‘Tis the end-of-year season when many of your clients may look to you for guidance on how to approach their finances and business strategies in 2026. As your client’s trusted advisor, you can help shape their future with client advisory services (CAS). Whether refining your firm’s existing CAS approach or just starting out, check out 5 ways to expand your CAS practice. As an Intuit ProAdvisor, you can take advantage of new, advisory-focused education with CAS Foundations Pathway in ProAdvisor Academy. And, be sure to check out this month’s updates.

QuickBooks Online new features and updates—December 2025

Share these QuickBooks updates with your associates and clients on the latest innovations relevant to business owners and admins.

Stay In the Know

Learn about the most exciting innovations. Join us for a live webinar on Thursday, December 18 at 11 AM PT, or visit the Hub to watch weekly videos. You won’t want to miss our next show where we'll take a deeper dive into the newly launched Intuit Accountant Suite, exploring features such as the Books Close beta and realm consolidation. Plus, we'll share exciting updates on the latest release of the Intuit Enterprise Suite. See you there!

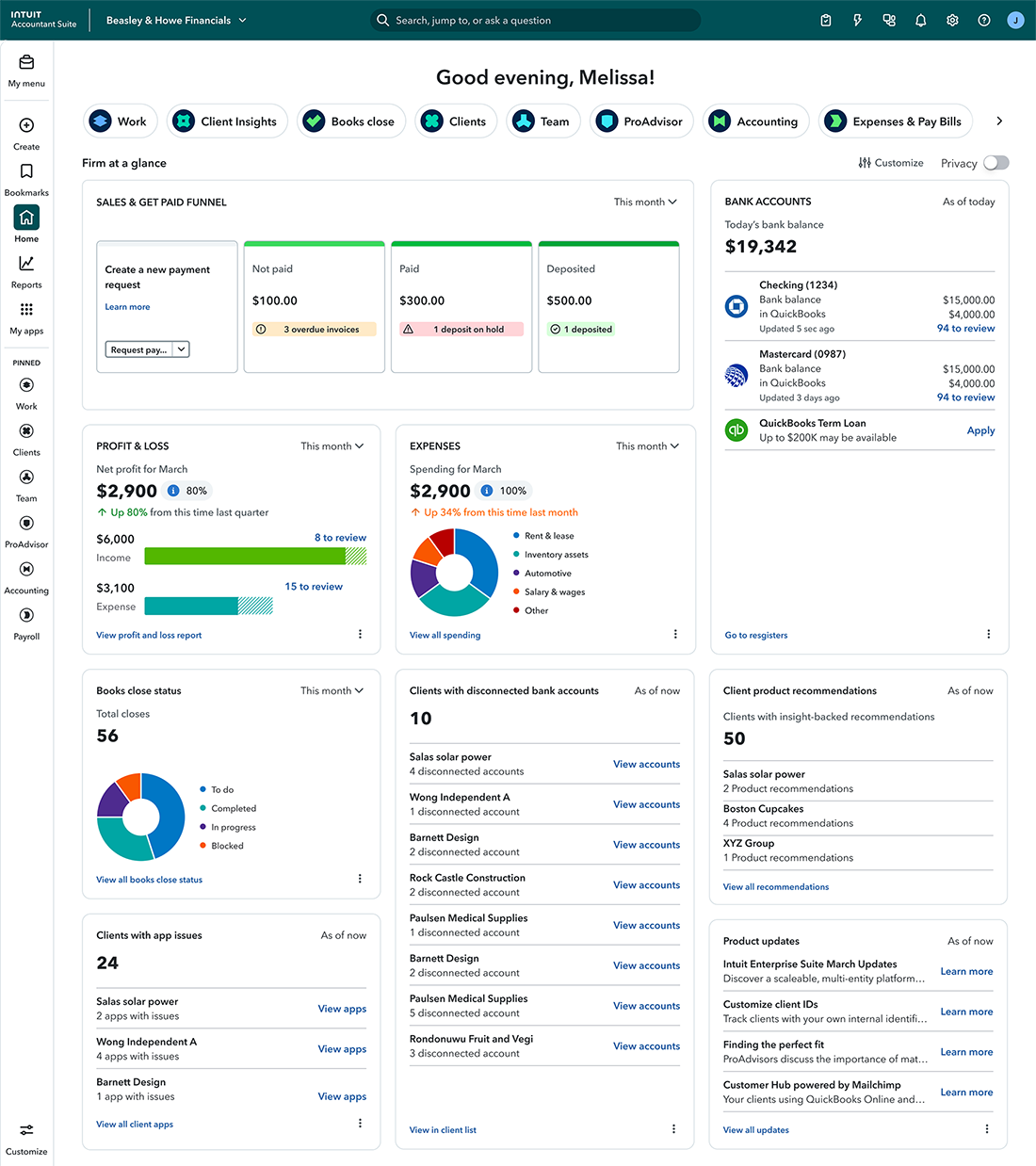

Intuit Accountant Suite Accelerate and Books Close available in beta

Earlier this year, we launched Intuit Accountant Suite Core, the new AI-powered suite designed by accountants and built by Intuit, as the next generation of QuickBooks Online Accountant. Firms have been using this all-in-one, AI-powered suite of tools to serve clients and increase their productivity.

You can now experience premium options in Intuit Accountant Suite Accelerate, with beta access currently available at no additional cost. With Accelerate, you get access to Client Insights and an overview of all your clients, complete with customizable views and segments, so you can surface the right insights and key benchmarks in one place. In addition, AI agents monitor your entire client portfolio, proactively identifying important trends for you across financial KPIs, payroll data, AP/bill pay data, and more.

You can also get beta access to Books Close to help speed your month-end process and spot issues faster. Books Close is available in the Intuit Accountant Suite Core and Accelerate plans to streamline your review and close process with AI-powered anomaly detection. Edits you make using Books Close will automatically update your client’s data across each of their QuickBooks files.

With these new capabilities, your firm can count on Intuit Accountant Suite to streamline more operations, and make faster, more confident business decisions.

If beta access is available to your firm, your admin users of QuickBooks Online Accountant or Intuit Accountant Suite can select Settings, ⚙, then Subscriptions and Billing, Firm Subscription, and choose Try Intuit Accountant Suite.

The latest updates to Intuit Enterprise Suite

In a nutshell: Several new updates to Intuit Enterprise Suite were just released last month.

