July is Global Enterprise Agility Month, an initiative to emphasize the importance of adapting quickly to changing market conditions, client needs, and new technologies. With so much tech introduced in just the last few years, this occasion offers you a great opportunity to look at incorporating one or two advancements in the near future to help your firm grow. Check out more info on using tech to improve critical business processes and how choosing the right tech can increase the value of your business. Also consider this month’s QuickBooks Online updates.

QuickBooks Online new features and updates—July 2025

Share these QuickBooks updates with your associates and clients on the latest innovations relevant to business owners and admins.

Table of contents

Table of contents

Stay In the Know

Learn about the most exciting innovations. Visit the Hub to watch weekly videos or join us for a live webinar on Thursday, July 17 at 11 AM PT. You won’t want to miss this one that covers a live demo of the new Intuit platform along with some AI agents in action. See you there!

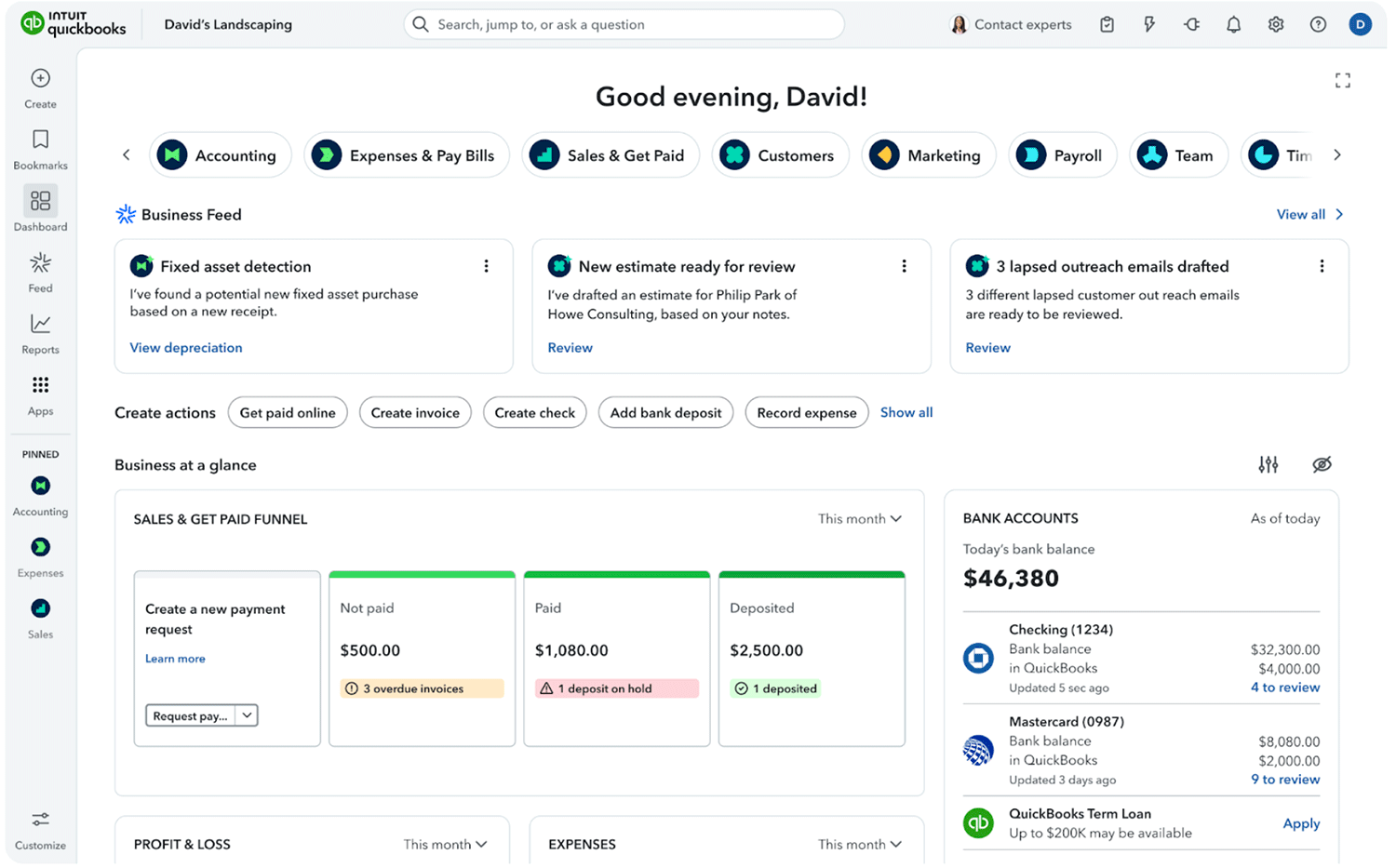

QuickBooks Online enhanced with new Intuit AI agents

In a nutshell: QuickBooks Online now has a more holistic experience with a virtual team of Intuit AI agents to simplify day-to-day work and free up time to collaborate with your clients.

