When we speak to accountants, one message we hear from you is the need for a QuickBooks® payroll solution for clients who only need payroll services. We heard your feedback … and created two stand-alone QuickBooks Online Payroll subscriptions to give you and your clients the flexibility to only subscribe to products that fit their needs and support the growth of their business.

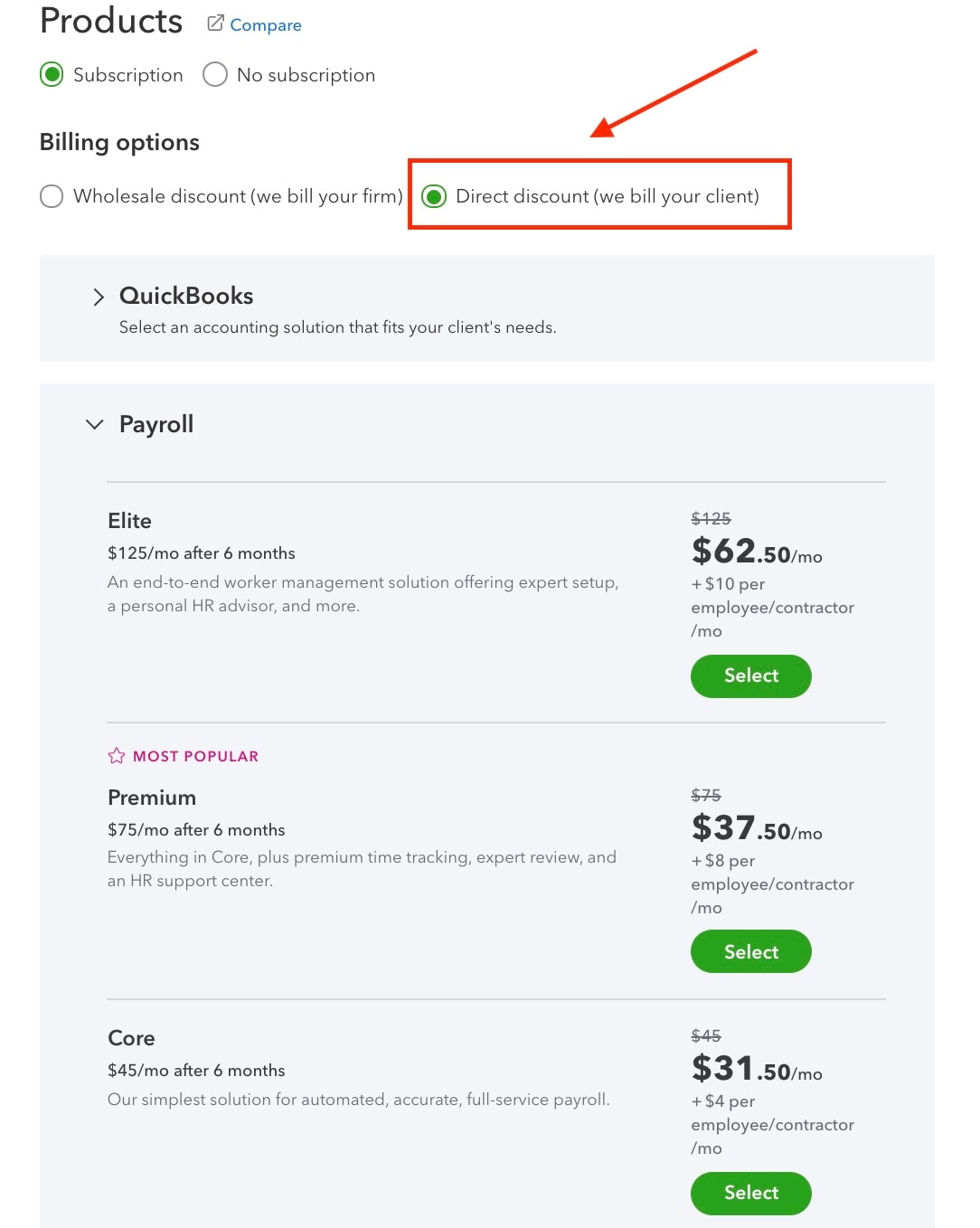

If your client only needs payroll services, you can offer them QuickBooks payroll service (Core, Premium, or Elite) without a QuickBooks Online accounting software subscription. This means that even without QuickBooks Online, you can still manage payroll-only clients, right on the QuickBooks platform. Additionally, if an existing client wishes to cancel their QuickBooks Online subscription, they can retain their payroll subscription.