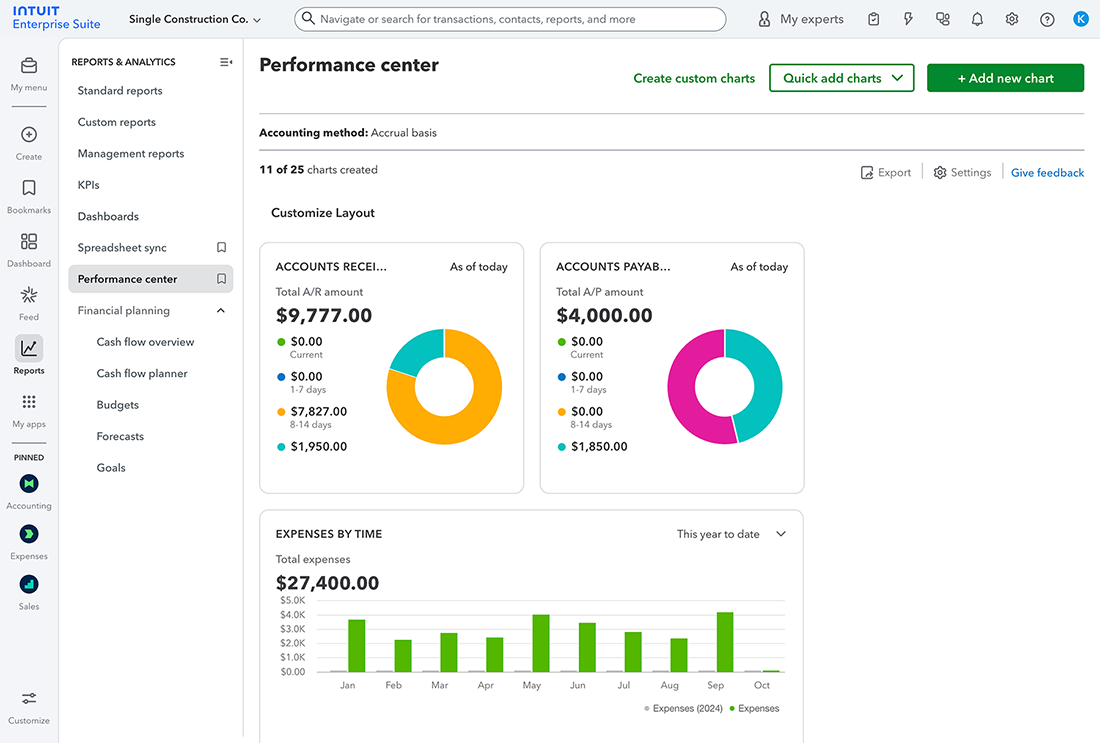

Intuit Enterprise Suite delivers enterprise-grade power to help future-proof your client’s finances. It leverages AI to automate workflows and deliver real-time insights while connecting all your data—helping you close faster and plan smarter. Our latest updates focus on improved business intelligence, new and enhanced Intuit AI agents, multi-entity and dimension capabilities, all in a modernized platform experience delivering greater efficiency with enterprise-grade power.

We’re proud to share several updates in the November release, including these highlights:

- Consolidated view: Get a single dashboard for multi-entity data and safely extend access beyond admins—making it easier to share work, strengthen controls, and boost productivity as your client grows. Your client can now assign permissions to their team members (including bookkeepers and in-house accountants) to perform multi-entity tasks and view consolidated reports based on the companies they access.

- Multi-entity reporting enhancements: Get deeper insights with richer details in reports, expanded drill-down into consolidated reports, visibility into intercompany activity, and broader team access by role for more collaboration, informed decisions, and efficient processes.

