September is the time for wrapping up the quarter and preparing for year-end needs. This pivotal period is a great opportunity for your firm’s team to discuss planning and priorities for next year. To help guide these conversations, take a look at hot topics for accounting firms in 2025. Another topic of interest is growing your firm with client advisory services, which you can explore in this eBook. Along with your discussions, be sure to check out this month’s updates.

QuickBooks Online new features and updates—September 2025

Share these QuickBooks updates with your associates and clients on the latest innovations relevant to business owners and admins.

Table of contents

Table of contents

Stay In the Know

Learn about the most exciting innovations. Join us for a live webinar on Thursday, September 18 at 11 AM PT or visit the Hub to watch weekly videos. Our next show covers updates to Intuit Enterprise Suite and introduces you to the new Payments Agent and Payroll Agent.

A more powerful QuickBooks experience for you and your clients

In a nutshell: Your clients using QuickBooks Online will be getting an all-in-one experience that saves time on tasks, while you’ll get easier ways to move around QuickBooks Online Accountant.

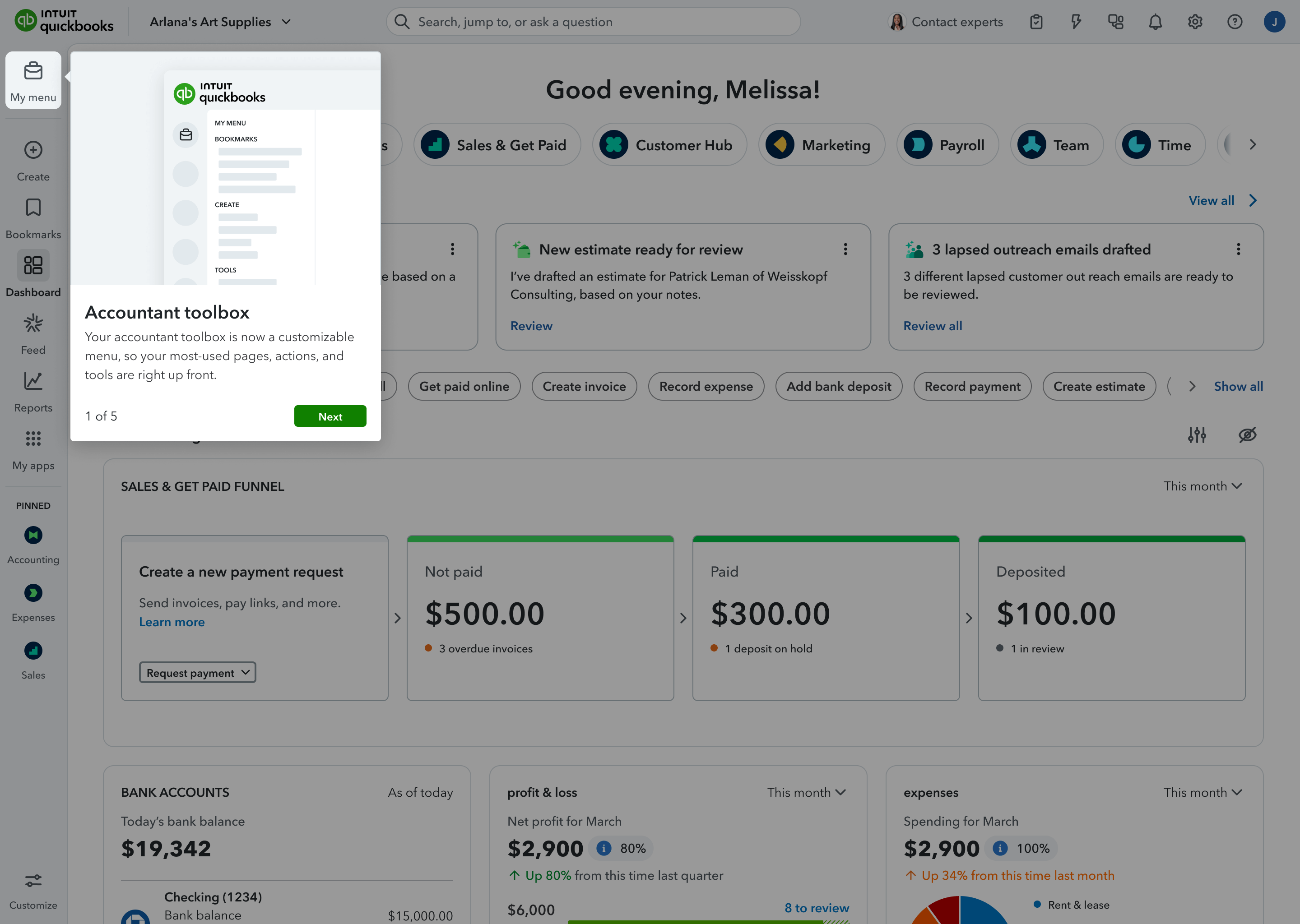

The new QuickBooks Online look and feel has time-saving automations, and an interface your clients can customize with all their favorite features, plus a few new ones. Take a comprehensive guided tour of the new experience from Advanced Certified QuickBooks ProAdvisor Hector Garcia, CEO at Quick Bookkeeping & Accounting.

