With the ever-evolving push in accounting firms to increase efficiency and scalability, automation has come front and center. As with most innovative technology, there is always the initial excitement around going all-in on experimentation to dive head first into a new tool or software. While we’ve all spent countless hours in this exploratory phase, don’t lose sight of why you are bringing something new into your firm.

After years of going through this cycle, it’s critically important to have a clear “why” in your experimentation process. There may be multiple reasons why you are looking to leverage automation in your firm. Maybe you want to streamline the accounting close processes or get better data on how your team spends its time. Maybe you just enjoy experimenting with new technology. There is no right answer across the board, and whatever your motivation, the most crucial step to success is to have that open conversation with yourself and your team.

If your “why” is for your own personal enjoyment in exploring new technologies, this conversation changes quite a bit. But for those who are exploring automation to scale or transform your business, I have one piece of advice: Do not build a single automation before you process map your firm.

This surely sounds a bit less exciting than the allure of jumping straight into building an automation. However, I can nearly guarantee your automation success rate will be 10x greater than if it were built without any process mapping beforehand.

What is process mapping?

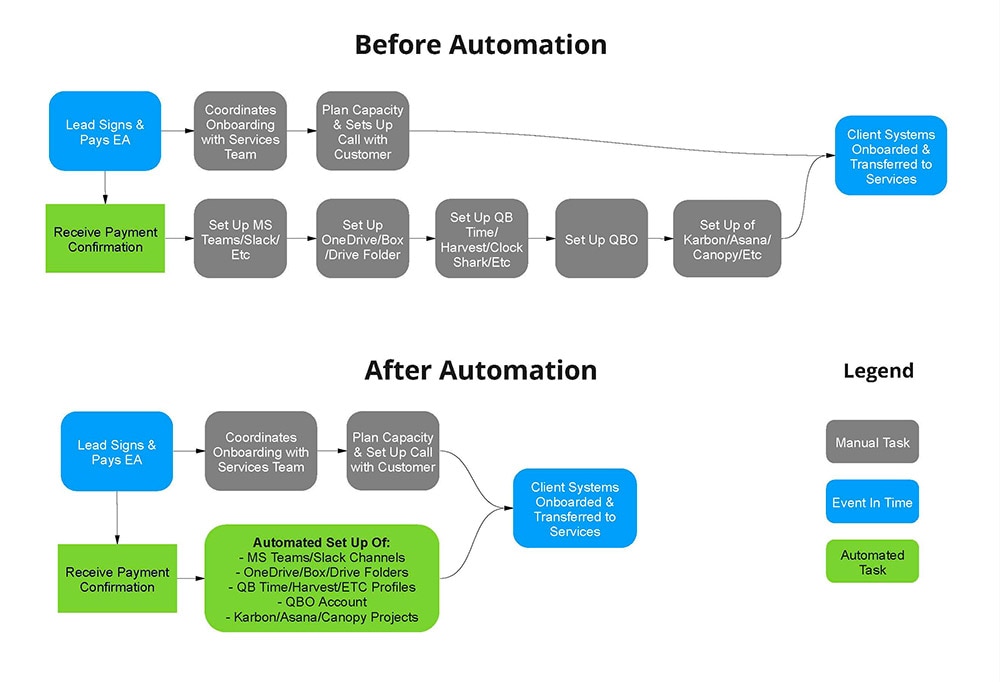

Process mapping is the exercise in which you, your team, and/or an outside party document the exact process you are looking to automate—usually in a visual format. It outlines in order the specific steps of the process, including which people, apps, or documents are used. Here’s an example of what we use at GrowthLab.