A few months back, I conjured up a hack to create inventory valuation adjustments in QuickBooks® Online because the feature didn’t natively exist at the time. And, I used the U.S. QuickBooks Online test drive company, Craig’s Design and Landscaping Services, to illustrate the scenario.

Poor Craig. In that example, he decided to diversify into the area of office supplies, and he knew nothing about them. In fact, he purchased floppy diskettes!

This month, Craig has decided to rebrand: he is now calling his business “Craig’s Used Cars and Landscaping.” He knows about as much about used cars as he does office supplies. He will not listen to anyone who tries to talk him out of it. This cannot end well. All anyone can do is help make QuickBooks Online work for him in tracking his inventory and his cost of goods sold.

Here’s what we know about buying and selling used cars, at least as far as Craig’s business model is concerned:

- Craig is using QuickBooks Online Plus.

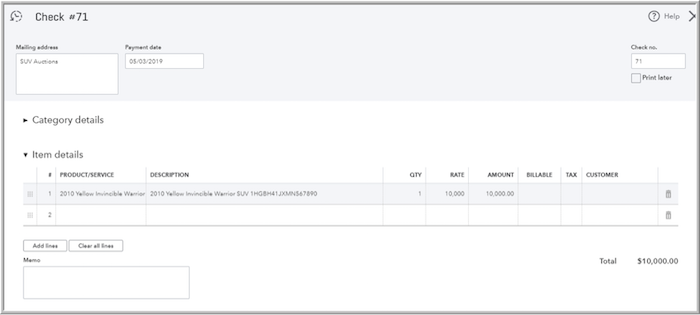

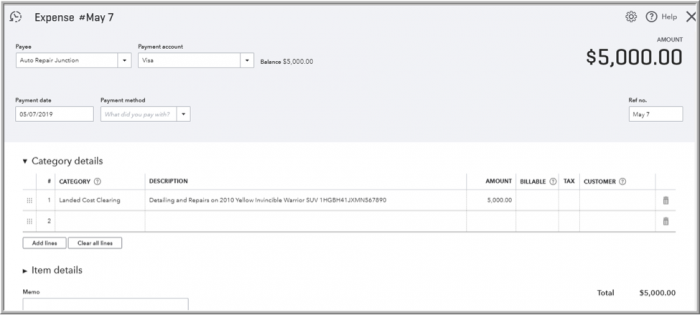

- He will buy each used vehicle at an auction or privately from a seller, pay for some cleanup and repairs for the vehicle, and then advertise and resell the vehicle at a higher price (hopefully).