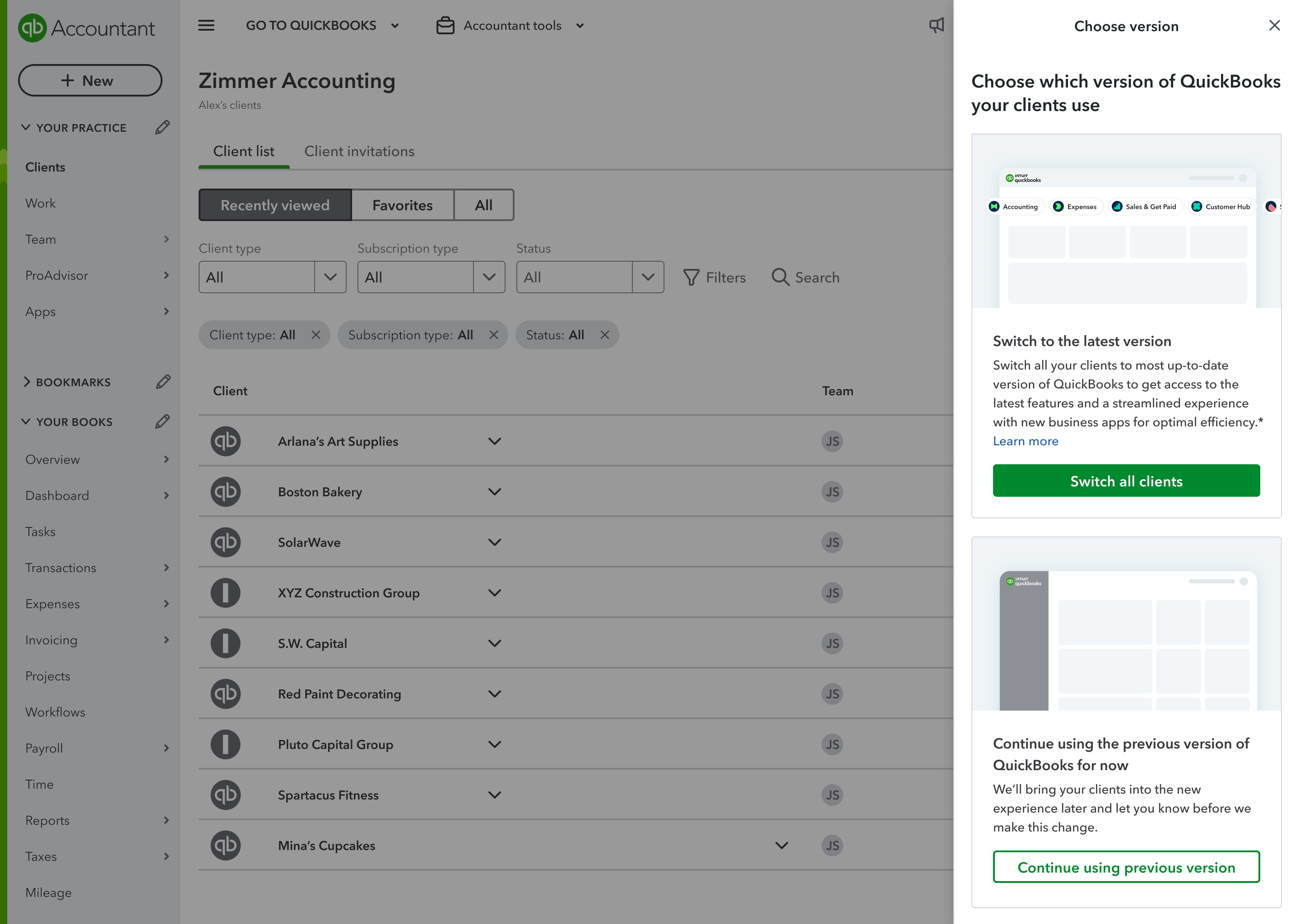

As you may know, you can now opt your clients in or out of this new QuickBooks Online experience, and can do this in bulk by selecting Settings ⚙ and then Choose client version.

Please note that any clients opted out will be moved to the new experience on October 1, 2025, when the classic QuickBooks look and feel becomes unavailable.

In addition, you can now customize your menus to navigate where you need to go faster. This new, accountants-only My menu design puts your most-used bookmarks, actions, and accountant tools at your fingertips. You can click it to see Bookmarks, Create, and Tools. You can add, remove, and reorder your bookmarks from the Bookmarks tab, from My menu, or from the list on the left.

Help us develop a new solution for accountants: Intuit Accountant Suite

In a nutshell: We’ve been building a new platform for accountants, with accountants, and we’re inviting firms like yours to help make Intuit Accountant Suite exactly what you want.

Taking the place of QuickBooks Online Accountant, Intuit Accountant Suite will be an all-in-one, AI-powered platform that helps accountants manage their firm, clients, and team. This refreshed workspace will help firms serve clients while supporting their own growth with tools to boost efficiency, streamline operations, and gain new insights.

Join the Intuit Accountant Suite beta and co-create with us

In September, many accounting firms will have the opportunity to begin using Intuit Accountant Suite. If your firm joins our beta program, you’ll get the chance to try the suite before the general public and share your opinions directly with us.

What’s in the beta

Intuit Accountant Suite will have all the functionality you're currently using in QuickBooks Online Accountant. Here’s a quick peek at some of what’s included in the beta:

- Optimized performance speeds to power your efficiency, regardless of how many clients you have**

- Dashboards personalized to each team members’ role, with widgets that surface important insights and tasks, and reminders to help prioritize their day

- Alerts about disconnected bank feeds and data connection issues as needed, so you’ll know you’re working with the most up-to-date data

We will expand this beta to more firms as we add functionality, to help us validate the best ways to meet your needs. Firms participating in our first beta will get early access to new features as they become available.

