Late payments are a common but burdensome issue for small businesses, influencing their operational and financial health. As an accounting professional, understanding the complexities surrounding late payments can enhance your advisory role, helping clients navigate these challenges more effectively. Here are the top five takeaways from the 2025 Intuit QuickBooks Small Business Late Payments Report and what they mean for your practice.

5 key takeaways for accountants from the 2025 Intuit QuickBooks Small Business Late Payments Report

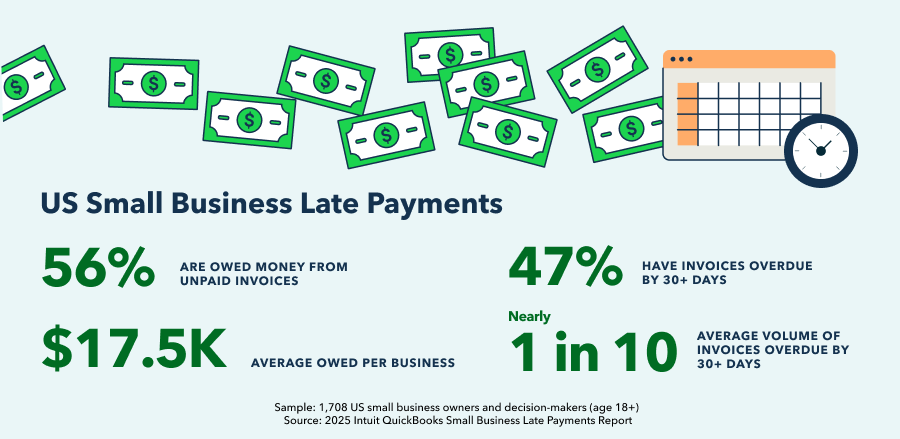

1. 56% of US small businesses are owed money from late payments

The report reveals that 56% of US small businesses are owed money from unpaid invoices. On average, each of these businesses is dealing with an estimated $17,500 in outstanding payments. Further complicating this issue, nearly half (47%) of these businesses have invoices overdue by more than 30 days, and almost 10% of all their invoices fall into this significantly late category on average.

What this means for accountants: This is a crucial juncture for you to step in with strategic advice. Whether working with established clients or onboarding new clients already facing financial challenges, initiating conversations about strategies for faster payments and thorough invoice tracking can be a game changer. For accountants, this means:

- Initiating client conversations about outstanding invoices: Schedule a proactive check-in with clients to discuss their current accounts receivable and identify businesses with significant late payments.

- Recommending and implementing automated invoicing systems: Guide clients in selecting and setting up digital solutions that automate invoice generation, delivery, and follow-up reminders.

By advising clients on how to leverage the right digital solutions, accountants can help enhance clients’ cash flow and overall financial health.

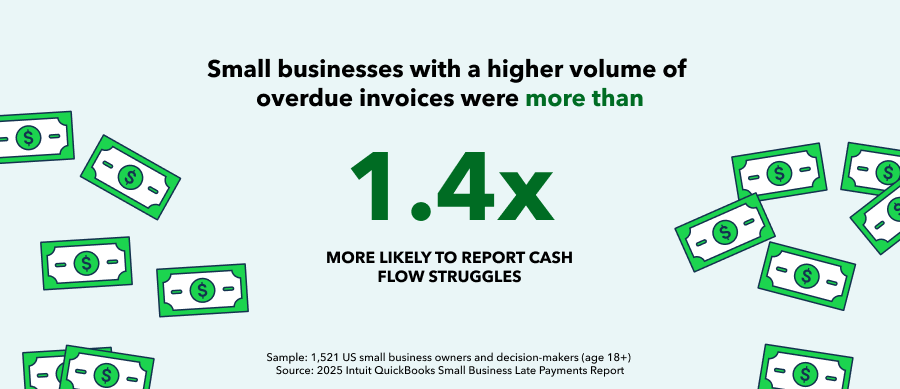

2. Cash flow issues are common for small businesses with overdue invoices

Small businesses struggling with a higher volume of overdue invoices were 1.4x+ more likely to report cash flow issues.

What this means for accountants: Maintaining healthy cash flow is vital for businesses, especially in managing the ripple effects of late payments. Accountants can help clients stay on track by:

- Delivering cash flow visibility: Providing clients with a comprehensive, end-to-end view of their cash flow empowers accurate forecasting and proactive contingency planning.

- Prioritizing data accuracy: It’s crucial to ensure data reliability. Advising clients on significant financial decisions, such as purchasing assets or entering new leases based on inaccurate numbers, poses a significant risk to business health.

3. Overdue payments are linked to increasing credit reliance

Data points to a correlation between late payments and heightened reliance on credit. Small businesses more heavily affected by overdue invoices were more likely to report higher usage of loans, lines of credit, and business credit cards over the last year. They were also 1.7x more likely to say they’ve become more reliant on credit cards.