QuickBooks is now enhanced with more powerful features that enable easier collaboration with clients, improved insights, and smarter search. The refreshed platform brings your client’s work into one place, including business feed, customer reports, customer hub, and more.

You and your clients can also use three new AI agents within QuickBooks to help complete essential tasks and strengthen your collaboration. You’ll maintain control to review and approve the work these agents complete for you:

- Accounting Agent helps keep books clean and accurate, and flags what needs approval or attention.

- Payments Agent helps facilitate faster payments and getting bills paid on time.

- Finance Agent analyzes and summarizes financial data to help you stay on track to your goals.

We also plan to introduce a more powerful experience built exclusively for accountants with AI agents designed to help deliver excellence to your clients, save time, and get more done. A beta version is coming this summer. Plan to test drive the new experience and ask questions at Intuit Connect.

Important pricing details and product information

Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For more information about Intuit Payments' money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/.

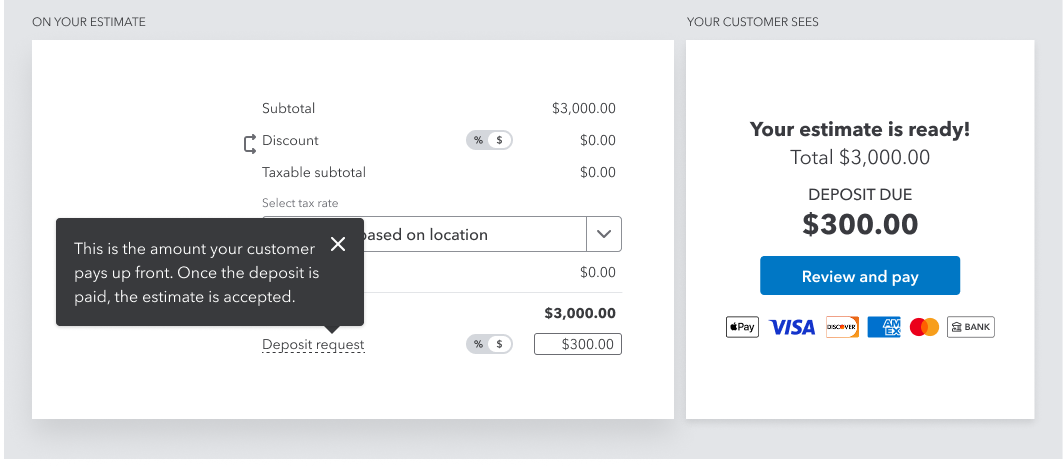

Take deposits on estimates in QuickBooks Online Payments

In a nutshell: Your client’s service-industry or project-based clients can now use QuickBooks Payments to request and accept deposits on their estimates.

Lock in projects faster with instantly payable deposits. Speed up your cash flow by making it easy for your clients to pay with deposits on estimates. With QuickBooks Payments, you can send customers an estimate with a deposit they can pay online right away through our secure online portal.

With real-time tracking of upfront payment, you can see when customers view and pay their deposit to get a clear view of your cash flow, minimizing financial risks at project start.

Note: Limited availability. Features may be more broadly available soon.

Important pricing details and product information

Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For more information about Intuit Payments' money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/.

**Product information

QuickBooks Payments: QuickBooks Payments account subject to eligibility criteria, credit, and application approval. Subscription to QuickBooks Online required.

