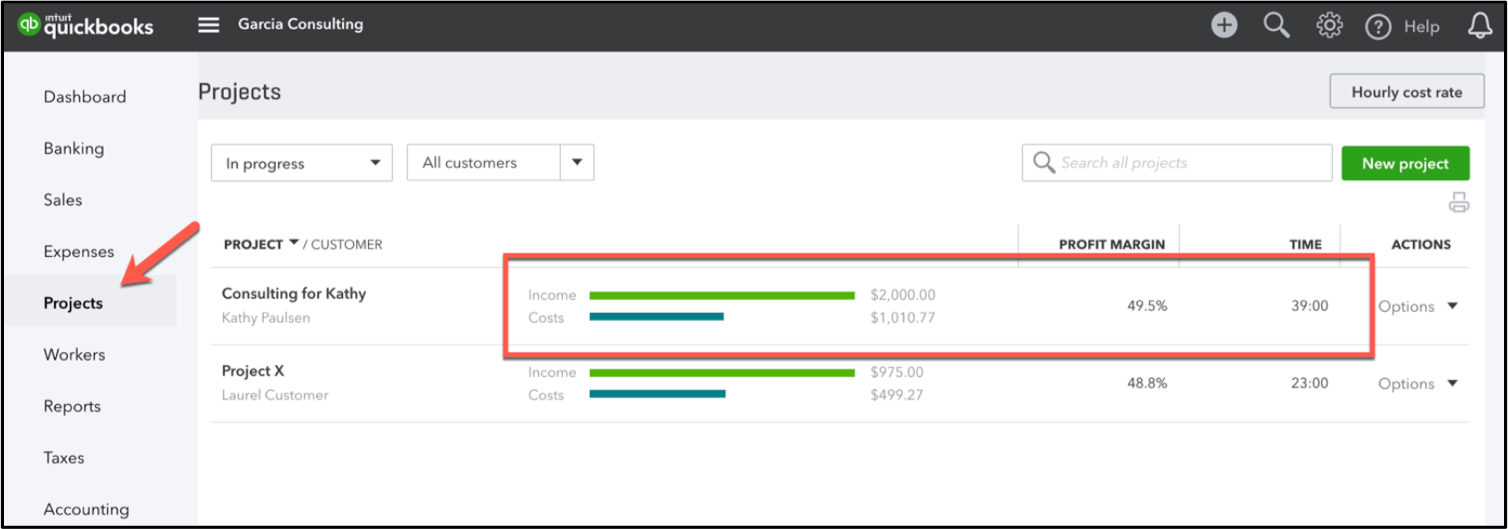

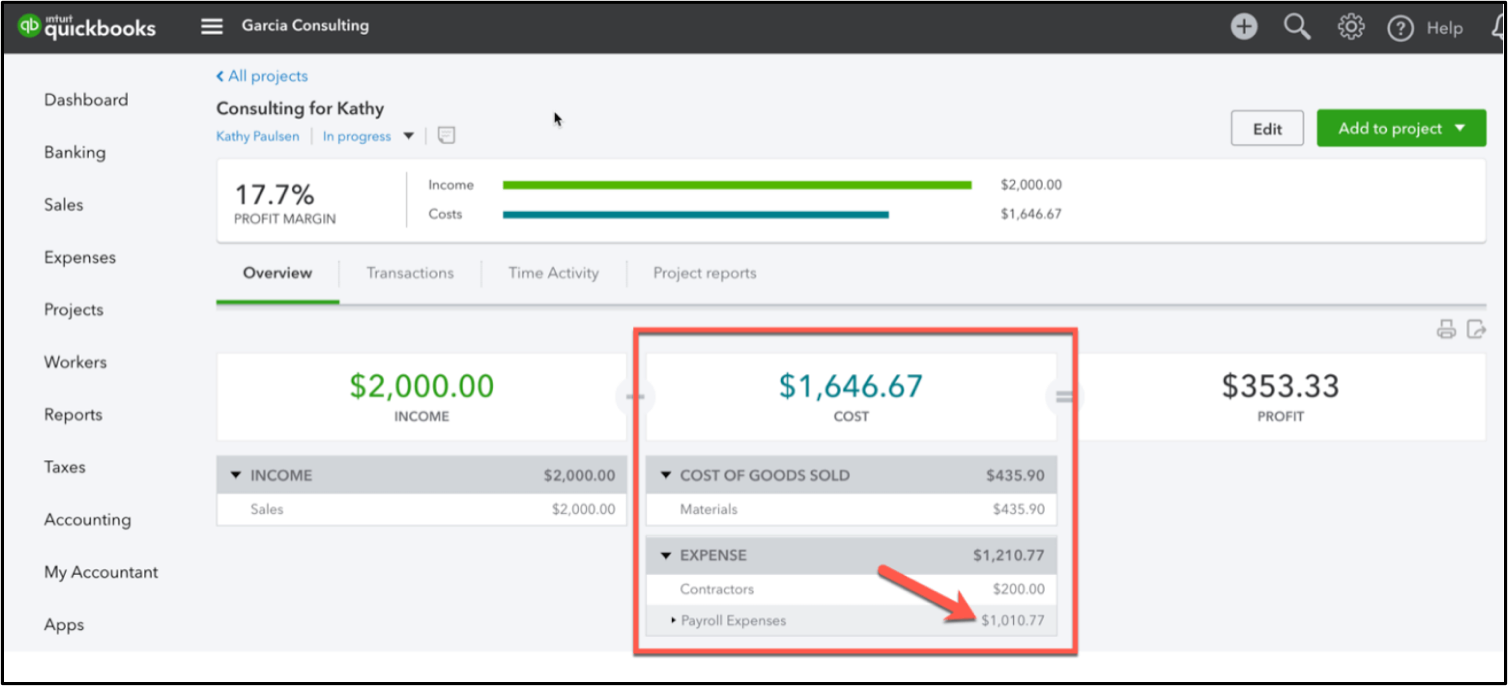

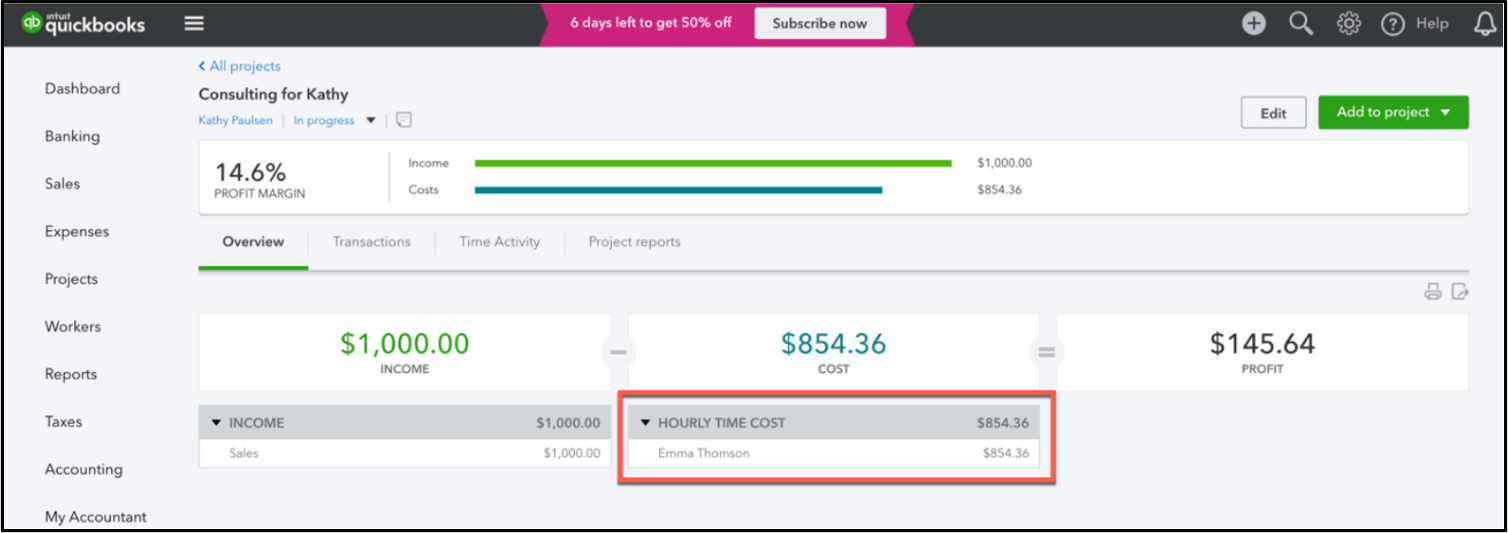

Many clients struggle to know if they are making money on their projects at any given moment; they want to make sure they are charging the right amount and determine whether a project is profitable.