What this means for accountants: Clients benefit from understanding the risks involved with poor credit management. Credit can serve as a useful tool, but can become a burden if used to cover persistent cash flow shortages. Working with clients to monitor their credit usage enables strategies to reduce dependency and diversify financing options. Accountants can help safeguard credit as a tool for good by:

- Implementing early warning systems for credit stress: Set up systems to monitor your clients' financial data for early signs of credit stress, such as mounting credit card balances or late loan payments. Use this information to proactively reach out and provide support before the situation escalates.

- Advising on expanding financing portfolios: Educate clients on alternative funding sources beyond traditional loans and credit lines. Explore options such as grants, angel investors, venture capital, or crowdfunding. Help them develop a plan to diversify their portfolio and reduce reliance on any single type of financing.

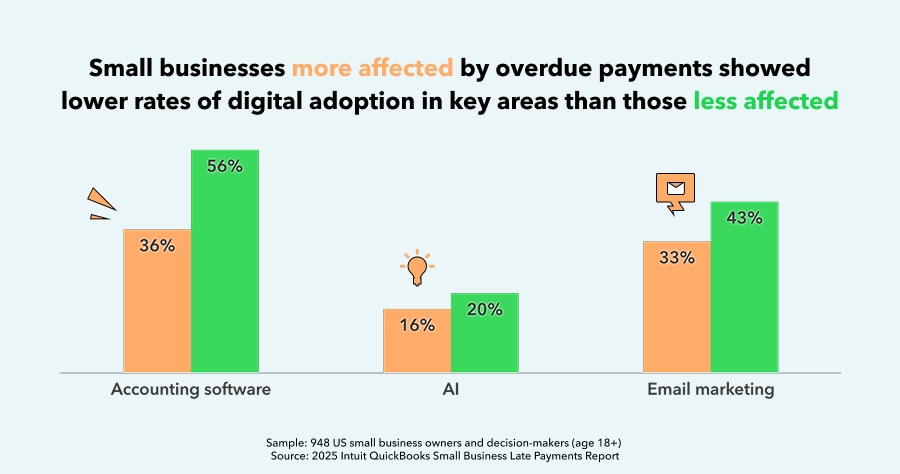

4. Tech gaps emerge with late payments

Small businesses more affected by overdue payments showed lower rates of digital adoption in key areas. This pattern appeared across accounting software (36% vs. 56%), AI (16% vs. 20%), email marketing (33% vs. 43%), and more. In other words, businesses with a higher volume of late payments were significantly more likely to say they don’t use accounting software.

Similarly, those with longer payment terms were also 1.3x more likely to self-identify as late adopters of new digital tools (40% vs. 31%). The digital landscape changes quickly; research shows integrated systems can be critical for business growth. Keeping pace requires strategic technology use.

What this means for accountants: You can play a critical role in bridging these gaps. Guiding clients to the right digital tools helps streamline operations. For instance, software designed to automate payment reminders can help businesses avoid overlooking overdue invoices. Similarly, platforms that integrate multiple payment options give customers more flexibility, potentially leading to faster payments. When accountants help clients implement effective digital solutions, they empower them to run more efficient, competitive, and forward-thinking operations. Success can come from:

- Showcasing success stories: Share case studies and testimonials of other clients who have successfully streamlined operations with the right digital solutions. This helps build confidence and encourages adoption.

- Implementing digital payment solutions: Advise clients to adopt digital payment methods, which can expedite the payment process and offer more convenience to their customers, potentially reducing late payments.

5. Hiring difficulties connected to late payments

Beyond financials and digitization, the report’s findings highlight a link between late payments and workforce challenges. Small businesses more impacted by late payments were more than 1.3x more likely to report problems hiring skilled workers. The challenge of hiring skilled workers intensifies when payment terms are extended. Those with longer terms were 1.6x more likely to report difficulties hiring skilled workers than their peers with shorter payment terms.

What this means for accountants: Late payments may lead to instability that makes it harder to attract and retain talent, while also hindering growth. Clients should understand that healthy cash flow may influence their ability to compete for top employees, invest in their team, and strategically plan their headcount. Accountants can step in to strategically guide clients by:

- Advising on the right timing for workforce growth: Beyond simply identifying the problem, accountants working in the advisory space can play a pivotal role in helping clients determine when to add headcount. Should a business consider expansion this year? Or is their current fiscal position too precarious?

- Recommending tech bridges for staffing gaps: If a business is not yet financially robust enough to support additional staff, accountants can guide their clients toward implementing and optimizing technology solutions to bridge the gap. This might involve leveraging automation to increase efficiency, adopting tools that streamline workflows, or providing real-time financial insights that inform better resource allocation.

The Bottom Line

The 2025 Intuit QuickBooks Small Business Late Payments Report highlights critical issues affecting small businesses. As their accountants, you're on the front lines helping them navigate these challenges. This data provides key insights to start conversations with your clients. You can offer strategic advice grounded in real-world trends. Using these insights, you can identify ways to help clients strengthen their financial health and operational efficiency.

Recommended for you

Get the latest to your inbox

Get the latest product updates and certification news to help you grow your practice.

Thanks for subscribing.

Relevant resources to help start, run, and grow your business.