A message from Intuit QuickBooks:

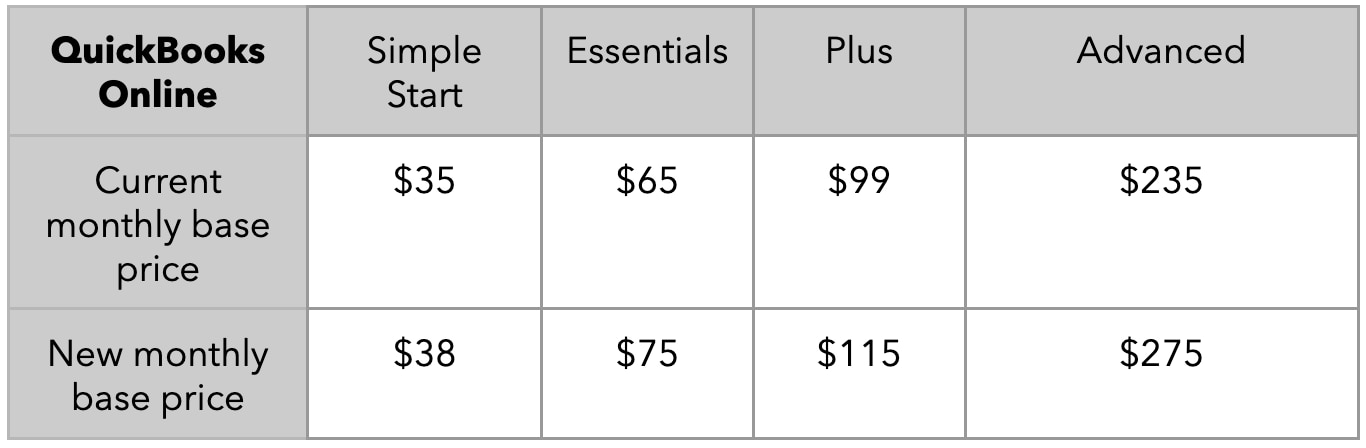

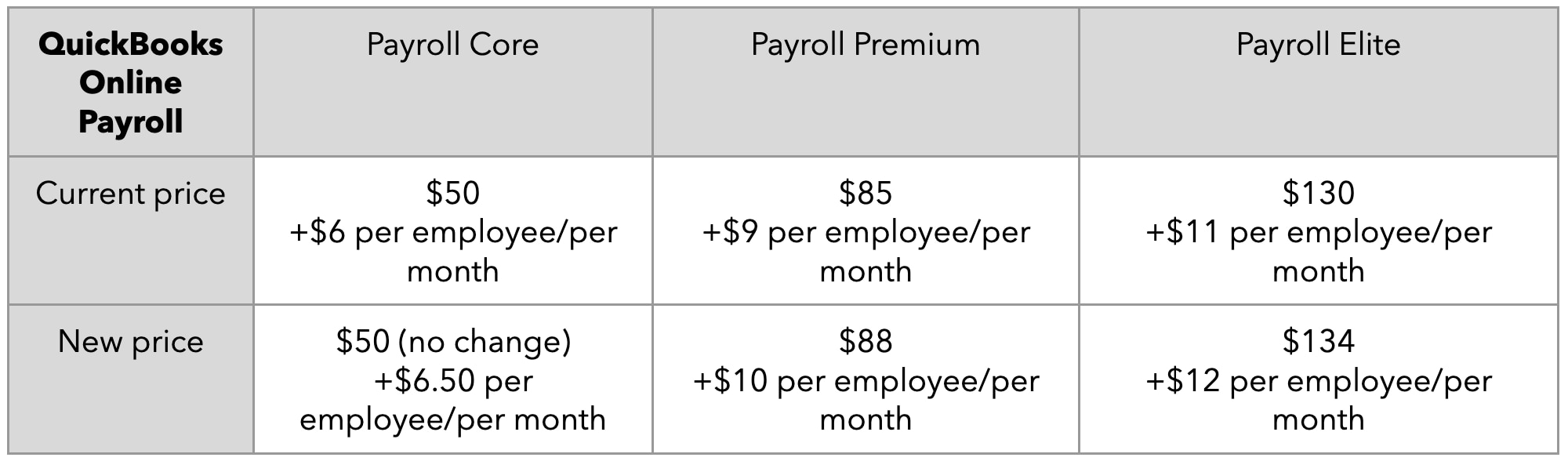

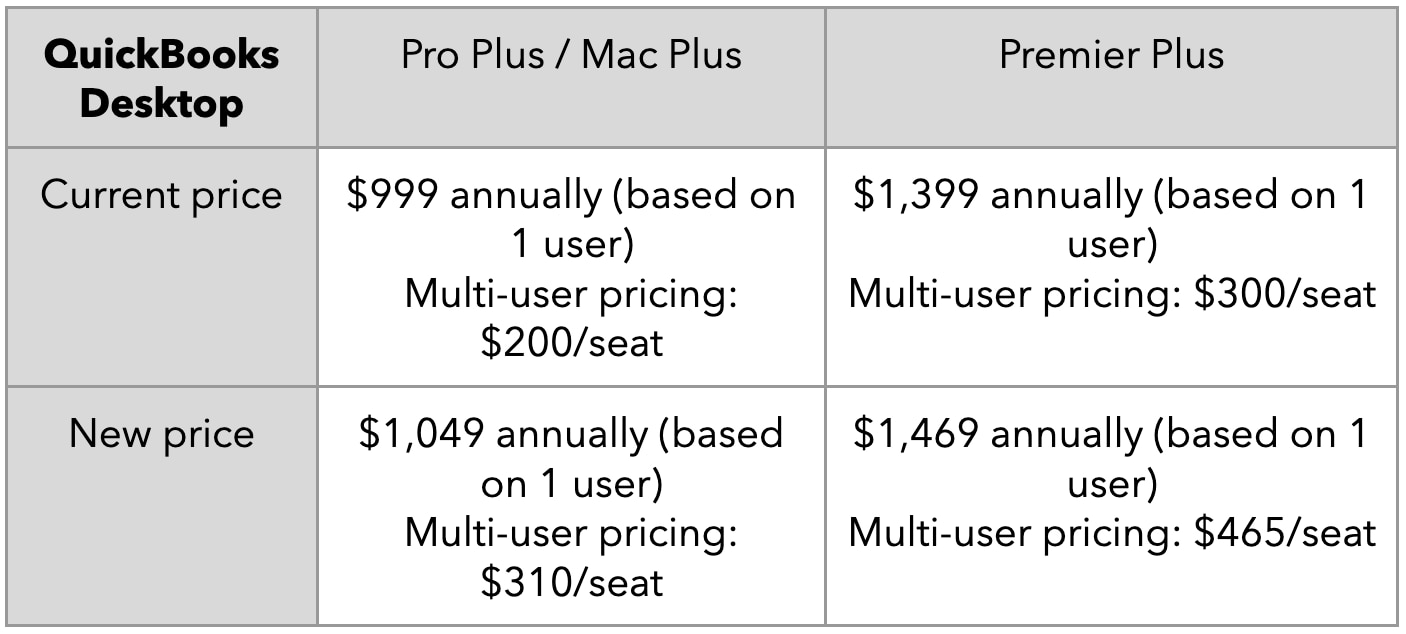

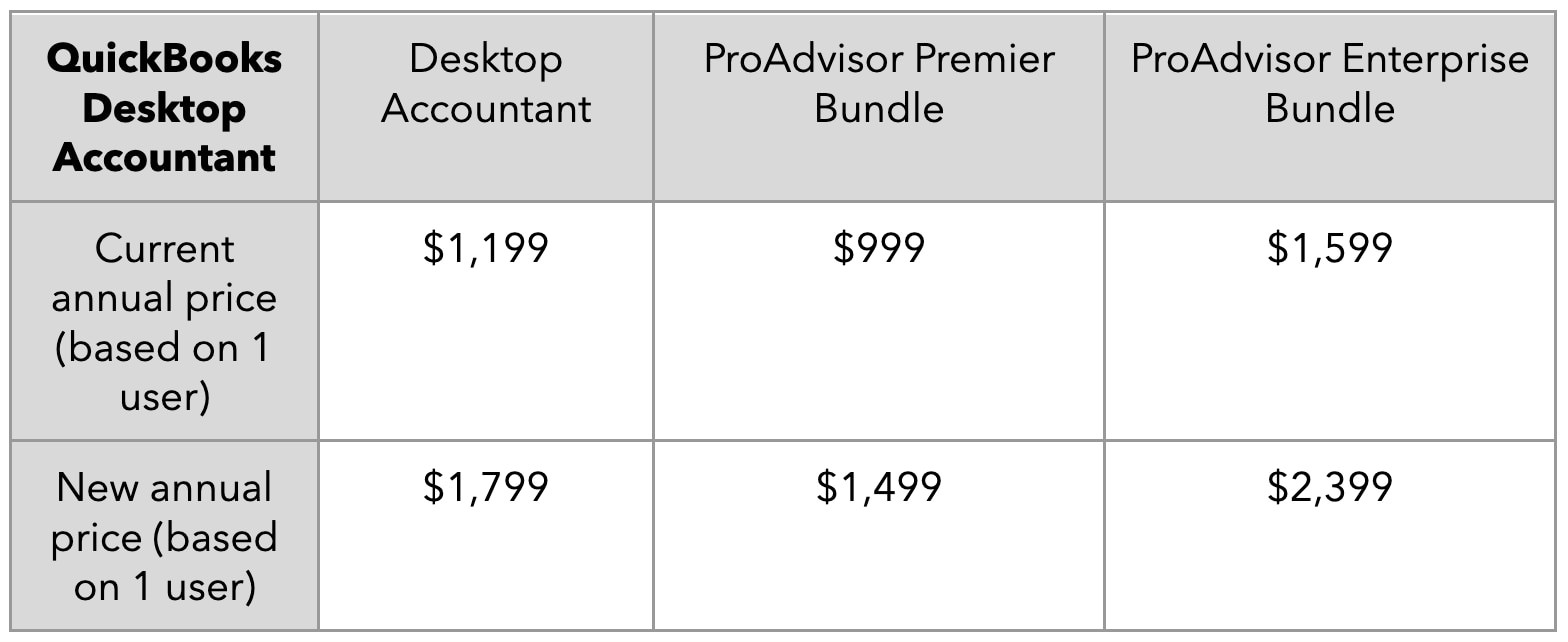

Thank you for choosing QuickBooks. Our pricing will be changing, as we invest in innovations to introduce a more powerful QuickBooks Online that delivers a more efficient way for you to run your firm and help grow your clients’ businesses. Detailed information is below.

Coming soon to QuickBooks Online, an insightful combination of AI automation working overtime, paired with your trusted guidance to deliver the best outcomes for your clients. All in one place, with only one job to do—give you and your clients time and confidence to grow your businesses.

Here's what to expect:

- More efficiency and time savings: Automation and AI agents are built directly into QuickBooks workflows to complete repetitive tasks for you and your clients, increase accuracy and compliance, and streamline operations.

- Easier collaboration with your clients: Efficient communication with clients is important to your working relationship. With better collaboration tools, you and your clients can seamlessly communicate and collaborate in QuickBooks to eliminate time-consuming back and forth.

- Simplicity and convenience, all in one place: With the launch of our customizable interface, we’re combining even more QuickBooks business tools and third-party apps to work seamlessly together. We’re making it easier to do the most critical jobs—all in one place—including customer management, accounting, expenses, payments, and payroll. Data flows between tools, enabling intelligent insights.