Frequently asked questions

ProAdvisor Preferred Pricing

Why are you making these discount changes now?

Retiring the wholesale discount program is necessary in order to deliver the product and support you and your clients need today and in the future. We’ve recently released innovations, like performance center with industry benchmarking, month-end review, payroll insights, advisory training, and more. To help you better manage your firm’s own financials, we upgraded Your Books, giving you access to QuickBooks Online Advanced and QuickBooks Online Payroll Elite with QuickBooks Time, for free.

We’ve also heard how important it is for you to have quality support when you need it. We are actively increasing the number of experts on our accountant support team, improving our caller recognition, and expanding expert knowledge across payments and payroll to help you get quick and reliable answers. These changes will enable additional improvements to how we support you.

What are the advantages of the new ProAdvisor Preferred Pricing program?

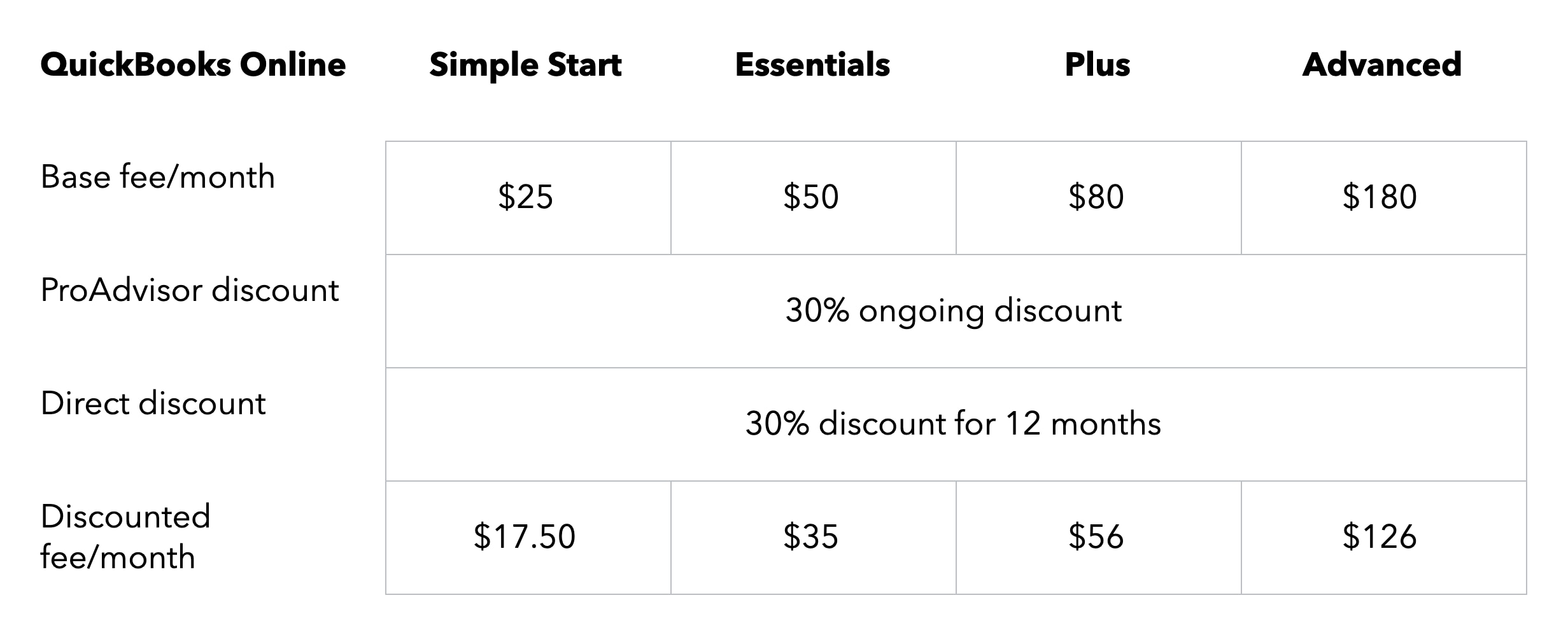

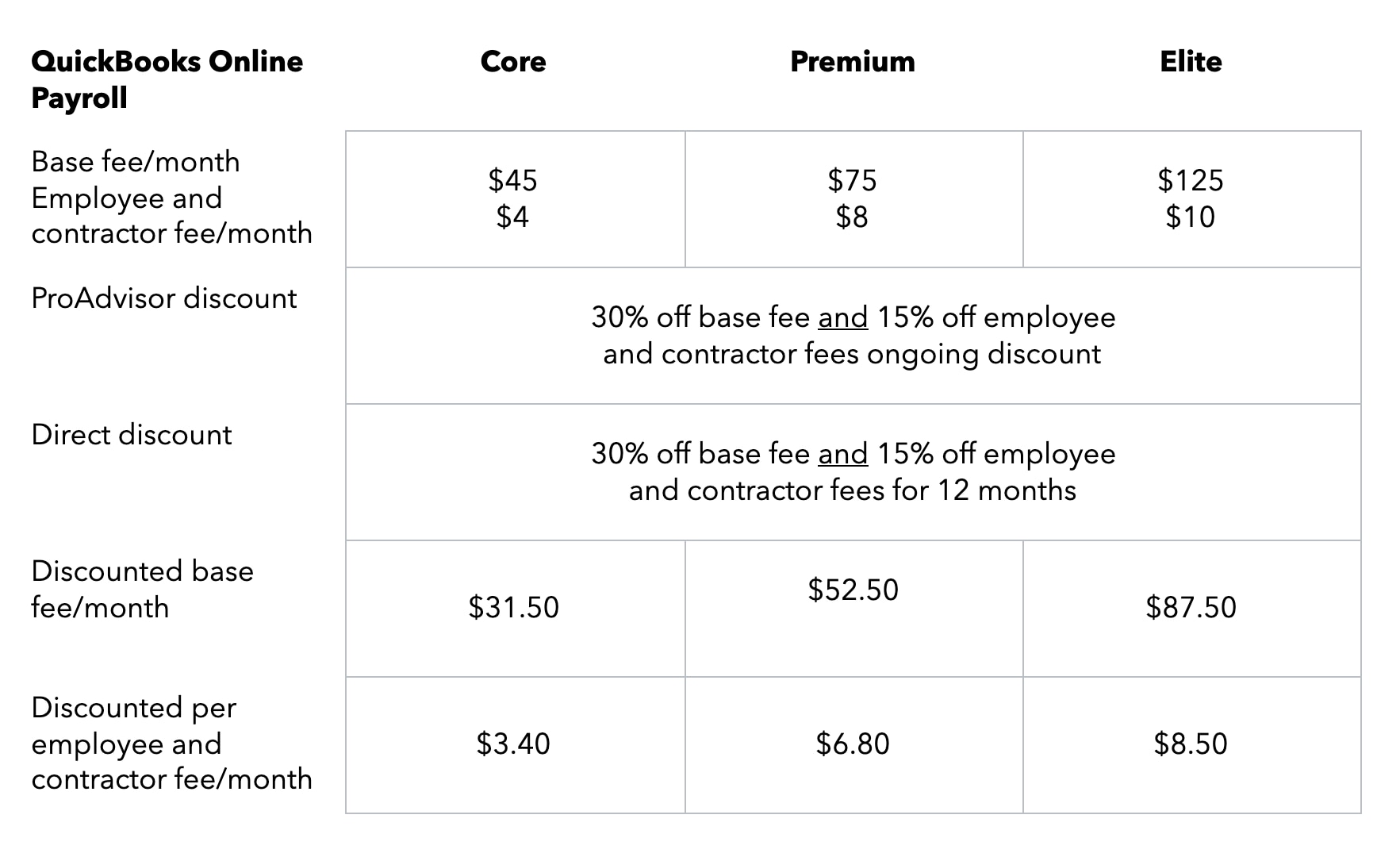

With the ProAdvisor discount, you receive our best long-term savings option for clients new to QuickBooks, including our only ongoing discount. To maintain flexibility, the ProAdvisor Preferred Pricing program has two options for monthly billing.

- For the clients you pay for, enjoy savings month after month with the ongoing discount. You are billed monthly for all subscriptions and can decide how you pass on the cost to your clients. You also have access to monthly itemized bills displaying all of your firm-billed clients for easy tracking.

- For clients who prefer to pay for their subscriptions, you can pass through a direct discount for the first 12 months of their subscription, after which they will pay the full then-current list price.

When does the new ProAdvisor Preferred Pricing program go into effect?