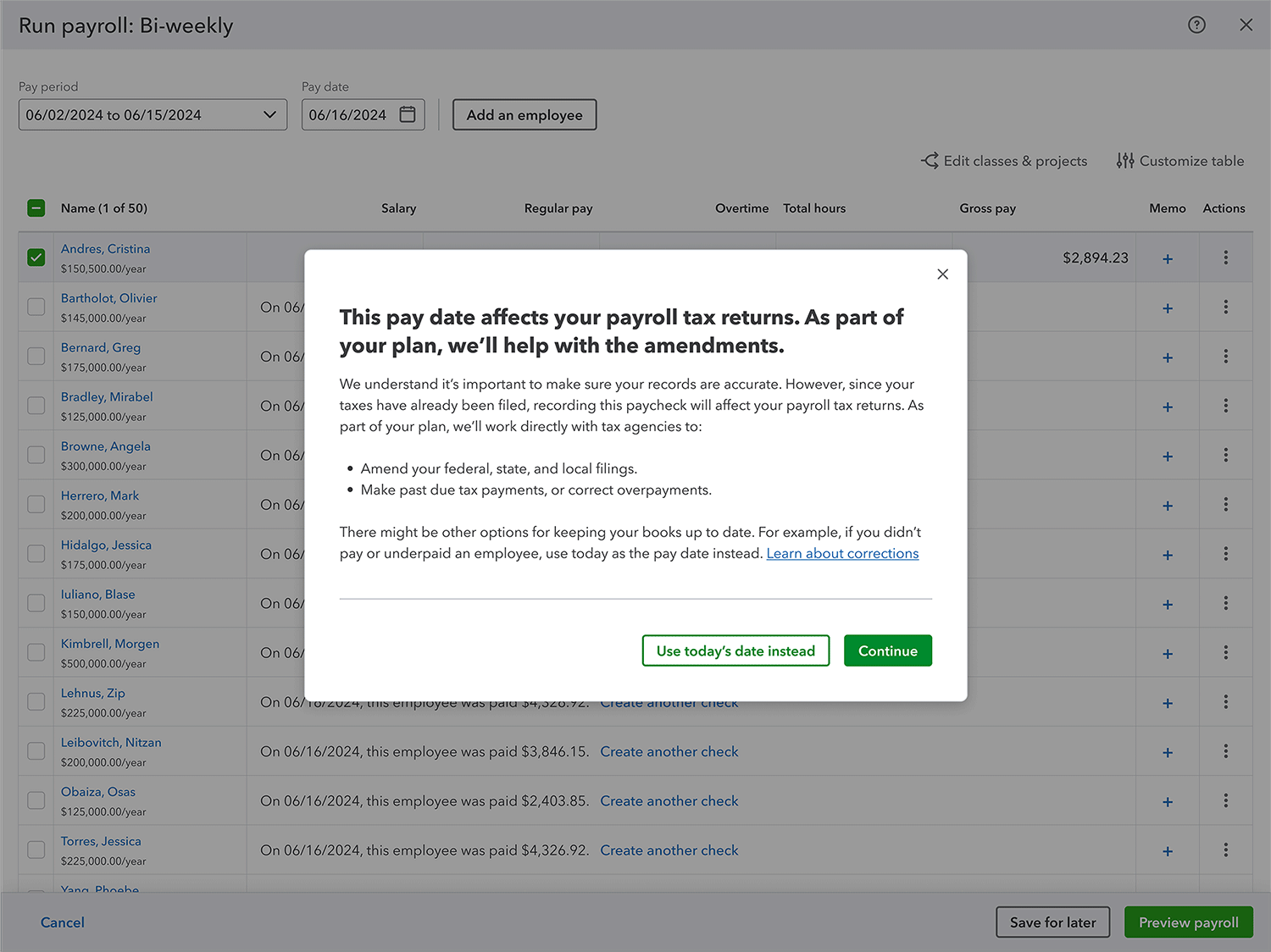

Correct paychecks for closed quarters in QuickBooks Online Payroll

In a nutshell: You and your clients who use QuickBooks Online Payroll can now edit, void, and record past paychecks for a closed quarter.

This enhanced flexibility to make paycheck changes can give you more confidence at every pay period throughout the year. You’ll be able to make the paycheck corrections you need without spending extra time on manual workarounds or calls to customer support. After recording a past paycheck, you will also be able to sync the additional transactions to the Chart of Accounts.

In addition, clients using QuickBooks Online Payroll Premium and Elite can request an amendment in QuickBooks, and we will work directly with tax agencies to amend and process payments for the necessary payroll taxes.

Important pricing details and product information

Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For more information about Intuit Payments' money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/.

**Features

Paycheck corrections: Limitations may apply. Customers are responsible for any penalties and interest that may be assessed for late tax payments, unless subject to the Tax Penalty Protection program. Limitations may apply.