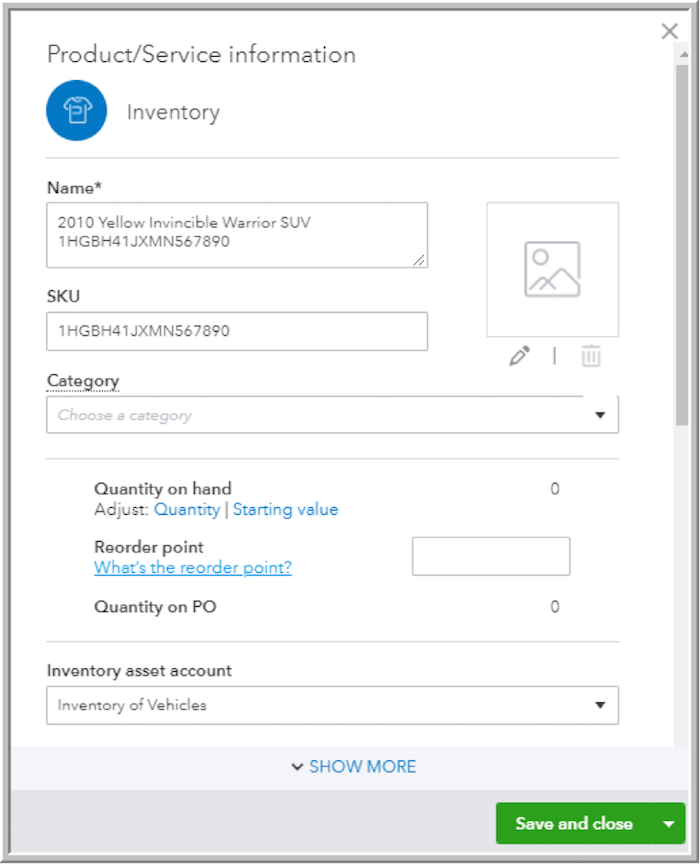

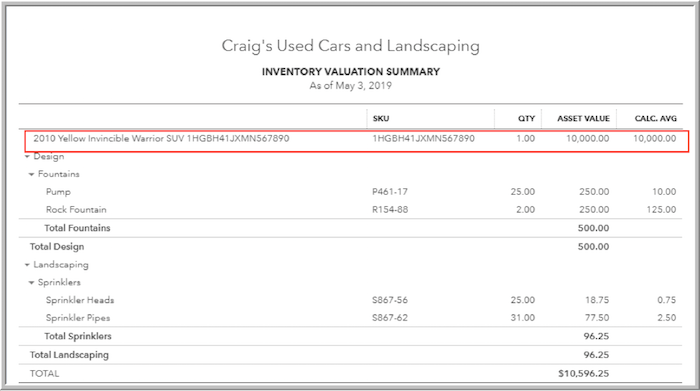

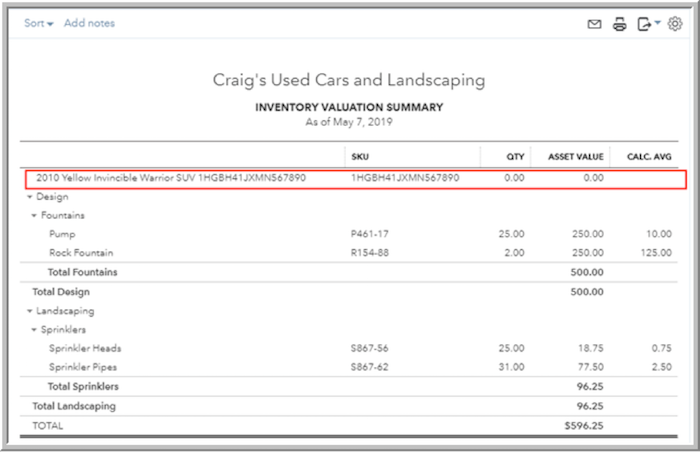

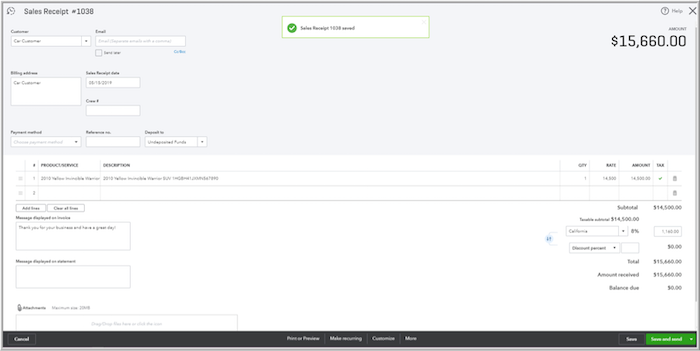

- For illustration purposes, each vehicle will be assigned a unique product/service inventory item name, consisting of the vehicle year and then the color, followed by the make and model, and then the 17 digits of the VIN (Vehicle Identification Number). Here’s an example: “2010 Yellow Invincible Warrior SUV 1HGBH41JXMN567890.” This is a very long name, and I’ll address this later on in this article. The optional SKU can consist of just the VIN, and the description can be more complete, if desired. Categories can also be used if you want to split vehicles.

- Since VIN’s are unique, there will only ever be a quantity of ONE of any vehicle, until it is sold, and then the item will be made inactive.

