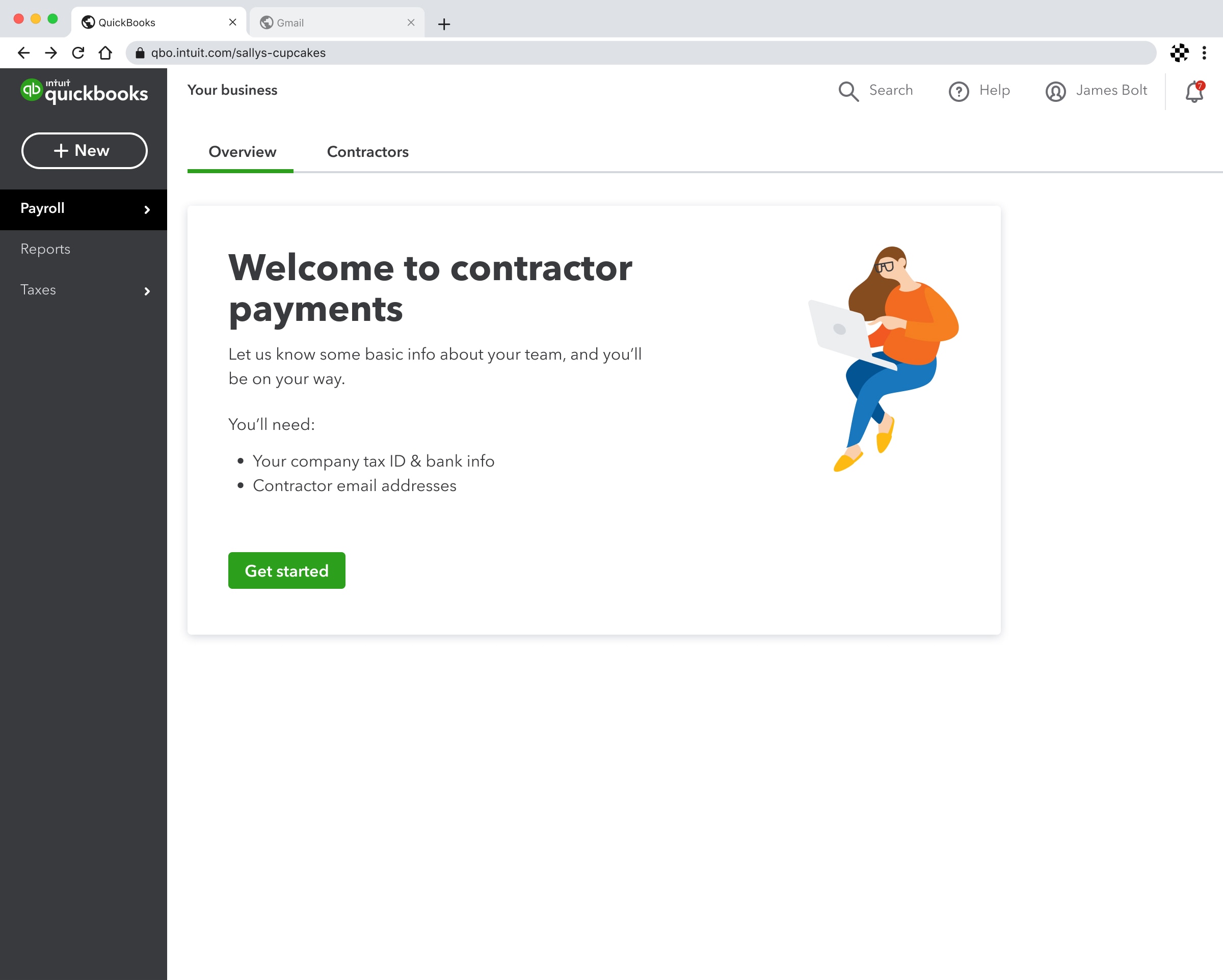

QuickBooks contractor payments

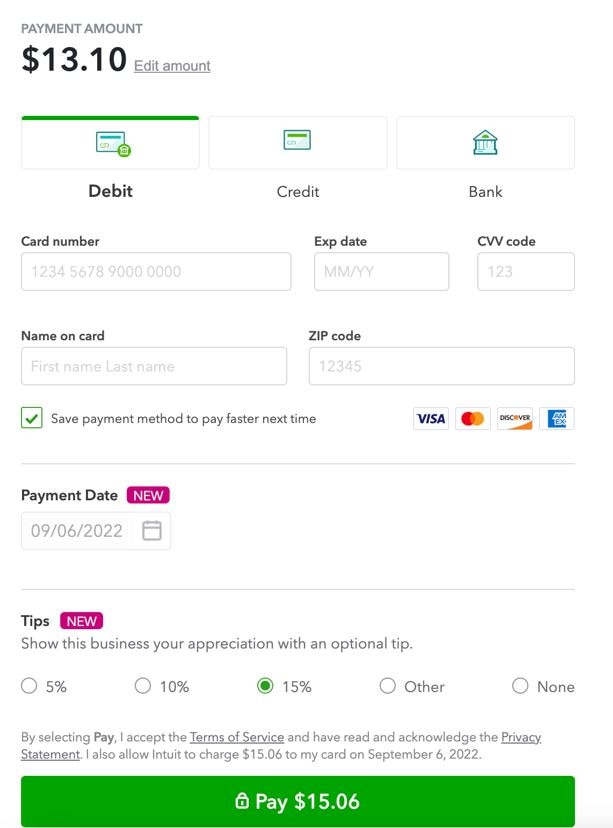

Now available: Option to add tips to invoices in QuickBooks Online