- Dynamic allocations: Rather than spending hours processing repetitive entries, your client can sum their balances and allocate them in one step with dynamic allocations to speed up month-end processes and boost productivity. Note: Intercompany account mapping must be set up before your client can use allocation capabilities.

- Dimensions on Spreadsheet sync: Clients can boost team efficiency, help ensure accurate financial reporting, and handle more data effortlessly with Spreadsheet Sync’s new dimensions functionality. Create and update dimension values for multiple transactions directly in Spreadsheet Sync and seamlessly integrate the data with Intuit Enterprise Suite.

- AI-powered dimension recommendations: Allow a client’s team to focus on higher-priority tasks with AI-driven dimension value suggestions that minimize manual effort and improve dimensional reporting accuracy. For products, services, and fixed assets without default dimensions values, your client will get suggestions for their review and approval.

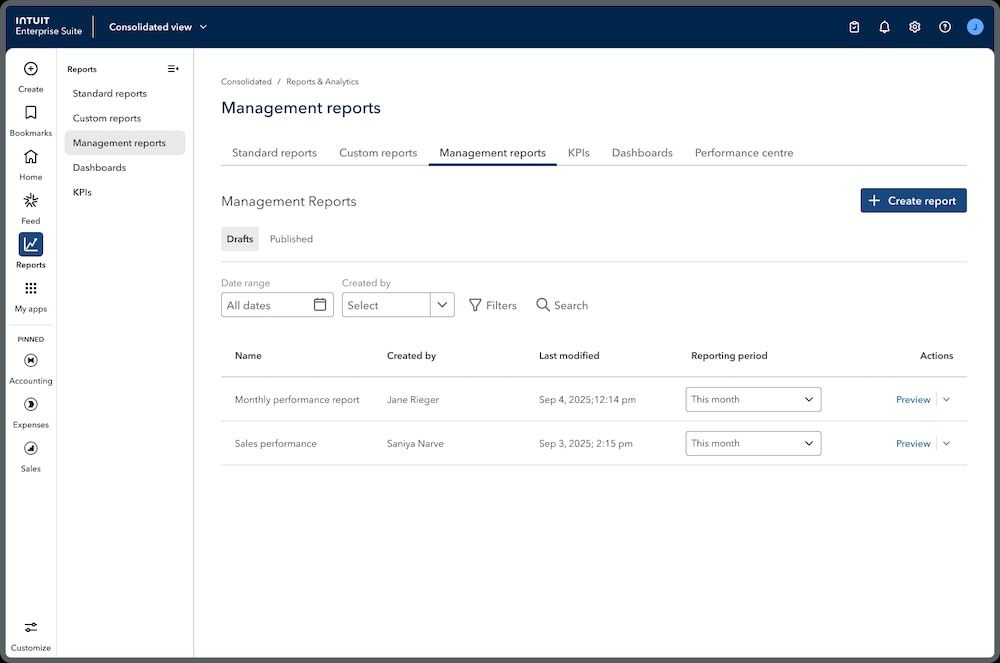

- Management reports: Turn standard financials into branded, presentation-ready packages that combine financial reports, KPIs, charts, and written insights into professional, ready-to-share packages with cover pages, branding, and executive summaries.

