Financial fraud is a growing global crisis, with losses in the US alone reaching $12.5 billion in 2024, according to FTC data. Globally, fraud scams and bank fraud schemes contributed to an estimated $485.6 billion in losses in 2023, as reported in Nasdaq's 2024 Global Financial Crime Report. Nearly one-third of financial institutions reported direct fraud losses over $1 million in 2024. These figures are more than just numbers—they highlight an escalating threat to organizations worldwide.

As fraud tactics become increasingly sophisticated, AI fraud detection has become a necessity for modern financial security. For client advisory firms, this technology is no longer a nice-to-have—it’s a critical tool to protect client assets and stay ahead of evolving threats.

In this guide, we explore how AI-powered fraud detection is transforming client advisory services, providing actionable insights that can help your firm safeguard client portfolios, enhance fraud risk prevention, and stay ahead of emerging risks.

Understanding AI fraud detection

Artificial intelligence (AI) in fraud detection uses machine learning to analyze financial data, identifying suspicious patterns more quickly and accurately than traditional, rules-based systems. For client advisory firms, these tools offer a scalable, adaptive defense against increasingly sophisticated threats.

Unlike static systems, AI models evolve continuously—learning from legitimate and fraudulent activity to stay ahead of emerging tactics. This adaptability is especially valuable for firms managing high-volume, complex portfolios where anomalies can be difficult to detect manually. By assessing risk across multiple dimensions in real time, AI not only reduces operational exposure, but also helps preserve client trust.

Legacy detection methods—manual reviews, static rules, and post-incident response—are no longer sufficient. AI has transformed fraud prevention from reactive to proactive, and can now be used to:

- Surface hidden patterns across accounts and systems.

- Learn from new types of fraud without manual intervention.

- Monitor all transactions continuously and contextually.

For growing advisory firms, using AI for fraud detection isn't just a technological upgrade—it’s a strategic imperative in a threat landscape that evolves by the day.

How AI is transforming fraud detection

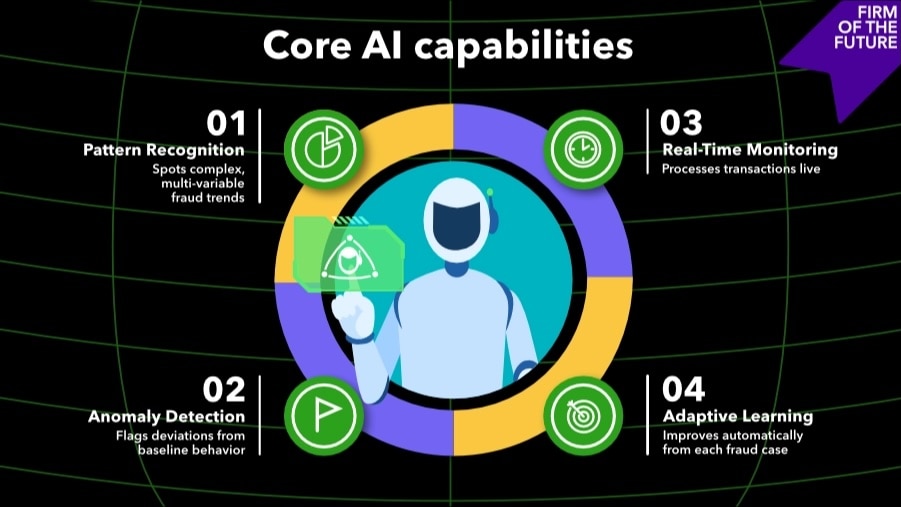

AI fraud detection relies on a set of core capabilities that work together to identify threats faster, more accurately, and at scale. For client advisory firms, these tools offer a smarter way to manage fraud risk across complex portfolios and high-volume transactions:

Pattern recognition

Unlike traditional systems, AI identifies complex fraud patterns by analyzing multiple variables simultaneously. They evaluate transaction histories, user behaviors, and contextual information to spot subtle correlations that would be invisible to human analysts.

Anomaly detection

AI systems build a baseline of expected behavior for each client and account, then flag deviations that may indicate fraudulent activity. By continuously learning from new data, they distinguish between true risk and legitimate outliers, minimizing false positives without missing critical threats.

Real-time analysis

AI models process transaction data as it happens, enabling immediate detection of suspicious activity. This allows your firm to respond in the moment, reducing exposure and protecting clients before fraud can escalate.

Adaptive learning

These systems improve over time by learning from attempted and confirmed fraud cases. As fraud tactics evolve, AI adapts without manual rule updates, making your firm’s defenses more resilient with every transaction it processes.

Key components and technologies behind AI fraud detection

AI fraud detection systems rely on a tech stack built for speed, scale, and adaptability. At the foundation is a unified data architecture that integrates real-time financial, behavioral, and contextual data across all client channels. This holistic visibility enables machine learning models to detect known fraud patterns (via supervised learning) and emerging threats (via unsupervised learning).

A real-time analytics engine processes transactions in milliseconds, stopping fraud as it happens. Paired with intelligent alerting and prioritization, your team can stay focused on the highest-risk activity without getting bogged down by noise.

And because the system learns from every outcome—both real threats and false alarms—the accuracy improves over time, reducing the need for manual tuning. Still, like all AI systems, it benefits from having human oversight to ensure that everything is performing as intended.