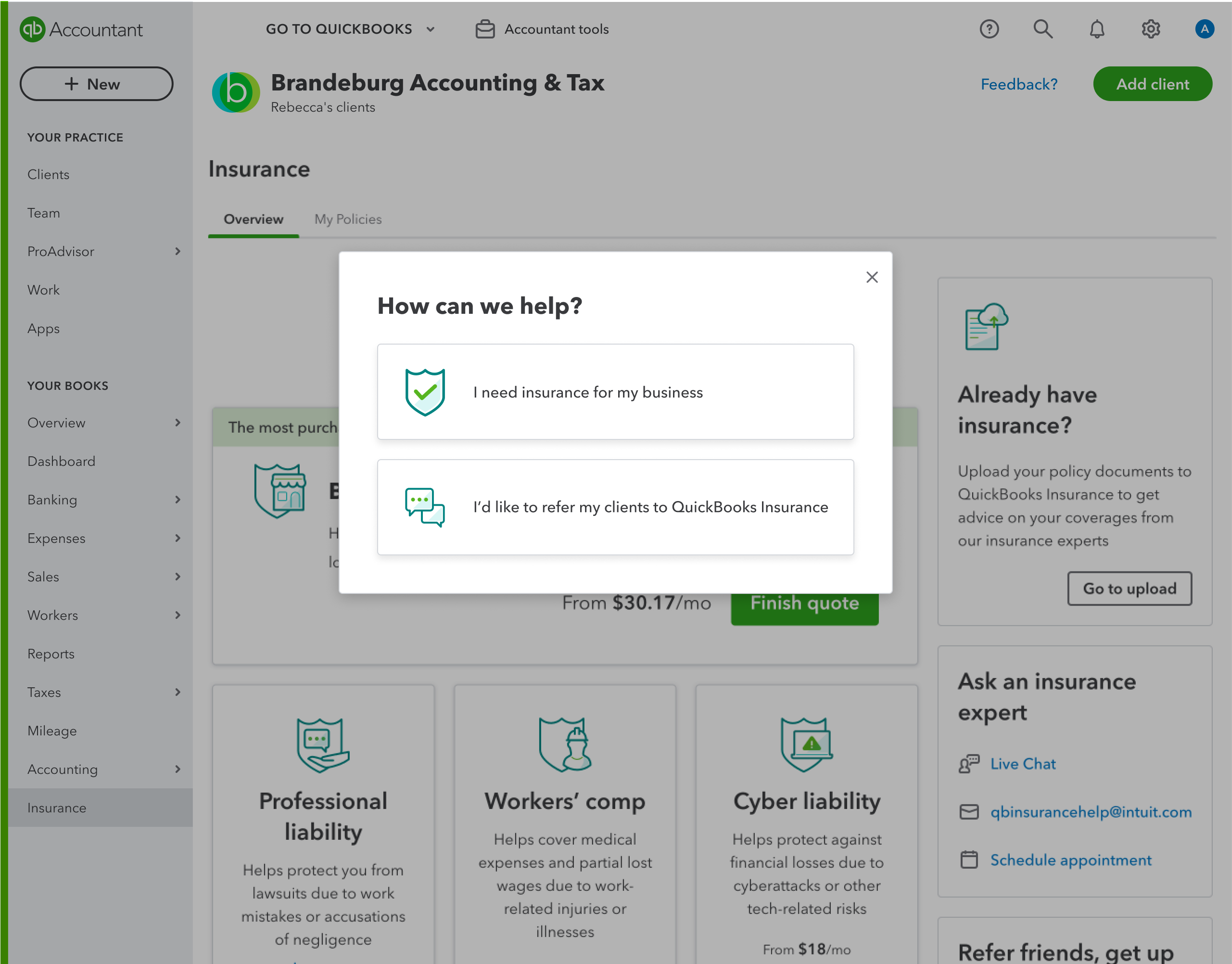

QuickBooks Insurance for your practice and clients

Personalized migration assistance to QuickBooks Online