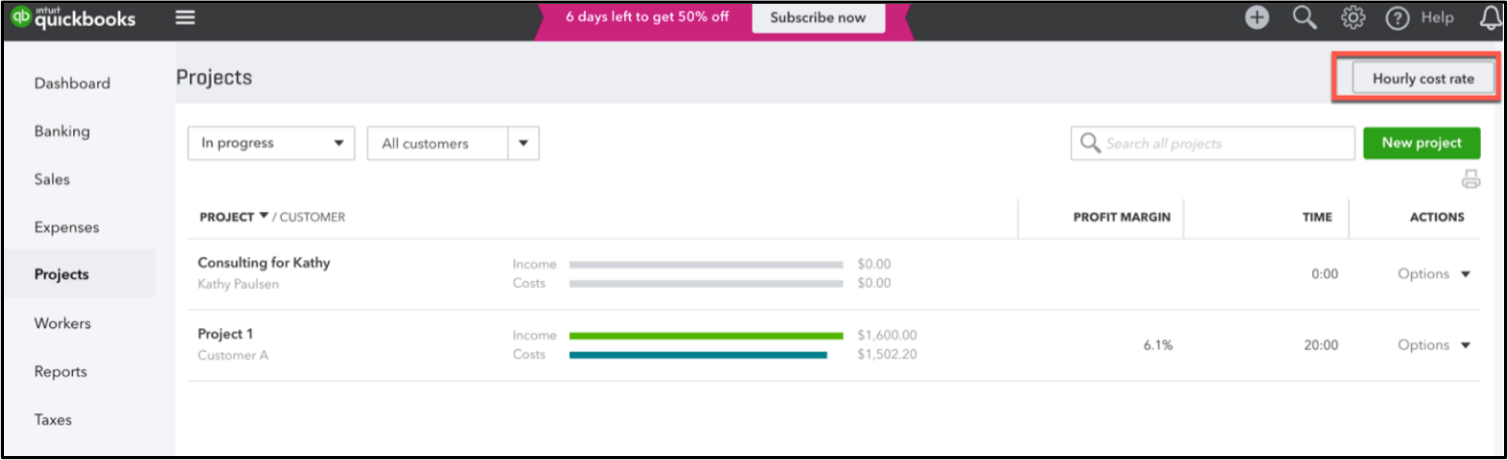

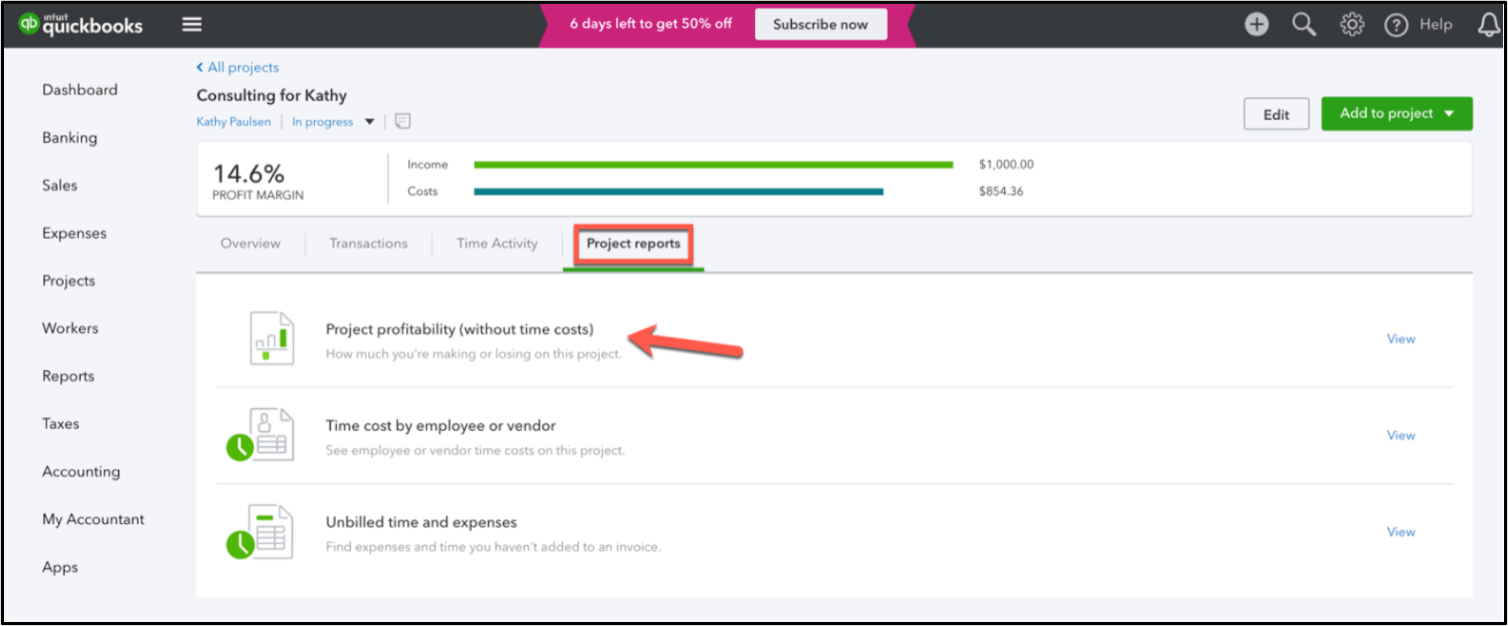

QuickBooks® Online Plus added the projects feature last year to organize all the transactions related to a project in one place. Projects can be created under a customer or a sub-customer, and allows a user to assign any expense transactions to that project; it is often referred to as “job costing.”

