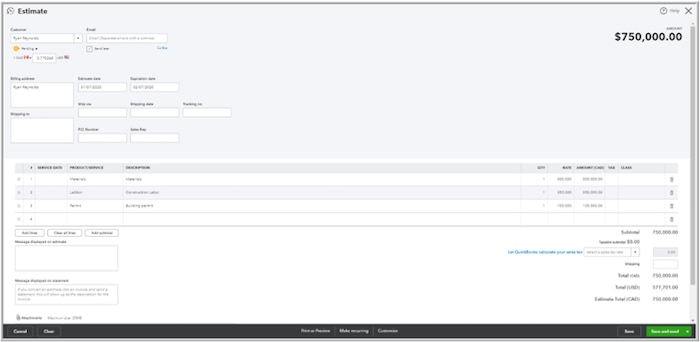

Remember our old friend Craig of Craig’s Design and Landscaping Services? He’s tried his hand at landscaping, used car sales, and computer accessories. Last month, he decided to give construction a whirl, but he consulted his colleagues about best practices and he learned how to ask for, and track, customer deposits.

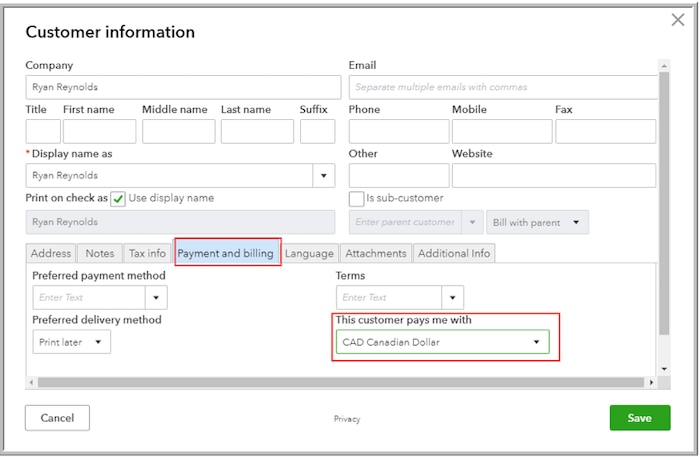

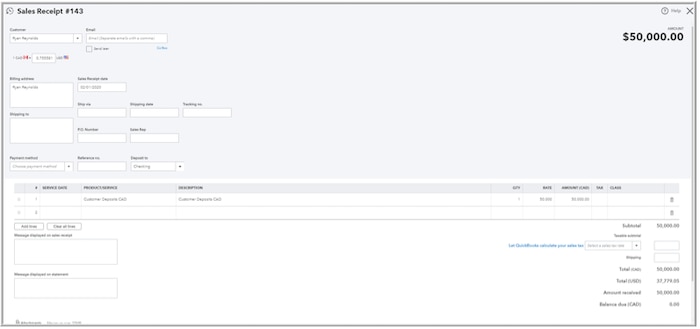

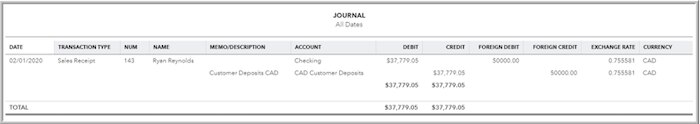

