As you wrap up the final month of busy season, you can take heart in knowing you’re helping each and every client. April is Financial Literacy Month, and we recognize your hard work in helping business owners better understand finance and gain stronger financial standing. In case you missed them, be sure to share these free tax resources with your clients—and catch up on this month’s updates below.

QuickBooks Online new features and updates—April 2025

Share these QuickBooks updates with your associates and clients on the latest innovations relevant to business owners and admins.

Table of contents

Table of contents

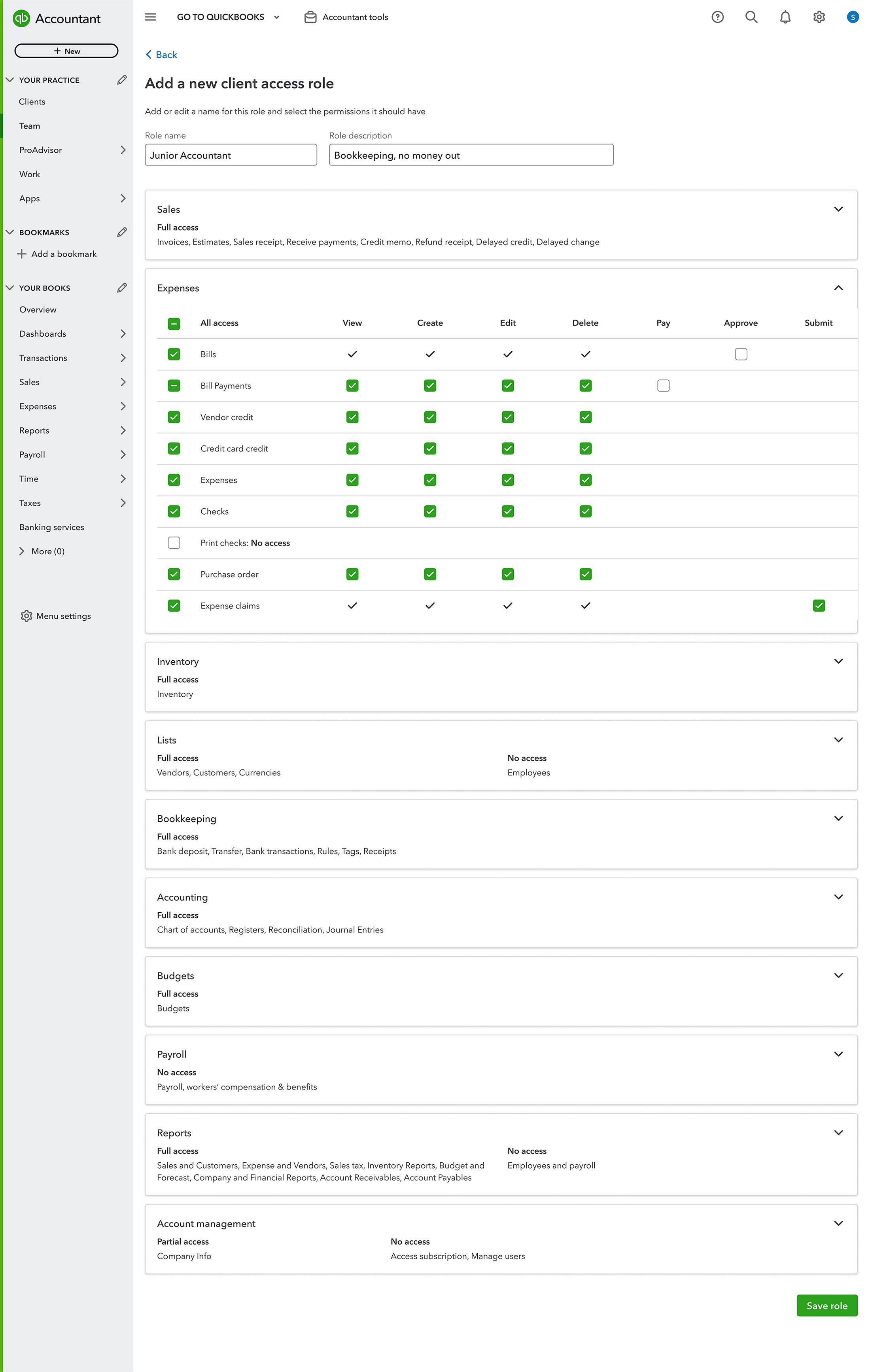

Assign more granular role-based access and permissions to clients’ books

In a nutshell: Set more precise permissions for 14 more QuickBooks Online Accountant features, and customize them for your team members’ needs.