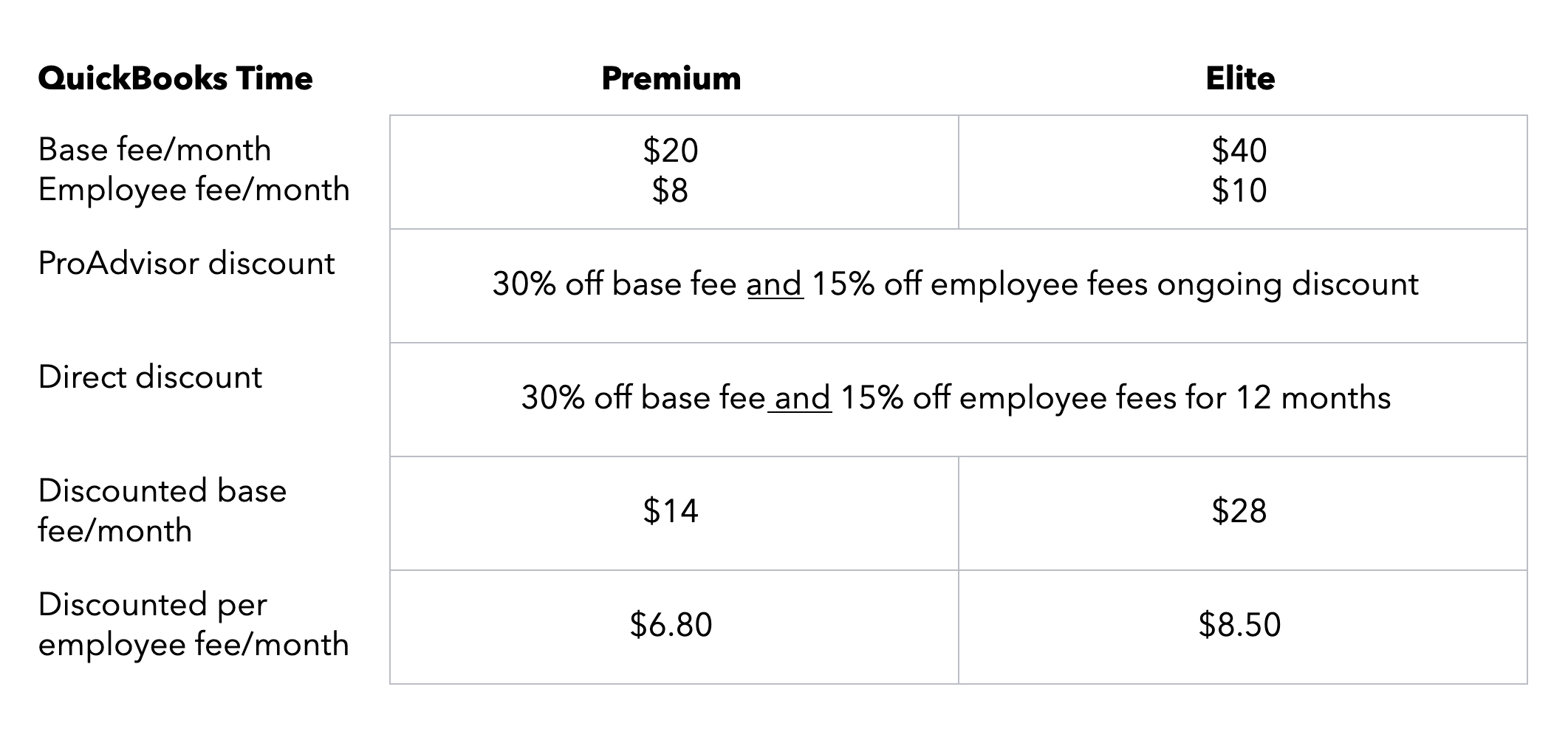

ProAdvisor Preferred Pricing launches on July 15, 2021 for new QuickBooks Online, QuickBooks Online Payroll and QuickBooks Time subscriptions. ProAdvisor Preferred Pricing discounts also apply to any subscriptions added, upgraded, or downgraded after this date.

Who is eligible for the ProAdvisor Preferred Pricing program?

The ProAdvisor Preferred Pricing program is available for any accounting professional who signs up for QuickBooks Online Accountant and initiates new client subscriptions in the Add client tab.

Can I offer ProAdvisor Preferred Pricing to clients with an existing QuickBooks Online subscription?

The ProAdvisor Preferred Pricing program is available for new QuickBooks Online, QuickBook Online Payroll and QuickBooks Time subscriptions only. If a QuickBooks Online Accountant account assumes the billing for an existing subscription, they are charged the then-current list price without additional discounts.

There are some exceptions which you can learn more about here.