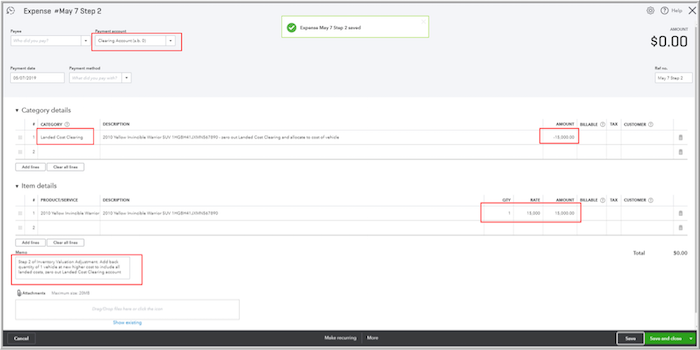

- After purchasing each vehicle, there are usually some outlays required to get the item ready for resale: repairs, maintenance, detailing or perhaps even advertising.

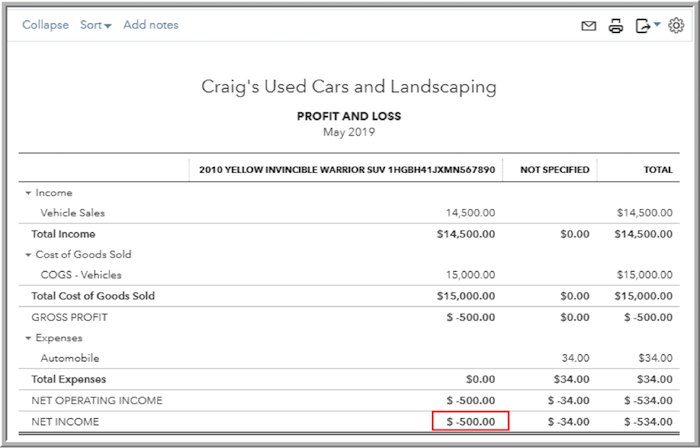

- The challenge here is to assign these costs to the cost of the vehicle, rather than general overhead expenses, so that the cost of goods sold are properly impacted when the vehicle is sold and the item profitability is correct. In other words, Craig needs to know if he’s selling his used cars at a profit after spending the after-purchase money on them: he needs QuickBooks Online to track the fully landed costs of the cars.

In the interest of transparency, I have seen suggestions that used car dealers not bother with different items, and instead assign a different class for each different vehicle, and then run a Profit & Loss by class. The problem with this approach is twofold:

- Classes may already be in use for another purpose, and it’s not a good idea to use classes for more than one purpose.

- With the launch of QuickBooks Online Advanced in the U.S., QuickBooks Online Plus has a maximum number of 40 total classes and locations. With a new class for each vehicle Craig buys and sells, that maximum can be reached very quickly, and Craig would have to upgrade to QuickBooks Online Advanced at a much higher subscription cost.

And, yes, it is true that Craig might want to turn to a third-party app that handles the heavy lifting of inventory and landed costs and integrates with QuickBooks Online. But, Craig is unsure that he wants to stay in the area of used cars, and he’s also price-sensitive so he wants to use QuickBooks Online with no external app for now.