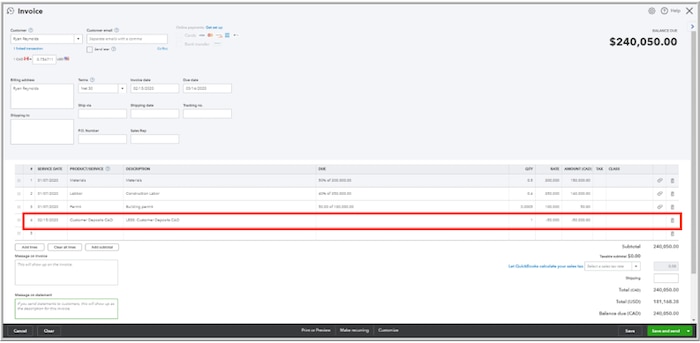

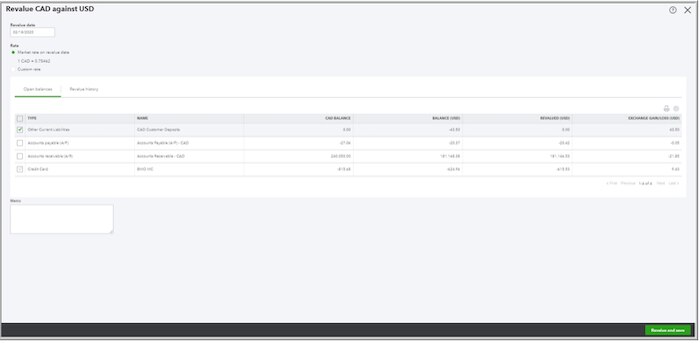

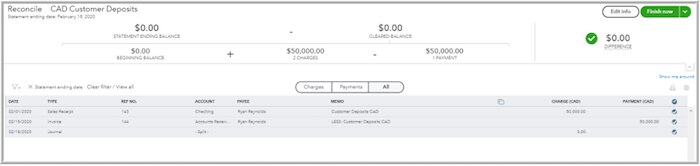

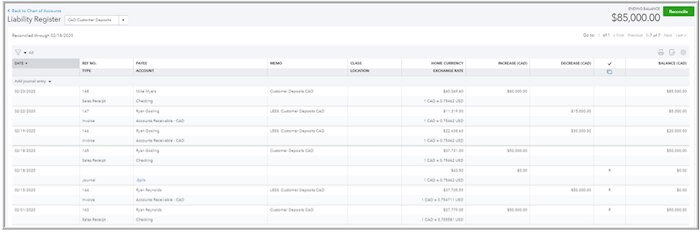

Guess what? Craig’s Construction is doing so well because he’s using it to track customer deposits that he’s decided he’s going to go international and sell in Canadian dollars to Canadians. He wants to sell to them in Canadian dollars, so that his Great White North customers aren’t put off by exchange rates.

