There’s no question that QuickBooks® offers robust automation. The options are endless, including automation of bank rules, automatic emailing of scheduled reports, and tasks and workflows. The goal is to allow accountants and business owners to “set it and forget it.”

Nothing is more rewarding than having your bookkeeping done for you while you are going about your day. Your bookkeeping can be done for you automatically and accurately.

QuickBooks Payments is a prime example of how the deep integration of services can take a lot of the guesswork out of the activities that occur after an invoice is sent, paid, deposited, and reconciled.

Many businesses prefer to pick and choose the applications they use for their business. However, challenges arise when a company uses other services instead of using QuickBooks for all of its services.

QuickBooks does many things well, but it can’t specialize in everything. As a QuickBooks Solution Provider, we see companies coming to us with a “Frankenstein” of workflows and processes—some applications talk to each other, but many don’t. We are often faced with finding a way to bridge these communication gaps so that they can talk to each other.

Not all apps are created equal. The phrase “integrates with QuickBooks” is tossed around like “free-range” eggs. Fun fact: Did you know that to be considered “free range,” the farmers merely have to provide the “opportunity” for the hens to be outdoors? Actually, the hens don’t have to be outdoors. They could feasibly have the same chicken coup conditions with an “open door” policy. Whether the hens take them up on that is another story. So, just like free-range eggs, “integrates with QuickBooks” requires some investigation so that the user understands the expected outcome.

Here are some questions to help with that:

- Which version of QuickBooks are we talking about here? Is it QuickBooks Online or Desktop? If it’s a different platform, does that warrant switching platforms? If the integration is such that it makes sense to switch, what other services or workflows would be affected by that change?

- Is the integration one direction or bi-directional? The best integrations are those where it doesn’t matter where the data entry takes place. If you create a customer in QuickBooks, does it show up in the App, and vice versa?

- What kinds of transactions are created by the integration? If the transaction it makes is a journal entry, there are a LOT of QuickBooks workflows that would be missing out. Sales tax, sales reports, accounts receivable, and accounts payable features could potentially be bypassed by the way the app is sending transactions to QuickBooks. While this could be a workable solution, you will want to know that ahead of time.

- What about reversing the integration? If an error is made, can you edit the same transaction, or do you have to delete and reenter? The best apps will allow you to edit the same transaction after a change is made, but if you have to manually delete a transaction in order to resend the transactions again, that could be bothersome.

- How often does a synchronization happen? Is it real time, on a schedule, or does the integration need to be initiated manually? The answer to this question will play a part in how you work with the app.

Once you have the answers to these questions, you will have the framework to work with the app. The best integrated apps are bidirectional, sync automatically, and allow you to pull back what was sent to make corrections and resynchronize. That doesn’t mean that an app is garbage if it doesn’t do that, but just be aware of what you are in for.

Case study for Frankenstein affiliate payments

Our company was retained to solve a dilemma with a partner program that uses many applications, including QuickBooks and other applications. Unfortunately, the programs are not talking to each other, which has made the process tedious and disjointed. Anyone with an affiliate payment can attest to the nightmare of sending and receiving payments.

Our client has an extensive nationwide network of professionals and needs to pay commissions monthly. The client currently uses an accounts payable management program to make payments to that network. The problem arises because the client receives a lump sum payment from their sales each month. In order to pay affiliates for their respective sales commission, the client is tasked with identifying each sale for every secondary affiliate. Then, when the reporting is finalized, the client sends payments to each affiliate. This takes countless hours each month due to the large number of transactions required in QuickBooks Enterprise.

There are three pain points in automating this process that must be overhauled:

- Reconciling payments received is a nightmare. The amount of time it takes to reconcile payments received from the third-party vendor is staggering. The affiliate commission opportunities are stacked, complicating the process even more, so if an affiliate refers a partner, they are paid an override for each sale that the referred person processes.Therefore, each large payment has to be reconciled against which referral is being paid out, and then confirmed to who the referral belongs. The client has no way to automate this and has been calculating commissions manually, making the process extremely burdensome.

- Bill.com functionality is limited. After reconciling the payments due to each partner, the client is ready to send out the commissions. Payments to the clients’ affiliates are imported into Bill.com as a bill, so that the client can pay commissions and the details of each sale are included when imported. However, the payment processor’s restrictions when sending the payments do not allow the description of each sale to be included on the invoices.The client has been using a workaround because the affiliates want to know which sales they receive payment for. The client has resorted to a convoluted method of using a 12-character reference field to provide that detail, which has its own set of challenges. Because the reference number must be unique, the residual payments also have to be unique, thus limiting the characters available. Typing out the unique 12 characters for each affiliate is additional unnecessary work for the client.

- Secondary affiliates have to account for those payments. The secondary affiliates need to know the exact sales they are being paid for and any referral commission, so that they can track their sales in their own company QuickBooks file.

Due to the complex requirements, the client can’t just rip off the Band-Aid and start over, without carefully considering all of the processes in place. Questions that begin with “Why don’t you just use ‘Y’?” are quickly met with “Because of ‘X’!!!”

You eat an elephant one bite at a time, so we decided to approach this project by dividing the challenges into three “bite-sized” sections. In order to be a successful solution, the proposed solution needs to work within the current workflows and be adaptable to possible changes that may occur in the future. No problem, right?

Begin at the end

We decided to begin at the end because it would have the greatest impact on the largest number of people, without the upheaval of current processes.