Intro to Intuit Enterprise Suite course in ProAdvisor Academy

In a nutshell: ProAdvisor Academy now offers a self-paced training course on Intuit Enterprise Suite.

Firms often face a struggle when a client’s business grows in complexity. What a client needs most in this situation is an integrated, powerful system that can scale with them.

You can now get an introductory look at Intuit’s connected solution for growing and complex clients in a 60-minute, self-paced course.

With it, you’ll learn the basics of Intuit Enterprise Suite, who it’s for, and how it can help firms streamline client workflows, leverage AI-powered features to automate manual tasks, connect key business functions, and deliver greater value for businesses growing in size or operational complexity. You’ll also explore its interface and the process for onboarding, so you can confidently support your clients who use Intuit Enterprise Suite and discuss what to expect with those considering the platform.

This course will also deepen your understanding of how Intuit Enterprise Suite can allow your firm to work more efficiently, advise with confidence, and deliver greater value to your clients.

After completing this course, you’ll be able to:

- Explain the benefits that Intuit Enterprise Suite offers clients and accounting firms.

- Identify suitable clients for Intuit Enterprise Suite.

- Present an overview of Intuit Enterprise Suite navigation, key features, and tools.

- Describe how to sign clients up for Intuit Enterprise Suite.

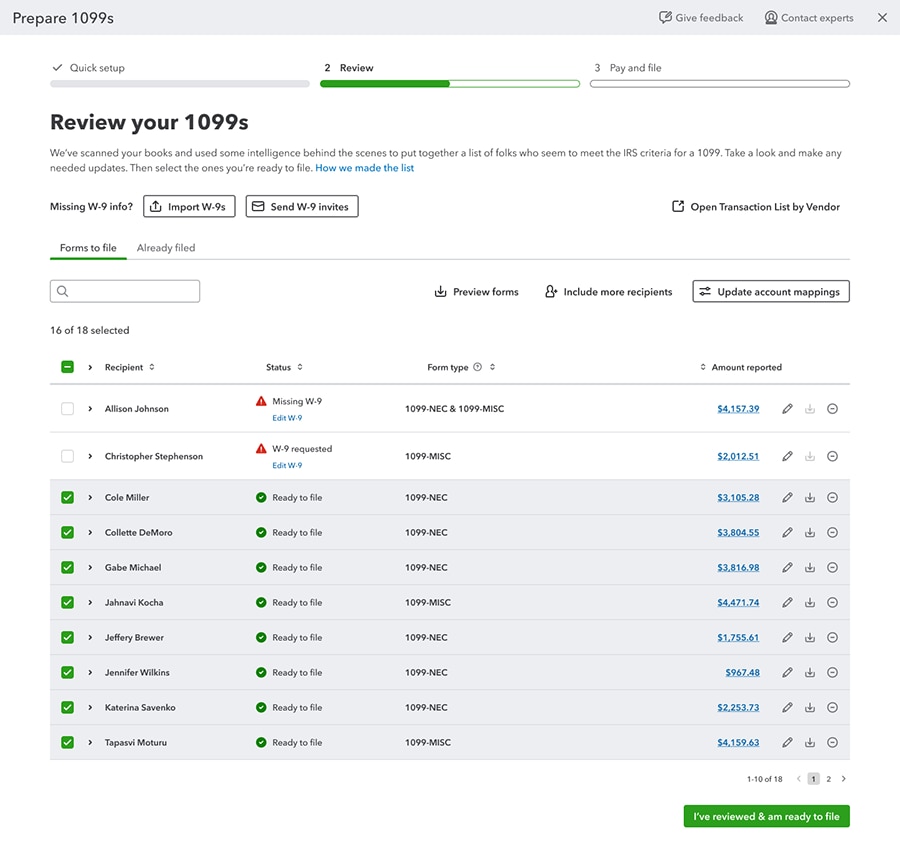

Bulk W-9 upload and automated 1099s

In a nutshell: Save time and reduce errors from manual processes with automated 1099 and the new W-9 bulk upload capability in QuickBooks.

Skip manual data entry by uploading W-9 forms from vendors in bulk. You or your client can review suggested vendor or contractor matches, which they can approve to update and automatically add to their vendor data in QuickBooks.

