Whether you're looking forward to cooler autumn temperatures or pumpkin-spiced drinks at your local coffee shop, September's got plenty of good stuff in store. To help you ring in this first month of fall, we've got new time-saving updates to share with you.

Share QuickBooks updates with your clients: Send them this link for QuickBooks innovations relevant to business owners and admins.

In The Know Webinar: Register today for the next In The Know Webinar on Thursday, Sept. 14 at 11:00 AM PT, a monthly webinar for accountants to learn more about the latest and greatest product feature updates.

What’s new in September

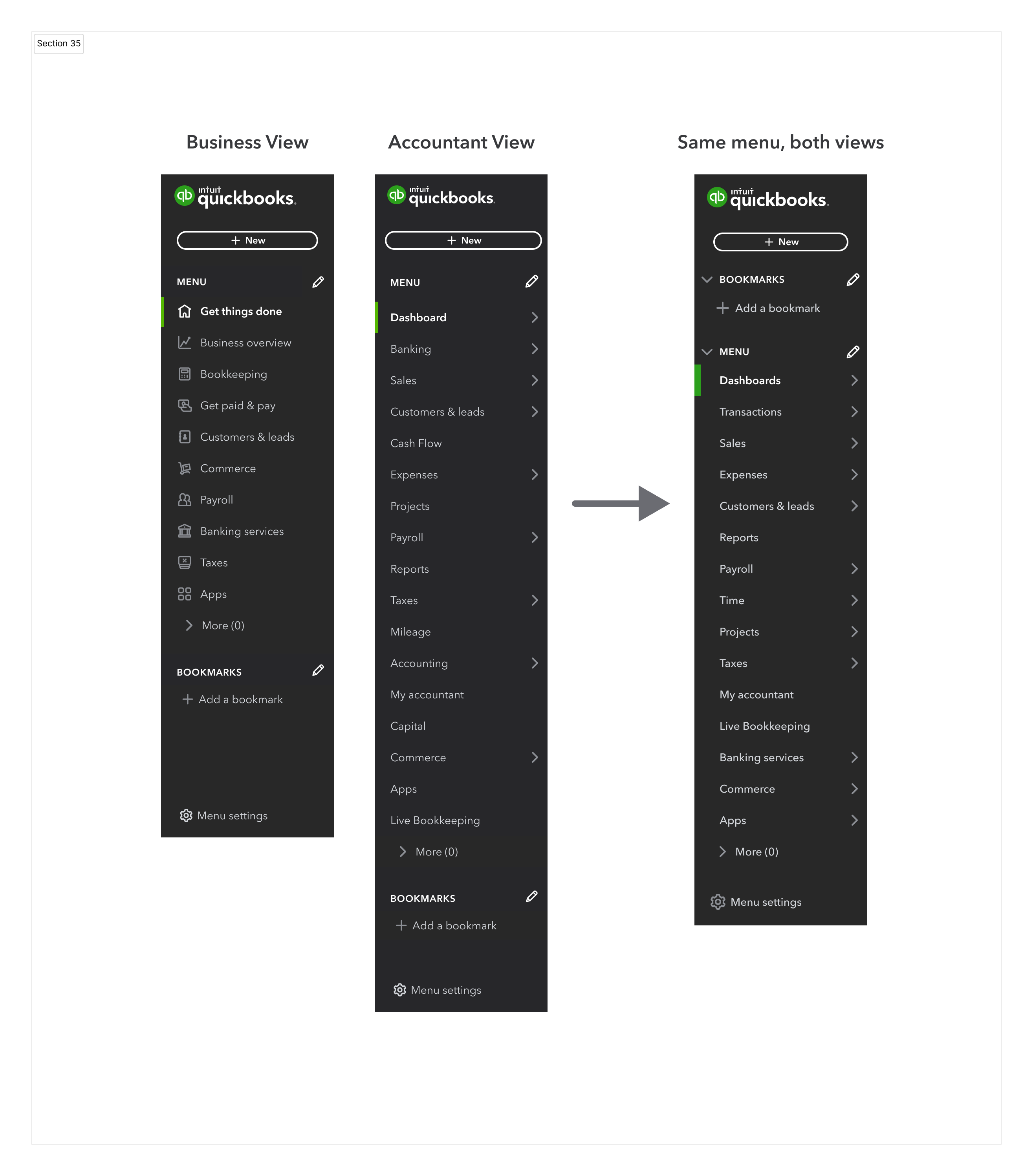

Consolidated navigation menu in QuickBooks Online

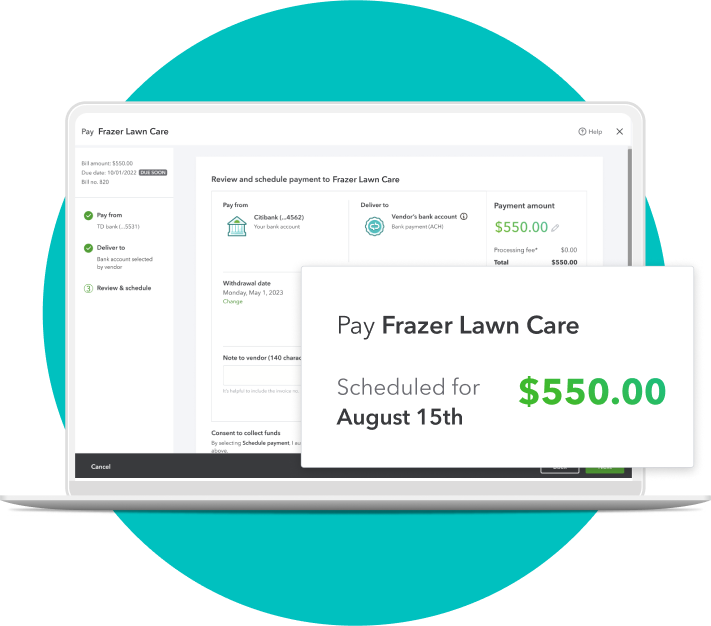

Introducing QuickBooks Bill Pay

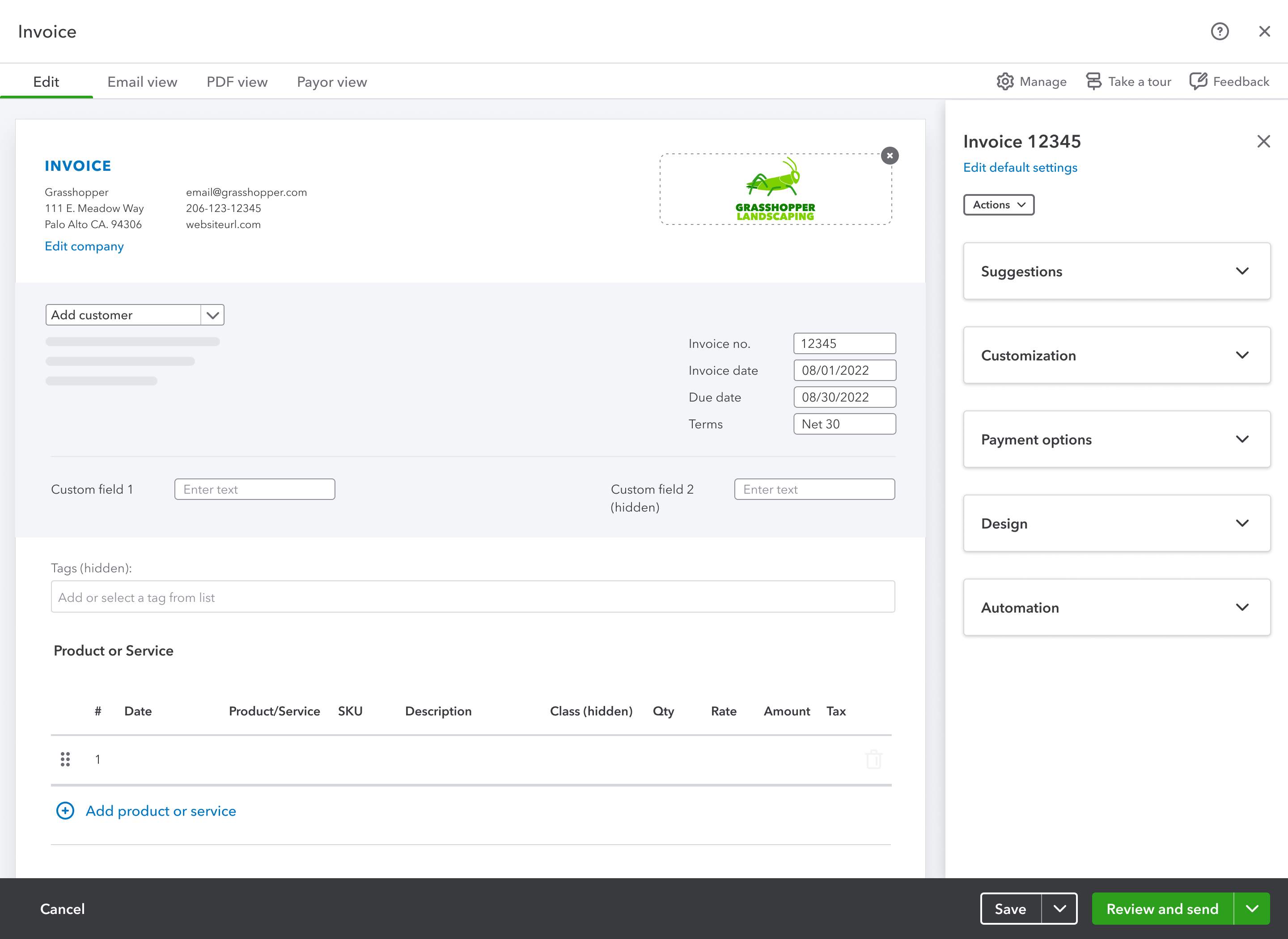

New invoicing for QuickBooks Online officially becomes standard