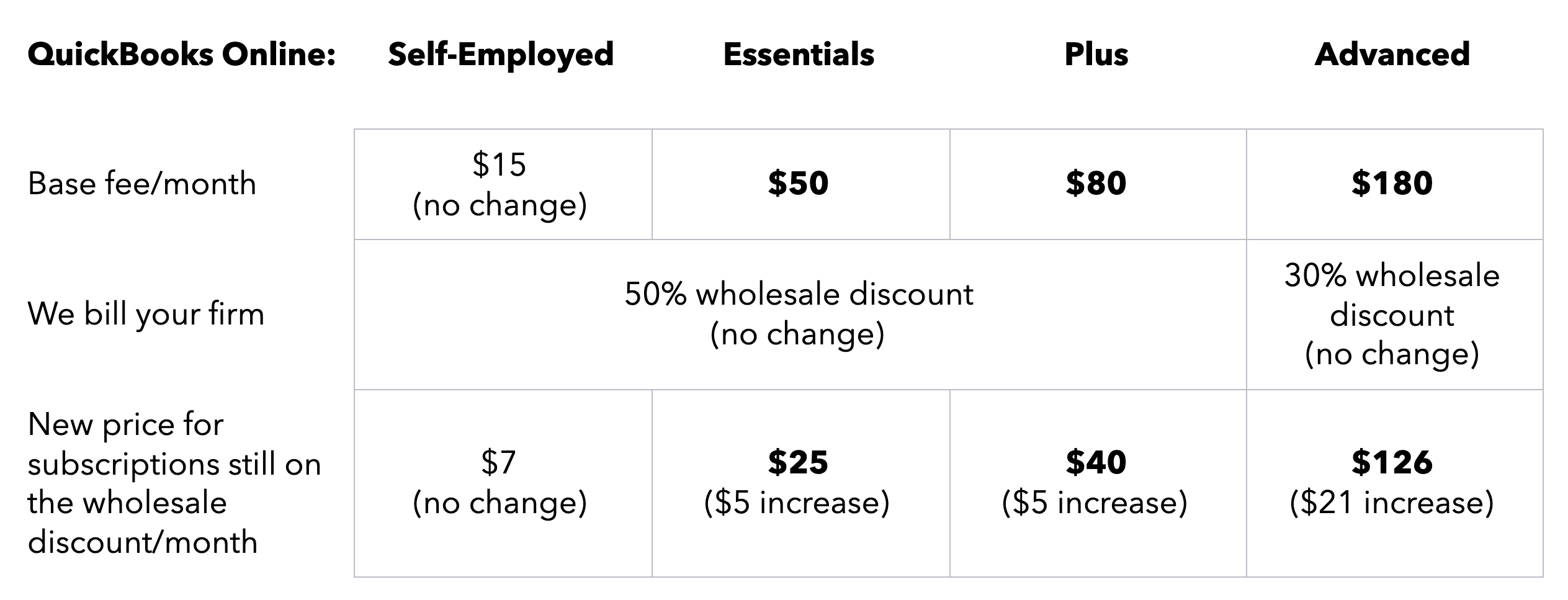

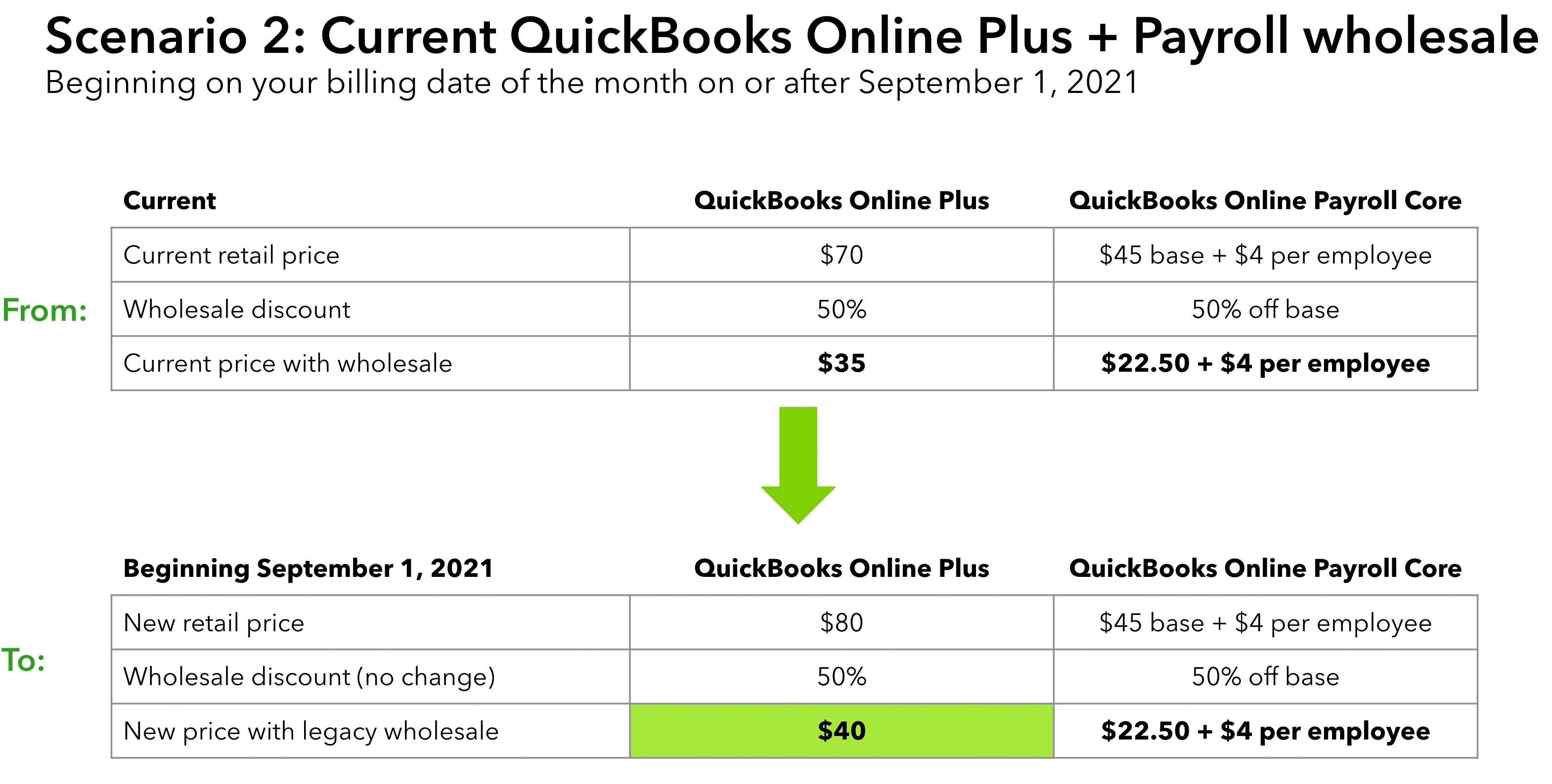

What is happening to the 50% discount for my clients currently on wholesale discount?

All customers on wholesale discount prior to July 15, 2021 will retain the 50% lifetime discount. However, if the subscription is upgraded or downgraded, the ProAdvisor Preferred Pricing program discounts will apply.

In what regions will the ProAdvisor Preferred Pricing program be available?

This new program will be available to US customers. Offer and pricing programs vary by country. Please refer to the specific country pages for the region you are interested in for more information.

