Accounting has come a long way from paper ledgers and manual calculations. Misconceptions characterize the profession as being resistant to change, but trends paint a different picture. Accounting professionals today are leveraging technology to streamline processes, enhance client services, and stay ahead of the curve. Their adoption of automation, artificial intelligence, and analytics are paving the way for the profession’s continued transformation, which promises advancements robust enough for a rapidly evolving business landscape.

The 2024 Intuit QuickBooks Accountant Technology Survey unpacks how technology is arming the industry with the tools it needs to stay ahead, stay responsive, and stay resilient. New data from the QuickBooks-commissioned survey of 707 US accountants and bookkeepers highlights six important trends:

- Accounting professionals believe that failure to keep pace with technological advancements poses the greatest risk to the industry — and plan to invest in AI and automation tools the most to stay ahead.

- Nearly all respondents (98%) say they’ve used AI to help clients and their businesses over the last 12 months.

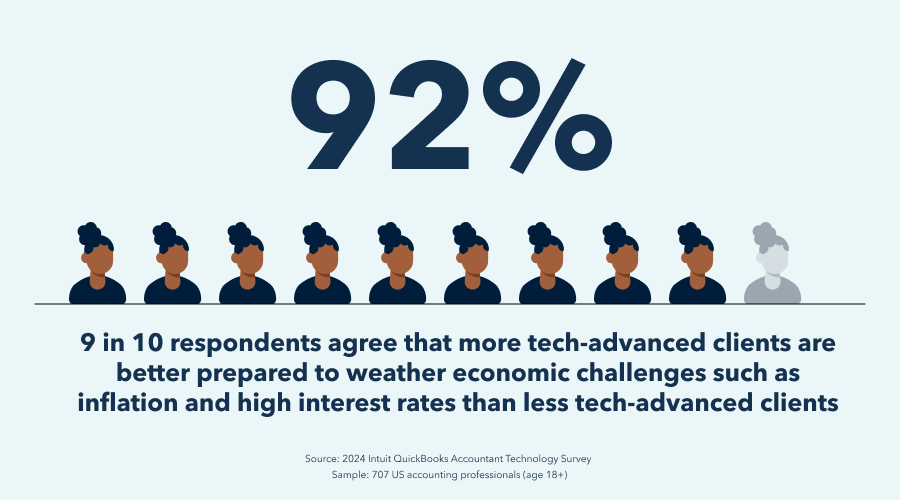

- Almost all (98%) have felt the headwinds of inflation and interest rates, but more than 9 out of 10 agree technology can help them — and their clients — to weather these challenges.

- More than 9 in 10 respondents who have outsourced work agree that outsourcing is another way to maintain business growth by improving efficiency and giving more time to focus on advisory services.

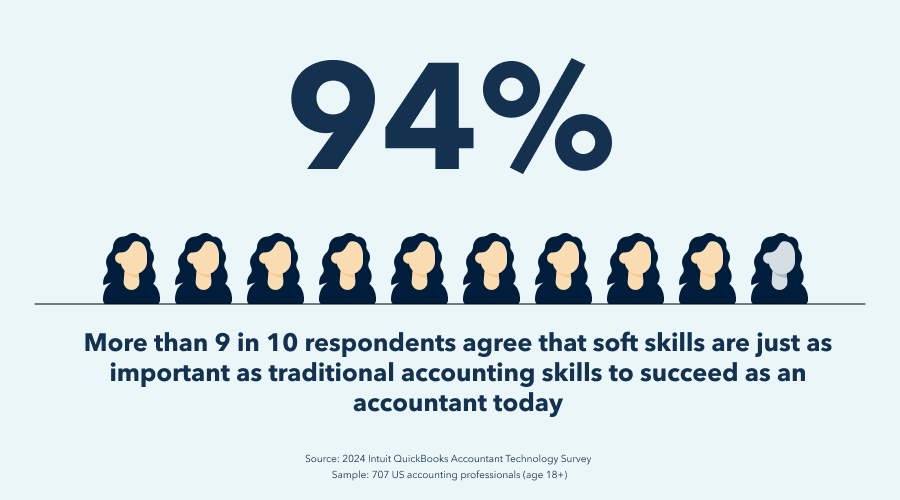

- Amid widespread hiring challenges, more than 9 in 10 agree the latest technology could help them solve skills shortages by helping to attract and retain talent.

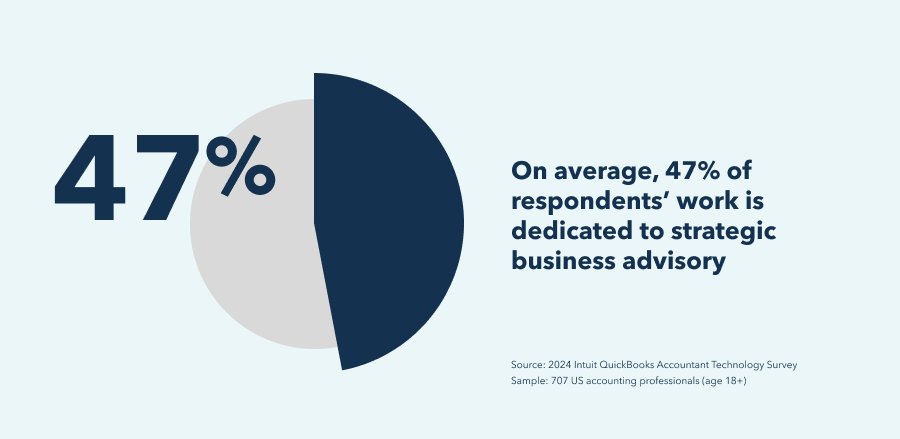

- Client needs are increasing, particularly with financial and technology management, but technology is a key to saving time and elevating advisory services.

_________________________________________