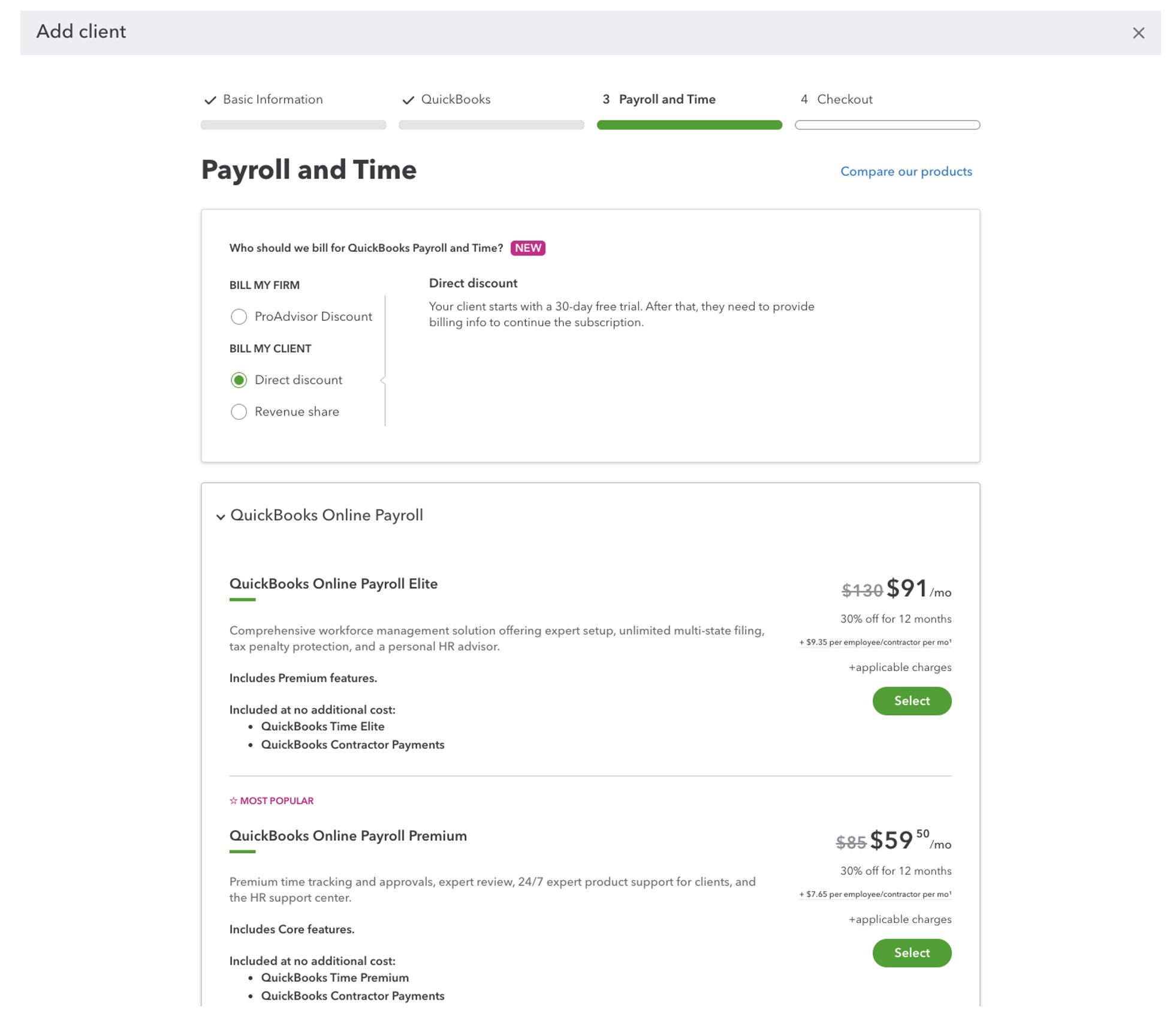

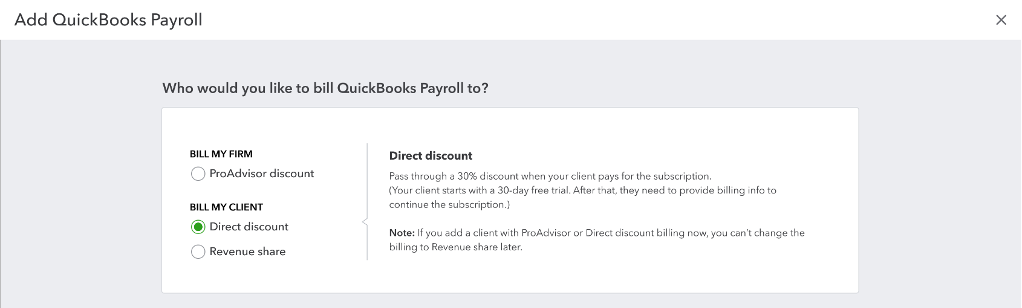

Starting July 8, 2024, you will have more flexibility and control over who pays for your clients’ QuickBooks subscriptions. Through QuickBooks Online Accountant, you can now mix and match the billing options for each QuickBooks product based on what best suits your client and your firm.

This new customization will apply to existing and new clients, and can help your firm standardize your monthly QuickBooks invoice without the complications of variable costs. The ability to split the billing per product might even make it easier for your firm to recommend add-on QuickBooks products to your clients without having to manage the monthly billing and operations.