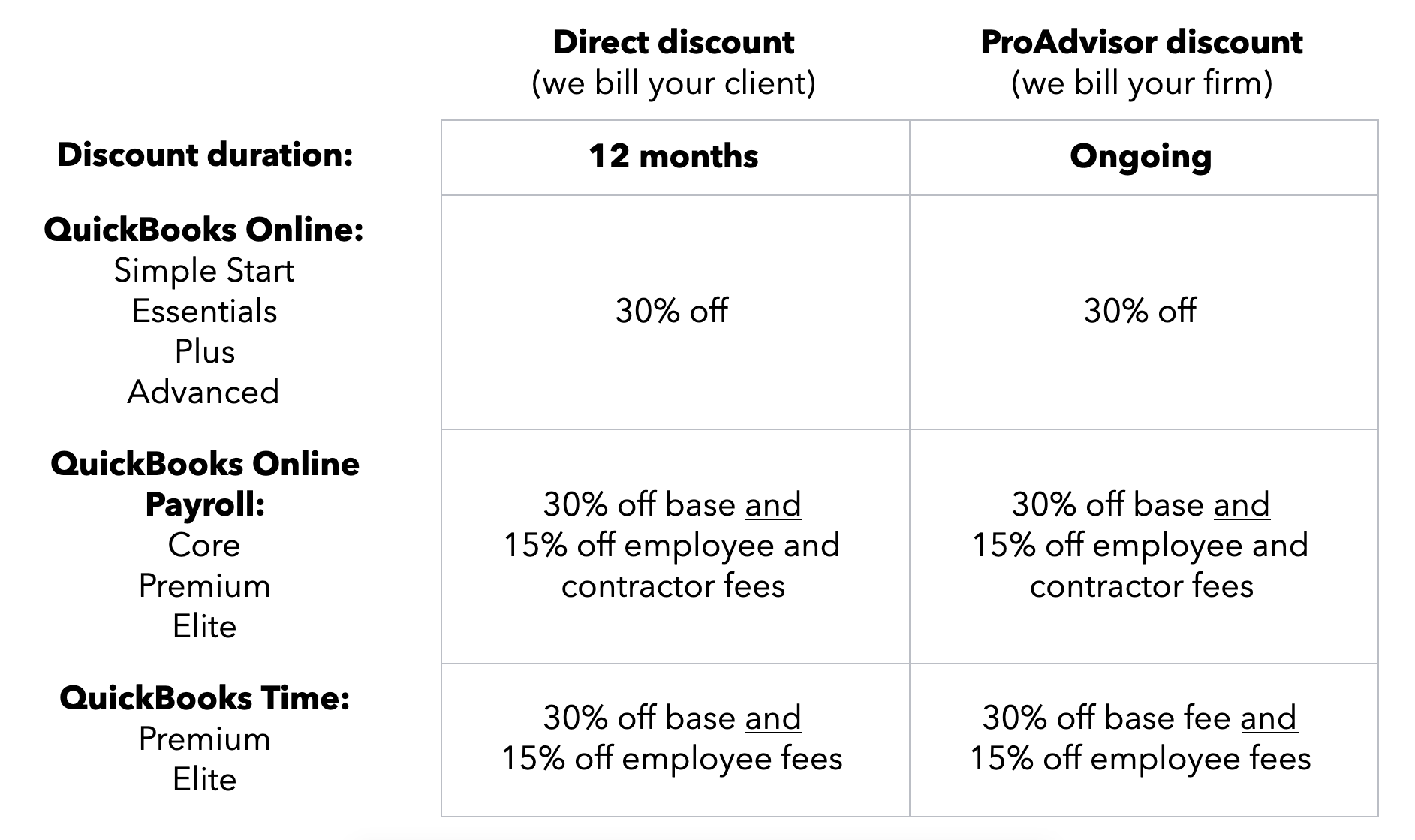

What is the difference between the ProAdvisor discount and the Direct discount?

Both discounts are available exclusively via accounting professionals through the “Add client” section of QuickBooks Online Accountant. When starting a new QuickBooks Online subscription for a client, you can select either “ProAdvisor discount” or “Direct discount.”

With the ProAdvisor discount, you pay directly for the subscription and enjoy an ongoing discount. With the Direct discount, your client pays for the subscription and receives the discount for 12 months. At the end of the 12 months, the client is charged the then-current monthly list price.

What is the ongoing discount?

We understand the importance of a reliable monthly bill for you and your clients, which is why we are offering the ongoing monthly discount to accounting professionals via the ProAdvisor discount. When you select this option, Intuit will bill your firm each month for all eligible client subscriptions and you can enjoy the ongoing savings month after month.