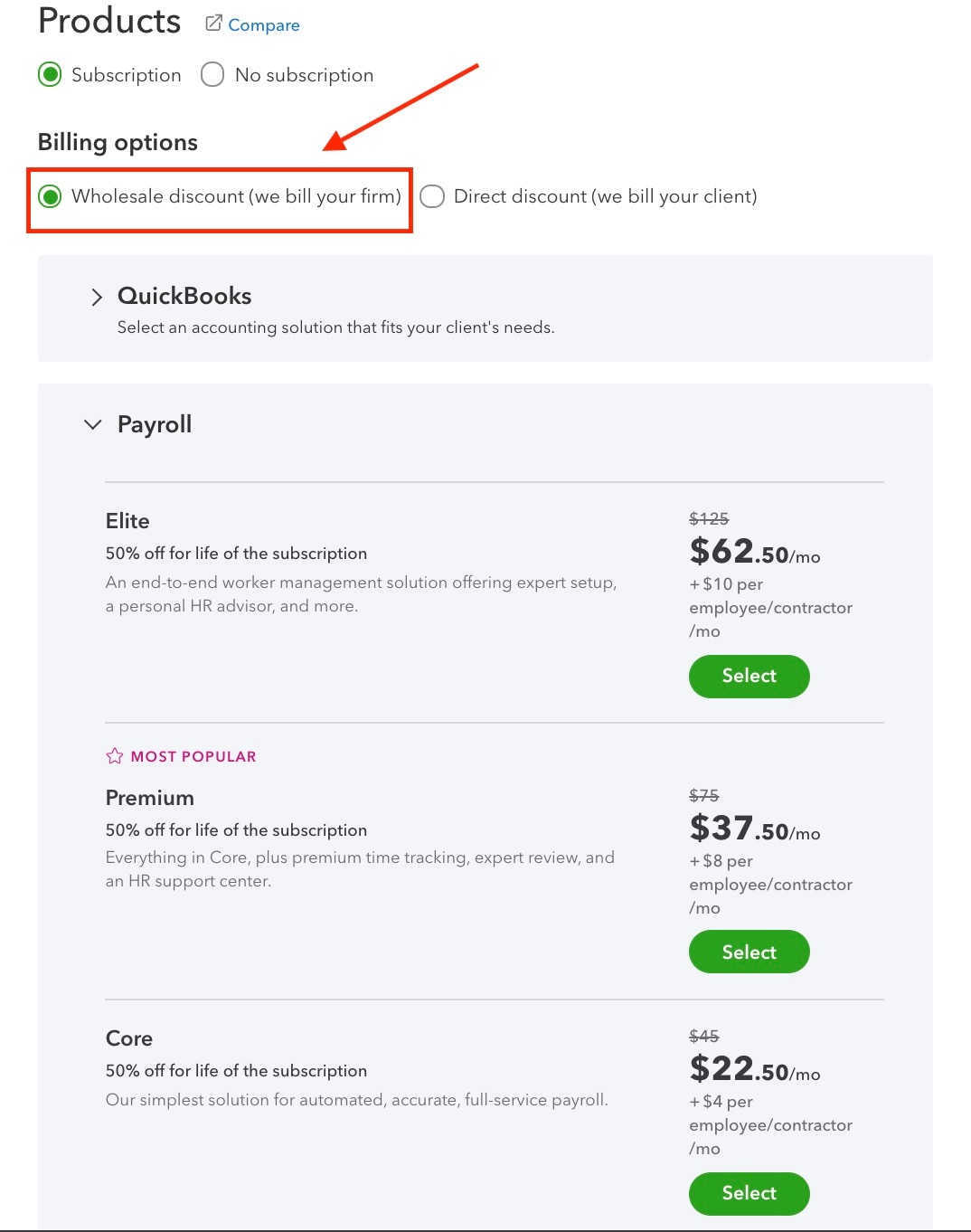

Firm-billed stand-alone QuickBooks Online Payroll: We bill your firm*

The firm-billed option provides a 50% discount on the retail price of payroll for life. This billing option also gives you the flexibility to build service packages that fit the needs of your clients and your firm. On July 15, the pri