We were trying to find a way to create trackable invoices for the affiliates, so that they can import their invoices into their QuickBooks. In a perfect world, when our client has a commission to pay an affiliate, the affiliate would have an open receivable in their books, awaiting a future payment. There are additional barriers due to the QuickBooks Business Network and security features. However, QuickBooks and other networks are continuing to automate the process. As we described, the client is currently initiating a payment to an affiliate, and the affiliate receives an invoice that has no details of the sales, so the client had to look for a new solution.

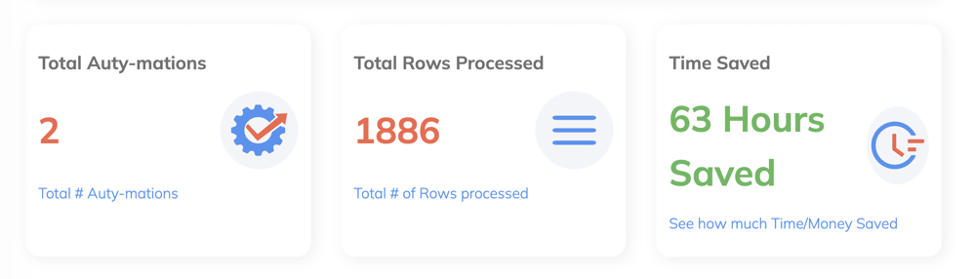

We discovered a new entry in the bulk transaction space and began working with them with this project in mind. The company is Autymate, and their solution is called Autymate Transactions.

There are several aspects of their integration that we felt were unique in this case:

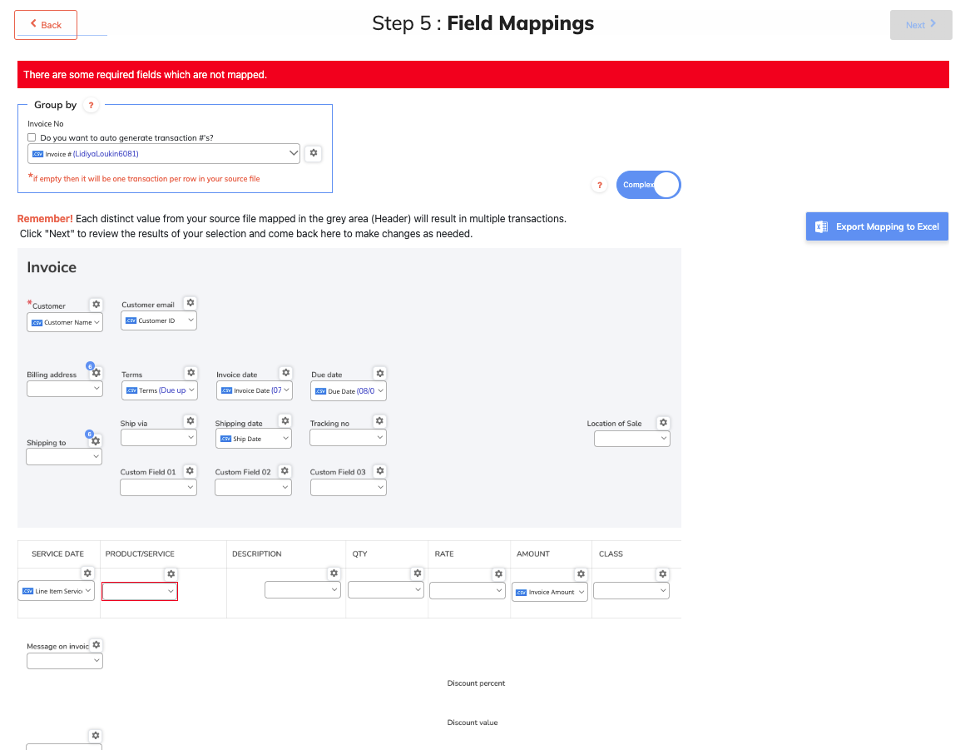

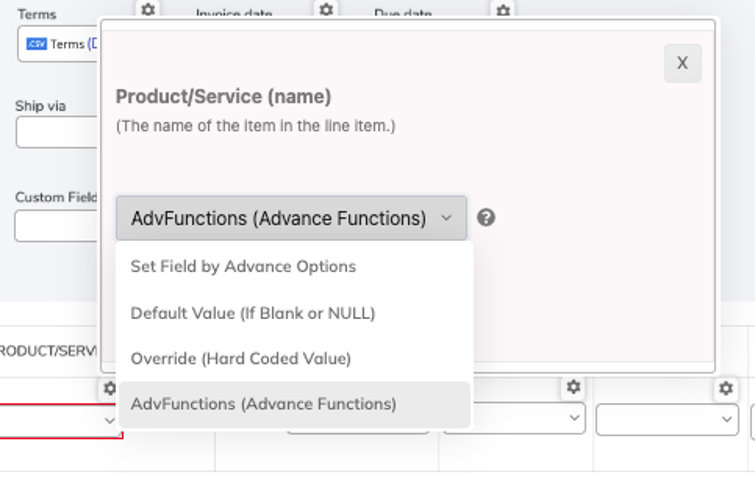

Column mapping simplicity: Their solution shows the type of transaction with the columns mapped to certain fields, helping you ensure what column will be mapped to what field. Knowing what you’re doing in QuickBooks makes it easier to understand what data will go where.