Modernized business intelligence

With new tools and flexibility for reports, app integrations, KPIs, and dashboards, you and your clients get the business insights and analysis you need with real-time performance tracking all in one place.

- Improved modern report view: Get quicker access to insights with more streamlined reporting that has more accessible customization. The intuitive, enhanced modern view is now the standard for all reports, with automatic refresh, consistent customizations, ordering that aligns with GAAP reporting standards, zero-balance visibility, and more.

- Calculated fields: Get the views your clients need without data exports and spreadsheet calculations. Create custom formulas and perform calculations on top of existing report data, save your report, and come back to it anytime, all without tedious workarounds.

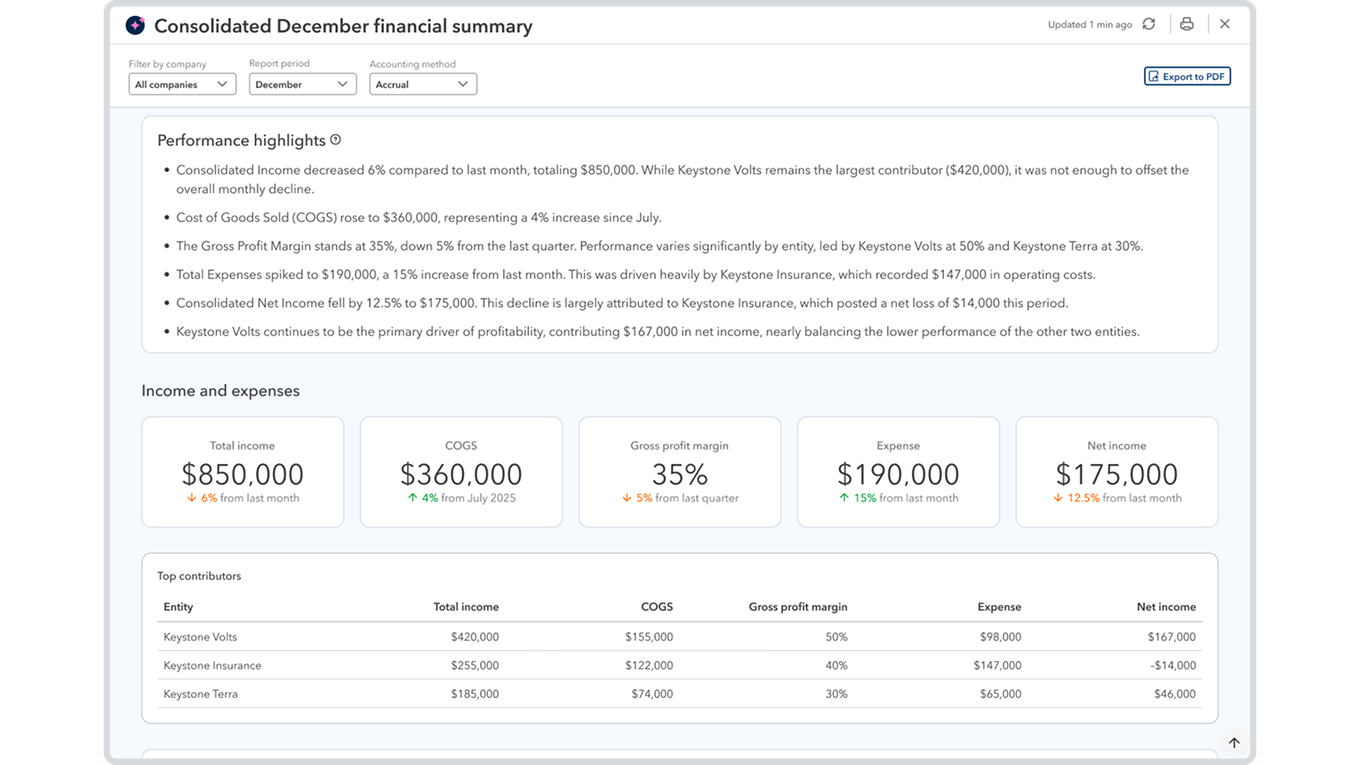

- Management reports: Simplify customizing and sharing company-level and multi-entity management reports that offer more KPIs and custom metrics to fit your clients’ goals. For example, add KPI widgets and charts in consolidated view and use smart chips to automatically update dates and figures throughout a report.

