As you settle into the new year, it’s a great time to get a new lens on advisory and how it can benefit your clients’ growth—and your firm’s. To start the discussion, learn about “augmented advising” with an episode of our On the Books podcast called Numbers and narratives: Redefining advisory for 2026. For guidance on the change management and tech side of advisory, be sure to take a look at Software change management: A comprehensive guide for accountants. After that, be sure to read about this month’s updates.

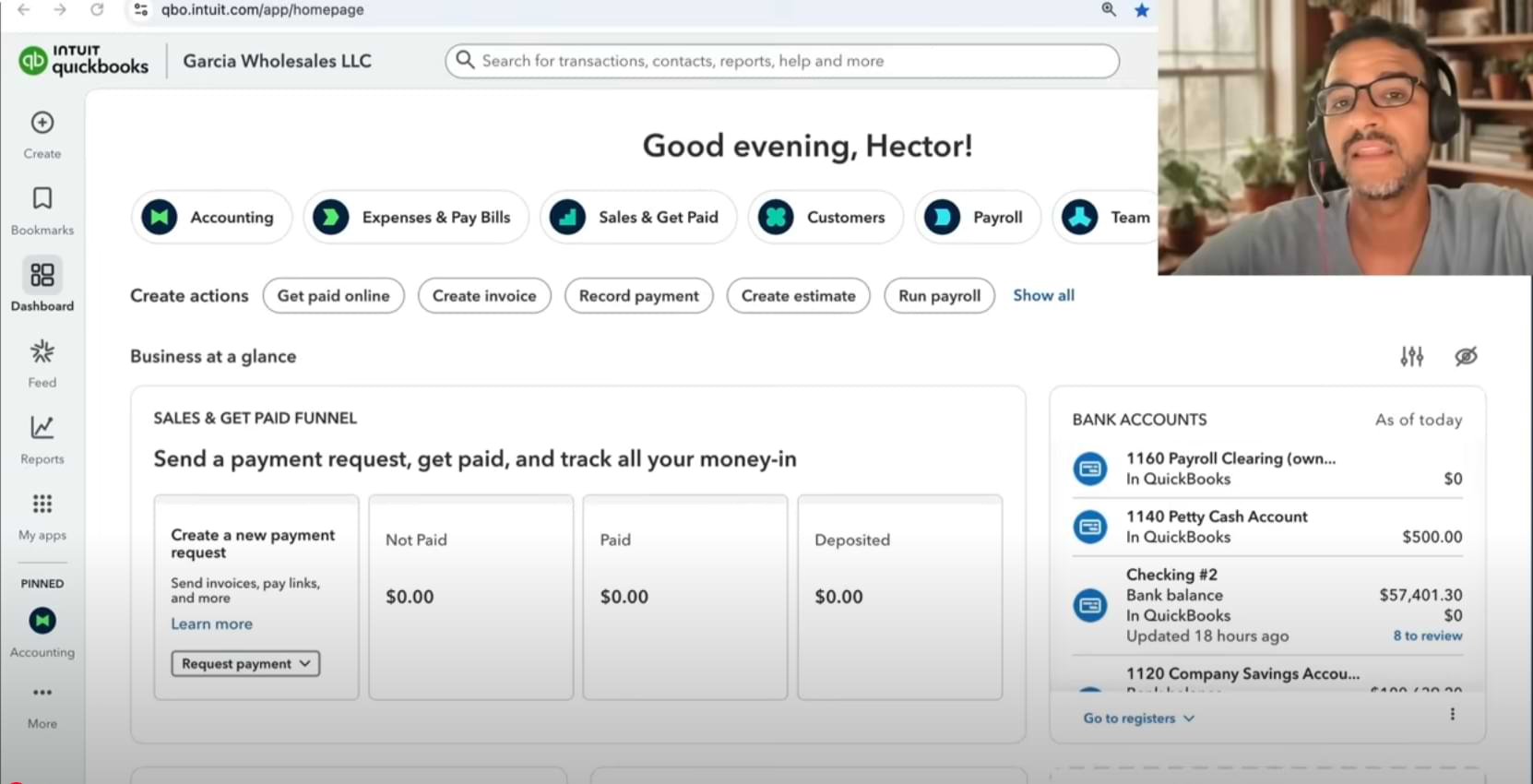

Share these QuickBooks updates with your associates and clients on the latest innovations relevant to business owners and admins.

