What is a #RecipeforSuccess? Developed by QuickBooks ProAdvisors®, the #RecipeforSuccess campaign provides key ingredients and steps for your clients’ small businesses to achieve success. Search “Recipe” to find related articles on this site, and join the conversation on Twitter: #RecipeForSuccess.

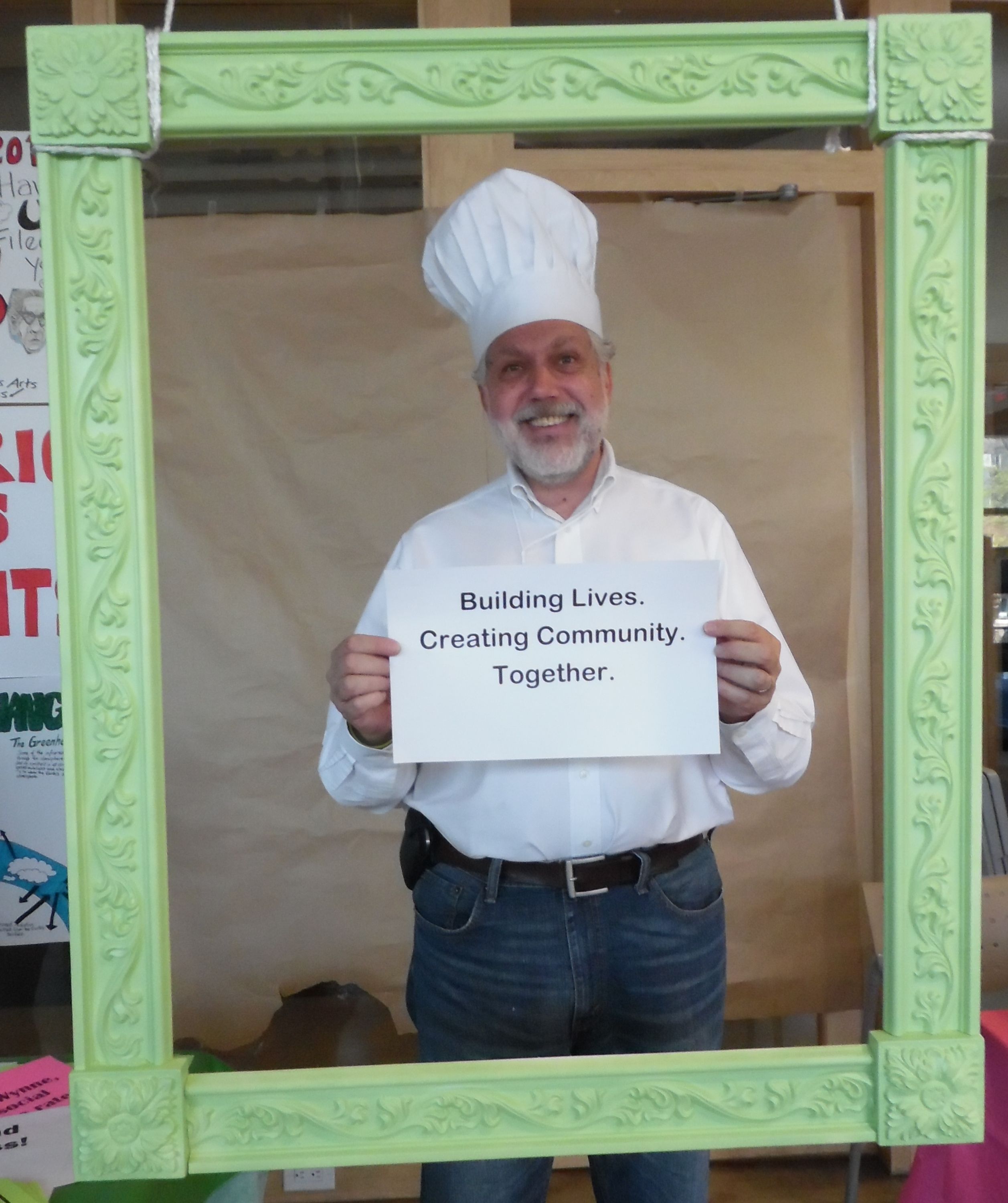

Master Chef: Bill Kennedy

Charities are best nourished with reports that are simple and hearty, based on a small number of local ingredients. Charities focus on supporting their community. Nobody wants to spend a lot of time digesting financial statements. They want to see progress on their specific goals, as well as the assurance that the operations are sustainable.

First, the financial kitchen needs some tools!

Ingredients:

- 1 Solid General Ledger account structure for proper display and plating

- 3 or more classes to show the fruits of their labor

- Projects for a proper pairing of funding drinks with wholesome expenses

- An assortment of apps to save time

- An enthusiastic ProAdvisor to assemble all the ingredients for the meal

Step 1: Create a flexible financial structure

Start with a simple set of GL revenue accounts within your accounting software (I recommend QuickBooks® Online), such as donations, grants and government funding. Add in the expense accounts, such as staff, communications, office and operations costs. Underneath these general headings, add the detailed accounts needed for financial reports. Create a class for each strategic goal from the board of directors.

Projects are the icing on the cake! They allow you to track all the money in and out for fundraising events, board initiatives and designated funding. At any time, you can serve up tasty little reports, based on any time period, for management decision-making and board approval. To help you set up projects, follow this link.

Step 2: Develop a financial plan

Working with the leadership staff, create a budget by mixing in this year’s plans with last year’s experiences. Fold in the GL accounts and classes. Some kneading and massaging may be required to make it all fit!

Charity financial plans go beyond budgeting. In addition to an income statement, there may be a capital budget for building, equipment and furniture purchases, as well as separate plans for fundraising and staffing. But, the big difference is that for charities – meeting budget just shows that the nonprofit lived within its financial constraints; it does not say whether the charity’s strategic goals were met. For that reason, non-financial goals, such as number of meals served, employment positions found, housing placements located or people trained, are also important. For more information, click here.

Step 3: Blend in technology

Adding in apps helps everyone. A payment app allows the charity’s officers to approve payments without having to travel into the office to sign checks. An expense app goes out and grabs bills from suppliers, speeds up processing and allows volunteers to submit expenses for reimbursement from their cellphones. No more faded receipts or little bits of paper! Here is a list of apps recommended for charities. You can find more apps that work with QuickBooks at apps.com.

Step 4: Enjoy!

With this recipe, the financial statements will be ready for consumption straight from the oven! Use the detailed report for managers and the summary one for the board. Make sure you compare the budget numbers to the actual results and write an analysis to accompany it. For added appeal, decorate the story paragraphs with green for good, yellow for caution and red for needs attention. Remember that boards prefer lots of green, so help the charity work on anything that needs attention. Here are some practical pointers for Board reporting.

Final word

Working with charities is rewarding. You are helping the people who help others. The focus is different than a for-profit company, and there are specific tax and accounting rules to follow, but on the whole, the finances are straightforward. And, it certainly helps to have the proper tools in the kitchen!