Many accountants are moving toward an advisory model with their client services, such as being a virtual CFO. Developments in AI and automation allow us to offload repetitive tasks to technology, enabling us to use our time to serve our clients with impactful advisory services.

But moving away from compliance toward advisory comes with many challenges. One of the first challenges you’ll face? Creating a pricing strategy.

In this blog post, I’ll cover advisory pricing strategies, including common pricing mistakes, types of advisory pricing models, and how our virtual CFO team implemented a subscription-based pricing model.

Common pricing mistake: Pricing too low or too high

Firm owners often worry about pricing their services too high. I find that’s a common concern with people in general. Unconsciously, we assume every person on this earth is looking for the cheapest option. The reality is that effective pricing strategies are based on value.

My first “real” job was selling knives. These weren’t regular knives you buy from a supermarket. These were high-quality, last-a-lifetime knives. While the price was high ($600 then, around $2,000 now with inflation factored in), the average person was willing to pay for the quality because they would save them time cooking and they would never have to replace their knives.

When it comes to accounting advisory services, clients are paying for the value of your expertise. A business owner can study up on KPIs, benchmarking, forecasting, scenario planning, and other areas, and perform the back-office accounting tasks themselves. However, it will take them a significant amount of time they could be spending on increasing profitability and managing their teams. A business owner can also look for the cheapest bookkeeper in their local area, but they will be missing out on the advisory services a wiser accountant can offer that can dramatically increase scalability and growth.

There is an opportunity cost to pursuing the cheapest option in many circumstances—and accounting advisory is no exception. That is why pricing your services for the value you provide is a best practice. You are showing your client that your services have value, and you receive a fair price for the years of expertise and knowledge you’ve gained.

While it might sound cliché, you need to believe in the value you provide to overcome the fear of pricing too high. If you clearly and confidently explain and market that said value, you will receive more clients than you initially expected.

On the other hand, if you price services too low, you will have a volume issue. While pricing high provides you with fewer, more lucrative clients, pricing too low will cause you to have too many low-cost clients. For some firm owners, this might be ideal. For most, this won’t be the case. You will likely struggle to keep up with demand, while not receiving the right price for the value your team provides.

This is why we take the route of fewer, high paying clients.

Why is it important to address these mistakes?

Without the right pricing, you will see your closing ratios, profit margins, bottom line, and client retention suffer.

Closing ratios

A closing ratio is a great indicator of whether your pricing is just right. Your closing ratio should be between 25-35%. If this isn’t the case, you need to adjust pricing ASAP. If you are closing less than 25% of deals, your pricing is too high. If your closing ratio is above 35%, your pricing is too low and likely doesn’t match the value your service provides.

Profit margins

If your profit margins do not support price adjustments, it may be time to look at your direct costs and expenses. A large portion of your expenses will be related to team salaries. This will be a good time to analyze whether your team is at capacity and if they can take on more work to reduce cost per client. I’d also suggest looking at other direct costs, such as software, to determine if these costs could be cut.

In our firm, we look for 50% gross profit margin because our team is mostly stateside. If our team were international, we’d look for a margin closer to 60%.

We also maintain a net contribution margin of 72% on all engagements, meaning we need to be 72% profitable on our engagements, on average. We need to be able to accept that we will marginally win on some clients and greatly win on others. Overall, the margin needs to end near 72% so that we can obtain our 50% gross profit margin.

Bottom line

Your bottom line should come in between 20%-30%. If this isn’t the reality for your firm, you should be looking at administrative costs not associated with direct production costs. In the same way that we can cut direct costs, we need to look for fat to trim in our indirect production costs.

Client retention

It’s important that you know the exact number of clients you will need to pick up per month. You should also know the average dollar amount of each client, and therefore, the overall dollar amount you will need to gain from new clients each month. This metric is important to keep in mind to scale your business.