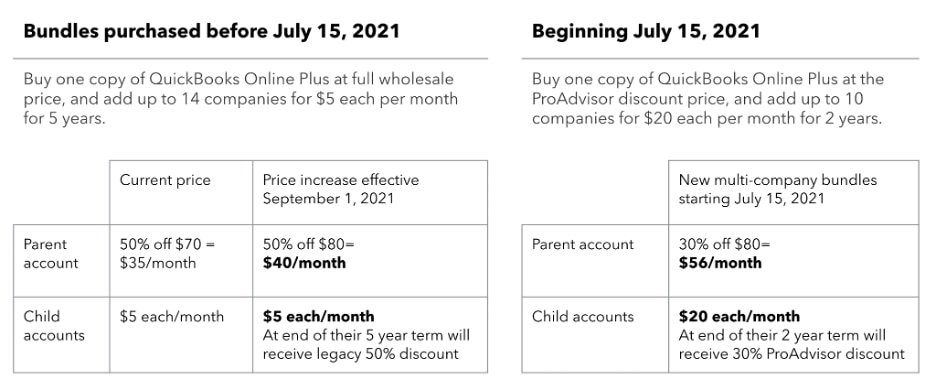

Will there be any changes to the multi-company discount?

With the launch of ProAdvisor Preferred Pricing, the new multi-company discount will be: Buy one copy of QuickBooks Online Plus at the ProAdvisor discount price, and add up to 10 companies for $20 each per month for two years.

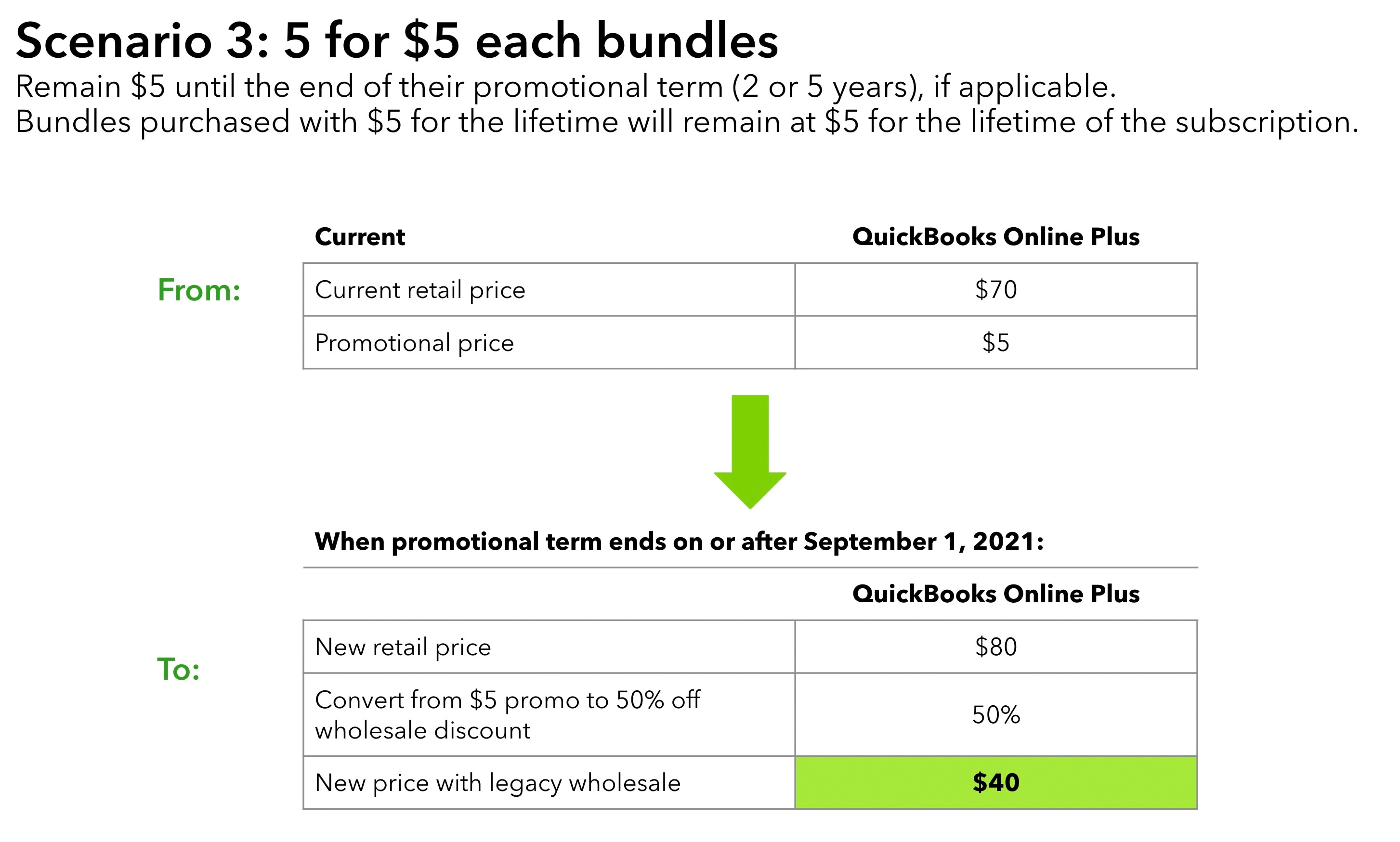

There will be no changes to the discounts or child-account prices on multi-company bundles purchased before July 15, 2021. Parent accounts on an existing multi-company offer will be subject to the QuickBooks Online Plus retail price change, and will increase from $35 to $40 (maintaining 50% wholesale discount applied to the new QuickBooks Online Plus Price of $80) on or after September 1, 2021. At the end of the 5-year term, child accounts will increase from $5 each to 50% off the then-current price of QuickBooks Online Plus as the legacy wholesale discount will apply.