Rather than staying limited to predefined roles, now you can edit and create custom roles that allow permissions for the creation, editing, viewing, and deletion of 14 additional features.

As your firm grows, delegating work and limiting team members’ access to high-risk activities and sensitive data becomes more important. To properly balance workflow efficiency and data security, you’ll need more granular custom roles.

With the updated permission controls in QuickBooks Online Accountant, you’ll have the flexibility to grant firm users the specific permissions they need. You’ll also get the control and peace of mind knowing your workflows can run efficiently and your clients’ sensitive data can remain more secure.

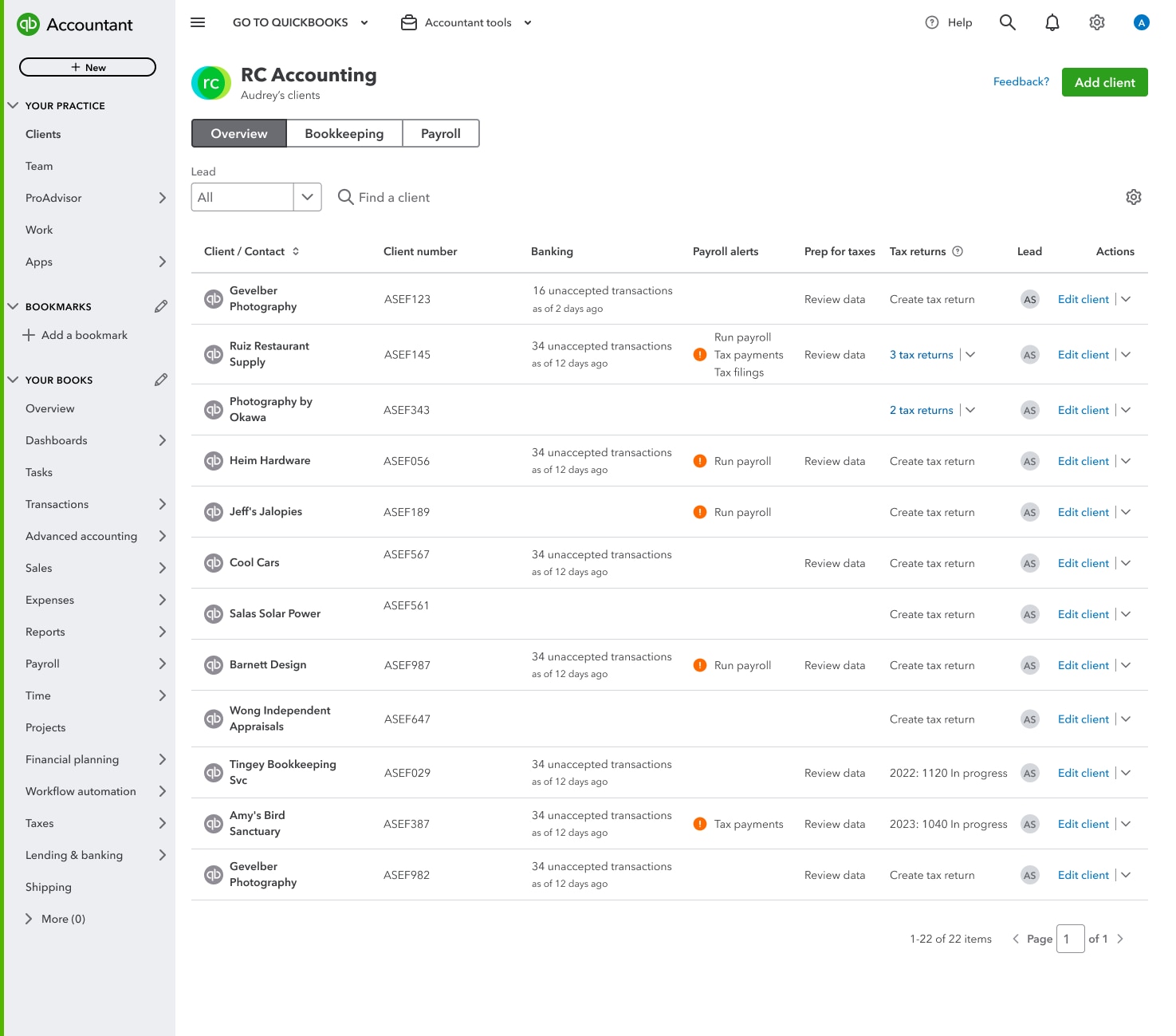

Set custom client IDs in QuickBooks Online Accountant

In a nutshell: Track clients with your own internal tracking identifiers by using the new custom client ID field.

You can add the IDs you’ve given your clients to QuickBooks Online to help your firm:

- Search by client ID

- Streamline client tracking in QuickBooks Online Accountant

- Locate clients and navigate directly to their QuickBooks data

You can add your client’s ID either by editing an existing client or when you add a new client. Then, you can choose to display the client ID field on your client list and search by client ID.

Latest updates released in Intuit Enterprise Suite

In a nutshell: Check out all the latest updates to Intuit Enterprise Suite.

Intuit Enterprise Suite delivers a scalable, integrated multi-entity platform designed to enhance productivity and profitability that you can use to help clients with complex needs.

We’re excited to share several updates in the March release, including:

- Multi-entity accounting and financial management: For example, simplify multi-entity allocations by pre-assigning accounts for your client’s intercompany transactions. Afterwards, you or a team member can allocate these transactions across entities directly from the bank feed, expense form, or bills—whether equally or in percentages you set.

- Dimensions and business intelligence: For example, dimensional P&L forecasts help you evaluate revenue and expenses by your clients’ predefined dimensions, to pinpoint profitable areas and highlight areas that need attention. Use historical data or your existing budget to generate precise forecasts of up to 3 years, and customize them by applying rules to various dimensions and classes.

- Industry-specific customizations: For example, create customizable, flexible project budgets to track your client’s project data from one connected system and get real-time insights into project financials. You can also import a budget from a spreadsheet, assigning dimensions to line items and using AI to help find and address duplications and mismatches along the way.

- Workforce management: For example, expanded retirement partnerships can help clients attract and retain top talent by allowing them to offer comprehensive 401(k) benefits packages from Human Interest that are designed for both nonprofit and for-profit businesses and provide a wide range of investment options.**

