The accounting profession continues to evolve, with technology and AI reshaping how firms and accountants keep operations sharp while delivering increased value to clients. Based on insights from 700 accounting professionals, the 2025 Intuit QuickBooks Accountant Technology Survey spotlights how forward-thinking accountants are. Across the board, they’re leveraging AI and automation to enhance efficiency, alleviate stress, and solidify their standing as trusted advisors in a competitive landscape. By integrating these tools, accountants are striking a balance between maintaining rigorous compliance standards and expanding their capacity for strategic services that drive growth.

2025 Accounting trends: How accountants are staying ahead with AI and automation

Jump ahead:

- Tech-forward accountants: Boosting productivity and advisory with AI and automation

- Advisory on the rise: Leveraging tech for strategic value

- Growth mindset: Overcoming tech and talent barriers

- Managing overcrowded tech stacks: Accountants seek streamlined solutions

- Client tech adoption drives demand for accountant expertise

- Outsourcing is clearing the way for strategic focus

- Recruiting for the future: navigating the tech skills gap

- Methodology

Key findings:

- AI is a daily driver: 46% of accountants use AI every day, significantly outpacing small businesses (28%).

- Productivity and peace of mind: 81% of accountants report AI boosts productivity, and 86% agree it reduces mental load.

- Advisory surge ahead: 79% of accountants expect growth in strategic advisory services in the next year, with volume projected to grow 38% on average.

- Tech for time savings: 95% of accountants say technology cuts compliance time, allowing more focus on strategic advisory.

- Growth depends on tech: 85% of accountants believe not adopting new tech will hinder their firm’s growth goals.

- Integration is key: Accountants report their firms manage an average of 8 different digital tools, but 89% say better integration is needed for growth.

- Standardized tech stacks emerge: 1 in 3 accountants say their firm has implemented standardized tech stacks across the practice and clients.

- High-value clients are tech-forward: 83% of accountants agree higher-value clients are more likely to be tech-advanced.

- Competition is rising: 79% of accountants anticipate increased competition for high-value advisory clients.

- Outsourcing for strategic focus: 80% of accountants report their firm outsourced services in the past year, with 83% agreeing it gives their firm a competitive edge.

- Hiring for tech skills: 75% of accountants say their firm has increased its focus on technology skills in recruitment.

Tech-forward accountants: Boosting productivity and advisory support with AI and automation

Accountant firms plan to spend an average of $20,000 on tech in the coming year

Accountants are prioritizing technology to enhance productivity and deliver greater client value. Over the past year, respondents report their firms have invested an average of $19,000 in tech, with plans to spend $20,000 in the year ahead.

More accountants are investing in AI

The spotlight is firmly on AI and automation, with 64% of respondents reporting their firm plans to invest in AI in the coming year, up from 57% last year. Automation also remains a key focus: 45% say their firm plans to invest in this area.

Top 3 priorities for investment:

- AI (64%)

- Automation (45%)

- Marketing apps/software (40%)

More than 9 out of 10 accountants are automating processes

Automation adoption is nearly universal among accountants (95%), improving everything from payroll processing (47%) and accounts payable/receivable (46%) to data entry and transaction processing (43%).

Top 5 benefits automation is driving for accountants:

- Better data accuracy (98%)

- Workflow efficiency (97%)

- Overall productivity (97%)

- Time savings for staff (95%)

- Quality of client service (95%)

More than 2 in 5 accountants use AI daily

AI has moved from innovation hype to essential infrastructure. It’s not just boosting efficiency—it’s renegotiating how accountants work. This shift is evident, with 46% reporting daily AI usage, outpacing small businesses (28%).

Client services and internal operations get an AI boost

Over the past year, 88% of respondents have used AI to improve the way they deliver value to their clients, making processes more efficient and impactful.

The top 3 most common areas where accountants are leveraging AI include:

- Data entry and processing (50%)

- Financial forecasting (44%)

- Tax services (38%)

On the operational side, respondents are using AI to optimize workflows, freeing up time to focus on higher value activities.

Top 3 internal processes accountants are streamlining with AI:

- Invoicing and payments (44%)

- Client portfolio management (43%)

- Client communications (42%)

9 in 10 accountants leverage AI for strategic advisory work

AI is transforming client relationships, with 93% of respondents leveraging it to support their strategic business advisory role for clients. By automating tasks and generating insights, AI is enabling accountants to focus on delivering business-critical guidance.