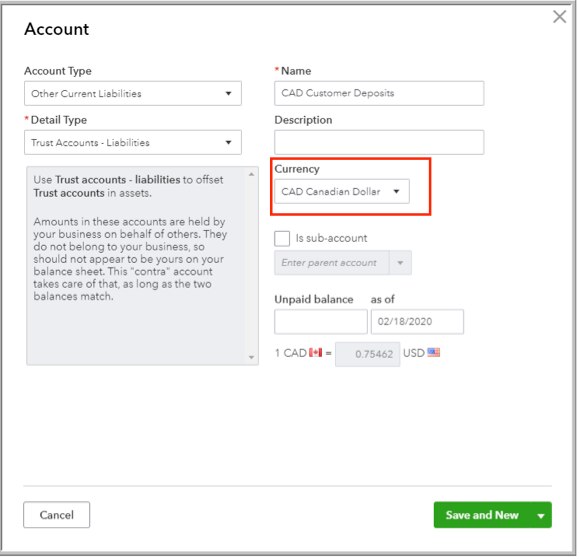

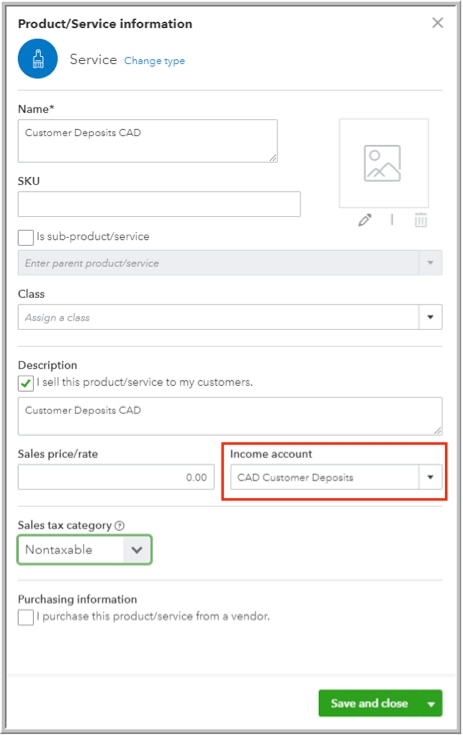

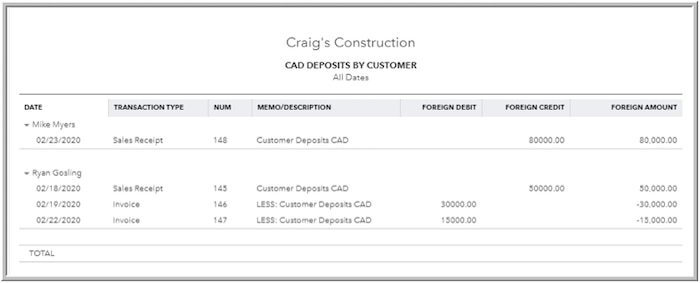

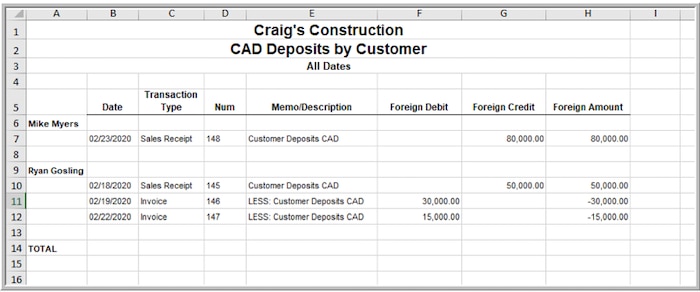

He’s going to ask for upfront deposits from the Canucks, too, and these deposits are also going to be in Canadian dollars.

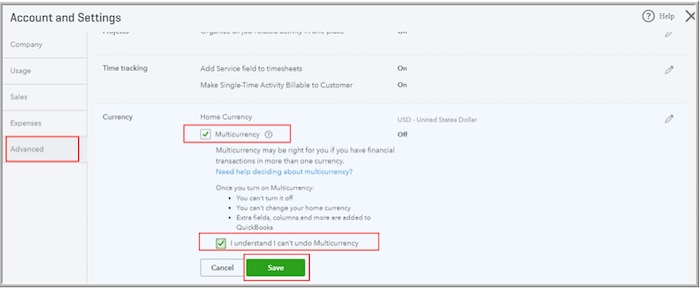

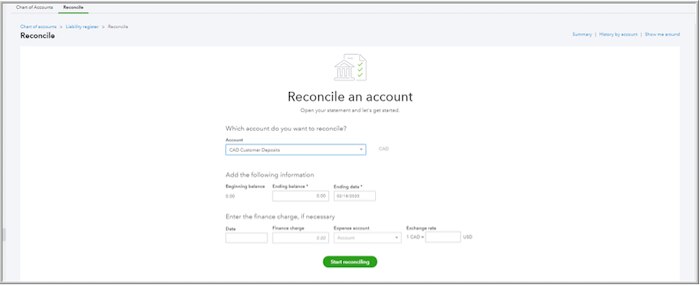

So, he’s asked me to help him set up and use Canadian dollar (CAD) deposits. Once I realized he wasn’t kidding, and he’d be tracking accounts receivable in CAD as well, we turned on multicurrency in QuickBooks® Online (QBO). I warned him first, “Craig, you know we can’t turn off multicurrency.” He was adamant, so we went into account & settings > advanced > currency and we turned on multicurrency: