This account is often overlooked, and it is essential to be sure that the account only holds those work in process (WIP) expenditures. If there are transactions from closed matters, you will need to check with the attorney of record and determine if the expense needs to become a firm expense.

Keeping a good eye on the over 90-day AR aging report

Reviewing the outstanding and overdue accounts receivable is just as critical. Many law firms do a less than stellar job of maintaining the accounts receivable records. I recommend the accounts receivable clerk or bookkeeper follow up with each attorney of record on any open invoice 90 days past due. Should the open invoice be written down or should you move those clients to collections?

Maintaining the unapplied cash payment income account

Some of my immigration and family law clients do a tremendous volume of invoicing. When you combine this with multiple staff members entering transactions, you may find errors in dates where payments are recorded before the actual invoice date. A gentle reminder to keep a watchful eye on this account will help keep the records in the proper order. Just run a profit and loss by cash basis to reveal the transactions that need to be corrected.

Reminder to the attorney to turn in their receipts

For compliance, we like to have receipts for all transactions. With QuickBooks, this can be a simple task. Just scan and upload. But, if we find a missing receipt, we can notify the attorney. If they have access to QuickBooks, gently remind them that the receipt is missing. Once it is uploaded, we can mark that task as complete.

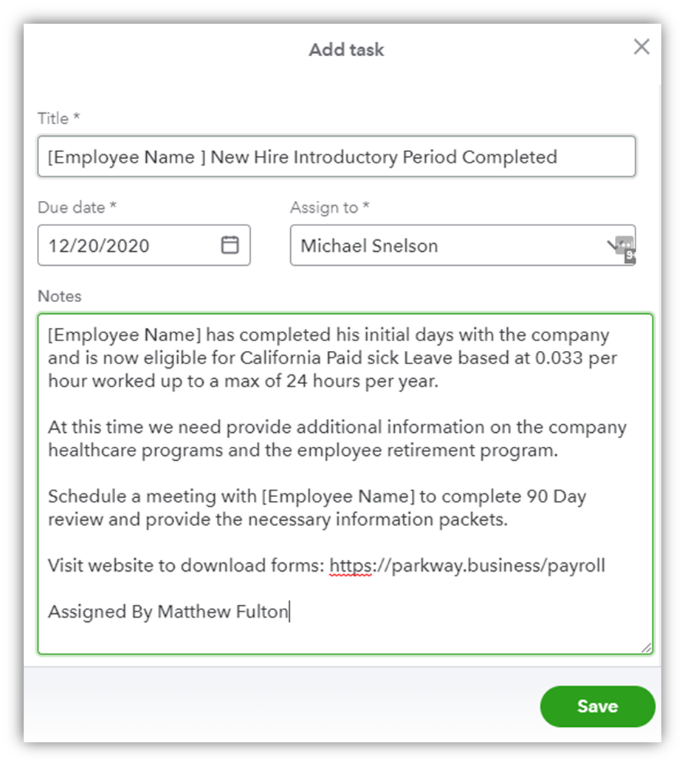

Remember, these tasks do not have to be QuickBooks-only tasks. Think outside the box! Maybe you need to order a birthday cake for a staff member. Perhaps you need to get a gift for a client that gave you a referral. Assign that task as a reminder, and you can keep your law firm running smoothly.

Creative uses for Tasks in QuickBooks Online Advanced

Real estate and property management:

- Lease Renewal Dates: Set up reminders for important lease renewal dates.

- Safety Checks: Create a task to make sure all Fire suppression systems have been checked each year.

Construction industry:

- Review COI: Set up a reminder during a large project to review all certificates of insurance are valid for any subcontractors on a job.

- 1099 Review: Set up a task to review contractors w-9 information is up to date and accurate.

More task ideas for any business:

- Workers compensation: Another powerful use of the tasks feature is to set reminders for important dates, such as your workers compensation renewal date. This simple task will provide your team enough time to start shopping your policy for the best rates on the market as well as prepare for their next workers compensation audit.

- Business license: Create a task that reminds you when you need to update your business license.

- Corporate filings: Avoid late filing fees by setting up a reminder to update your statement of information and your annual minutes for your corporation. If you provide these services, you can setup tasks to help you remember when to discuss with your clients.

- Special deadlines: Create a task to help remind you of special deadlines, such as the PPP cover period.