Top 3 ways accountants are using AI for advisory services:

- Generating AI-assisted suggestions for improving client relations (55%)

- Creating AI-generated financial summaries (51%)

- Providing real-time insights during client meetings (44%)

Custom solutions are the next frontier. With 82% of accountants reporting proprietary AI systems in use or planned for development, firms are tailoring technology to match their footprint.

Accountants emerge as AI evangelists

Accountants are embracing AI not just for its functionality, but for the meaningful impact it is having on their day-to-day work. Three in 5 (62%) respondents describe themselves as AI evangelists in the workplace. This enthusiasm is backed by results—81% of accountants report that AI has directly improved their productivity.

AI reduces mental load, leaving room for even more impact

AI is easing the mental load for accountants, with 86% of respondents agreeing that AI has helped reduce their mental load by simplifying day-to-day tasks. Despite this relief, 81% of respondents recognize untapped potential, noting they want to leverage AI even more to meet the evolving needs of their firms and clients.

Advisory on the rise: Leveraging tech for strategic CAS value

Advisory growth set to surge in the year ahead

Nearly 8 in 10 respondents (79%) anticipate an increase in strategic advisory services over the next year, with the volume of advisory work expected to grow by an average of 38%.

As this shift takes hold, accountants see several key benefits for their firms taking on more strategic advisory work, including:

- Boosting firm revenue (94%)

- Growing client lists (89%)

- Job satisfaction (81%)

- Improving client quality (78%)

Compliance remains a cornerstone

This transition isn’t about abandoning compliance, but optimizing its foundational value to create space for higher value services. Respondents report dedicating an average 62% of their workload to compliance (e.g., tax filings, financial statements, bookkeeping, auditing, etc.) and only wish to reduce this slightly to 58%. Here, technology is the enabler, helping accountants reclaim time for strategic advisory roles while maintaining compliance as a cornerstone of their work.

Tech is driving efficiency and unlocking advisory potential

For 95% of respondents, technology is helping their firms reduce time spent on compliance tasks while creating more capacity for strategic advisory services.

The top 3 most common ways technology is enabling accountants to shift their focus include:

- Boosting overall efficiency (55%)

- Providing advanced analytics for deeper business insights (54%)

- Automating repetitive compliance tasks (48%)

This blend of enhanced productivity and actionable insights is positioning accountants as indispensable advisors in a complex business landscape.

Growth mindset: Overcoming tech and talent barriers

Firms are prioritizing growth with client and advisory expansion

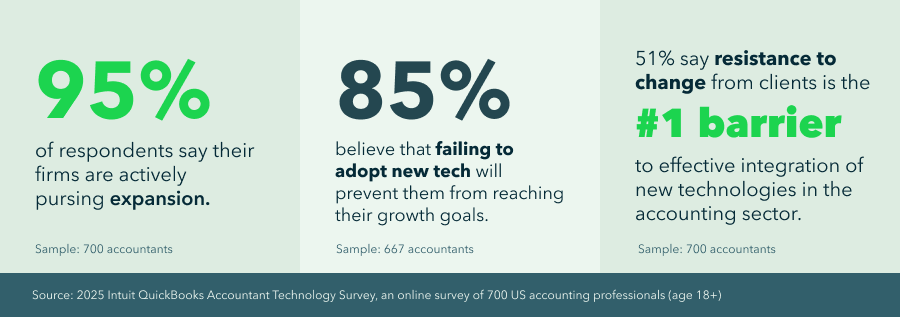

Accountants are focused on growth, with 95% of respondents reporting their firms are actively pursuing expansion in the year ahead. This growth strategy focuses on three key objectives:

- Increasing the number of client numbers (56%)

- Attracting higher value clients (51%)

- Expanding range of advisory services (43%)

Tech adoption is the key to keeping growth on track

Despite the benefits of an increasingly digitized business, managing technology is becoming more complex, with respondents reporting their firms use an average of 8 different applications.

This dependence on multiple tools has created critical pain points, including:

- High subscription costs (44%)

- Integration challenges (41%)

- Time-consuming data entry (41%)

- Staff training on multiple platforms (33%)

Despite these hurdles, a strong consensus emerges: 85% believe failing to adopt new technologies will prevent them from reaching their growth goals. And nearly 9 in 10 (89%) agree that their existing digital solutions could be better integrated to truly support their expansion plans.

For firms aiming to thrive in the year ahead, overcoming these challenges will become mission-critical for success.