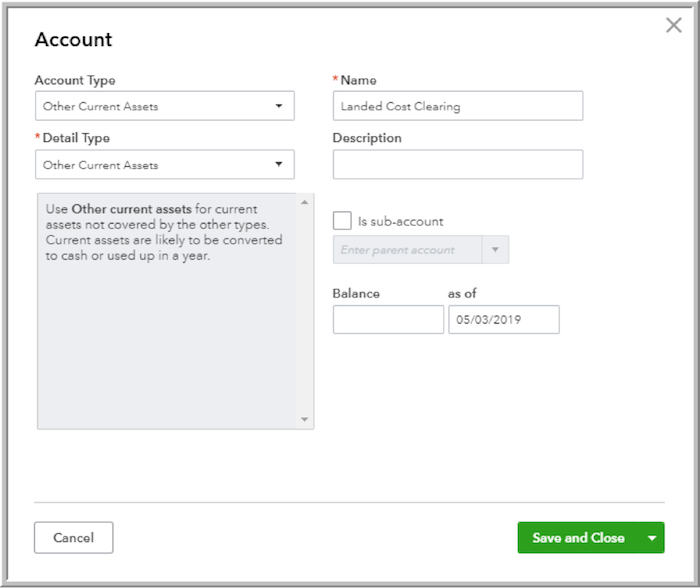

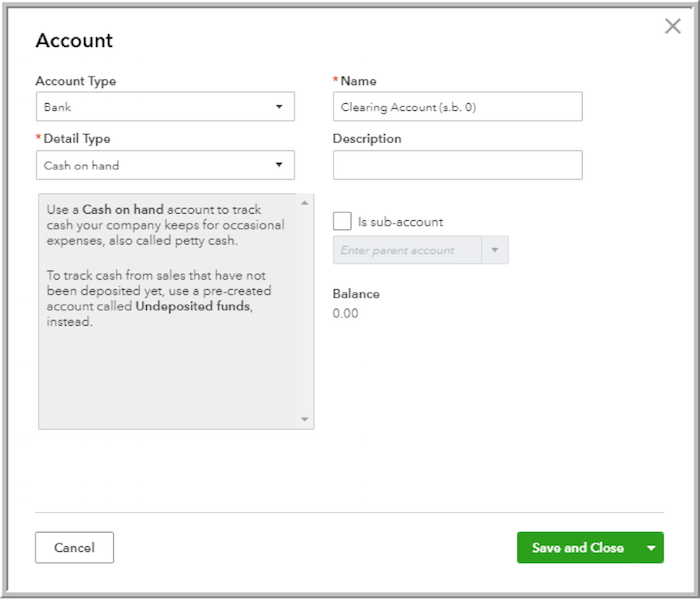

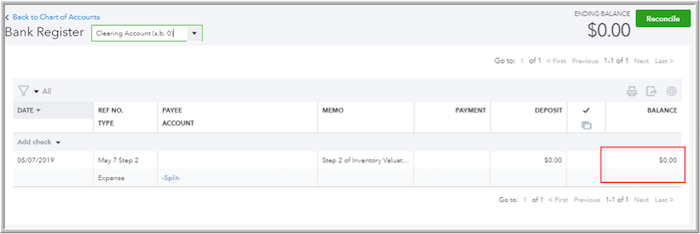

Believe it or not, we can design QuickBooks Online Plus to absorb fully landed costs, and it’s not too different from the model we used for inventory valuation adjustments.

Let’s get started:

