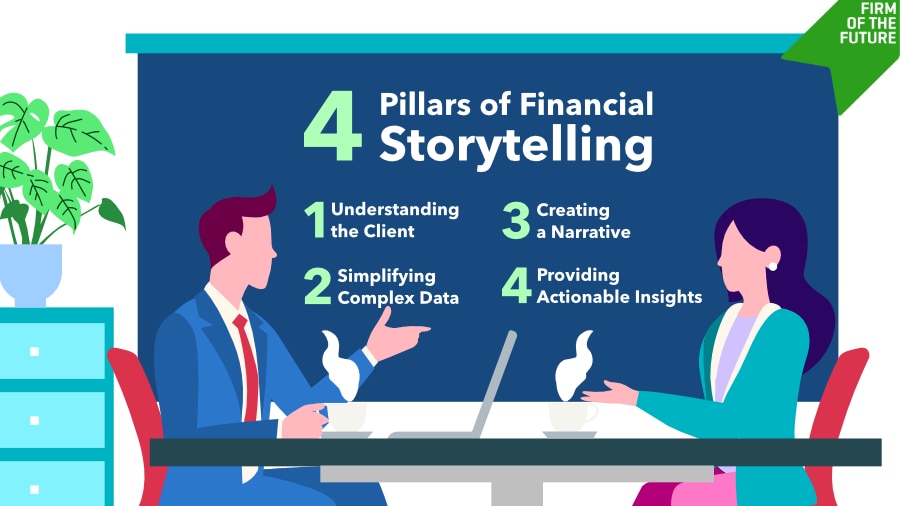

In today's fast-paced financial world, the role of a financial advisor is not just about crunching numbers or analyzing balance sheets. It's about telling a story—a financial story that resonates with clients and helps them make informed decisions. This is the essence of "financial storytelling."

The evolution of advisory services

Financial advisors and accountants have traditionally provided insights based on data. However, with the rise of technology and the increasing complexity of financial markets, there's a need for a more holistic approach. This is where financial storytelling comes into play. It's not just about presenting numbers; it's about weaving those numbers into a narrative that makes sense to the client.