Addressing tech resistance to fuel firm growth

Resistance to technology adoption is standing in the way of progress for many accountants. Respondents identified three key roadblocks that are preventing effective integration in the profession:

- Resistance to change from clients (51%)

- Lack of staff technical skills (39%)

- Internal org resistance to change (39%)

These findings highlight a critical need to educate clients about the value of new tools while investing in staff training to build confidence and expertise. Bridging these gaps can unlock the potential of firms’ tech investments, helping them meet ambitious growth goals and stay ahead in a fast-changing industry.

Managing overcrowded tech stacks: Accountants seek streamlined solutions

Standardized tech proves its value with efficiency and accuracy gains

Accountants are navigating the challenges of managing ever-expanding digital tools, with many feeling the strain of overcrowded tech stacks. Two in three (66%) respondents admit to feeling overwhelmed at least weekly with the volume or complexity of workflows required by their tech stacks, even as AI helps ease mental load for some. This underscores a growing need to ensure digital systems work together seamlessly.

Some firms are taking a clear stand: 36% have fully standardized their tech stacks across staff and clients to improve efficiency and reduce friction, and 57% maintain a preferred, but flexible lineup of tech.

Accountants take bold stance to prioritize digital alignment

Standardizing technology is emerging as a vital strategy for accountants, with 98% of respondents acknowledging its benefits. From streamlining operations to increasing client satisfaction, alignment across digital tools is becoming the bedrock for success.

The top 5 biggest benefits include:

- Accuracy and consistency in financial reporting (62%)

- Improved data processing and efficiency (56%)

- Easier client onboarding (43%)

- Higher client satisfaction (40%)

- Enhanced data security and control (38%)

For many, the focus on standardization reflects a bold commitment to streamlining operations, with 61% of respondents agreeing that firms committed to tech standardization should sever ties with clients unwilling to adopt their preferred digital platforms. This trend signals that technology alignment is now more than operational—it’s also strategic.

Client tech adoption drives demand for accountant expertise

Most high-value clients also love technology, but competition is heating up

For accountants, success isn’t just about their own technology—it also hinges on how their clients use it. On average, 52% of clients are considered tech-forward, split between:

- 25% tech-advanced: Leveraging cutting-edge tech for a competitive advantage

- 27% tech-proficient: Relying on tech for most functions, but not adopting the most advanced tools

The remaining 48% fall behind in adoption:

- 26% tech-limited: Comfortable using technology for only a few specific tasks

- 22% tech-challenged: Struggling with adopting and integrating new technologies

The link between client tech proficiency and growth is unmistakable: 83% of respondents say high-value clients are more likely to be tech-advanced, making these partnerships a priority.

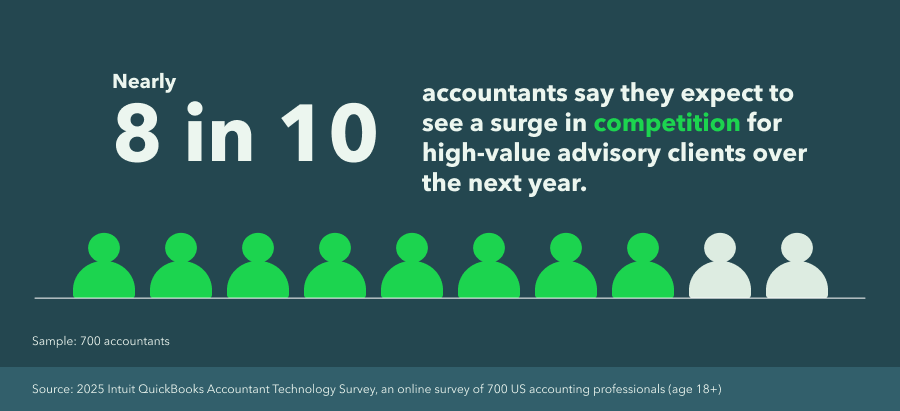

Still, stakes are rising, as 79% of respondents foresee competition for these high-value clients increasing in the year ahead. Accountants eager to thrive must strike a balance: maintaining advanced tech capabilities to align with forward-thinking clients while remaining equipped to support those still navigating foundational challenges.