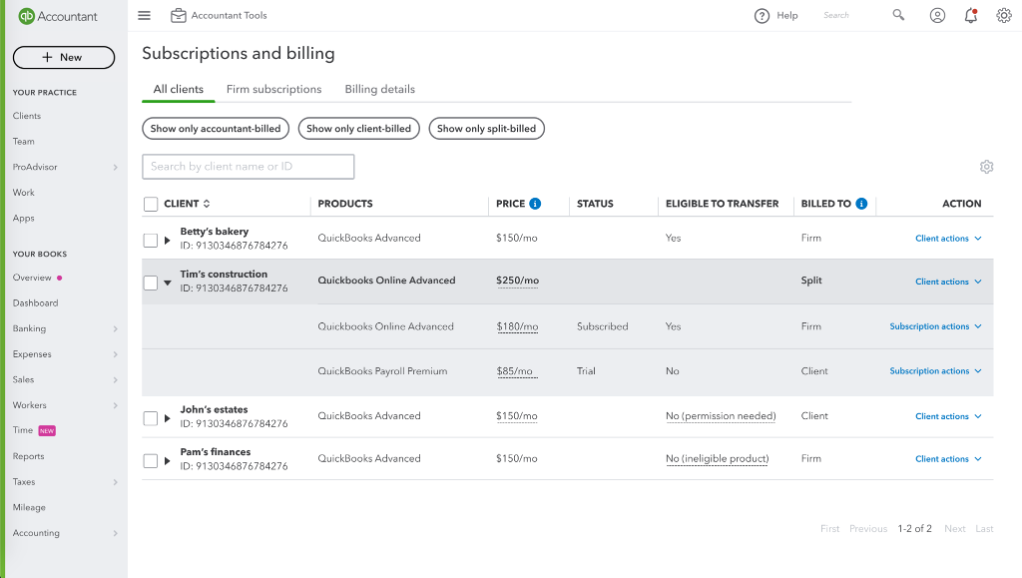

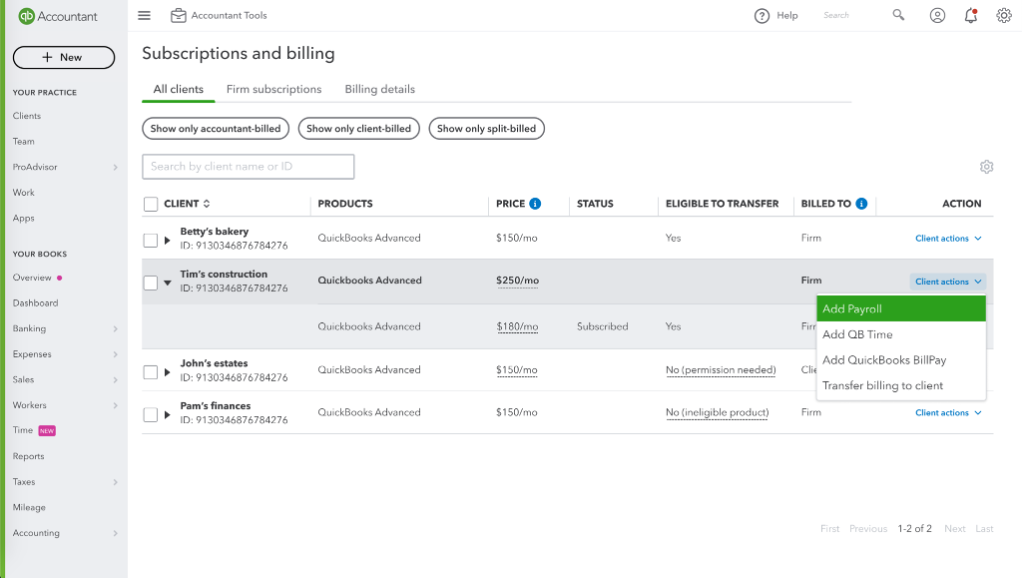

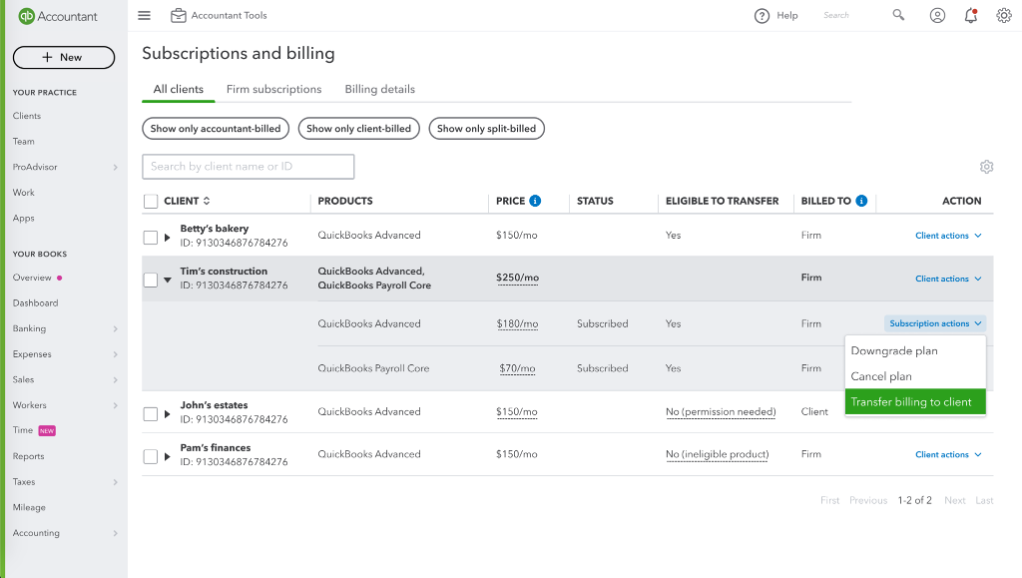

Sign into QuickBooks Online Accountant, and go to Subscriptions and billing to choose the right billing option for each of your clients’ subscriptions. You'll also have the option to select the desired billing options by subscription when you first add a new client.

What is changing?

Rather than billing either your firm or your client for all of their QuickBooks Online subscriptions, you will now be able to select how to bill each product. For example, you can choose to have your clients directly pay for products with variable fees, such as QuickBooks Online Payroll, 1099 filings or Contractor Payments, and QuickBooks Time, while your firm continues to pay for QuickBooks Online.

With the launch of this new feature, you’ll see a major change in the Subscriptions and billing page in QuickBooks Online Accountant. We’ve moved things around to make it easier to manage all of your clients’ subscriptions from a single tab where you can easily filter your client list based on how their subscriptions are billed: accountant-billed, client-billed, or split-billed.