August is here … and the end of the summer is near. But don’t worry—we’ve got some new time-saving updates so you can focus on enjoying the rest of the summer.

Share QuickBooks updates with your clients—send them this link for QuickBooks innovations relevant to business owners and admins.

In the Know Webinar

Register today for the next In The Know Webinar on Thursday, Aug. 17 at 11:00 AM PT, a monthly webinar for accountants to learn more about the latest and greatest product feature updates. This month, we’ll unveil a new navigation bar that will help improve your workflow and share an update on how to improve tax filing accuracy with direct access to the IRS Transcript.

Your Feedback in Action

Your Feedback in Action is a regular series of articles where we share product updates specifically driven by feedback from accountants. See our July edition for the latest updates.

What’s new in August

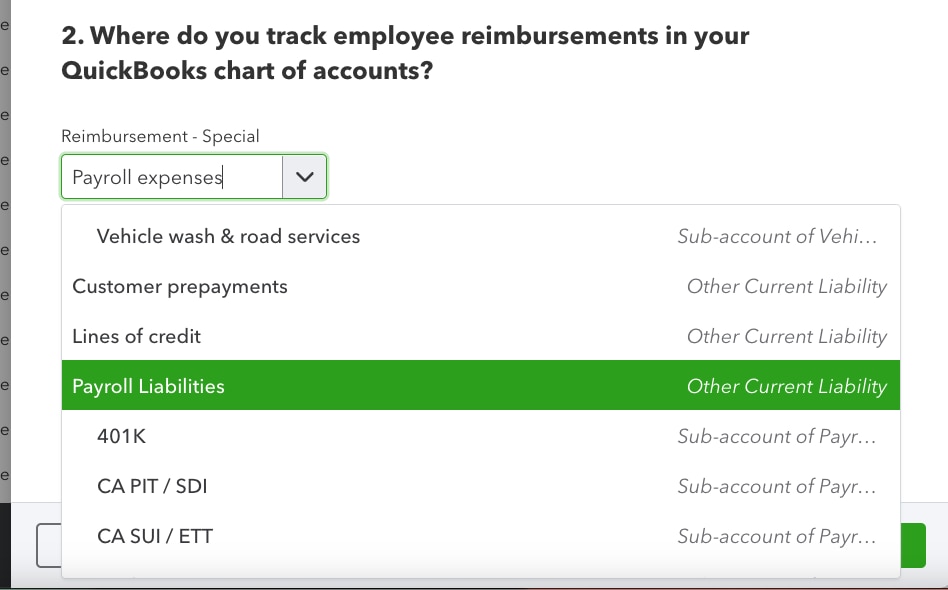