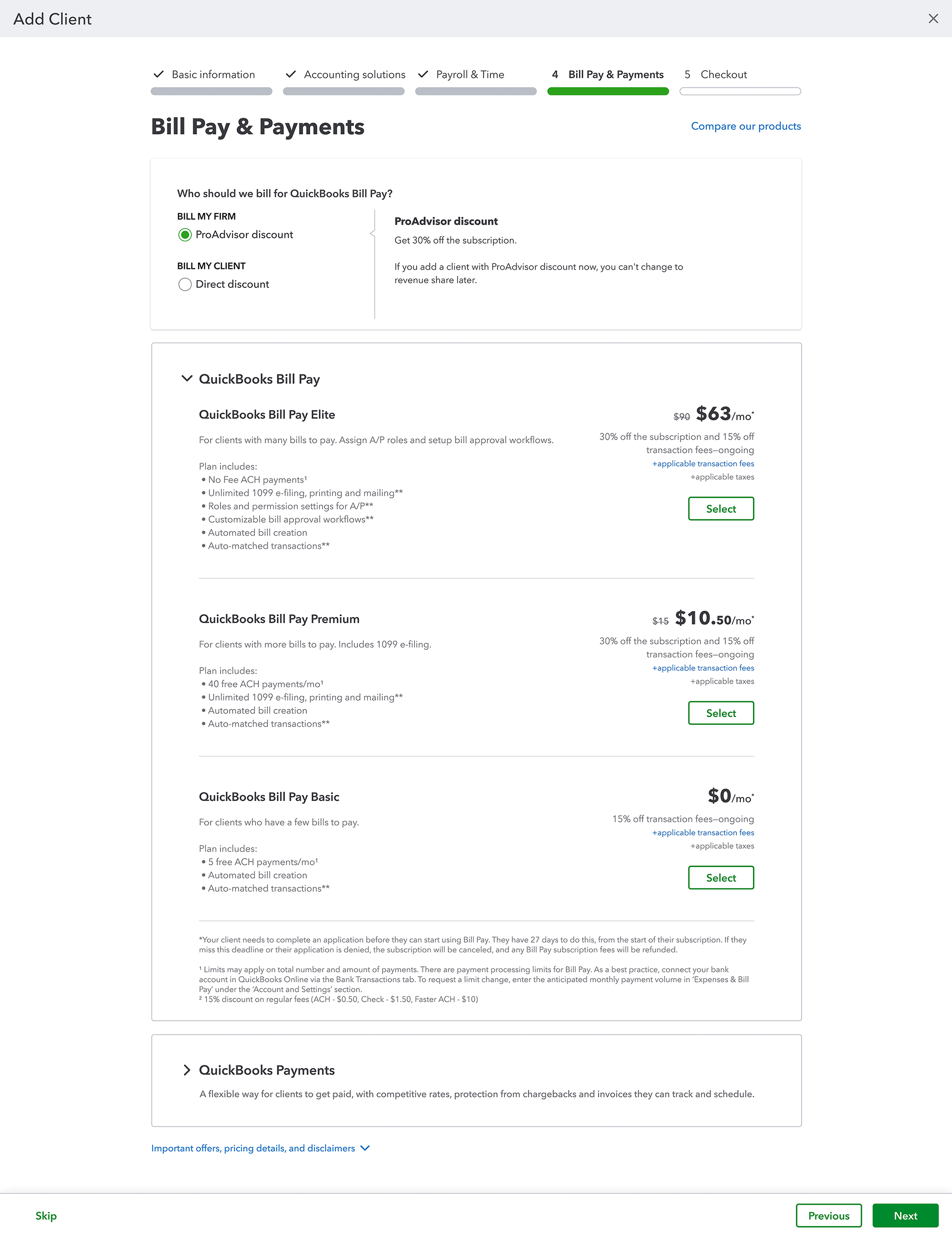

Adding QuickBooks Bill Pay for new clients and optimized processing limits

In a nutshell: You can now add QuickBooks Bill Pay while setting up a new client account within the Add Client process.

You’ll find this option in the Bill Pay & Payments step while signing a client up for QuickBooks. This way, you can avoid having to remember to add Bill Pay afterwards for your new client.

You can now also request a new optimal processing limit for their business directly in their QuickBooks Online, ensuring they can pay with confidence from the start.