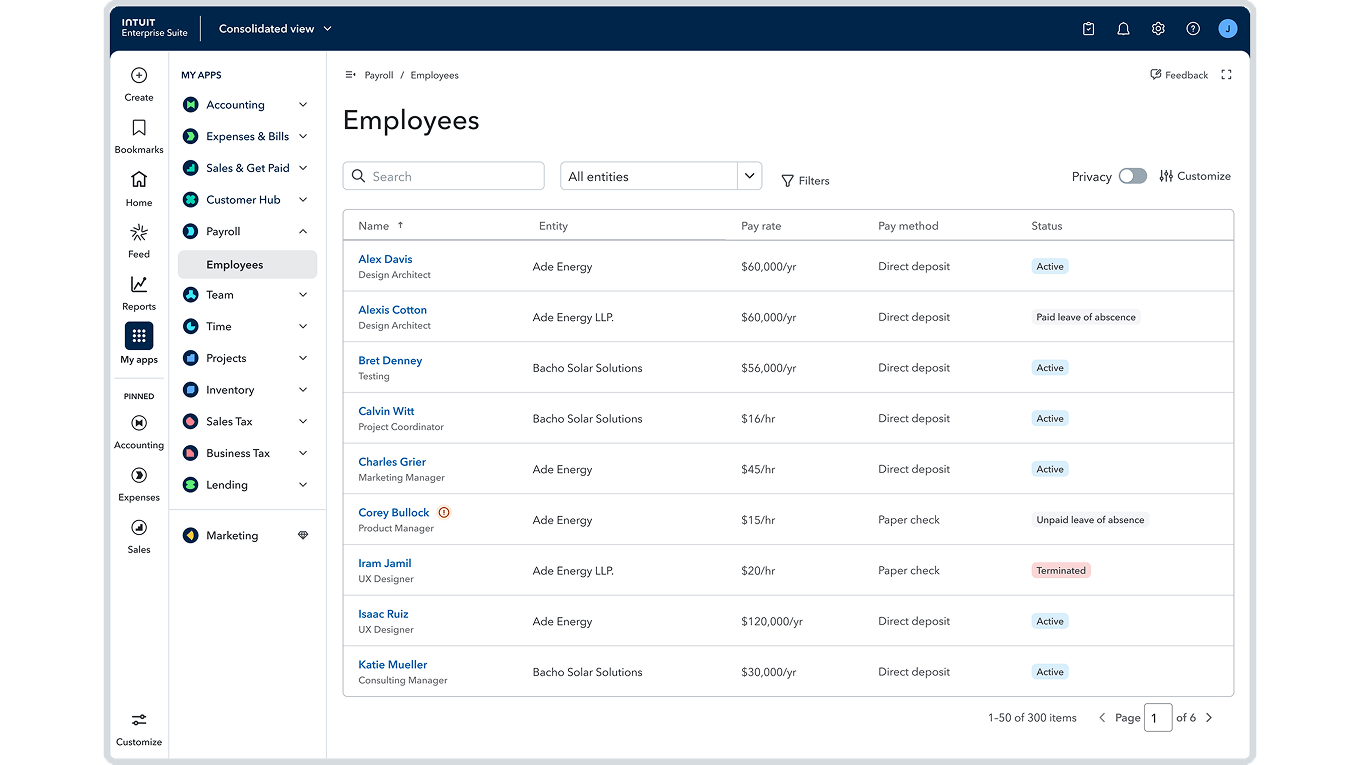

- More app integrations: In one place, analyze key business and financial metrics from multiple systems and see how everything fits together, without manual work. Clients can connect more third-party CRM and workforce tools, and combine the data directly with their data in Intuit Enterprise Suite.

- KPIs and dashboards: Expanded KPIs and dashboards allow you and your clients to track metrics using accounts from their chart of accounts as variables, specify a time period for each metric, and pull in variables from third-party data, among other capabilities.

For your mid-market clients, Intuit Intelligence delivers AI-powered insights embedded into core business workflows, helping teams better understand and act on their data. By analyzing financial and operational information in context, it reduces manual analysis, surfaces meaningful patterns, and enables faster, more confident day-to-day decisions.

For businesses with greater scale and complexity using Intuit Enterprise Suite, Intuit Intelligence extends these capabilities with deeper, cross-entity visibility and enterprise-grade insights. Embedded across consolidated reporting, advanced accounting, and multi-entity operations, it helps your clients understand cost drivers, evaluate profitability at scale, and maintain control as the business grows.