More account mapping flexibility in QuickBooks Online Payroll

Seamless payments data migration from QuickBooks Desktop to QuickBooks Online

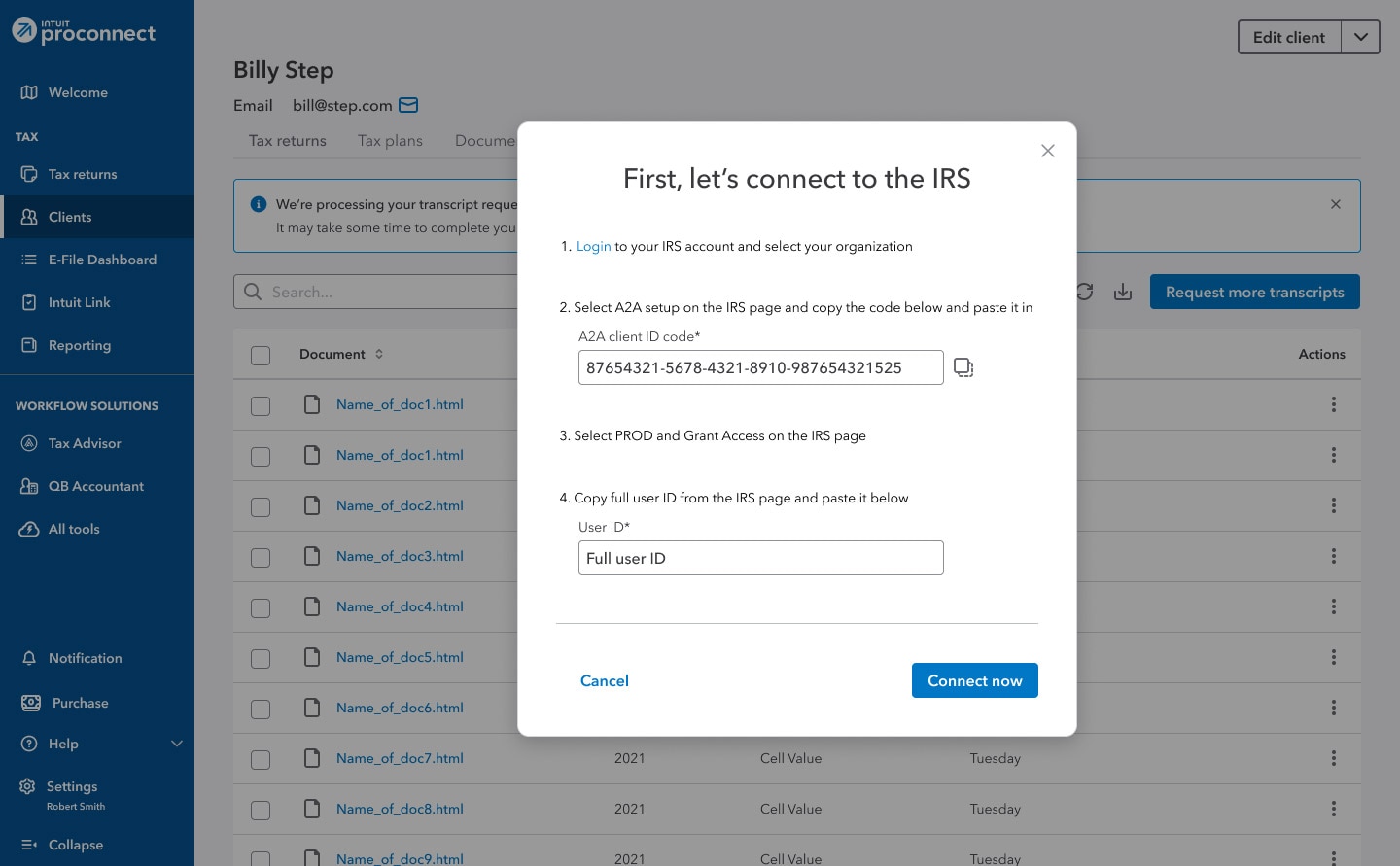

IRS transcript direct access in Intuit ProConnect Tax

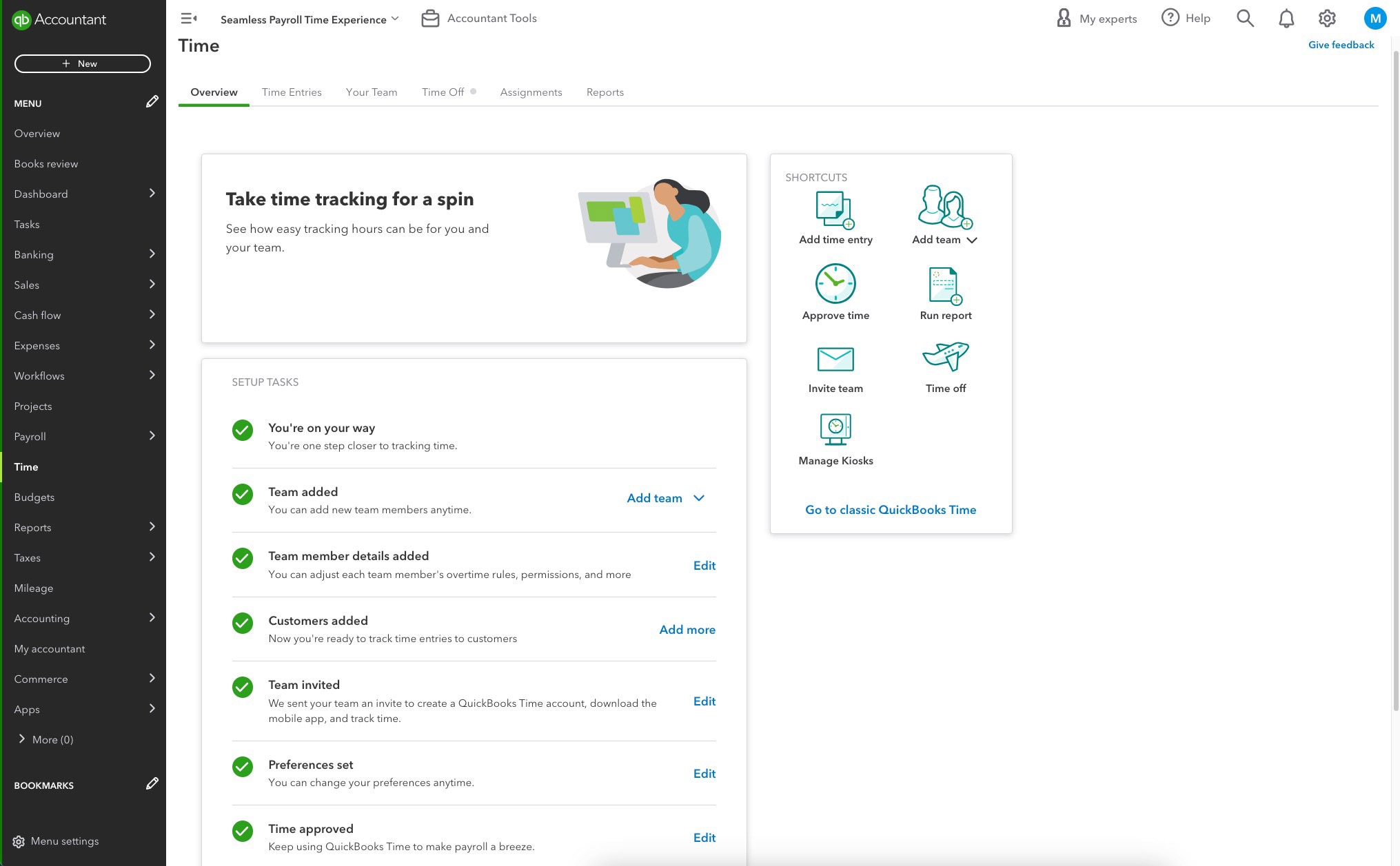

Do more with QuickBooks Time inside QuickBooks Online

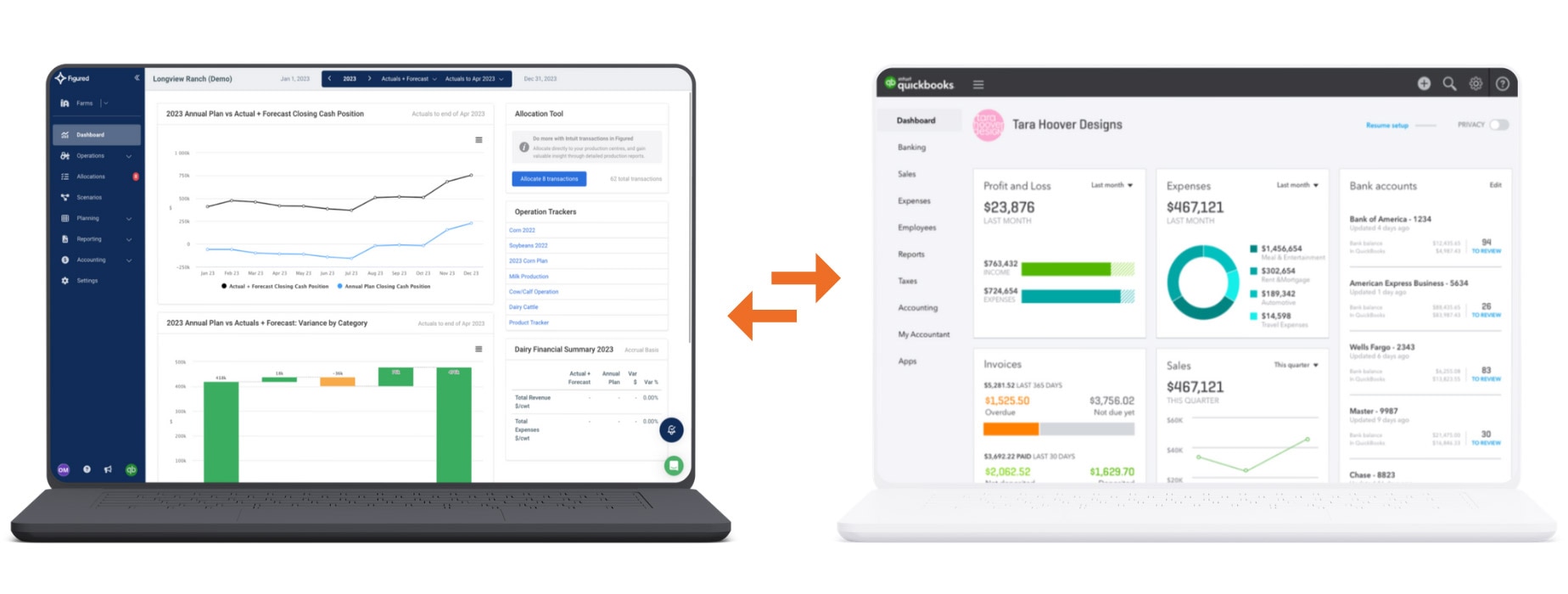

Smart farm management with Figured + QuickBooks Online

Fixed asset accounting in QuickBooks Online Advanced