Who can see and use tasks:

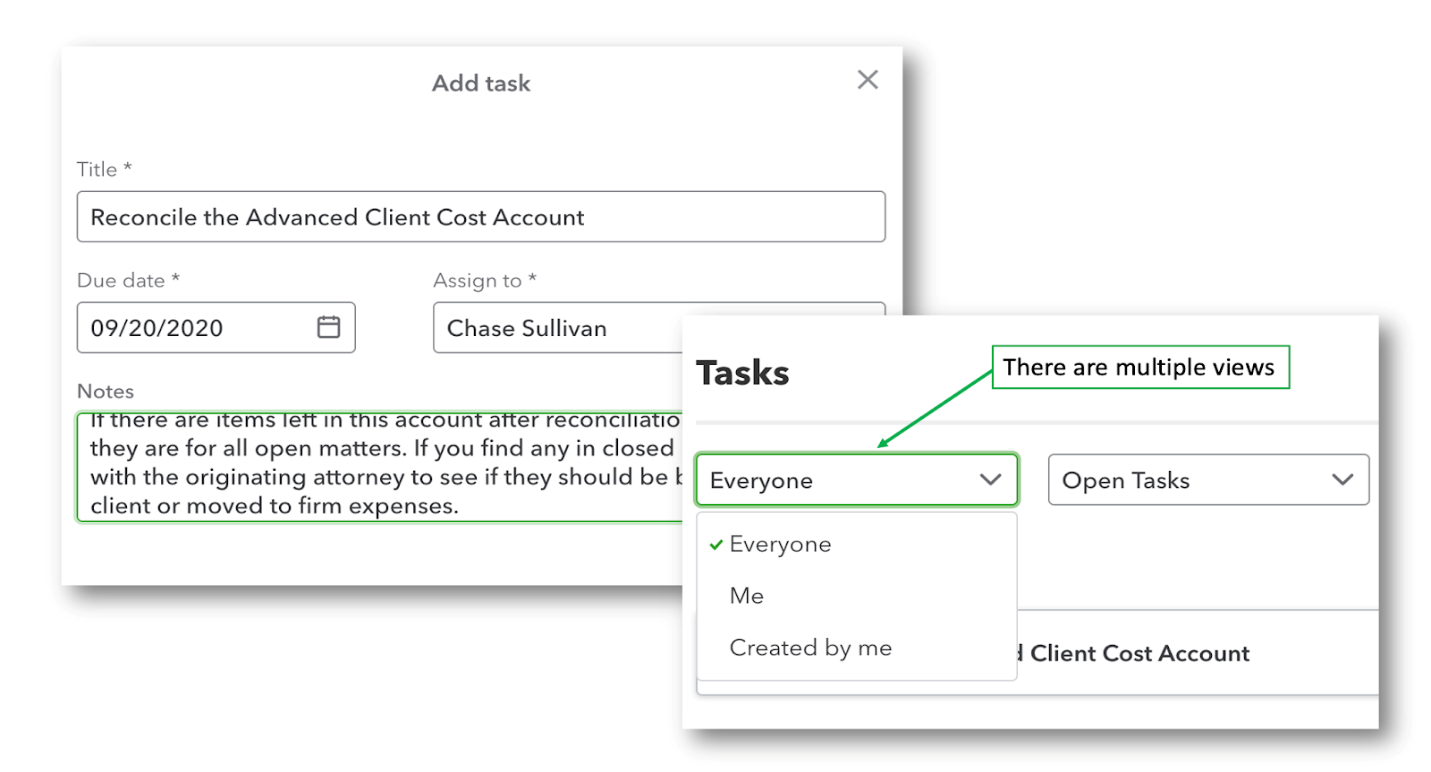

The new task feature can be used by anyone who is a registered user of that QuickBooks Online Advanced company file, except report-only users. Administrators have the greatest functionality to create a task as well as see the tasks created by others. For all other employees, only the tasks assigned to them or created by them will be displayed and grouped by:

Once a task has been marked as completed, it will be moved to a separate list to better view what is still outstanding.

Hopefully, we have managed to get you thinking about all the different ways you could harness the power hidden within Tasks. After playing with this new feature, we are excited to see the different ways that Intuit will embed this feature throughout all their features. Now it is your turn, what creative tasks would you be interested to see added as templates? Share your ideas in the comments below!