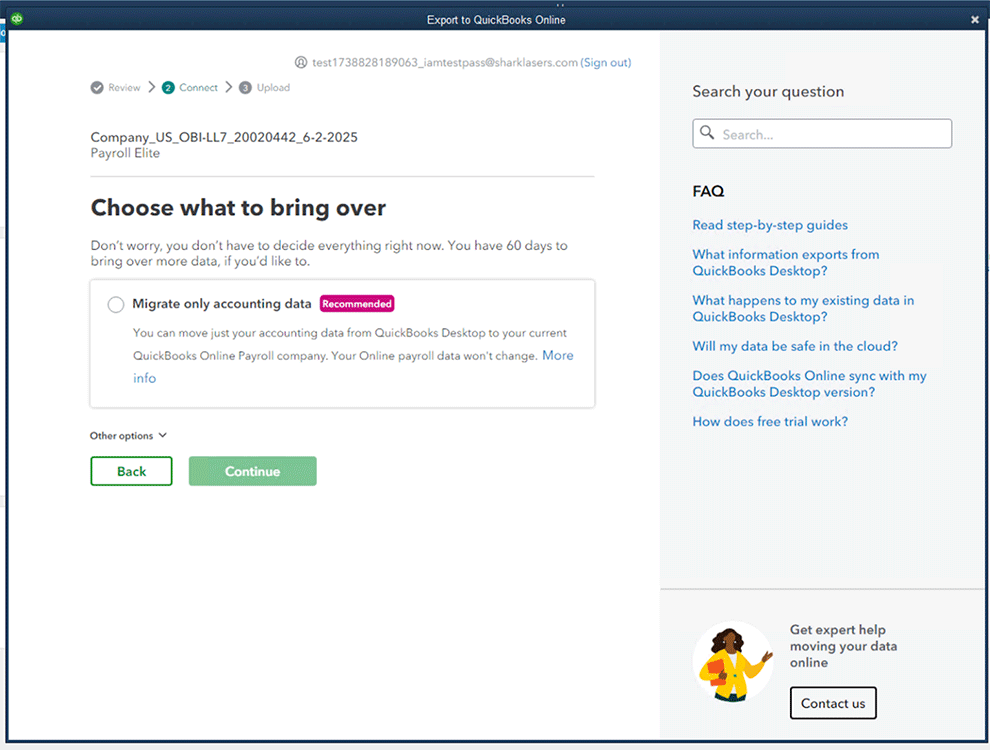

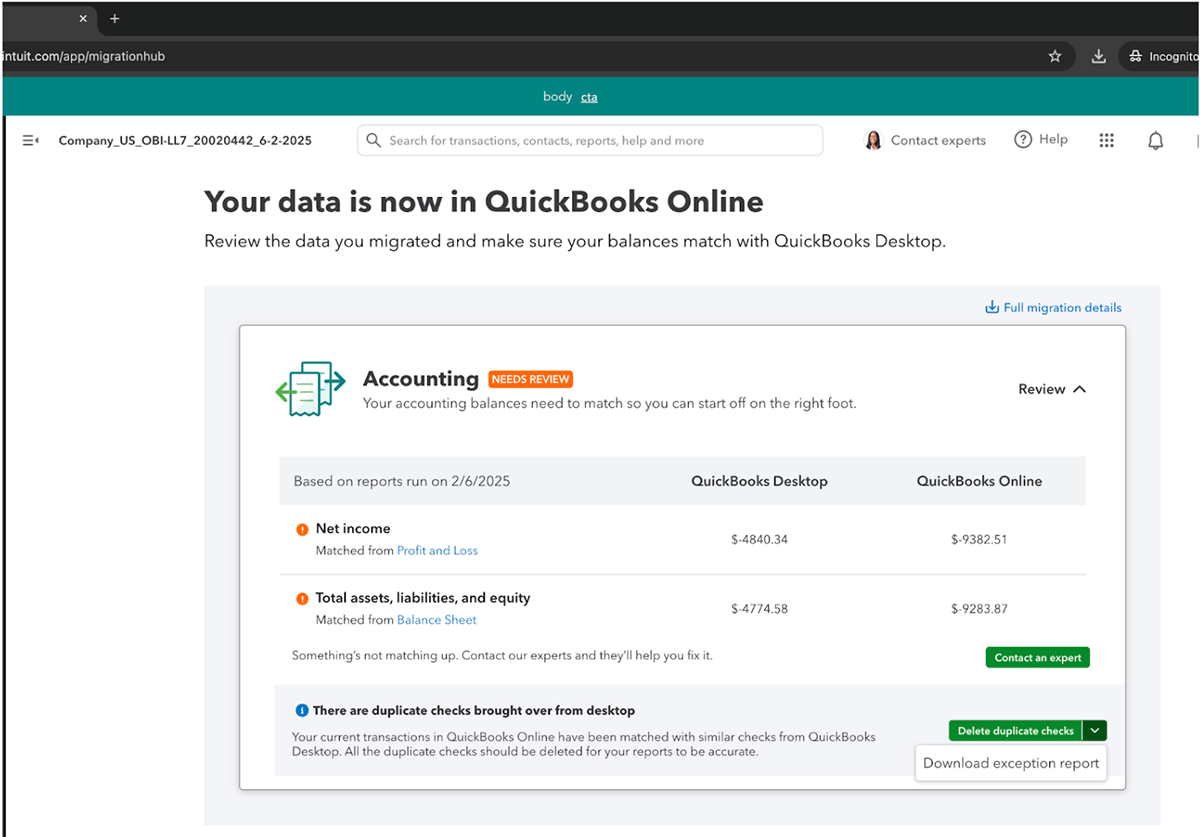

Bring together Desktop data and Online Payroll data in QuickBooks

In a nutshell: Migrate QuickBooks Desktop data into an existing QuickBooks Online Payroll company file without having to create a new QuickBooks Online account.

In response to feedback, migration is now more flexible. Your clients who use QuickBooks Online Payroll can now migrate more seamlessly to QuickBooks Online from Desktop without having to maintain two company files.

Rather than managing a client’s payroll and accounting separately, or forgoing payroll data and starting fresh with a new subscription, you can bring it all together in QuickBooks Online.

Note: This option is available to businesses with existing QuickBooks Desktop and QuickBooks Online Payroll subscriptions who are migrating to QuickBooks Online.

ProAdvisor annual recertification

QuickBooks Online has had another big year for innovation, adding and updating features that can help you improve client service. Recertification helps you keep your product knowledge sharp and helps firms like yours build upon a solid foundation for long-term stability and growth. This year’s training and exam contain updates on exciting new innovations, including QuickBooks Online Accountant, Intuit Enterprise Suite, and Intuit Assist.

Learn more about the recertification process, including deadlines and answers to your frequently asked questions.

The window to recertify is April 28–June 30, 2025. Prepare for the exam and learn about innovations in QuickBooks by joining our virtual conference on May 14 or visit self-paced training in ProAdvisor Academy, which will be live starting April 28.

1,000+ third-party app integrations with QuickBooks Payments

In a nutshell: QuickBooks Payments integrates with more than 1,000 third-party apps, allowing your clients to use them in more channels where they do business.

QuickBooks Online customers do not need to sign up for another payment provider. QuickBooks Payments transactions automatically reconcile with QuickBooks, reducing time spent on admin tasks.

To take advantage of this broad collection of integrations, you or your client can choose QuickBooks Payments as their payment gateway in the participating platforms they use for their business, including Chargebee, available in the App Store. Payments they receive in those platforms will then be processed through QuickBooks Payments and auto-matched in their books.