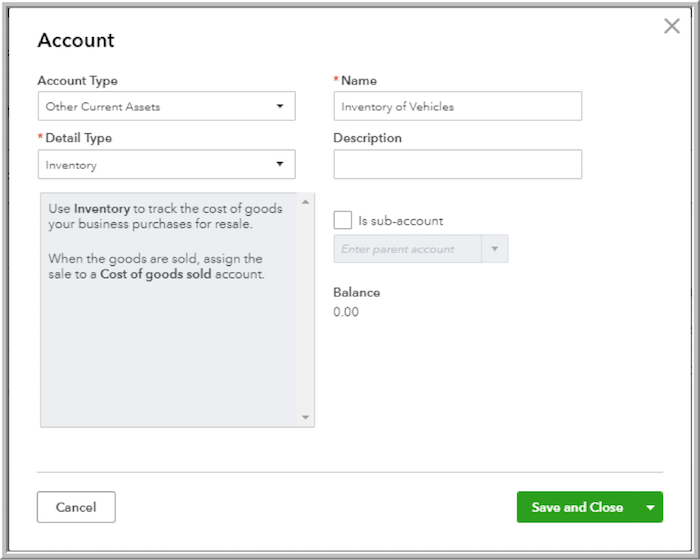

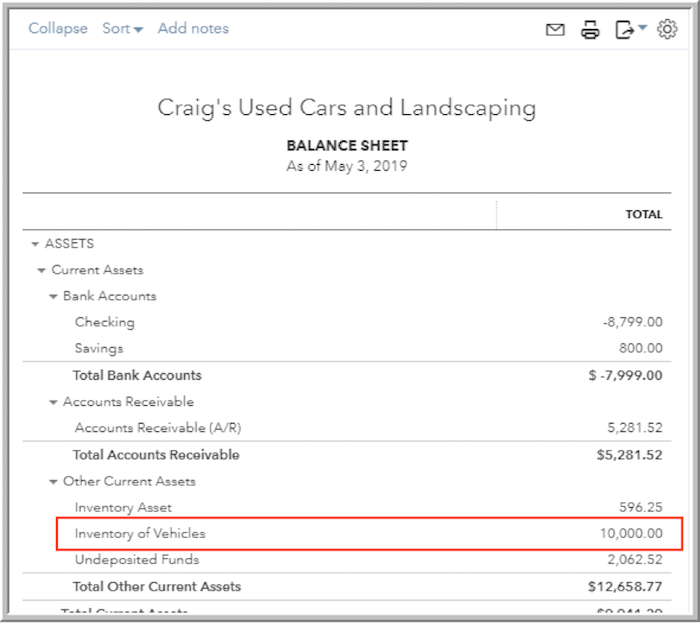

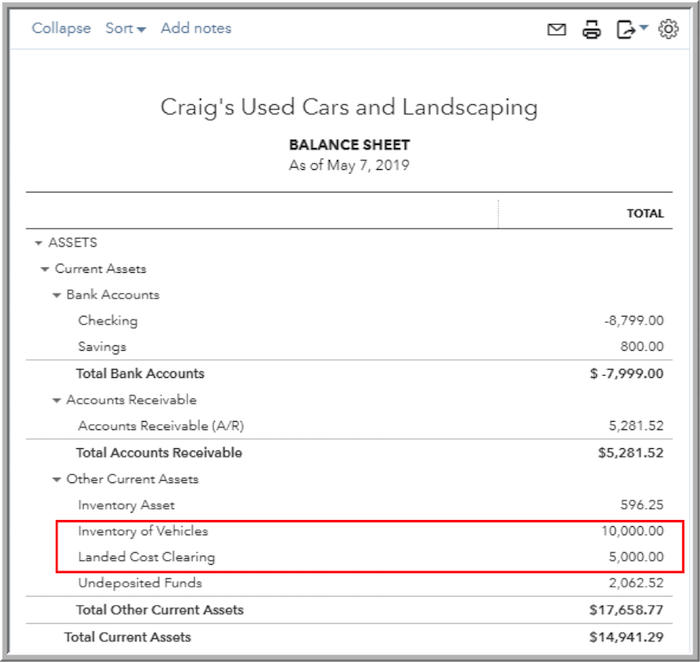

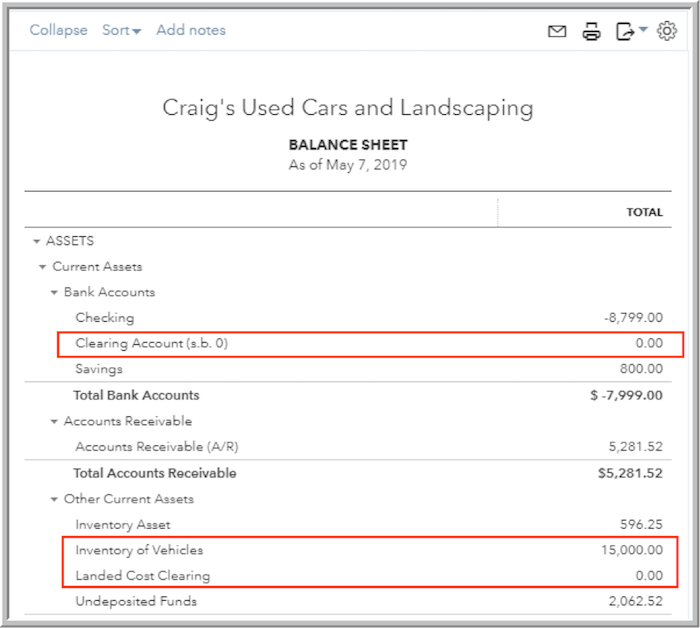

I’m setting up a separate “Inventory of Vehicles” asset account for the vehicles that Craig is going to buy and sell. I’m doing this to segregate the vehicles from any other inventory that Craig is tracking on the balance sheet in the test drive company: