We understand how critical it is for accounting firms and their clients to have an AP platform that delivers time- and effort-saving automations, accurate reconciliations to the books, and controls to manage risk when moving money out.

We are pleased to share the latest features of QuickBooks Bill Pay that have been built based on accountant and AP manager feedback, with the goal of helping you drive growth and efficiencies for your firm and your clients.

As a reminder, Bill Pay Basic is now included in QuickBooks Online Simple Start, Essentials, Plus, and Advanced plans; our Basic plan comes with 5 free ACH transactions. If you’re interested in using Bill Pay to process your firm’s AP, your QuickBooks Online Accountant account provides access to Bill Pay Elite at no subscription cost.

What is launching?

- Check images as proof of payment (check remittance).

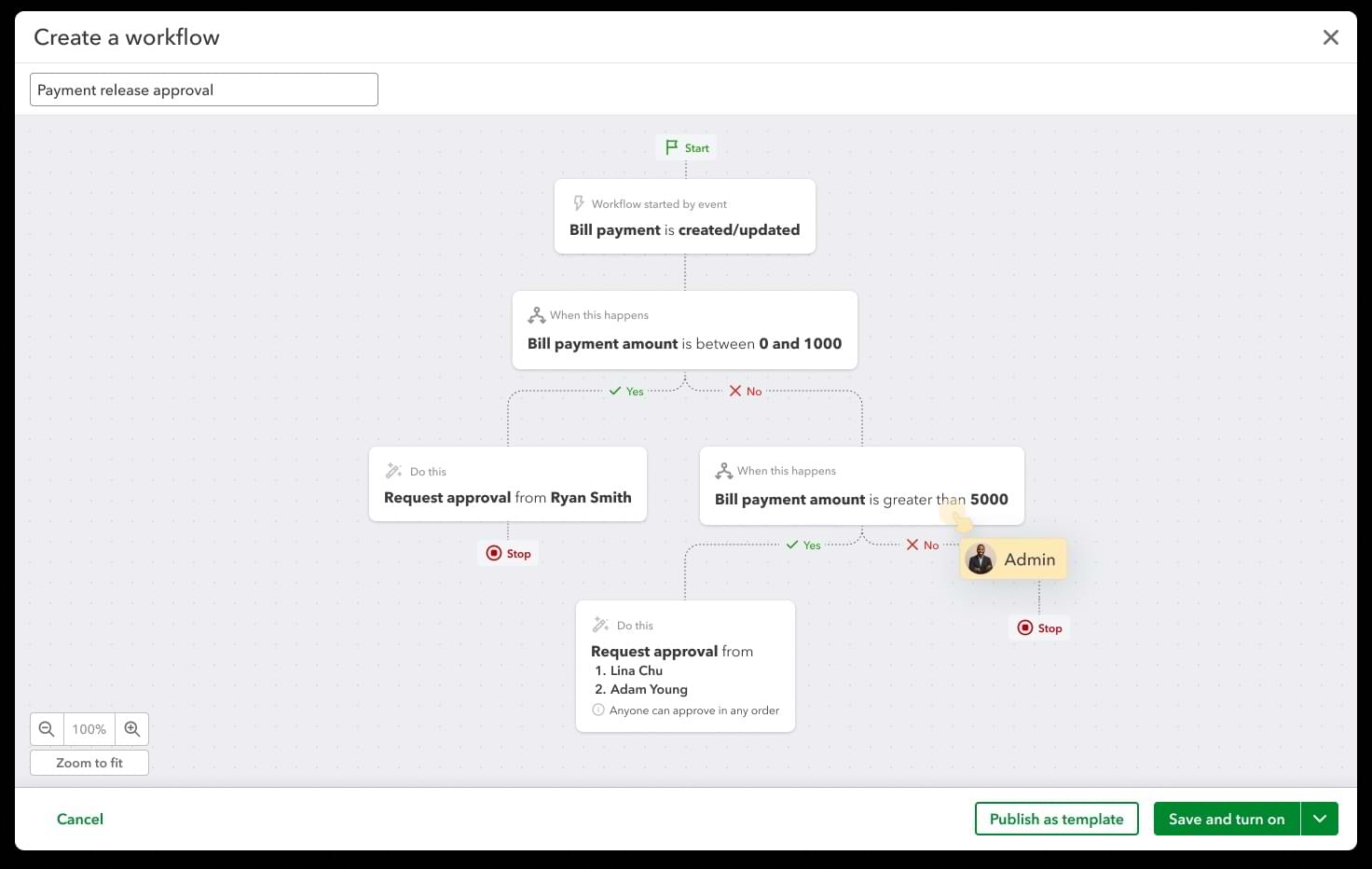

- Bill payment release approval workflows.

- Adding QuickBooks Online Accountant firms to the QuickBooks Business Network.

Check images as proof of payment (check remittance)

You and your clients can now view and download images of checks that have been cleared by the receiving bank, providing concrete proof of check remittance and clarity on payment status after a check has been released.

All Bill Pay subscribers can access this new feature. To view a cleared check:

- Access your client’s QuickBooks Online account.

- In the left navigation menu under My Apps, go to Expenses & Bills > Bill Payments.

- Click “View details” next to the transaction you’d like to review.

- Click “View check.” If the bill payment is marked as “Complete: and the check has cleared, the link will appear under the “Clearance date” column.

- The cleared check image will appear. You will have the option to view or download it.