Client needs continue to expand with tech management and business strategy

Client needs are growing, with accountants increasingly steeping into broader advisory roles beyond traditional financial services. Over the past year, respondents report clients needing more support in key financial areas, with the top areas being:

- Financial management (57%)

- Filing taxes (55%)

- Regulations and compliance (53%)

But the demand doesn’t stop there. Businesses are turning to accountants for guidance in areas spanning technology and strategy. Respondents say more guidance has been needed the most with:

- Technology management (62%)

- Business plans/strategy (59%)

- General business advice (47%)

Accountants are answering the call, becoming pivotal partners in their clients’ digital transitions. As technology needs expand, accountants are helping businesses tackle the most pressing challenges, including:

- Software implementation (57%)

- Providing training on new software (54%)

- Recommending new software solutions (53%)

Outsourcing can help clear the way for strategic focus

Outsourcing remains a go-to strategy for accounting firms

Outsourcing remains a top strategy for accounting firms, helping streamline operations and address rising client demands.

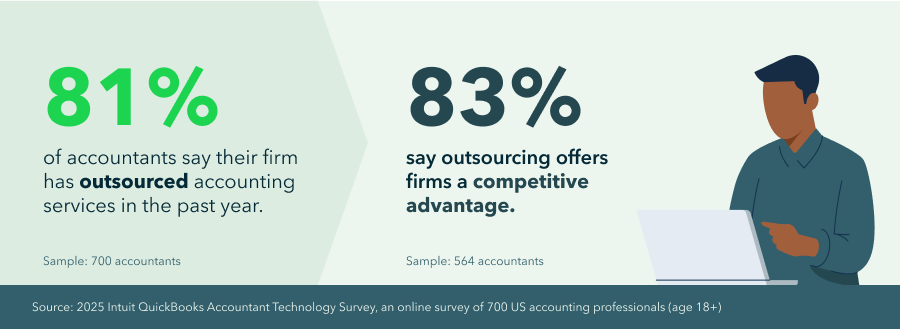

Eighty-one percent of respondents confirm their firm has outsourced accounting services in the past year, with top use cases including:

- Financial statement preparation (36%)

- General ledger and transaction management (34%)

- Tax return preparation and filing (34%)

As firms take on more demanding workloads, outsourcing has solidified its role as a strategic solution for streamlining operations and scaling impact.

Firms leverage outsourcing to refocus on high-value services

Eight-three percent of accountants view outsourcing as a competitive advantage. This momentum shows no signs of slowing down—63% of respondents say their firm plans to expand outsourcing efforts in the coming year, underscoring a growing practice that leverages external partnerships to drive profitability and stay ahead.

Recruiting for the future: navigating the tech skills gap

The enduring talent crunch

Recruitment remains a pressing challenge in the industry. Eight in 10 respondents report difficulty hiring skilled professionals. While hiring hurdles have eased slightly from prior years—down from 94% in 2024—the industry continues to grapple with a talent shortage across all experience levels. Securing junior level candidates with more than one year of experience proves especially challenging, noted by 42% of respondents, followed closely by hiring talent with five or more years (38%).

More tech training needed for teams

Tech readiness is compounding recruitment struggles. Just 28% of respondents say their firm’s training programs fully equip employees with the technology skills needed to meet today’s demands. This gap highlights a need for enhanced educational strategies, both internally within firms and across the broader industry, to ensure accountants can successfully navigate a rapidly digitized profession.

Shifting focus toward tech-savvy hiring to stay competitive

Firms are actively evolving their hiring strategies to address increasing demands for tech proficiency. Seventy-five percent of respondents report increasing their focus on technology skills in their hiring criteria, signifying a commitment to a tech-centric workforce. As technology continues to advance the accounting landscape, the profession is adapting—not just to fill roles, but to attract talent capable of keeping firms ahead of the curve.

Methodology

Intuit commissioned an online survey in April 2025 of 700 accounting professionals throughout the US, all aged 18+. Forty-seven percent are aged 28-43, 26% are 44-59, and 21% are 18-27. Thirty-six percent own an accounting or bookkeeping business and 64% are employed as accountants or bookkeepers within a firm. Among these participants, 24% work in larger firms with more than 100 employees, and 76% are part of smaller firms that employ between 0 to 99 individuals.

Half of respondents (52%) are male and 47% are female. Percentages have been rounded to the nearest decimal place, so values shown in data report charts and graphics may not add up to 100%. Responses were collected using Pollfish audience pools and partner networks with double opt-ins, random device engagement sampling, and post-stratification based on census data to ensure accurate targeting and results. Respondents received remuneration.

Intuit Accountants helps accounting, bookkeeping and tax professionals save time and grow their practice. Follow us on LinkedIn, Instagram, and Facebook.

Recommended for you

Get the latest to your inbox

Get the latest product updates and certification news to help you grow your practice.

Thanks for subscribing.

Relevant resources to help start, run, and grow your business.