In addition, fast-track 1099 preparation and filing by automating 1099s in QuickBooks. This AI-powered capability generates a list of vendors and their chart of accounts recommended for 1099 filing, according to IRS requirements, and drafts the 1099 forms using QuickBooks data. This simplifies and streamlines 1099 prep, so you can regain valuable time while ensuring accuracy.

Key updates we’ve made to QuickBooks Online

In a nutshell: Thanks to your feedback, we continue to make improvements that make your QuickBooks experience faster, easier, and more reliable.

QuickBooks Online has added several feature updates over the past three months to enhance workflows, including these highlights:

- The QuickBooks platform navigation and usability is easier and more customizable. For example, clients can view and work in multiple tabs by selecting Open link in new tab in the bookmark flyout.

- Accounting features are faster and more accurate, such as PDF to transaction conversion that converts PDF bank statements directly into transactions ready to be posted through the bank feed.

- Clients can now create and manage bills on-the-go with the QuickBooks Online mobile app (iOS and Android).

- Streamline inventory accounting and tracking with the Moving Average Cost (MAC) inventory valuation method, now available to customers using Plus, Advanced, or the Inventory add-on.

- Clients can offer employees on-demand pay—access to a portion of their earned wages before payday—at no cost through our partnership with Clair.**

Important disclaimer information

Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For more information about Intuit Payments' money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/.

**Product information

Mobile apps: The QuickBooks Online mobile and QuickBooks Self-Employed mobile companion apps work with iPhone, iPad, and Android phones and tablets. Devices sold separately; data plan required. Not all features are available on the mobile apps and mobile browser. QuickBooks Online mobile access is included with your QuickBooks Online subscription at no additional cost. Data access is subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance and events beyond your control. Product registration required.

**Features

On-demand pay: Clair is a financial technology company, not a bank. All Advances are originated by Pathward®, N.A. All Advances are subject to eligibility criteria and application review. Terms and conditions apply.

Intuit Business Credit Card alpha launch

In a nutshell: Introducing the Intuit Business Credit Card, a credit card designed to empower small businesses with the funding they need to grow and the intelligent tools required to master their spend and operations—all fully integrated with QuickBooks.

Note: The Intuit Business Credit Card is currently in an alpha phase of development and will move into beta in early 2026. You may have clients who receive a card offer during these phases, so we wanted to inform you about the card and its benefits.

For small businesses, steady cash flow is a common challenge. Businesses short on cash often have limited access to capital, and a lack of real-time visibility and control into their spending. And, manually tracking expenses and staying on top of employee spending takes precious time away from building a business.

The Intuit Business Credit Card integrates automatically with QuickBooks’s bank feed, which means no more manual entry, broken bank connections, or managing clients’ bank passwords.

The approval process leverages your client’s data that’s already in QuickBooks, so decisions are often fast-tracked. If approved, your client would receive a credit line from $1,000 up to $50,000. A business owner can check their eligibility and get a card offer without completing a long form or adding a hard inquiry to their credit report. They can also assign free physical and virtual credit cards to employees, set monthly spend limits, and monitor their spending in real time.

The Intuit Business Credit Card has no annual fee.** It also features competitive rewards such as 5% cash back on eligible Intuit software and services and 2% cash back on all other completed purchases.** Plus, more benefits are coming online every month. By putting more money into a business owner’s pocket, this card can lower the cost of running the business and improve cash flow.

Important product information

Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For more information about Intuit Payments' money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/.

**Features

Intuit Business Credit Cards are issued by WebBank. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

No annual fee, 5% cash back does not include transactional fees (ex: merchant services). Refer to Cardholder Agreement and Reward Program Terms for additional details.

Cash back and rewards will be applied in the form of a statement credit to your Intuit Business Credit Card account.

$200K Bill Pay processing limit for clients you refer

To reflect your firm’s trusted status and streamline bill payment processing, we’re providing a $200,000 starting base processing limit in Bill Pay for your eligible clients.** Eligible clients are those who are signed up or referred through QuickBooks Online Accountant, and who apply to any QuickBooks Bill Pay plans (Basic, Premium, or Elite). Note: The $200,000 starting base processing limit can take up to 7 days after signup to become effective.

