One 8 Solutions is a big proponent of QuickBooks Online and integrated QuickBooks Online Payroll, especially when it comes to Job Costing. I have worked with Intuit’s payroll solutions, starting with QuickBooks Desktop and tax tables, to the current Payroll Elite solution with QuickBooks Online. When we found out a few years ago that QuickBooks Time now comes included with payroll’s Premium and Elite subscription, it was a game changer for our firm and our clients.

We like the flexibility of the payroll offerings because they can handle the easiest ones, such as salary with only tax deductions to more complicated payrolls that involve time tracking, multiple deductions, and accruals. For simple payroll runs, auto pay feature allows us to set it up once and run automatically for each pay period. For the more complex ones, the time tracking functionality available with Premium and Elite speeds up payroll processing, since you don’t have to punch in the time in for each employee.

Elite Payroll gives you all you need for:

- Running payroll.

- Filing and paying taxes.

- Time management: calendar/scheduling.

- Human resources.

- Benefits administration.

Another reason this works well is that payroll is fully integrated with QuickBooks Online, so you don’t think about it as a separate program or app. All you need is just a mouse click away in one place.

Workforce management

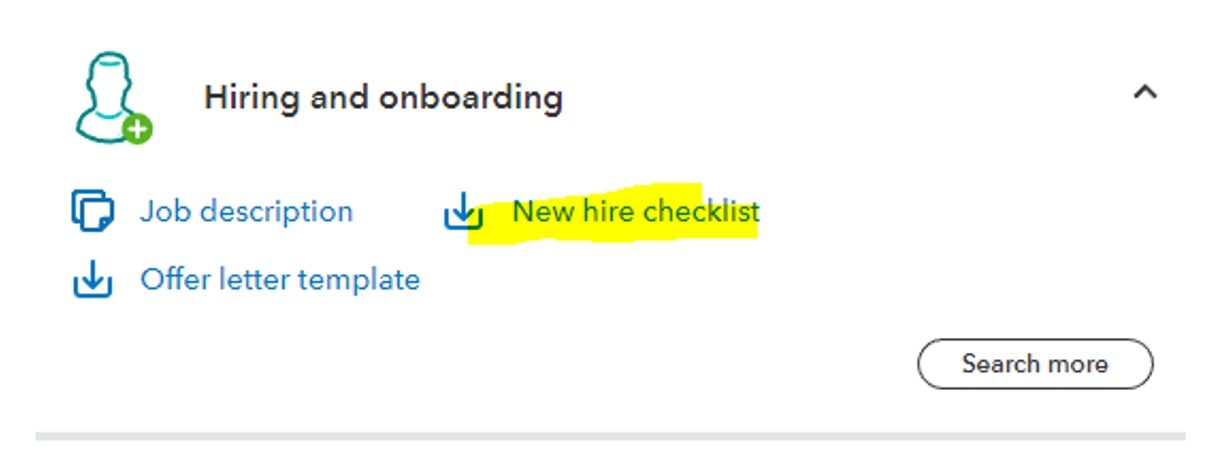

That brings me to how QuickBooks Online Payroll and its suite of connected tools have helped One 8 Solutions’ clients with a holistic workforce management solution. From onboarding, time tracking, benefits, and, of course, running payroll for employees, it covers everything.

We recommend the Elite option to our clients because of the high level of support Intuit provides with setting up a new payroll account or migrating from a different provider. Setting up payroll is tedious and worrisome work at times. You may find you need some guidance on what type of accounts, such as what entities you need to register for. These include withholdings, unemployment, family Leave, and state/county/municipal.

Intuit support will guide you on how to set up your employees with the proper pay rates, deductions, and contributions. We have moved clients from solopreneurs to mid-size employers, such as a 25-person plumbing company, using QuickBooks onboarding payroll team. The onboarding team will ensure it is set up correctly, especially mid-year conversion where history is extremely important.

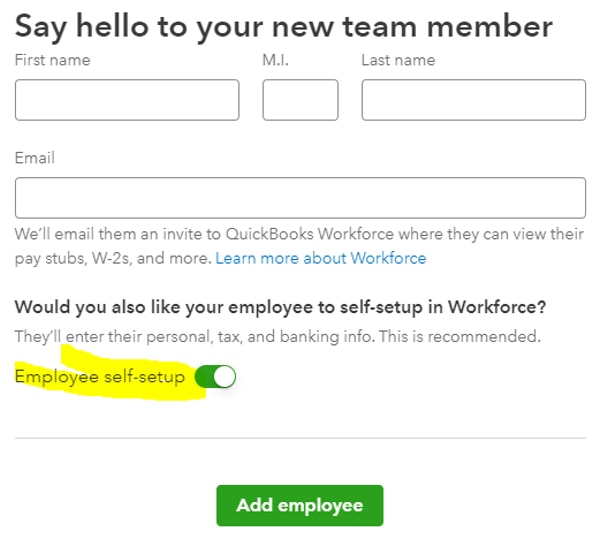

Setting up new employees

When you or you clients need to set up a new employee, QuickBooks makes it super easy, and literally starts with their workforce services. All you have to do is click "Add An Employee" and choose "Employee Self-Setup."