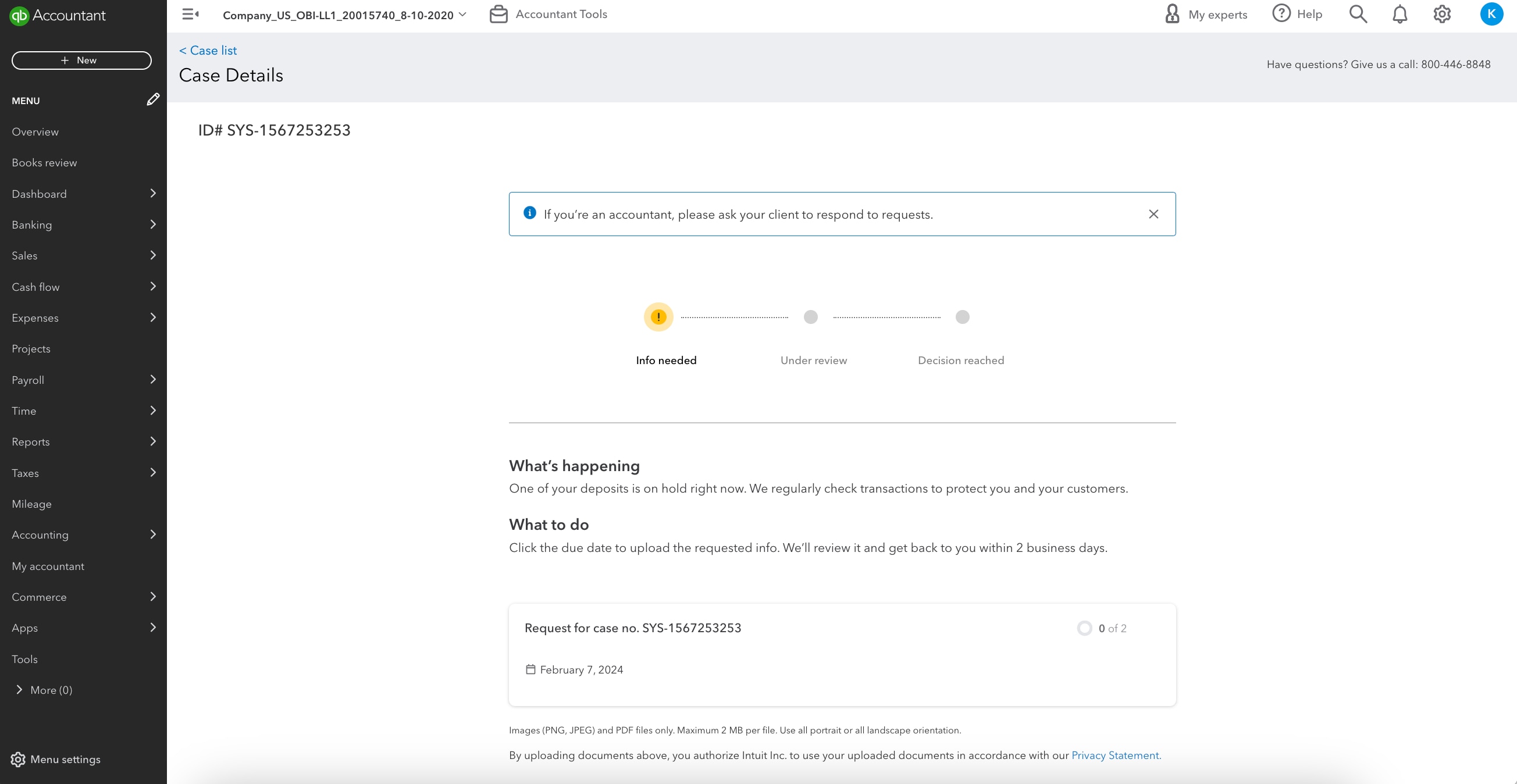

Access to Payments exception cases at the QuickBooks Resolution Center

Increase of QuickBooks Payments ACH transaction cap to $100,000

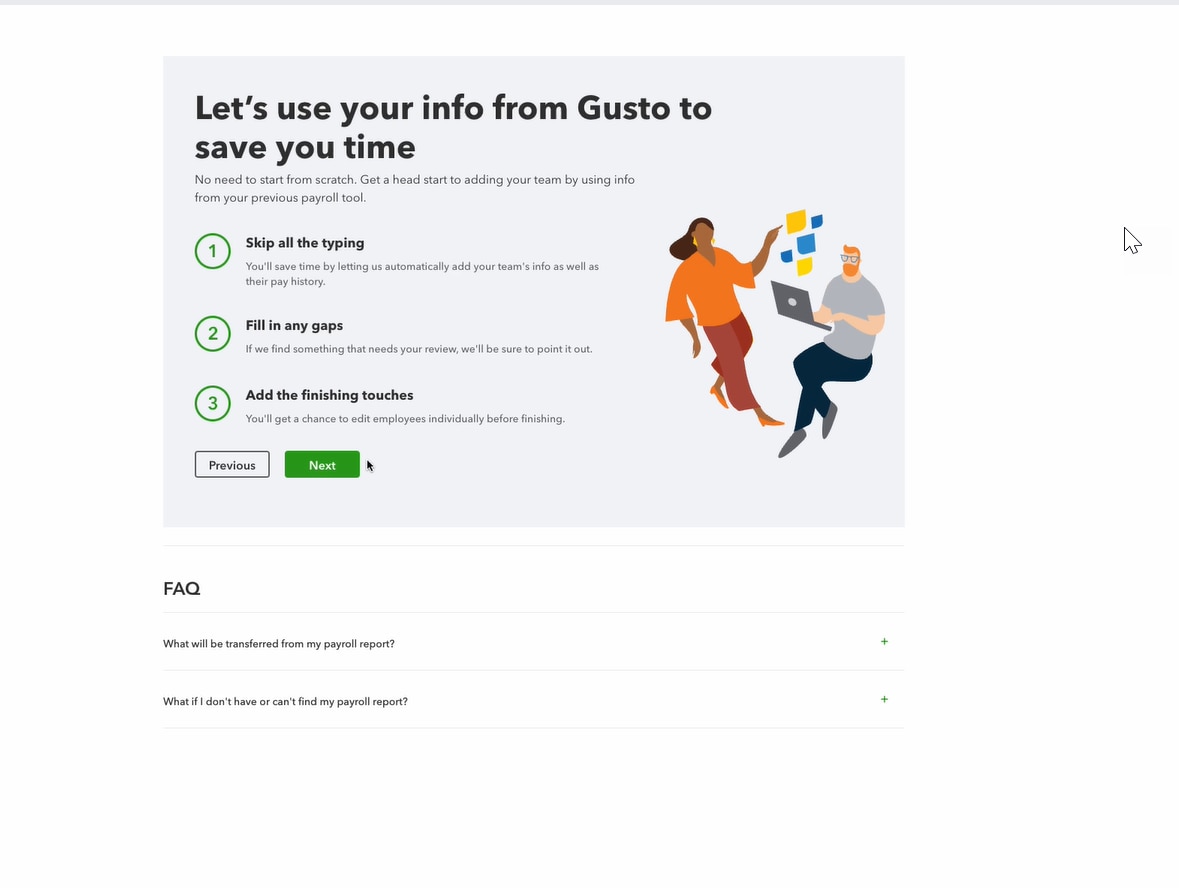

New QuickBooks Online Payroll setup automation

Checking, Payments, and Web enhancements to QuickBooks Money