Stay In the Know

Learn about the most exciting innovations. Join us for a live webinar on Thursday, February 19 at 11 AM PT, or visit the Hub to watch weekly videos.

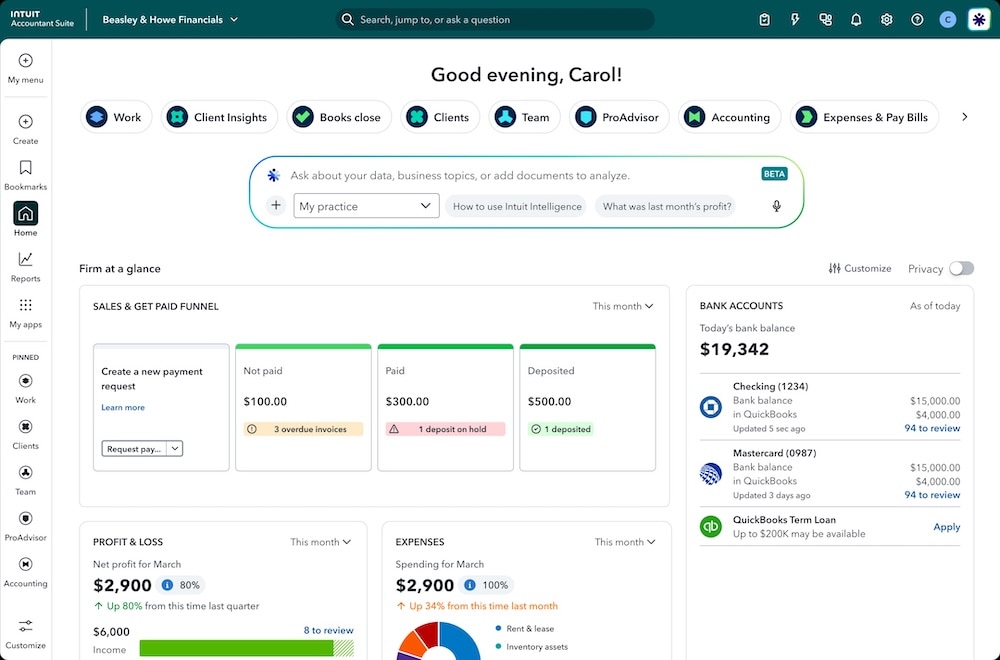

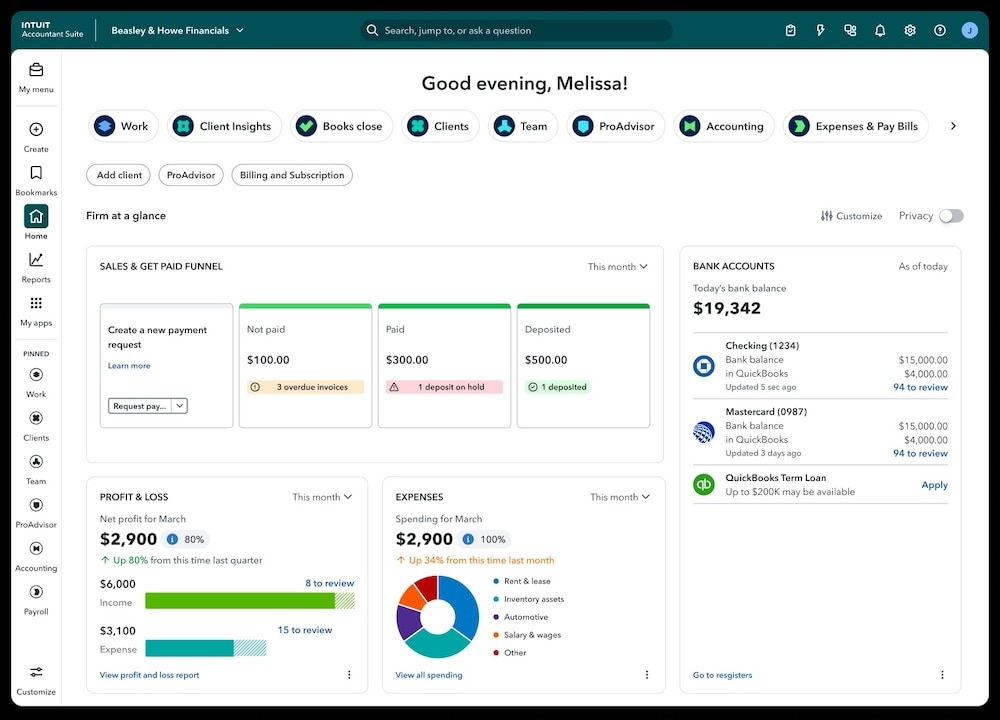

Better firm management with Intuit Accountant Suite

In a nutshell: You can use Intuit Accountant Suite to help improve firm efficiency, streamline operations, and make more confident decisions.

The latest innovations in Intuit Accountant Suite are designed by accountants, for accountants, to manage your firm, clients, and teams all in one place. You and your firm can use it to gain efficiencies from the start by managing all your QuickBooks Online client files with one sign-in.** In addition, you can organize your client list based on any segment you define, such as industry, region, or office, using client custom fields.

You can further streamline firm operations by using workflows that match the way you work. Accessible at no cost in beta, Books Close lets you manage and complete all your monthly close activities without switching into client files while ensuring quality and timely delivery.** Tailor your firm’s review and close process with customizable templates, custom statuses, and multiple assignees according to your firm’s specific preferences.

From one place, you can now monitor each client’s top KPIs and surface the right insights and key benchmarks. Client Insights provides an overview of your clients, complete with customizable views and segments.**