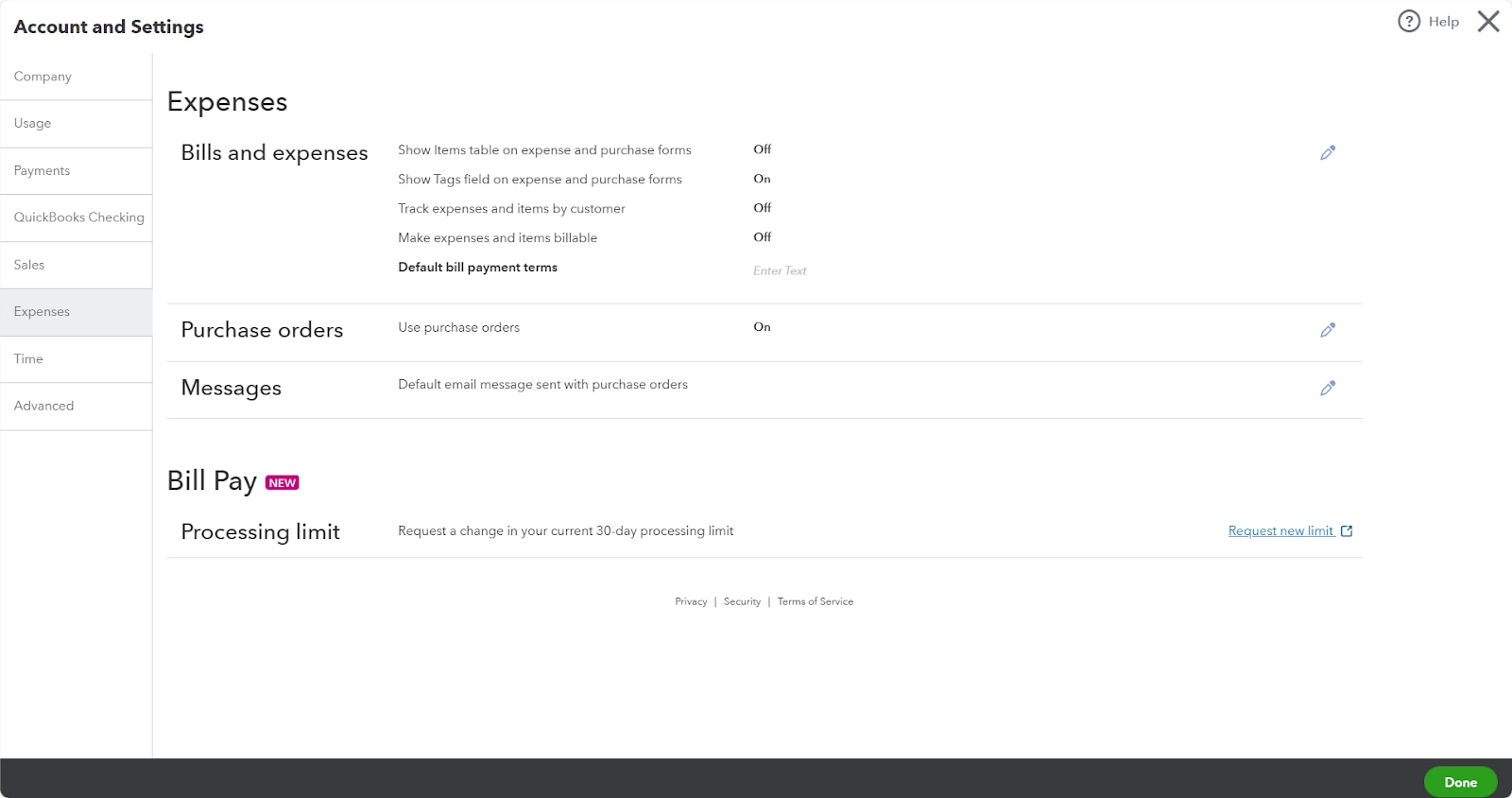

If your client needs a higher limit, you can still request an updated limit for their business directly in their QuickBooks Online account at any time. Go to Account and settings, then Expenses, Bill Pay, and choose Request new limit.

Important product information

Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For more information about Intuit Payments' money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/.

**Products

QuickBooks Bill Pay: Subject to eligibility criteria, credit, and approval prior to first payment. Subscription to QuickBooks Online required. Bill Pay Basic is included with QuickBooks Online when purchased directly from QuickBooks.com or QuickBooks Sales. Not available in U.S. territories or outside the U.S.