This metric is dependent on being able to retain your clients. Personally, we aim for a 90% client retention rate, meaning that only 10% of our annual clients will churn each year. While 10% might sound like a lot, one of our goals is to help our clients grow so much that they are beyond the scale of our services. Clients might sell their business and be acquired, need to bring on a full-time CFO and accounting team, or retire after a very successful run in their business. Either way, the 10% is a metric of our success.

With that in mind, you should factor in whatever client loss you expect into your forecast and ensure that new clients can replace lost revenue (plus more for growth).

What type of billing should virtual CFOs use?

When we first launched our firm, we tried hourly and flat-rate billing. These methods are based on pricing the services the same for every client, but we realized that this approach was killing us when we picked up big clients. These clients required more work, and we couldn’t arrive at a healthy profit margin.

After this approach failed to work for our business goals, we looked at retainer billing, but ultimately realized that this could have some issues if clients were asking for services beyond the retainer’s limits.

We then tried value-based pricing because it would give us the ability to scale our practice. Value-based billing is essentially based on the cost it would take to replace a virtual CFO and their team. This methodology was perfect, but didn’t necessarily streamline the actual billing process.

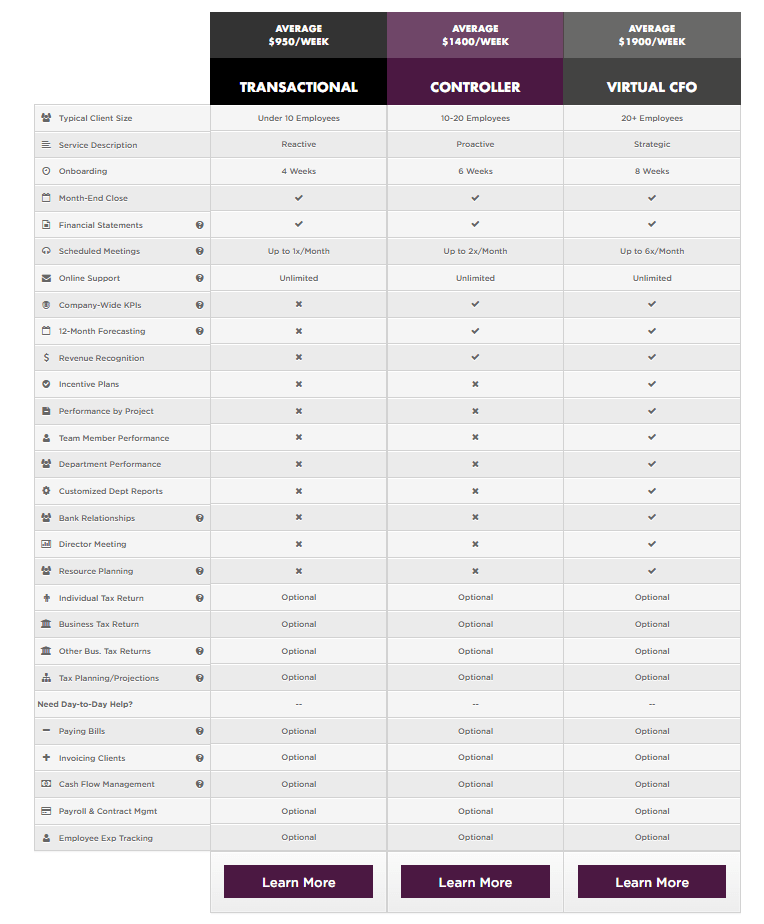

That’s when we combined the value-based approach with subscription-based billing. With this approach, we were able to productize our services and create a clear outline of what our services entailed. Subscription-based billing also gave us the opportunity to set up automatic payments with our clients, thereby streamlining our accounts receivable and our client’s accounts payable process. Clients were able to choose service levels that worked for their needs and access a là carte services to add to their subscription.

How we launched a subscription-based billing model

The first real step to building a subscription-based billing model is to productize services. Similar to how Netflix has different service options based on needs and preferences, we have three plans for different business needs and business sizes. You can see these different options below; note that pricing is an approximate value and not exactly what we charge each client. The services listed as "optional” towards the bottom of each list are our a là carte options.