Hector will present “QuickBooks Online Labor Job Costing for Projects” on April 18, 2019, at 1 pm ET. Register Today!

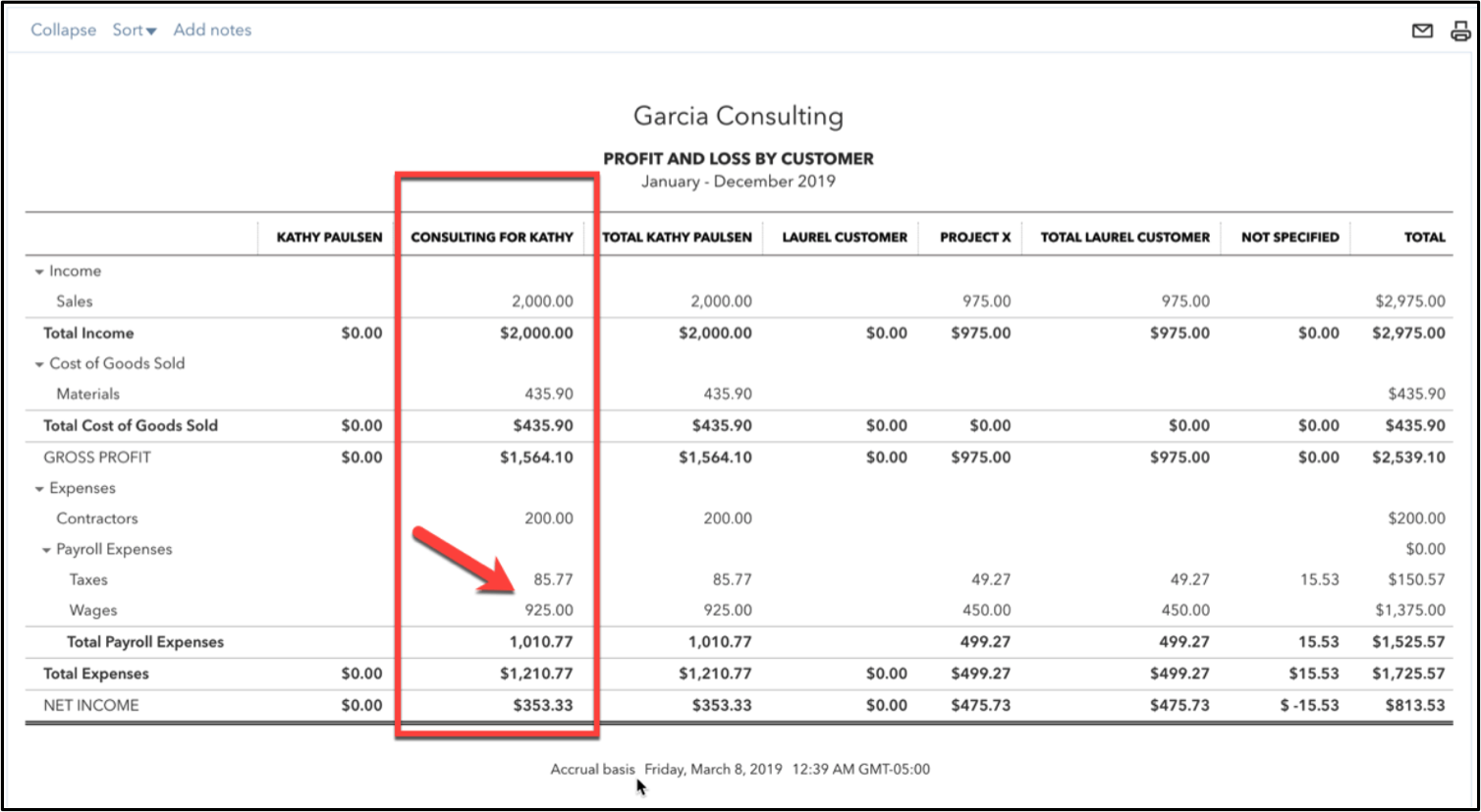

