As QuickBooks Live Bookkeeping has evolved to prioritize our assisted services, we’ve identified a potential need for QuickBooks Online Payroll customers to have access to qualified help when they have payroll tax questions. Potential topics include questions about multi-state payroll tax filings, how to deal with IRC notices, and more.

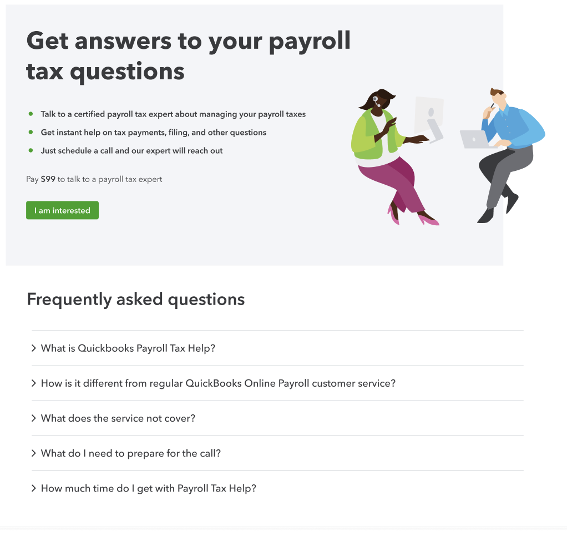

To help businesses get answers to their payroll tax questions, we’re launching a test this month for a new service called “QuickBooks Payroll Tax Help.” This test offers businesses and accounting professionals access to QuickBooks Payroll certified experts who will provide guidance without taking control of their payroll—someone who will “do it with me,” as it relates to answering payroll tax questions specifically.

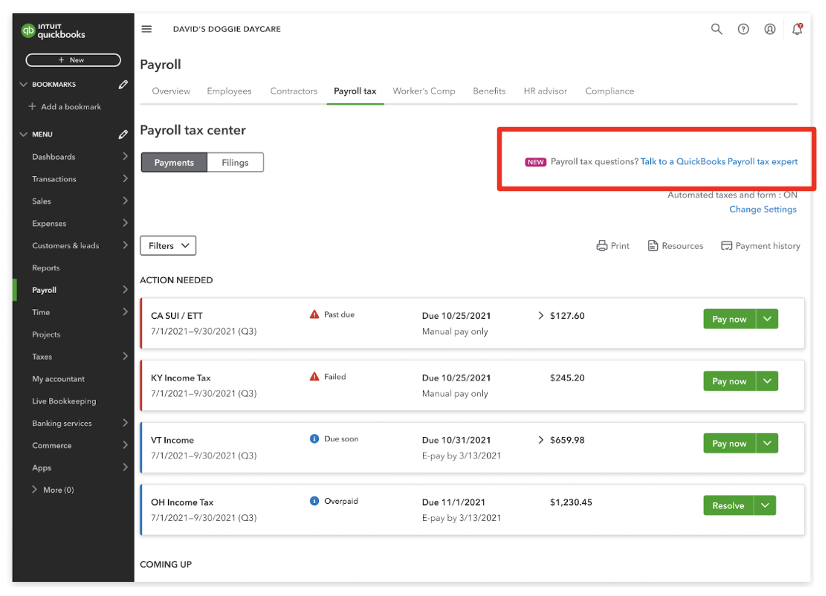

You may see the QuickBooks Payroll Tax Help offer on the QuickBooks Payroll Tax Center tab in QuickBooks Online Payroll.

How it will work

Customers who are subscribed to QuickBooks Online Payroll (any SKU) and exposed to the test will see the QuickBooks Payroll Tax Help offering within the Payroll Tax Center tab. Whenever a QuickBooks Online Payroll subscriber has payroll tax questions, they can use the Payroll Tax Center tab to submit a request for a call from an expert. Our QuickBooks Online Payroll experts will call them within minutes during regular business hours.

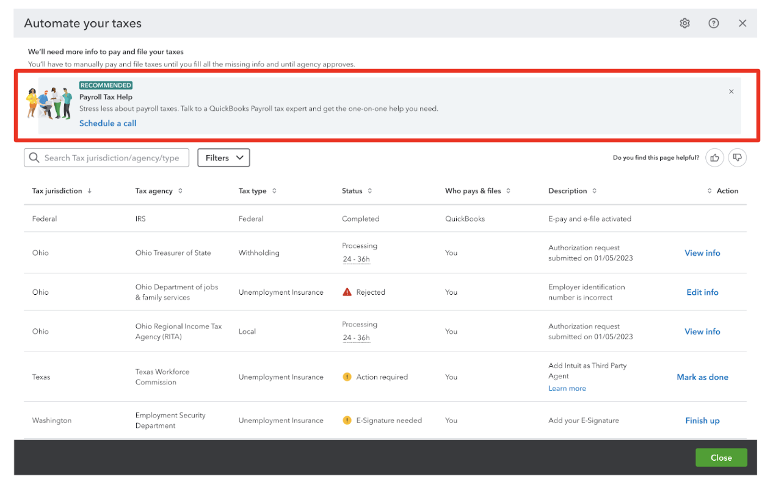

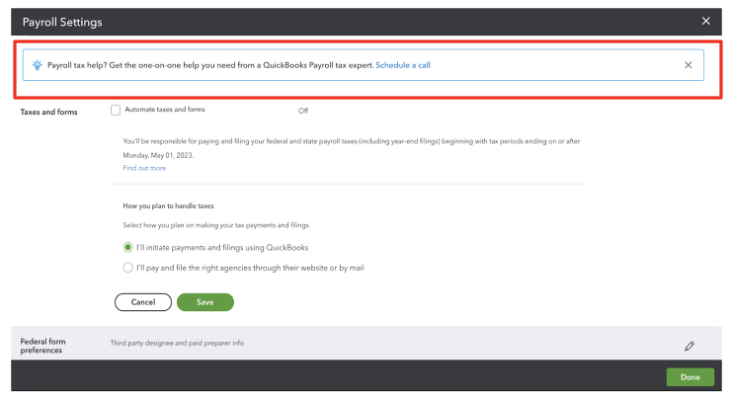

The service is presented to customers through a few points within the Payroll Tax Center tab, including the Tax Readiness screen, the Payroll Auto Tax On Settings page, and the compliance page. Each of these access points will lead the customer to a landing page where they will see more information about the service.

Access points

Payroll Tax Center tab