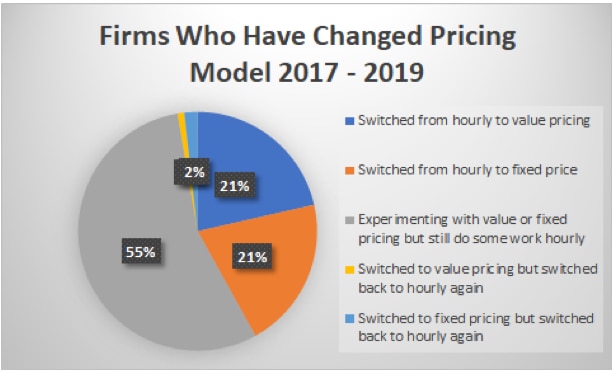

We also asked about your clients’ reaction to the change in the firm’s pricing model from hourly billing to value or fixed price. Almost 60 percent told us that clients were indifferent to the change, while 35 percent reported a positive response and less than 6 percent indicated negative feedback.

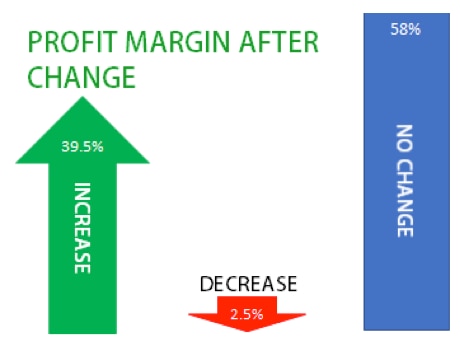

In response, one respondent told us, “Many clients left, the ones who stayed are all very positive.” Another shared that the process of changing their fee structure allowed them to really analyze their client base: “Our profit first went down because we ‘fired’ some customers, but it ultimately has gone up.”

Should you make the switch?

There are a lot of benefits with moving away from hourly billing, including increased profits, customer loyalty, and a more streamlined billing process. But, the implementation process is certainly not without risks, especially in the beginning, as firms get the hang of it and learn to determine the fair value of the services they provide to clients. Firms looking to learn more about shifting away from the billable hour can learn more from industry experts such as Ron Baker, Mark Wickersham, and Mike Michalowitz, who have all written various books and articles on the subject.

This great article by Dustin Wheeler of Eide Bailey LLP, explains the pros and cons of moving from hourly billing to value-priced accounting. He explains the benefits to the firm and their clients, and warns of not haphazardly trying to make the switch. A successful transition takes careful research, planning, and an organized introduction of the new pricing model to clients – ideally in phases.

Changing your pricing model is YOUR choice, and you need to do what is right for your firm and clients. While it’s important to stay apprised of what’s happening in our industry and continue to learn about new and different ideas, ultimately, your pricing model should reflect the values and structure of your firm.

Some advice from your peers

We asked respondents to share a piece of advice with their fellow ProAdvisors. We received so many great responses, below are just a small handful!

“Use what works for you and not what everyone else tells you to use.”

“Don’t be afraid to fire a client. It may be better for both of you.”

“Don’t settle for less. You need to set the bar higher by charging what you are worth. Knowledge and expertise should not be bargained with. We don’t go to the dentist and ask for a discount; why is it acceptable to ask accountants to lower their rates? By setting a firm boundary, I have quality clients, work less, and establish value.”

“Don’t undervalue your skills.”

“Don’t sell yourself short. I undercharged for too long. Quote a value pricing rate quickly because, over time, you will get faster and, if you are charging by the hour, you will make less. A smaller amount of good clients are better than a large amount of small, poor paying clients.”

“You are worth more than you think; your client needs to know that your mind is the real value, and you act as the health insurance policy for the business.”

“Raise your prices!“

“Don’t overpromise and underdeliver. Do the exact opposite.”