What firms should know

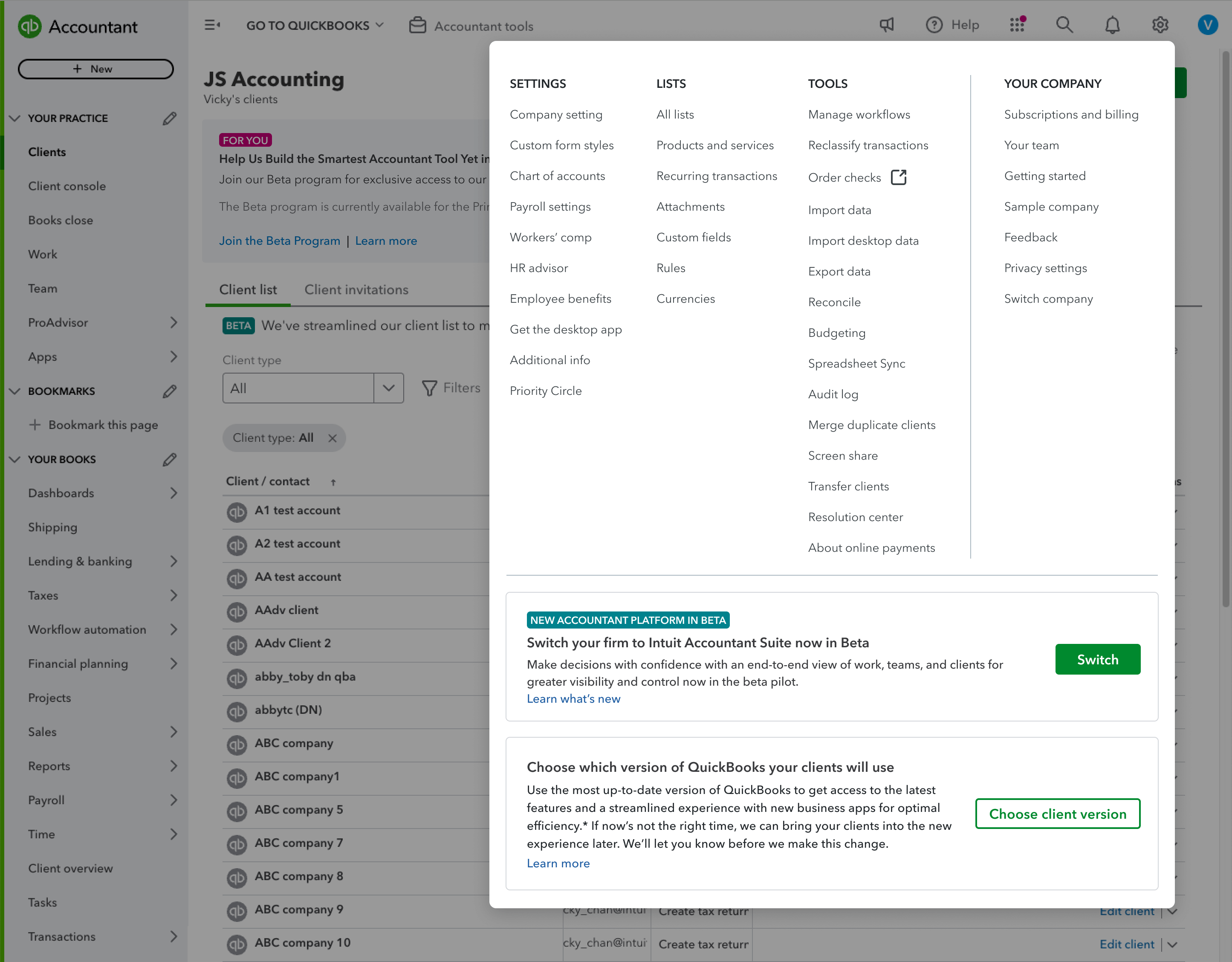

Not all firms will get beta access to Intuit Accountant Suite. Eligibility will be based on a combination of factors, including number of accounts and the addition of other Intuit products. To see if your firm is eligible, check Settings ⚙ in QuickBooks Online Accountant. Admin users at eligible firms will see a message about the Intuit Accountant Suite beta program, along with a button to Switch.

Note: A QuickBooks Online Accountant user must be a primary admin in order to join the Intuit Accountant Suite beta. Primary admins will also be able to switch their firm back to QuickBooks Online Accountant at any time.

Important product information

**Features

Optimized performance speeds: Based on performance of QuickBooks Online Accountant vs. Intuit Accountant Suite with 50 customer files.

In the Know: Solutions Spotlight—troubleshooting, tips, and tricks

In a nutshell: Starting September 25, we’re offering a new virtual event every quarter where ProAdvisors can meet with Intuit Care experts.

