Important pricing details and product information

*ProAdvisor Preferred Pricing – ProAdvisor Discount Terms & Conditions

FOR QUICKBOOKS ONLINE ACCOUNTANT CUSTOMERS WHO TAKE ADVANTAGE OF THE 30% OFF QUICKBOOKS BILL PAY SUBSCRIPTION WITH PROADVISOR PREFERRED PRICING – PROADVISOR DISCOUNT OFFER

Eligibility: This offer is eligible to accounting firms who register or have registered for QuickBooks Online Accountant (“QBOA”) and use the ProAdvisor Discount option (“QBOA Customer”) for QuickBooks Bill Pay subscription fees. The ProAdvisor Discount invoicing option means that the QBOA Customer agrees to pay for QuickBooks Bill Pay subscription fees.

Pricing: Eligible QBOA Customers will be entitled to the following discounts:

- 30% off the then-current list price of QuickBooks Bill Pay

- 15% off the then-current per transaction fee for: (i) Standard ACH transactions (regularly $0.50 each) over monthly allotments (allotments may vary); (ii) Payments by check (regularly $1.50 each); and (iii) Faster ACH payments (regularly $10 each)

Discount and list price subject to change at any time at Intuit’s sole discretion. All prices are quoted without sales tax. If you add or remove services, your service fees will be adjusted accordingly.

Offer Terms: To be eligible, all QuickBooks Bill Pay subscriptions must be entered through ProAdvisor Discount. The discount is valid only for the named individual or company that registered for the QuickBooks Bill Pay subscription and cannot be transferred to another client, individual, or company. Cannot be combined with any other Intuit offer. Offer valid for a limited time only, only in the U.S., and is non-transferable. Terms, conditions, pricing, special features, and service and support options subject to change without notice.

**Product information

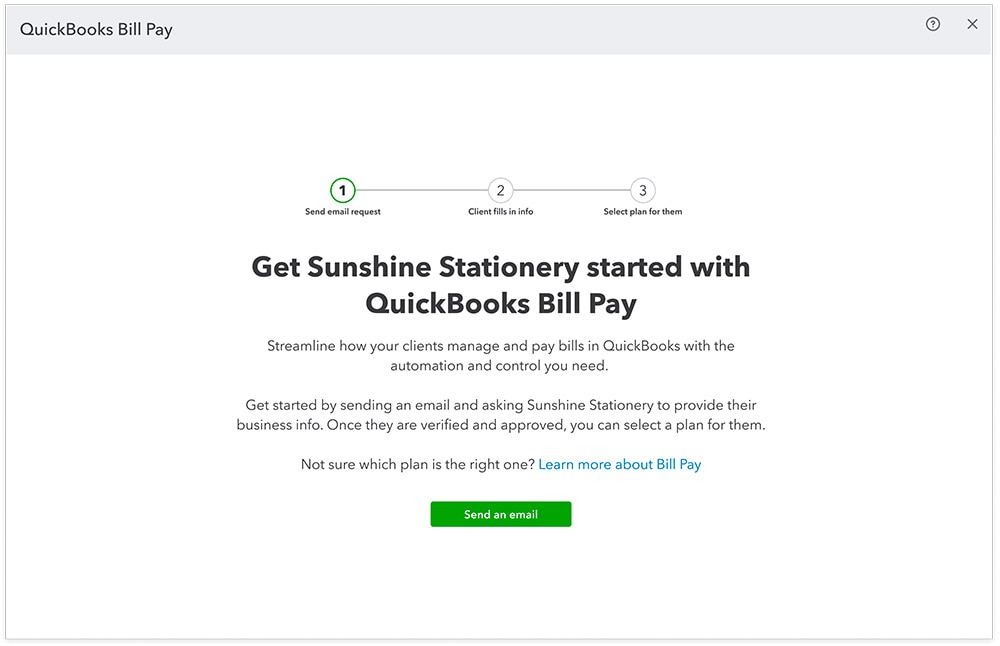

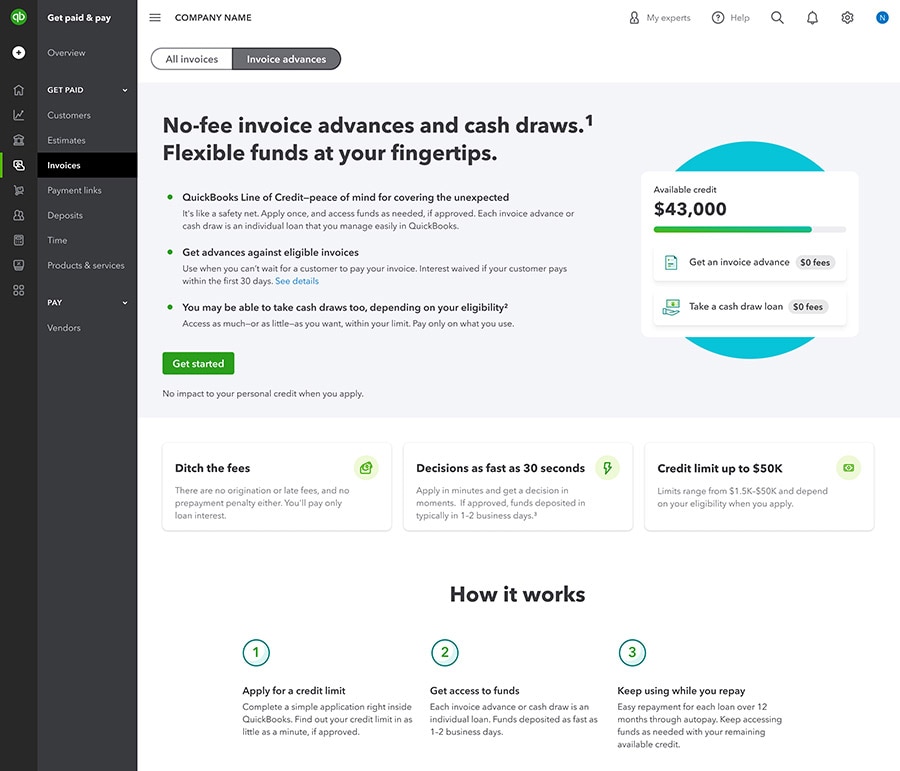

QuickBooks Bill Pay: QuickBooks Bill Pay account subject to eligibility criteria, credit, and application approval. Subscription to QuickBooks Online required. Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For more information about Intuit Payments' money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/.