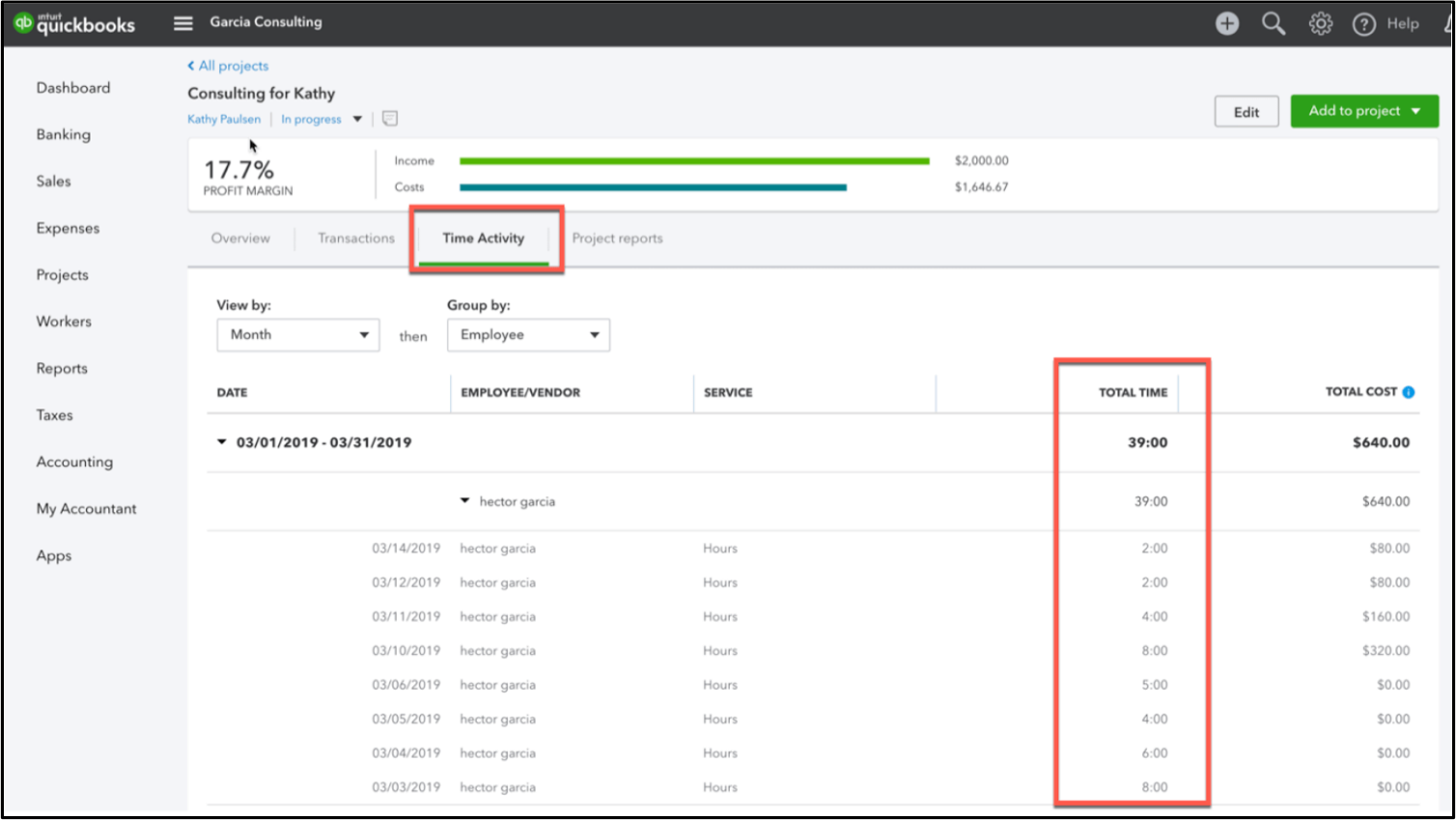

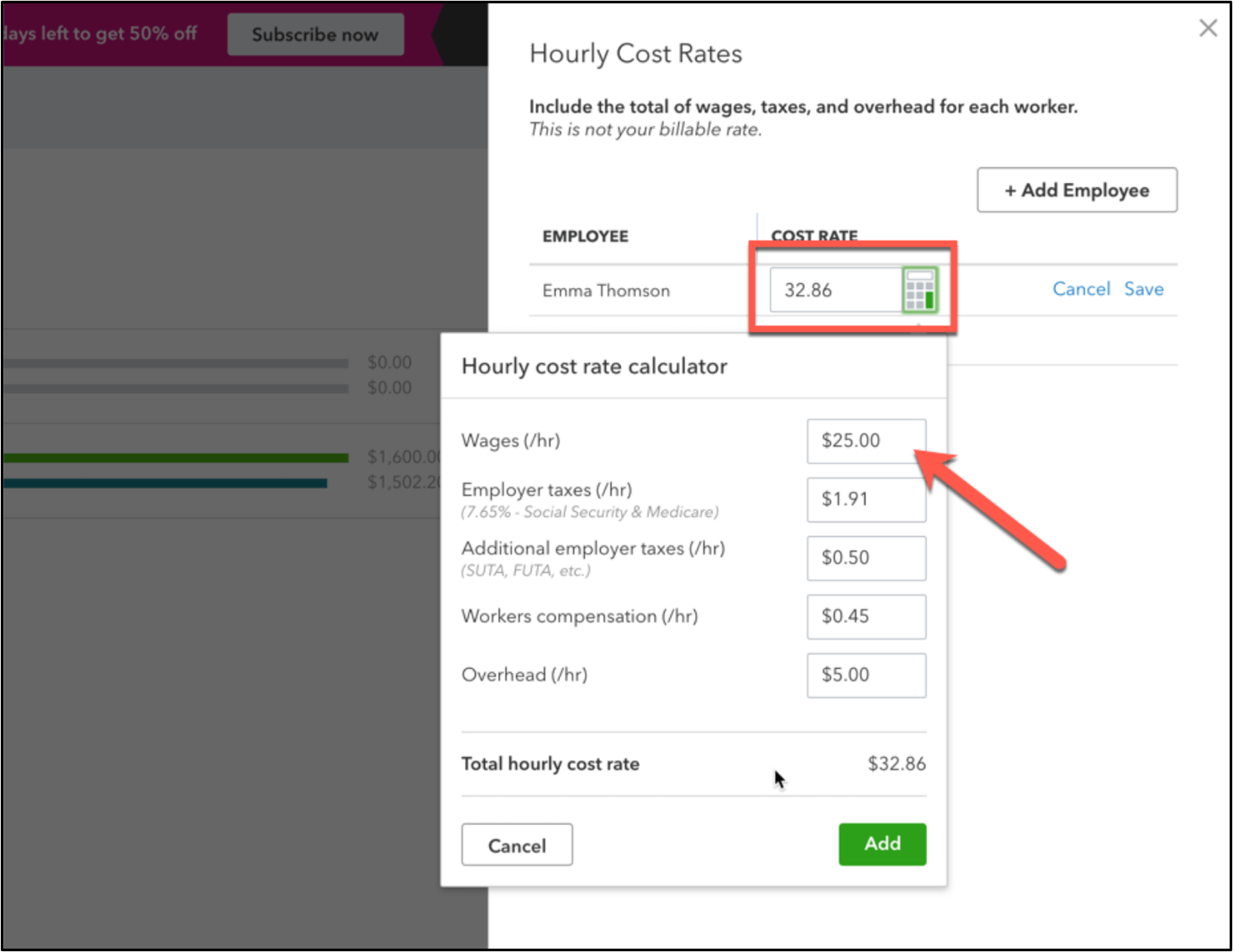

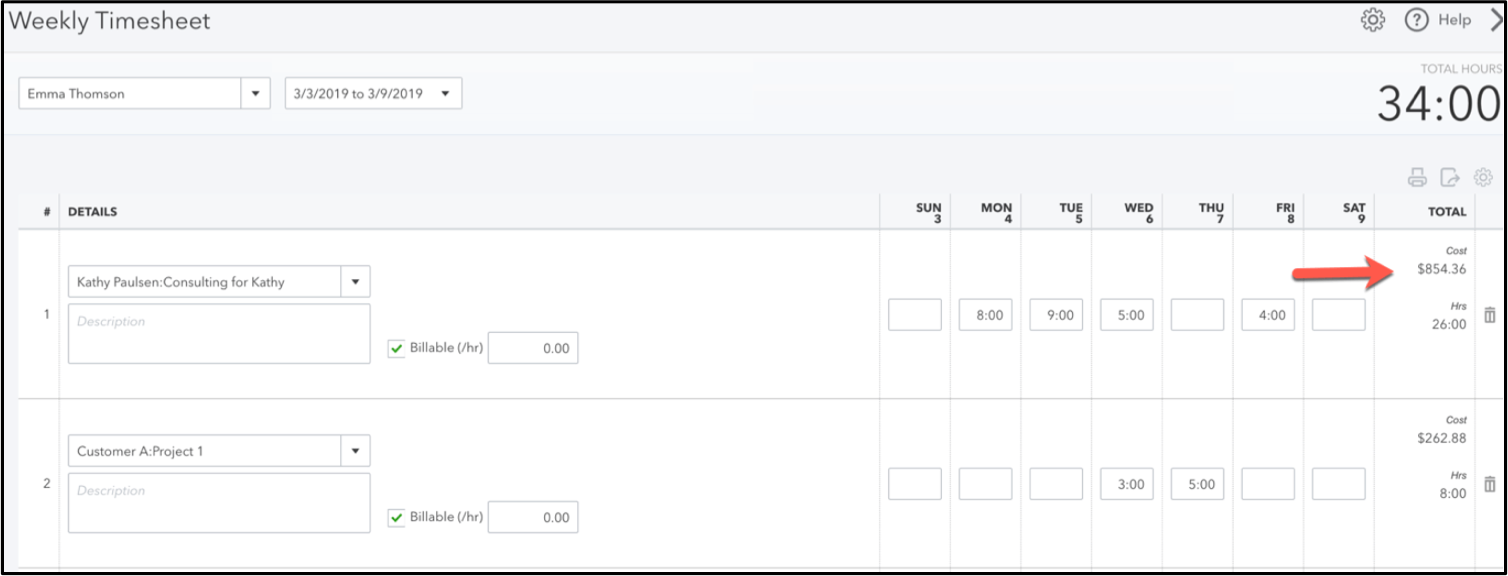

Before this latest release, you could do job costing for all transactions except payroll. Now, QuickBooks Online Plus and Advanced will calculate project profitability, including payroll costs. There are two modes to this new feature.