Emerging technologies to watch

Several new innovations are pushing the boundaries of what AI fraud detection can do—and hold particular promise for firms managing complex, high-value financial relationships:

- Advanced neural networks: Architectures such as recurrent neural networks (RNNs) and graph neural networks (GNNs) can uncover deep, hidden relationships between entities and transactions. These tools are especially effective in detecting layered fraud schemes involving multiple actors or accounts across portfolios.

- Natural language processing (NLP): By analyzing communications such as emails, documents, and chat logs, NLP helps surface potential phishing attempts or social engineering scams that may not appear in transaction data alone. This is increasingly valuable as attackers grow more sophisticated in targeting high-net-worth clients.

- Behavioral biometrics: These systems build individual profiles based on how users interact with their devices, tracking things like typing cadence, mouse movements, and navigation behavior. Even if your credentials are stolen, deviations in behavior can signal that something’s wrong.

- Blockchain-enhanced verification: While still maturing, blockchain-based tools offer new ways to verify identity and track transactions with full transparency, which helps with preventing fraud risk and identity theft without sacrificing speed or client experience.

Benefits of AI fraud detection

AI-driven fraud detection offers client advisory firms tangible advantages in operational efficiency and client experience. These include the following:

Stronger detection accuracy

AI systems outperform traditional rules-based methods by evaluating transactions in context, not just in isolation. This leads to sharper threat identification and, in some cases, up to 40% improvement in fraud detection rates, according to data from Sift’s Digital Trust and Safety Index.

Fewer false positives

By analyzing behavioral and contextual data, AI models reduce false positives that can disrupt legitimate client activity and deliver better protection without introducing unnecessary friction. For example, Danske Bank reported a 60% reduction in false positives after integrating AI into their fraud detection processes.

Real-time prevention

Unlike reactive legacy systems, AI tools monitor activity continuously, enabling your team to stop fraudulent behavior before losses occur, critical for clients operating at high transaction volumes.

Operational efficiency

Automating fraud detection processes reduces the burden on internal teams, lowers recovery costs, and minimizes time spent on manual reviews. The US Department of the Treasury highlighted that AI-enhanced fraud detection processes recovered $375 million in fiscal year 2023, demonstrating significant operational savings.

Client confidence

Deploying cutting-edge protection signals a clear commitment to safeguarding client assets. That trust becomes a differentiator, especially among high-net-worth clients who expect both discretion and defense.

Challenges of AI fraud detection

Despite its strengths, implementing AI for fraud detection isn’t plug-and-play. Client advisory firms face several hurdles that must be strategically addressed.

1. Data quality and compliance

Effective AI requires large, clean datasets that are often difficult to source in environments governed by strict privacy regulations such as GDPR and CCPA. Compliance must be built into every stage of implementation.

2. Legacy system integration

Many advisory firms operate on infrastructure that wasn’t built for AI. Integrating real-time engines and machine learning models into legacy stacks often demands custom workarounds or platform upgrades.

3. Model explainability

AI decisions can be opaque, creating hurdles in regulated environments that demand transparency. Your team has to be prepared to explain system behavior to clients, auditors, and regulators.

4. Evolving threats

As detection tools improve, so do the tactics of fraudsters, often using AI themselves. Staying ahead requires continuous model training and ongoing collaboration with technology partners who specialize in financial threat landscapes.

Future trends and innovations in AI fraud detection

As your client advisory firm continues to navigate an increasingly complex fraud landscape, several emerging trends are poised to shape the future of AI fraud detection, including the following:

The “AI arms race”

Fraudsters are increasingly using AI tools, such as deepfakes and synthetic identities, to carry out sophisticated scams. Notably, a deepfake-enabled fraud in Hong Kong defrauded a company of $25 million by impersonating executives over a video call. In response, financial institutions are developing equally advanced AI detection systems to identify and counteract such threats in real time.

Multi-modal biometric authentication

Combining biometric indicators such as facial recognition, voice patterns, and behavioral analytics strengthens security while maintaining user convenience. These multi-modal approaches are increasingly used by financial institutions to deliver seamless yet secure authentication experiences.

Consortium data intelligence

Collaborative data sharing between financial institutions boosts the speed and accuracy of fraud detection. For example, the UK launched UK launched data-sharing agreements between banks and tech companies to combat fraud. In the US, organizations such as FS-ISAC enable financial institutions to share real-time cyber threat intelligence, helping firms collectively detect fraud and respond to emerging risks.

AI in fraud detection: The path forward

AI-powered fraud detection is no longer a futuristic concept. It’s a strategic imperative. For client advisory firms, it offers the ability to detect threats earlier, respond faster, and build lasting client trust in an era of increasingly complex financial risks.

Of course, implementation requires careful planning: navigating data privacy, integrating with legacy systems, and aligning internal teams. Firms that get this right won’t just be reacting to fraud—they’ll be positioned to lead with a proactive, tech-forward approach to client protection.

To ensure that your firm is ready to make the most of AI in fraud detection, now is the time to:

- Invest in intelligent infrastructure that supports scalable, explainable AI systems.

- Form strategic partnerships with trusted technology providers.

- Upskill teams to keep pace with rapidly evolving threats.

- Communicate clearly with clients about how you’re leveraging technology and AI to protect them.

Firms that take these steps today won’t just mitigate risk—they’ll turn fraud protection into a competitive edge and a cornerstone of future-ready advisory services.

Recommended for you

Get the latest to your inbox

Get the latest product updates and certification news to help you grow your practice.

Thanks for subscribing.

Relevant resources to help start, run, and grow your business.