In the Know: Solutions Spotlight is a quarterly event bringing accounting and bookkeeping professionals like you together with Intuit Care leaders for an exclusive learning and growth opportunity. You’ll hear directly from Intuit Care Experts about solving complex challenges, optimizing workflows, and unlocking tools you may not have seen before. You will walk away with practical knowledge, new connections, and inspiration to help elevate your firm and career.

In our inaugural event on Thursday, September 25, ProAdvisors can learn:

- Insider tips on building the right foundation for Bill Pay success

- To unlock valuable time with advanced Bill Pay features

- How to effectively resolve vendor non-payment claims, address common processing errors, and more

We hope to see you there!

Important disclaimer information

Intuit (Sponsor ID# 103311) is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website: www.nasbaregistry.org.

Coming soon: QuickBooks Payments self-paced course in ProAdvisor Academy

Starting in September, you can learn how to use QuickBooks Payments to help your clients optimize their cash flow through this new 1.5-hour course in ProAdvisor Academy. In addition to expanding your skillset and accounting services, you’ll also receive 1.5 CPE credits.

With this course on QuickBooks Payments, you’ll learn how to:

- Identify customers who would benefit from QuickBooks Payments

- Recognize different forms of payment, when to use them, and their associated rates

- Guide an application for QuickBooks Payments and help set up an account

- Describe how to issue refunds, deal with declined payments, and manage disputed payments

- Identify which QuickBooks Online reporting features include Payments transactions

Important product and disclaimer information

Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For more information about Intuit Payments' money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/.

Intuit (Sponsor ID# 103311) is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website: www.nasbaregistry.org.

Custom client numbers in QuickBooks Online Accountant

In a nutshell: Now, you can add your firm’s custom client numbers in bulk in QuickBooks Online Accountant.

In 2025, firms began customizing their clients’ numbers in QuickBooks Online Accountant. This improved efficiency and reduces manual work at scale by letting firms track and search for clients, prepare invoices, and track expenses using their own internal client identification system.

This feature has just been enhanced and now allows firms to add and update thousands of client numbers at once by uploading a single CSV file. You’ll find this option in Clients. In addition, to help with billing reconciliation, the client numbers are now included in the CSV file download from Subscriptions and billing.

Bill Pay Basic comes with QuickBooks Online

In a nutshell: QuickBooks Online plans now include QuickBooks Bill Pay Basic for all customers.

Bill Pay Basic is now included with every new sign-up of QuickBooks Online Simple Start, Essentials, Plus, and Advanced. It can also be activated for your clients already using these subscriptions.

Bill Pay Basic can help you:

Automate busywork and say goodbye to manual bill entry. If a client forwards invoices directly to their QuickBooks account, QuickBooks generates pre-filled bills that you can then review, approve, and schedule.

Close clients’ books with confidence. Initiating and tracking payments within QuickBooks means that vendor payments are automatically recorded and matched to transactions, helping reduce reconciliation errors.**

Strengthen your advisory role. Integrating payables gives you real-time cash flow insights you can use to guide clients to smarter business decisions and provide the expert counsel your clients depend on.

For clients with more complex AP processing needs, you may prefer to upgrade to Bill Pay Premium or Bill Pay Elite. In addition, firms using QuickBooks Online Accountant get complimentary access to Bill Pay Elite for their own use.

Note: To activate Bill Pay, your client must submit a short business application.

Important product information

Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For more information about Intuit Payments' money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/.

**Product info

QuickBooks Bill Pay: Subject to eligibility criteria, credit, and application approval prior to first payment. Subscription to QuickBooks Online required. Bill Pay Basic is included with QuickBooks Online when purchased directly from QuickBooks.com or QuickBooks Sales. Not available in U.S. territories or outside the U.S.

**Features

Automatic matching: QuickBooks Online will only match bank withdrawals with transactions processed through QuickBooks Bill Pay. Not all transactions are eligible and accuracy of matches is not guaranteed.

Recommended for you

Get the latest to your inbox

Get the latest product updates and certification news to help you grow your practice.

Thanks for subscribing.

Relevant resources to help start, run, and grow your business.