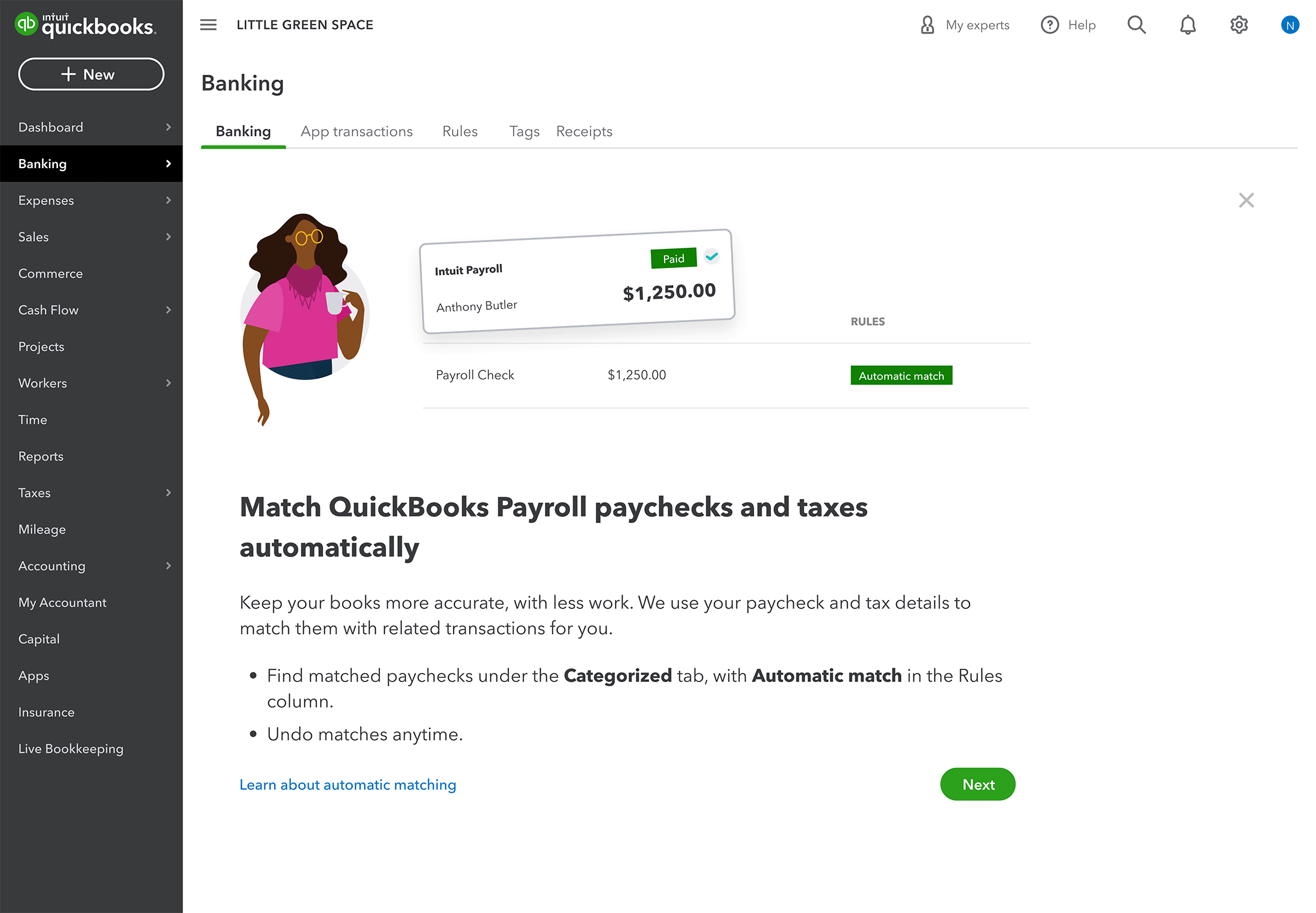

QuickBooks Online Payroll tax payments auto-matched

In a nutshell: QuickBooks Online will now automatically match each of your client’s payroll tax payments through QuickBooks Online Payroll to its corresponding bank transaction, while avoiding the time-consuming bookkeeping task of manual reconciliation from the bank feed.