Organize teams and clients your way. Get beta access to capabilities that allow you to assign teams and clients through custom role-based access groups aligned to your firm’s structure. With all-in-one firm-wide groupings, you can easily view your team and client groups.**

Use Intuit Accountant Suite to streamline your firm operations, train your firm for the future, and standardize quality on-time client service delivery for a greater impact—all in one place.

Important product information

**Features

Manage all your QuickBooks Online client files with one sign-in to Intuit Accountant Suite: Access client files that are connected to your Intuit Accountant Suite solution.

Books Close: You will not be charged during the beta program which runs through April 30, 2026. Beginning May 1, 2026, we will start charging for Books Close. You have the opportunity to continue to use Books Close for a fee, or cancel your subscription prior to that date to avoid charges.Pricing will be based on the number of clients onboarded to Books Close. Firms will choose which clients they onboard to Books Close. Charges will be based on the number of clients onboarded at the beginning of their billing month on their billing date. Firms with 50 clients or fewer onboarded, will pay $8/client/month. Firms with more than 50 clients onboarded, will pay $6/client/month.These charges will begin on your firm’s bill on or following May 1, 2026.

Client Insights: Requires upgrading to Accelerate, a paid plan within the Intuit Accountant Suite.

Team and client groups: Requires upgrading to Accelerate, a paid plan within the Intuit Accountant Suite.