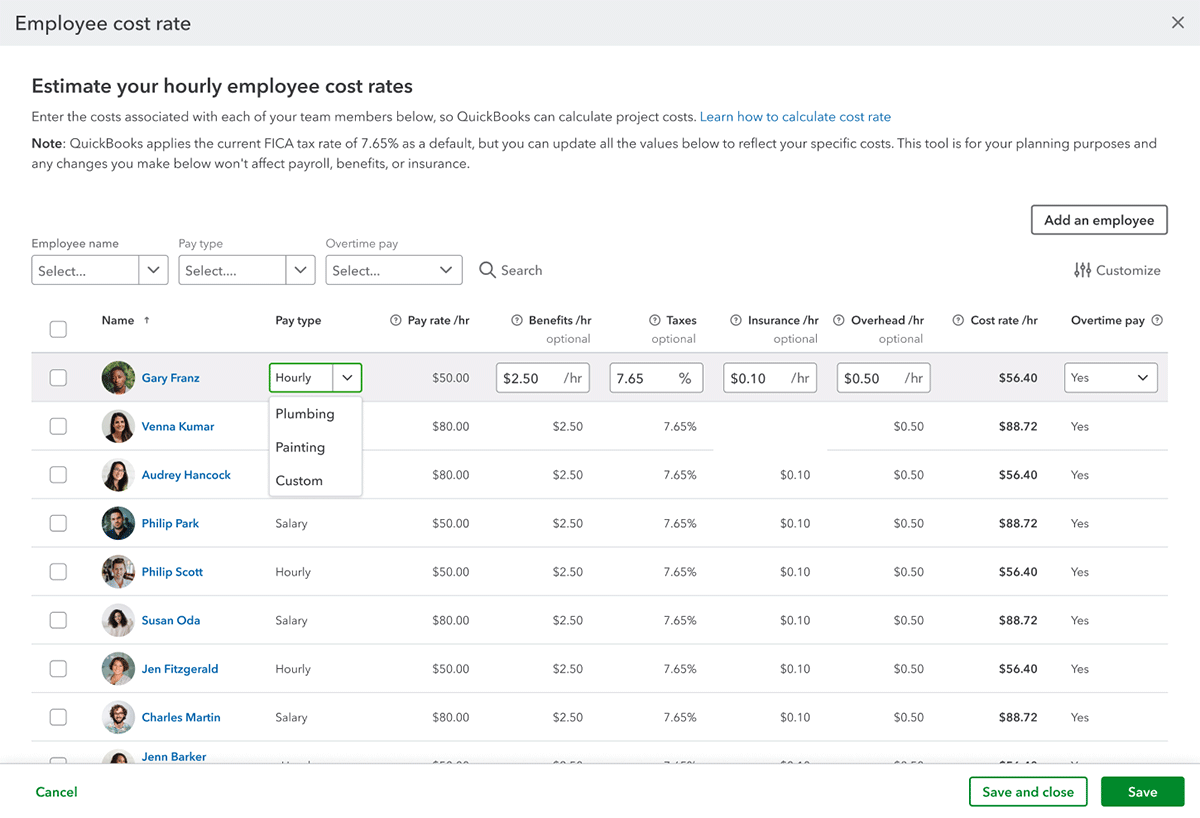

Employee cost rate calculator

In a nutshell: Your clients using QuickBooks Online Plus and QuickBooks Online Advanced can now calculate cost rates through a built-in calculator that syncs with QuickBooks Online Payroll.

Project-based clients can now more closely track project profitability in real-time using employee cost rates—without depending on third-party or tedious manual solutions. This new cost rate calculator will provide entry fields for common factors, including pay rate, benefits, taxes, insurance, and overhead expenses. For those using QuickBooks Online Payroll, employees’ pay types and pay rates will automatically appear in the calculator. In most cases, taxes will default to the standard FICA rate (7.65%) for US customers.

Once calculated, cost rates will automatically apply to time events added to Projects. After that, you or your client can address organization-wide changes in benefits and overhead by updating cost rates for multiple employees at once.

Note: The employee cost rate calculator does not yet calculate overtime cost rates.

Important pricing details and product information

Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For more information about Intuit Payments' money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/.

Underlying sales tax rates are estimated based on the location information associated with each individual transaction. Additional factors that may impact sales tax rates include product type, date, and customer type. Tax information needs to be validated prior to submitting to the IRS.

Introducing QuickBooks Live Priority

In a nutshell: Introducing QuickBooks Live Priority, a service providing unlimited specialized product expertise and training for $19 per month.

Sometimes, clients need quick answers to their QuickBooks questions—and now they can get help on demand. QuickBooks Live Priority provides fast access to onboarding and product guidance right in QuickBooks Online whenever they need it, even during evenings and weekends.**

Clients will get quick and thorough resolutions to their questions, and you’ll get the peace of mind that the answers are coming from highly trained QuickBooks experts. It is now available in QuickBooks Online.

Note: In the coming months, accountants will be able to add QuickBooks Live Priority for their clients through QuickBooks Online Accountant.

Important pricing details and product information

Expanded access to specialized product experts is available Monday-Friday 5-7 PM PT and Saturday-Sunday 6 AM-3 PM PT.

Recommended for you

Get the latest to your inbox

Get the latest product updates and certification news to help you grow your practice.

Thanks for subscribing.

Relevant resources to help start, run, and grow your business.