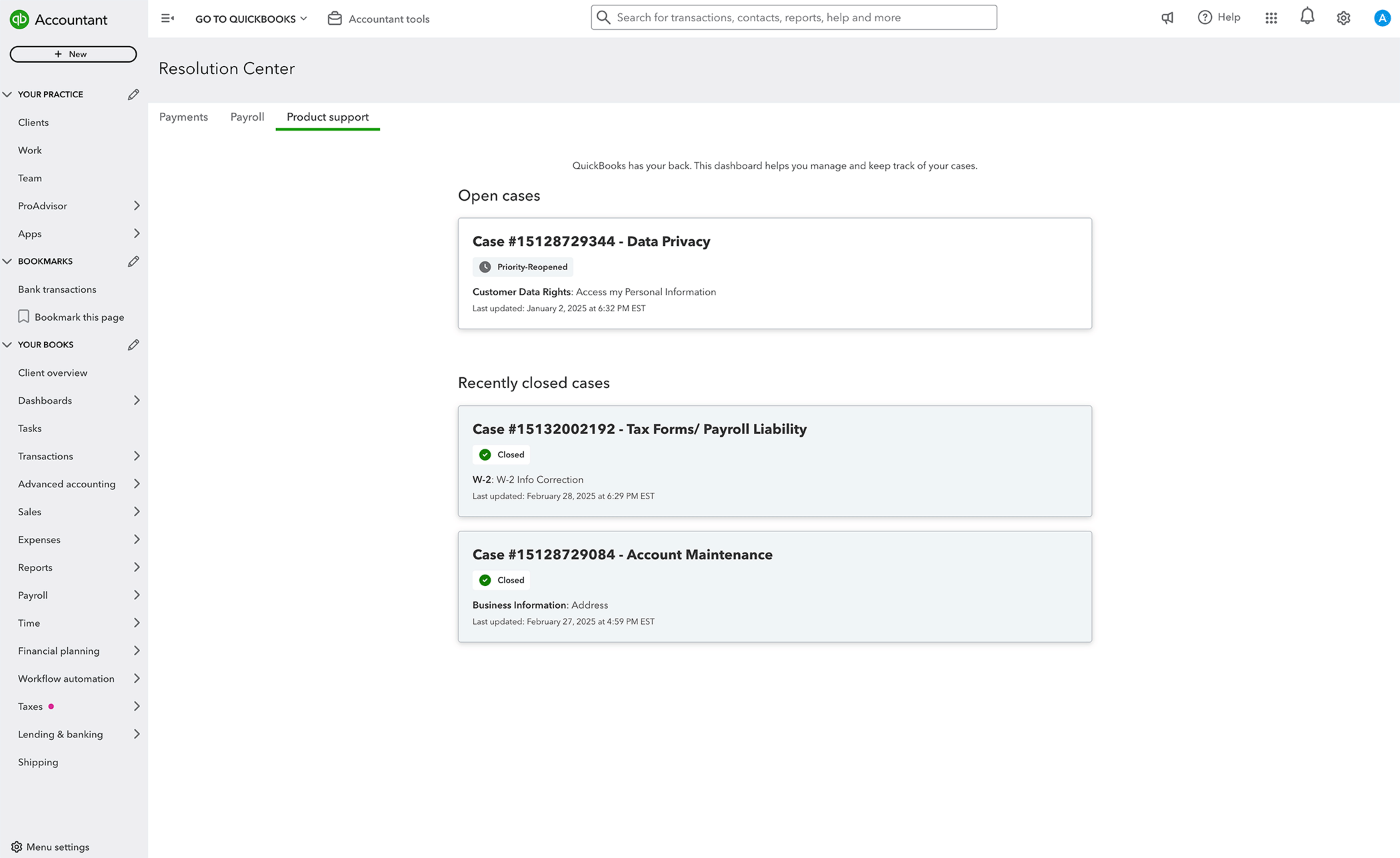

Resolution center in QuickBooks Online

In a nutshell: You and your clients can get an end-to-end view of their support cases in the new QuickBooks Online Resolution center.

To see it, select Settings ⚙ and then Resolution center. There, you’ll find a list of all open cases and cases closed within the last 30 days.

This enhanced transparency and visibility will help your clients track their in-progress product support cases and feel confident they’re getting resolved. This will also help to prevent added questions to you and your team.

Amazon Business integrates with QuickBooks

In a nutshell: Track clients’ Amazon Business purchases in QuickBooks Online, with no manual entry required.

Amazon Business combines the selection, convenience, and value customers have come to know and love from Amazon, with unique benefits designed for small businesses. Adding the Amazon Business Purchases app* to QuickBooks provides an enhanced level of integration with Amazon Business.

Then, in QuickBooks, you and your clients can:

- Seamlessly review transactions for their Amazon Business purchases and returns before adding them to the books

- Categorize each item separately and match them to bank or credit card records

- View detailed Amazon Business expenses, with product descriptions, item costs, and fee breakdowns for each transaction

Note: A QuickBooks Online admin who is also the primary Amazon Business admin can enable the Amazon Business Purchases app for the account.

Recommended for you

Get the latest to your inbox

Get the latest product updates and certification news to help you grow your practice.

Thanks for subscribing.

Relevant resources to help start, run, and grow your business.