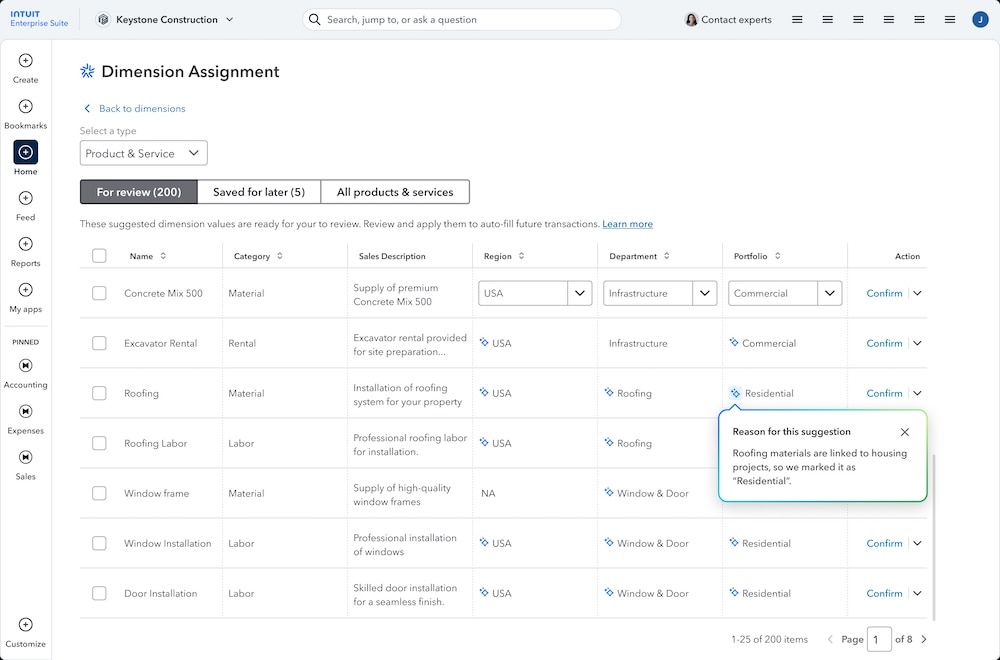

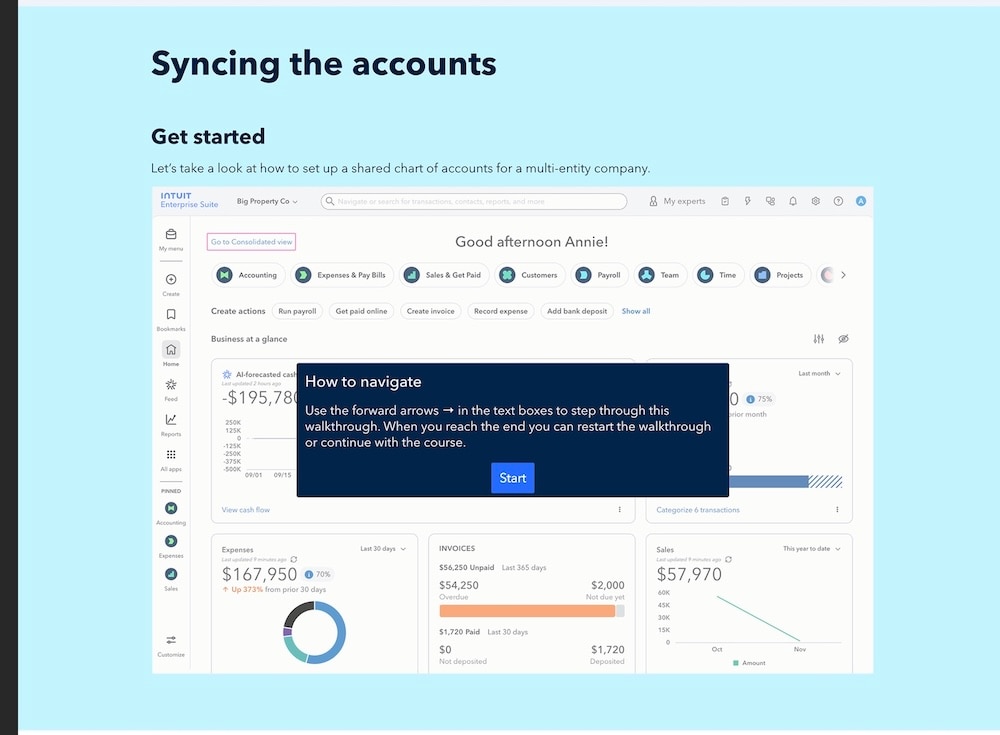

Latest Intuit Enterprise Suite updates

Intuit Enterprise Suite delivers enterprise power and AI-driven intelligence, tailored for clients’ businesses and delivered through a modern, intuitive experience. Our latest updates deepen Intuit Enterprise Suite’s operational power with greater automation, stronger governance, and sharper visibility, all in an AI-native ERP that’s intelligent, adaptive, and ready for what’s next.