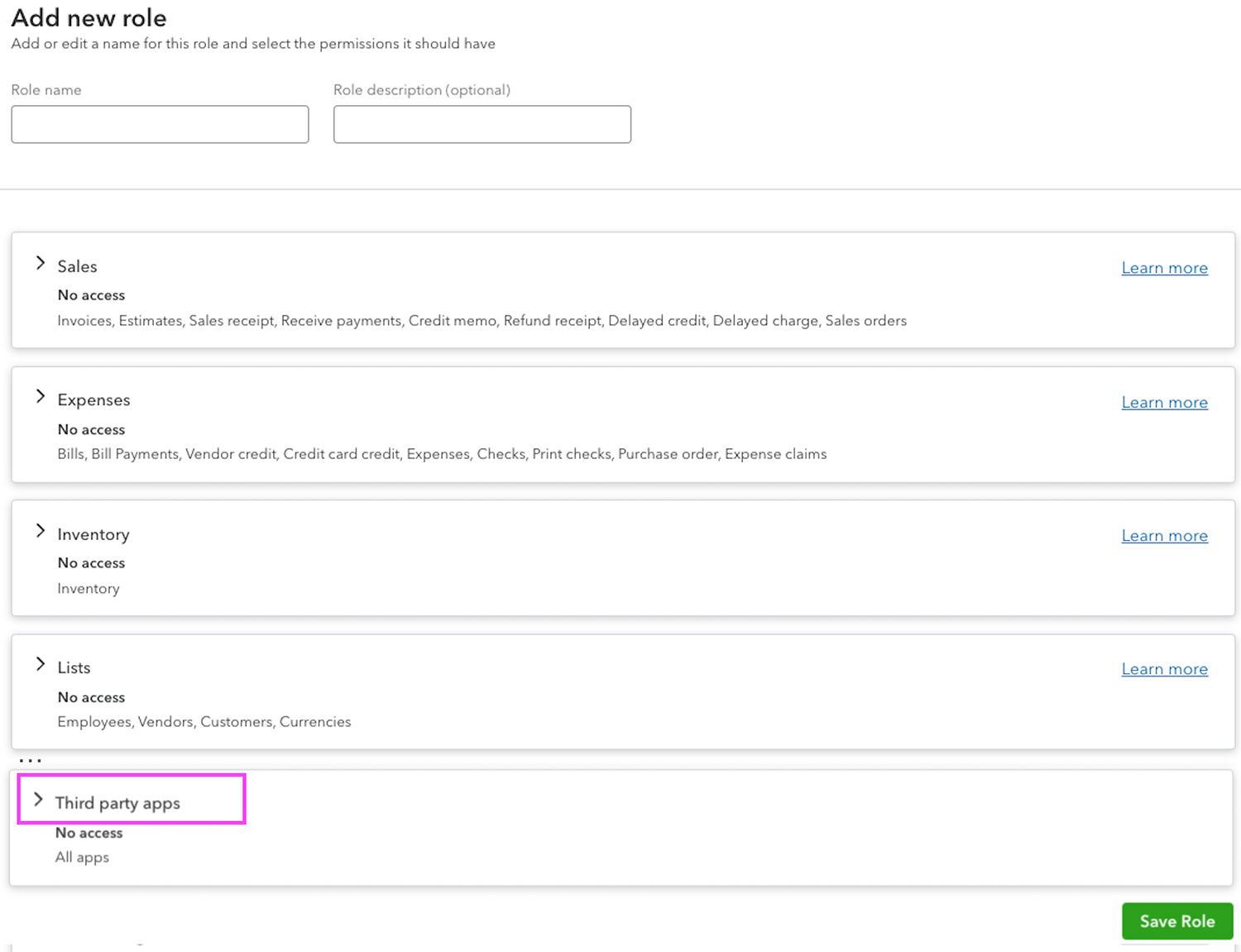

Assign access to manage third-party integrations

In a nutshell: Clients using QuickBooks Online and Intuit Enterprise Suite can now allow non-admin users to set up and manage third-party integrations.

Your clients can now create roles that include third-party access permissions, rather than assigning admin privileges in order to delegate these responsibilities. This can save business owners costs and headaches when assigning the roles they need for their team.

Help improve client workstreams and peace of mind by assigning access for third-party integrations.

Table of contents

Table of contents

Recommended for you

Get the latest to your inbox

Get the latest product updates and certification news to help you grow your practice.

Thanks for subscribing.

Relevant resources to help start, run, and grow your business.