Getting W-9 information—tax ID, address, and the 1099 vendor’s information—can be a time consuming task come 1099 season, and with the new IRS combined 1099 and W2 filing limit changes, it could be even more work for your clients if they are not e-filing.

Here’s how QuickBooks Online users can streamline this process:

Step 1: Identify whose W-9 information is missing

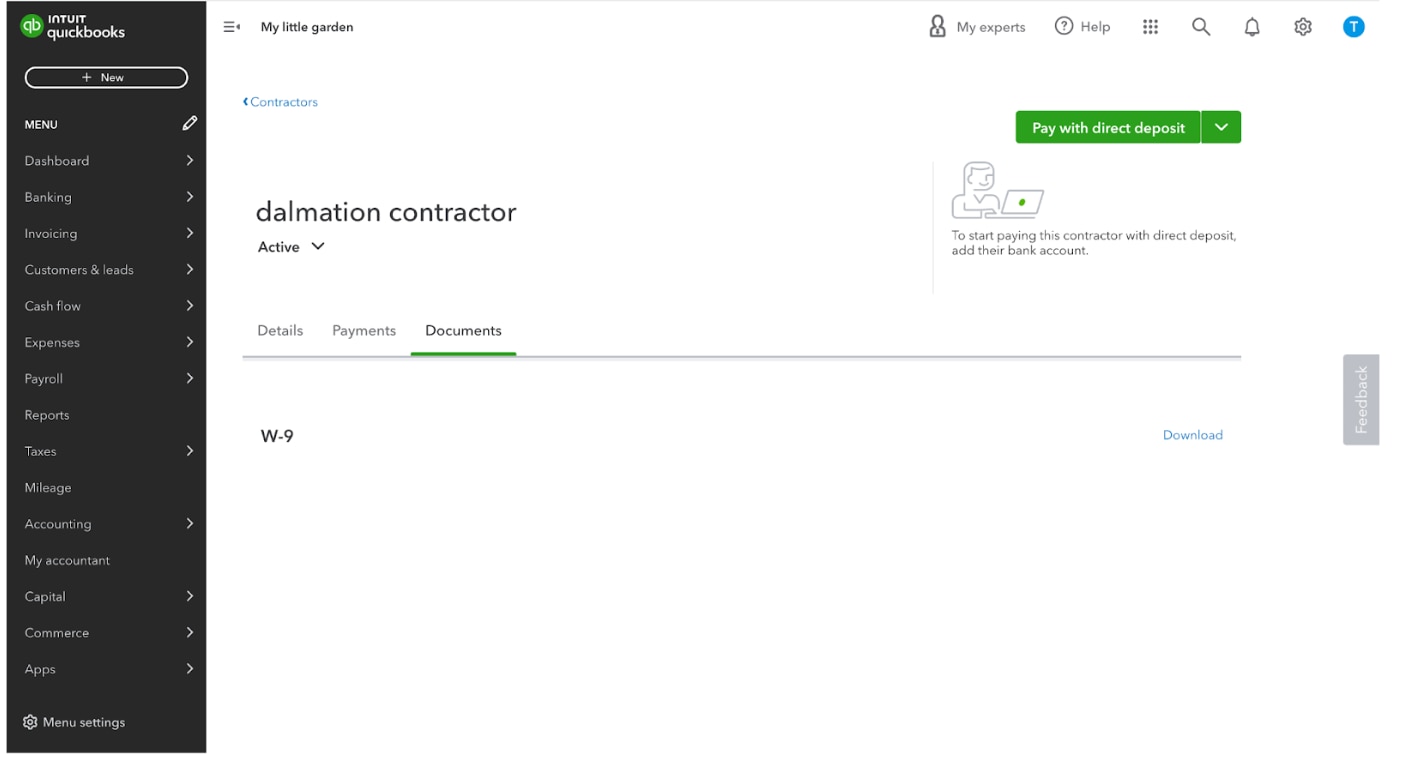

Go to expenses > contractors or Payroll > contractors.

Look next to the contractors name:

- Green checkbox: W-9 information is saved in QuickBooks Online.

- Gray clock: The contractor was invited, but did not fill out their information.

- Orange checkbox: The contractor was not invited to fill out their information.

Someone missing from this list?

Go to the Vendors list and check in the “1099 tracking” column to see if they have a check box. If they don’t have one, click on edit to check the “track for 1099” checkbox.” That way, they will show in the contractor list.

Step 2: Send W-9 invitations or reminders

For all contractors without a green check mark, you can click on “finish setup and pay” to send them a reminder in just one click, or add their email address to send them an invite.