As our most valued partners, our goal is to help drive the success of accounting professionals and the small business clients they serve. We accomplish this by delivering new and improved programs, products, and features that create workflow efficiencies, save time, and create confidence that a small business’s books are accurate and up-to-date.

As 2022 comes to an end, we reflected on the innovations launched over the past year, how they’re helping you and your small business clients thrive, and how we can continue to evolve them to meet your needs.

Here are 10 of the top innovations from QuickBooks® in 2022:

Artificial Intelligence: QuickBooks has continued to find new ways to innovate by leveraging artificial intelligence (AI) to create efficiencies and streamline workflows. Intuit® has 2 million AI models in production that are refreshed daily across its products and services. One example of AI in action is the QuickBooks Online Recommendation System that automatically identifies when an item could be associated with special tax rates or exemptions, and recommends the appropriate category for the item. Leveraging this technology helps lighten the burden on accountants while giving them the confidence that their clients’ books are accurate across sales channels.

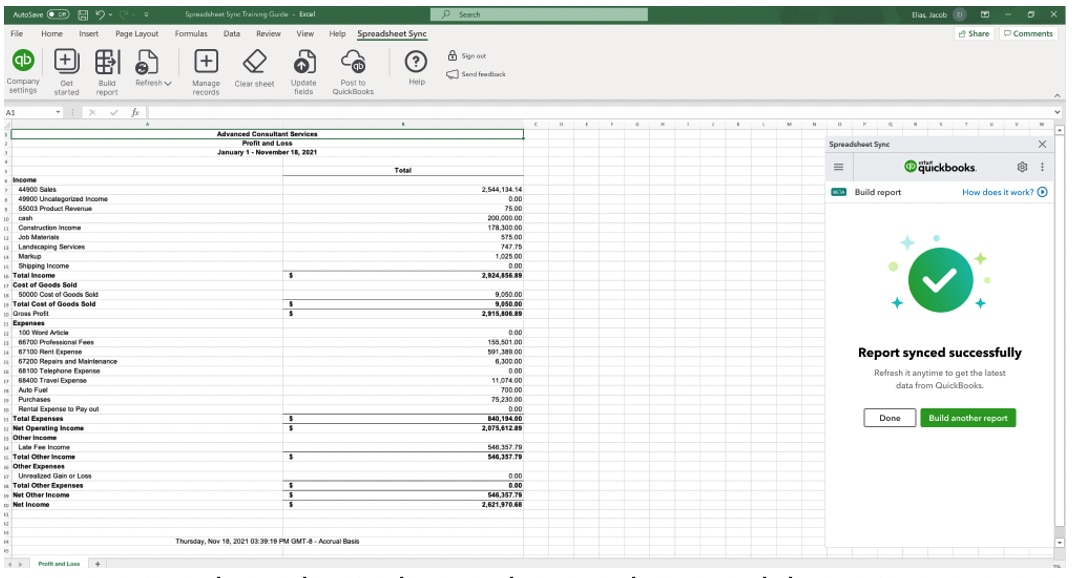

QuickBooks Online Advanced: QuickBooks Online Advanced was purpose-built to meet the unique needs of the mid-market. We recently rolled out several new integrations and features to ensure the platform continues to meet those needs. This includes Spreadsheet Sync, which enables two-way syncing with Excel to help customers streamline their reporting processes, and the Custom Report Builder with Flexi Widget, which can help create clear explanations of key performance indicators. We also launched Revenue Recognition, the new Chart View in Custom Report Builder, and Estimates vs. Actuals. All of these new capabilities drive home how QuickBooks Online Advanced offers a custom solution fit for the mid-market need.