How does this affect subscriptions I purchased on a bundle such as 5 for $5 each?

At the end of the two year promotional period, subscriptions will be billed at the then-current list price with the 50% wholesale discount since these subscriptions were purchased before July 15, 2021.

QuickBooks Online price increase

Why are you increasing prices now?

QuickBooks takes small business success seriously, especially during times of shifting and changing markets. Periodic price increases are necessary in order to deliver the product and support you and your clients need today and in the future. Some of our recent QuickBooks Online innovations include:

- Bill Pay*: an embedded bill pay capability that gives you more flexibility to pay bills online from QuickBooks.

- Tagging: create custom tags and reports to understand where you’re spending money and how you can be more profitable.

- QuickBooks Cash**: a small business bank account with no monthly fees, industry-leading APY (annual percentage yield), and Instant Deposit** at no extra cost, if eligible.

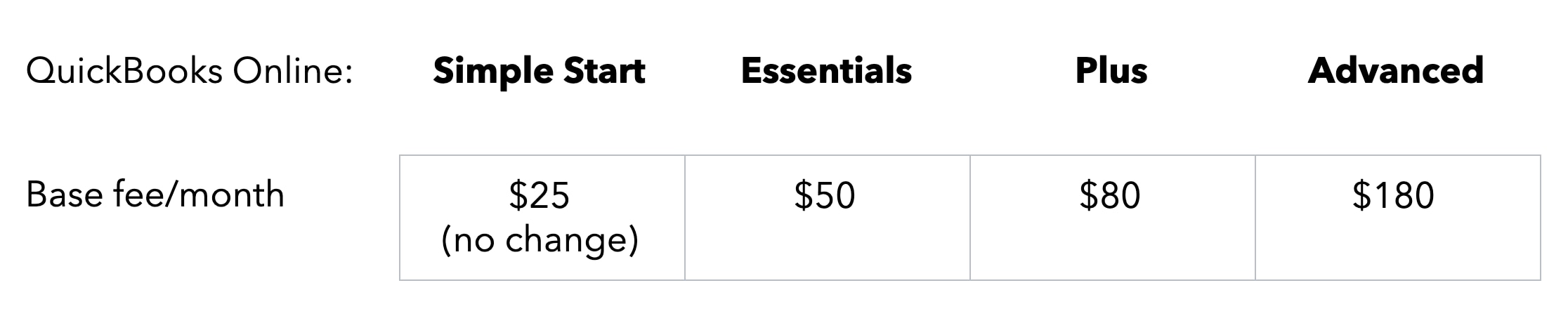

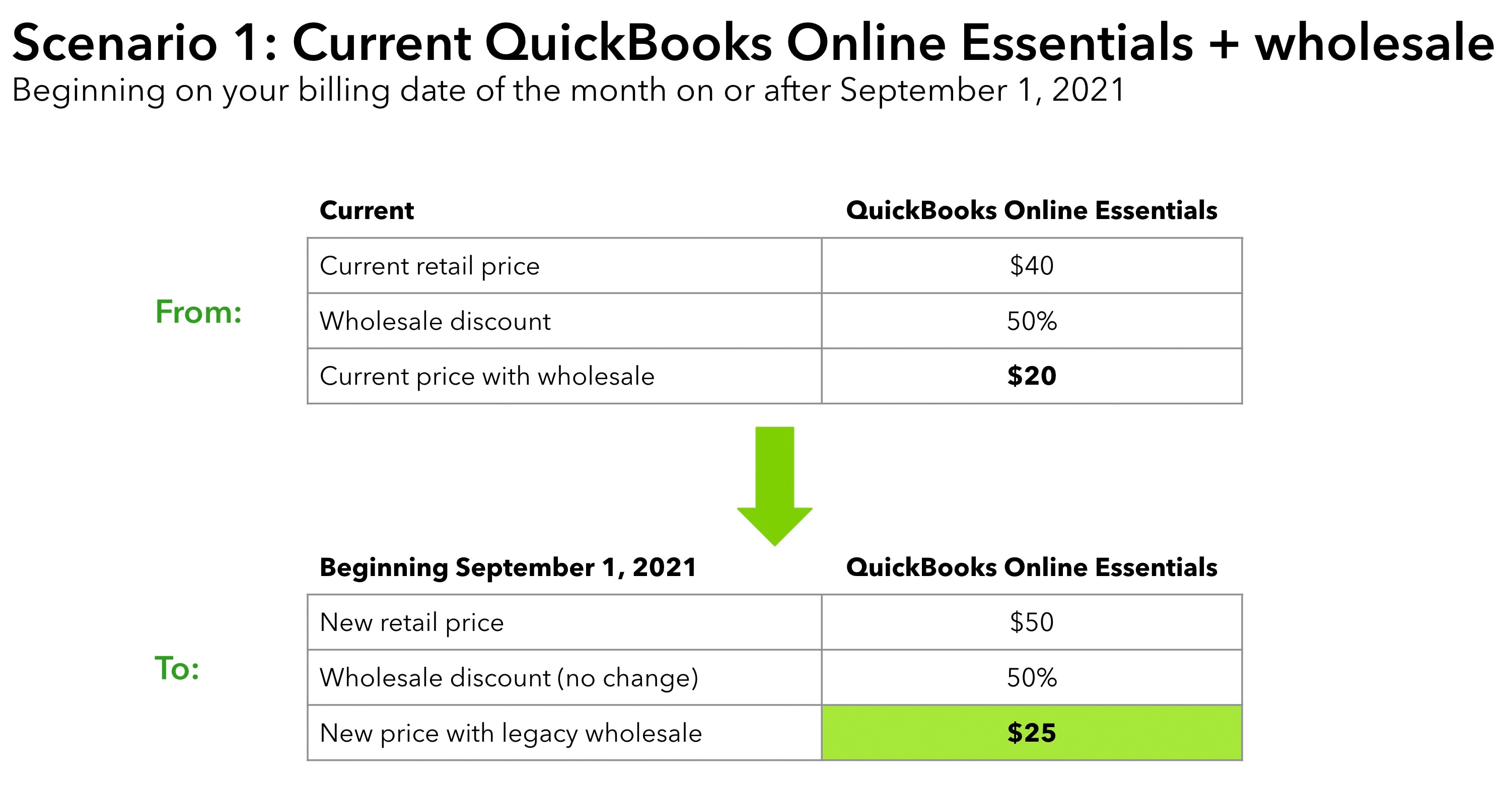

What prices are changing?

Please refer to the charts above for details.

When does the price increase go into effect for new customers added through accountants?

The QuickBooks Online price increase takes effect on or after July 15, 2021 for all new customers, including those added through QuickBooks Online Accountant.

When does the price increase go into effect for existing customers who pay for their own subscriptions?

The QuickBooks Online price increase goes into effect for clients that pay for their own subscription on Aug. 1, 2021.

When does the price increase go into effect for subscriptions enrolled before July 15, 2021 through the wholesale discount program?

The QuickBooks Online price increase goes into effect for these clients on or after Sept. 1, 2021.

Will prices increase for new customers I just added to my wholesale discount?

Price of subscriptions purchased within six months of the Sept. 1, 2021 price increase date will remain unchanged until the 7th billing month.

Disclaimers

Bill Pay. Bill Pay services powered by Melio with funds held by Evolve Bank & Trust or Silicon Valley Bank (members of the FDIC and the Federal Reserve). Requires a Melio account and acceptance of their Terms of Service and Privacy Statement. Subject to additional terms, conditions, and fees.

Instant deposit. Instant deposit is an additional service offered by QuickBooks Payments subject to eligibility criteria. Standard payment processing fees apply to each transaction. Deposits are sent to the bank account linked to your QuickBooks Debit Card or, at your election, another eligible debit card in up to 30 minutes from the initiation of the deposit. Deposit times may vary for third party delays.