We’re proud to share several updates in the February release, including these highlights:

- New multi-entity reports: You and your clients can now get additional visibility on cross-entity financial data with 5 new consolidated reports: Invoice list, Transaction list by date, Transaction detail by account, Deposit detail, and Check detail.

- Dimension assignments: Help add efficiency and accuracy to financial workflows by accessing dimension assignment from more pages, assigning dimensions in bulk, and saving transactions for later when you’re not ready to assign dimensions.

- Dimensions on workflow automation: Help make approvals, reminders, and tasks more efficient by setting dimension-based conditions in workflows to more closely match your client’s business structure and financial reporting requirements.

- Parallel approvals: Get more flexibility to create complex workflows that meet your client’s business needs by including parallel approvals with up to 5 approvers—and record more detailed audit trails along the way.

- AIA-style invoicing for construction (beta):** Clients can build trust with customers by generating invoices that provide more information and transparency. The new AIA invoice format in Intuit Enterprise Suite can track the total contract value on estimate, invoiced to date, invoice amount, and remaining balance at the phase level.

- Assignments in QuickBooks Time: Clients using Payroll Premium and Elite can manage all assignments in one place to reduce confusion, errors, and rework while improving overall payroll and job-costing accuracy.

Important product and disclaimer information

Beta features: These capabilities are currently in open beta and available to all Intuit Enterprise Suite customers at no additional cost. This is subject to change at Intuit's discretion.

Coming soon: ProAdvisor certification for Intuit Enterprise Suite

In a nutshell: ProAdvisor Academy now offers a full certification program for Intuit Enterprise Suite.

In addition to our existing introduction course, you can now take a self-paced, 4-course certification to help you confidently introduce, recommend, and use Intuit Enterprise Suite for your growing and complex clients.

With this certification in Intuit Enterprise Suite, you’ll be able to:

- Use Intuit Enterprise Suite-specific functionality, including multi-entity workflows, projects, and business intelligence.

- Apply Intuit Enterprise Suite to real-world situations, to help your clients get the most out of it.

- Identify right-fit clients for Intuit Enterprise Suite, guide them through onboarding, and make adjustments as their businesses scale.

- Support higher-value workflows by learning to use advanced capabilities like multi-entity management, project tracking, automation, and reporting—so you can support more client needs.

- Discuss how Intuit Enterprise Suite connects key business functions and reduces manual work, so you can streamline client workflows and help your firm operate more efficiently.

- Differentiate your firm by positioning your team as knowledgeable Intuit Enterprise Suite-ready advisors to growing, complex businesses.

- Earn recognition for your learning with CPE credit and 200 ProAdvisor points upon completion.

- Stay current as Intuit Enterprise Suite evolves using ongoing refreshed certification content that aligns with product enhancements and new functionality.

Get this no-cost Intuit Enterprise Suite certification to deepen your understanding of this solution, so you can help your firm recommend it to clients and help optimize clients’ workflows.

Important product and disclaimer information

Intuit (Sponsor ID# 103311) is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website: www.nasbaregistry.org.

New referral bonuses for QuickBooks Payroll Premium and Elite

In a nutshell: Your firm has new opportunities to earn referral bonuses on top of revenue share when you are approved into the ProAdvisor Revenue Share Program and add QuickBooks Payroll Premium or Payroll Elite for your clients.

To thank accountants for bringing clients to the QuickBooks Platform, we share a percentage of clients’ subscription revenue with firms that are enrolled in the ProAdvisor Revenue Share Program.

For instance, your firm can earn a 30% revenue share for each QuickBooks Online Payroll subscription your firm adds for a client (see full terms).