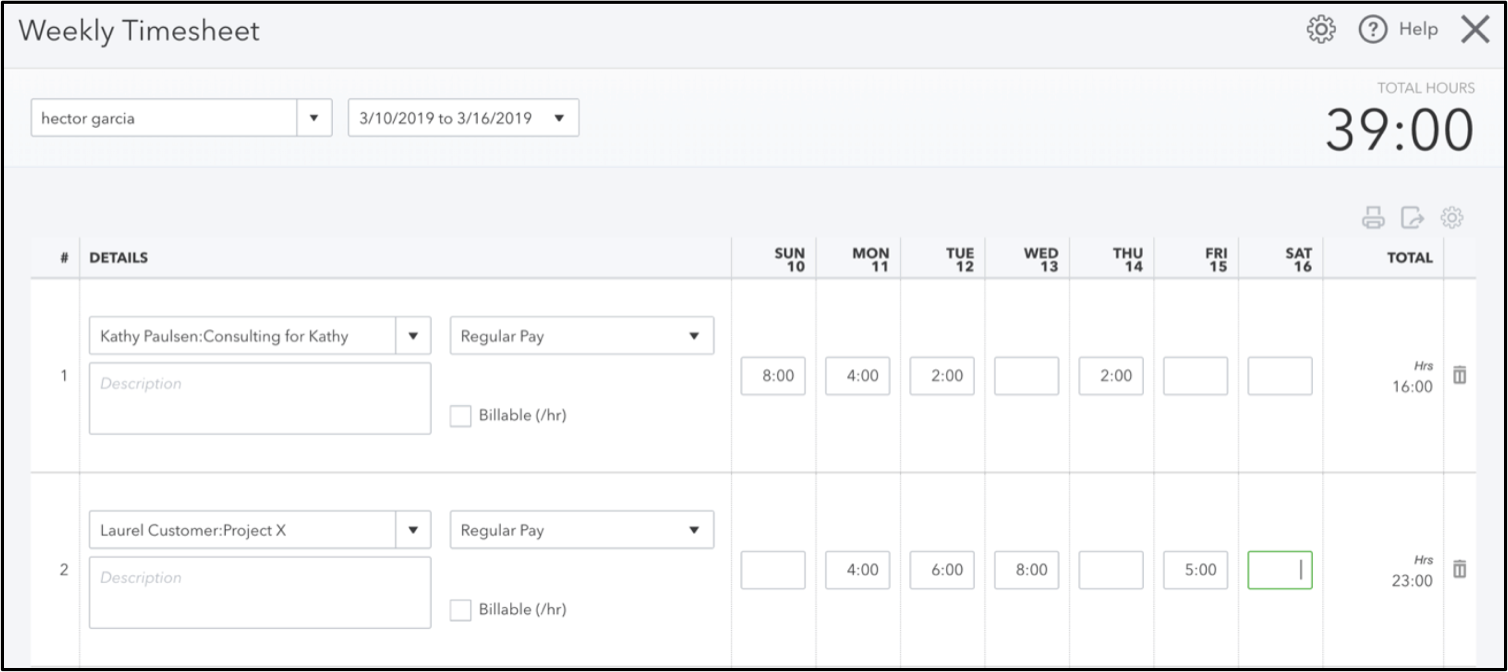

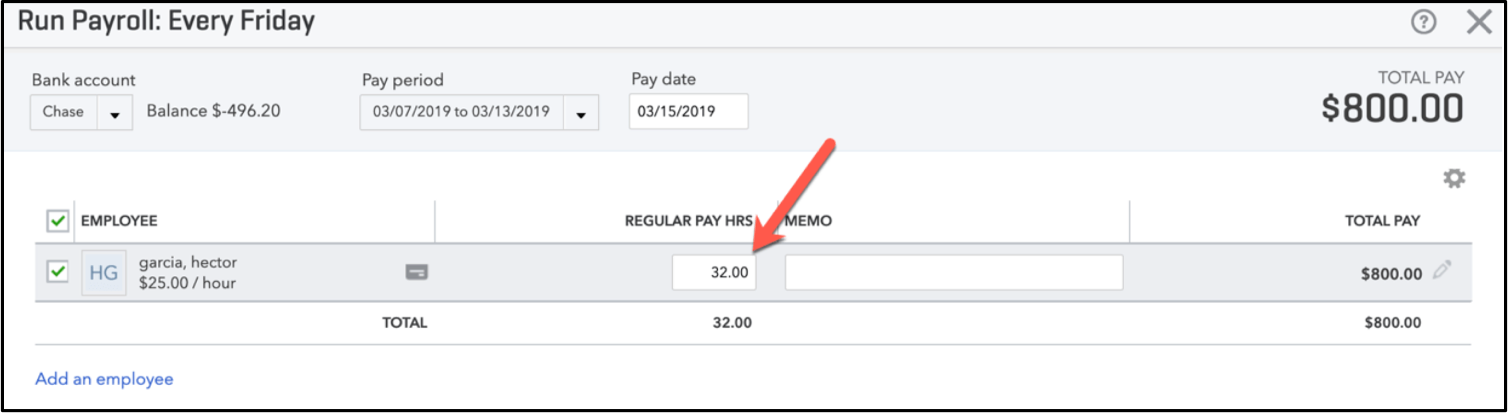

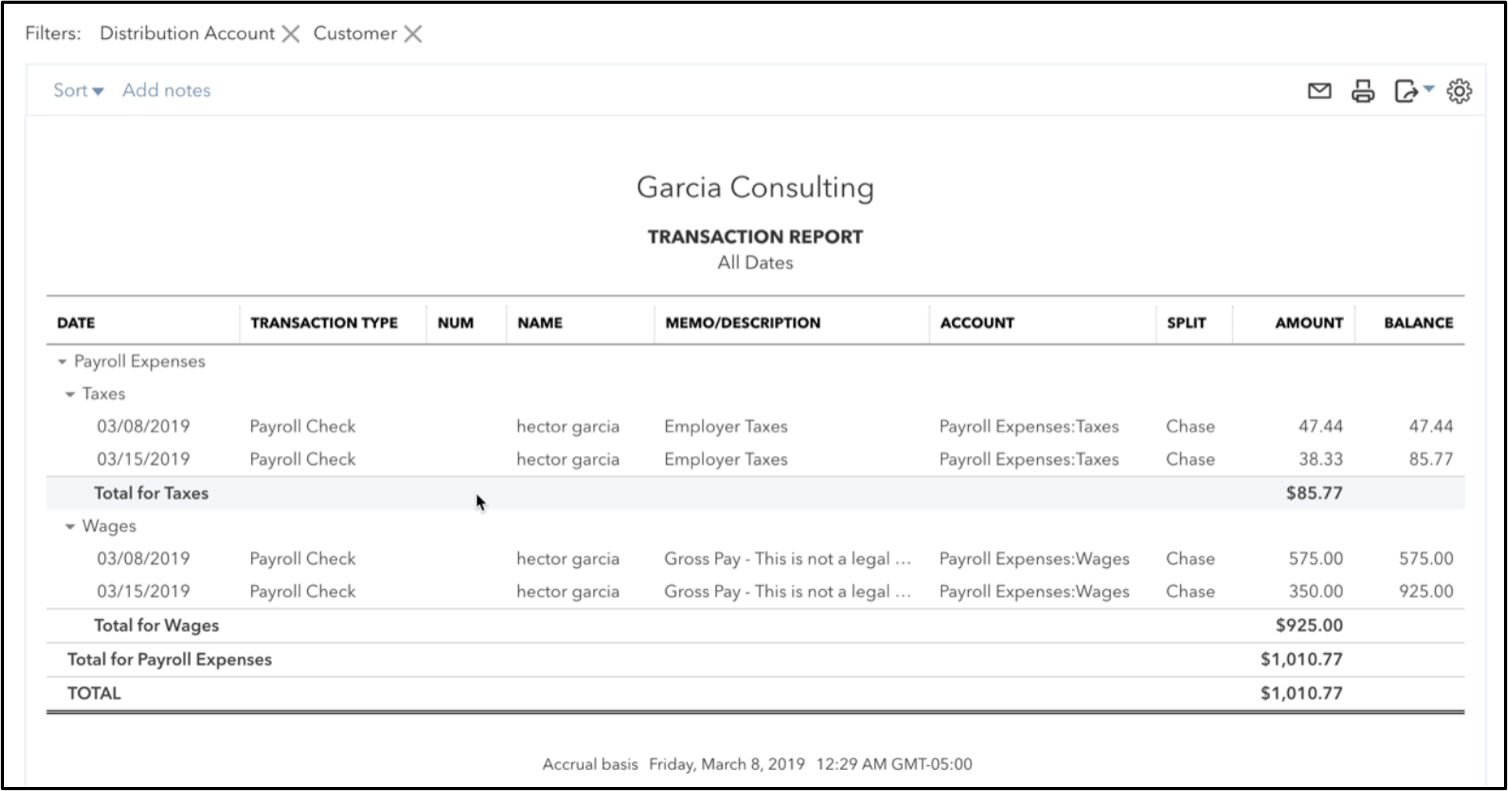

First mode: When QuickBooks Payroll is enabled, both the wages and employer taxes will be allocated to the projects that were used in the timesheets.