**Features

Automatic Matching: QuickBooks Online will only match bank withdrawals with transactions processed through QuickBooks Bill Pay. Not all transactions are eligible and accuracy of matches is not guaranteed.

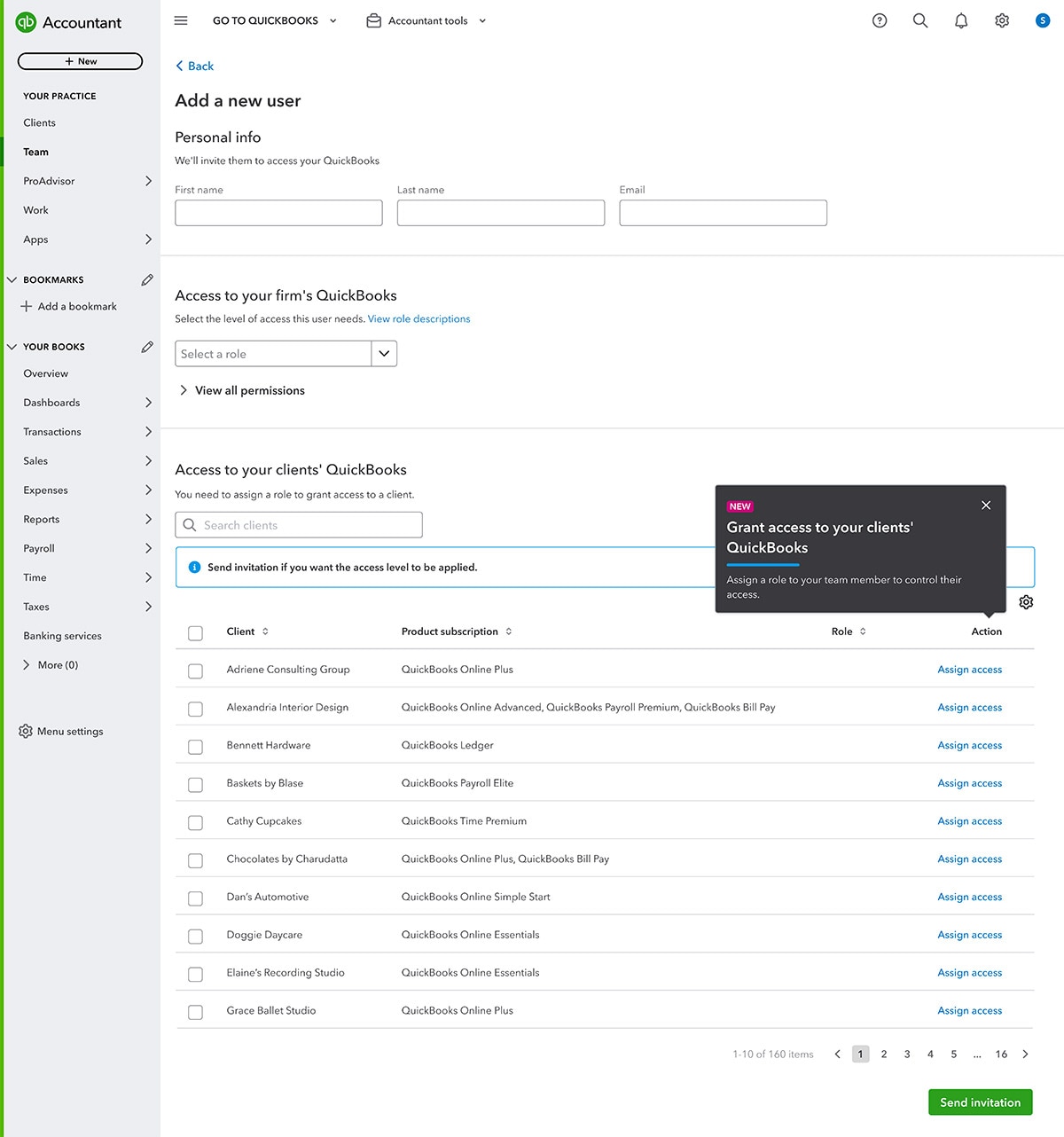

User Roles: Not available for QuickBooks Online Simple Start customers.

Standard ACH: Transaction fees apply for ACH payments transactions over the monthly allotted amount included in QuickBooks Bill Pay Basic and Premium plans. Limits may apply on total number and amount of payments.

Faster ACH: Faster payments are subject to eligibility criteria. Additional processing fee applies. Does not count toward monthly allotted ACH payments. Payments can only be scheduled as early as next business day (excluding weekends and bank holidays). Delivery times may vary due to third party delays or risk reviews.

Unlimited 1099 e-file: Create and e-file unlimited 1099-MISC and 1099-NEC forms in QuickBooks. 1099 forms are e-filed only for the current filing year and for payments recorded in QuickBooks to your vendors or contractors. Excludes state filings, please check with your state agency on any state filing requirements. If you have the Bill Pay Basic plan, 1099 e-filing services will be charged at the standard 1099 E-file Service pricing.