And now, for a limited time, your firm can earn an additional bonus for each first-time Payroll subscription your firm adds for a client by March 31, 2026 (see full terms):

- Get a $300 referral bonus for each new Payroll Premium subscription

- Get a $500 referral bonus for each new Payroll Elite subscription

Amazon Seller Connector by QuickBooks

In a nutshell: Your clients using QuickBooks Online and selling on Amazon Seller can access a new embedded QuickBooks experience within Amazon Seller Central to automate even more of their tedious tasks and better understand their store’s performance.

Using a newly enhanced integration with QuickBooks, Amazon Seller Central users can automate reconciliation and fee categorization. They can also transform raw financial data into actionable business intelligence, to help inform their decisions. Amazon Seller Connector is free for QuickBooks Online users.

To take advantage of this new integration, your clients should connect their Amazon Seller Central account with QuickBooks Online to track profit, sales, fees, and inventory from their store and other sales channels. Here’s how.

Let QuickBooks continue to help your clients grow, reclaim valuable time, and scale their business with a unified, real-time view of their entire ecommerce operation.

Intuit Intelligence and more now available in QuickBooks Online

In a nutshell: It’s here! Take advantage of foundational improvements, Intuit Intelligence chat, and Business Tax AI (beta) in QuickBooks Online for a smarter tax filing season.

QuickBooks has a number of improvements to help you and your clients get more done:

- Smoother bank connection management that simplifies communication around resolving connection issues.

- More automation and time-savers like increased accuracy, consistency and efficiency with streamlined workflows and better automation for complex process for accounting, payroll, and time tracking.

- Increased usability, quality, and data performance for faster, more intuitive workflows through upgraded mobile usability, data protection, enhanced reporting, and performance improvements to help work flow more seamlessly.

In addition, Intuit Intelligence chat, accessible to admin users, can help you make better decisions for your firm and clients faster. Turn questions into clarity and help drive action for measurable growth. Get more done faster with the help of Intuit AI, so you can focus on moving business forward with speed and accuracy.

Also new this month are 3 additional QuickBooks plans. These are designed to help more businesses standardize their books and get on the path to scalability earlier in their journey—which also helps you take them on as clients when they grow. For example, QuickBooks Free helps early start or growing solopreneur business owners track income and expenses with zero financial commitment.

Looking ahead

This is just the beginning for Intuit Intelligence in QuickBooks. A number of new product innovations are coming soon:

Streamlined services setup—on a rolling basis starting this month, your clients can get faster access to QuickBooks Payments, QuickBooks Bill Pay, and QuickBooks Payroll by submitting one application for all 3 services.

Get onboarded and set up seamlessly with smart conversational AI and human experts to simplify migration and help your clients get started quickly and confidently.

Gather tailored ideas with conversational AI brainstorming and Intuit Intelligence that provides insights in context of a business’s size, industry, seasonality, and historical data.

Explore possibilities with conversational AI analytics to inform predictive forecasting, simulate future outcomes, test scenarios, and see how today’s decisions impact tomorrow’s results.

Help clients stay tax-ready all year with Business Tax AI that suggests ways to optimize taxes, answers tax-related questions, provides real-time tax estimates, and streamlines year-end filing to save time.

Important product and disclaimer information

Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For more information about Intuit Payments' money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/.

This information is intended to outline our general product direction, but represents no obligation and should not be relied on in making a purchasing decision.

Intuit (Sponsor ID# 103311) is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website: www.nasbaregistry.org.

Intuit Connect ON

In a nutshell: The next virtual Intuit Connect ON quarterly event is coming up this month, and you can register for free.

Intuit Connect ON is our always-on platform where accounting professionals can learn and grow year-round, through events, content, and innovation updates.

Join us Tuesday, February 24, from 9–11 AM PT for our next quarterly virtual event where you can learn from industry leaders and earn a CPE credit.**

Table of contents

Table of contents

Recommended for you

Get the latest to your inbox

Get the latest product updates and certification news to help you grow your practice.

Thanks for subscribing.

Relevant resources to help start, run, and grow your business.

Looking for something else?

In a nutshell: Get an all-in-one view of 1099 filing status for all your clients, and save time filing through QuickBooks Online Accountant.