**Product Information

QuickBooks Cash Account opening is subject to identity verification and approval by Green Dot Bank.

QuickBooks and Intuit are a technology company, not a bank. Banking services provided by our partner, Green Dot Bank.

QuickBooks Payments and QuickBooks Cash accounts: Users must apply for both QuickBooks Payments and QuickBooks Cash accounts when bundled. QuickBooks Payments’ Merchant Agreement and QuickBooks Cash account’s Deposit Account Agreement apply.

QuickBooks Cash account: Banking services provided by and the QuickBooks Visa® Debit Card is issued by Green Dot Bank, Member FDIC, pursuant to license from Visa U.S.A. Inc. Green Dot Bank operates under the following registered trade names: GoBank, GO2bank and Bonneville Bank. Registered trade names are used by, and refer to, a single FDIC-insured bank, Green Dot Bank. Deposits under any of these trade names are deposits with Green Dot Bank and are aggregated for deposit insurance coverage up to the allowable limits. Green Dot is a registered trademark of Green Dot Corporation. ©2021 Green Dot Corporation. All rights reserved. QuickBooks products and services, including Instant Deposit, QuickBooks Payments, Cash flow planning / forecasting are not provided by Green Dot Bank.

FDIC insured up to $250,000: QuickBooks Cash Account funds are FDIC-insured up to the allowable limits through Green Dot Bank, Member FDIC upon verification of Cardholder’s identity. Coverage limit is subject to aggregation of all of Cardholder’s funds held on deposit at Green Dot Bank.

**Features

Instant Deposit at no extra cost: Includes use of Instant Deposit without the additional cost. Instant Deposit is an additional service offered by QuickBooks Payments subject to eligibility criteria. Standard rates apply for ACH, swiped, invoiced, and keyed card transactions. Deposits are sent to the bank account linked to your QuickBooks Debit Card in up to 30 minutes. Deposit times may vary for third party delays.

Annual percentage yield: The annual percentage yield (“APY”) is accurate as of March 1, 2021 and may change at our discretion at any time. The APY is applied to deposit balances within your primary QuickBooks Cash account and each individual Envelope. We use the average daily balance method to calculate interest on your account. See Deposit Account Agreement for terms and conditions.

National average interest rate: The average interest rate is based on the Federal Deposit Insurance Corporation’s national rate published the week of September 28, 2020. Learn more.

No monthly fees: Other fees and limits apply. See Deposit Account Agreement for details.