Building a client advisory services (CAS) offering or perhaps even a CAS practice is top of mind for many of today’s accountants. According to the CPA Practice Advisor, it’s “one of the fastest-growing revenue-generating segments for accounting firms.” It’s also a subject that goes well beyond identifying prospects and implementing a new set of client-centered services.

So far, we’ve talked about why a people-first strategy is important to providing great CAS and the ways in which business strategy drives people strategy.

In my last article, I talked about craft skills—high-level competencies that feed into specific roles. These skills are the building blocks of your firm’s talent, and performance process and career growth for employees. Often, they can be grown through upskilling, particularly when a team member is keen to take on a new role or move up in your firm. But sometimes there’s a gap—a skill or set of skills no one in your current organization can fill. When that happens, the only option is to hire.

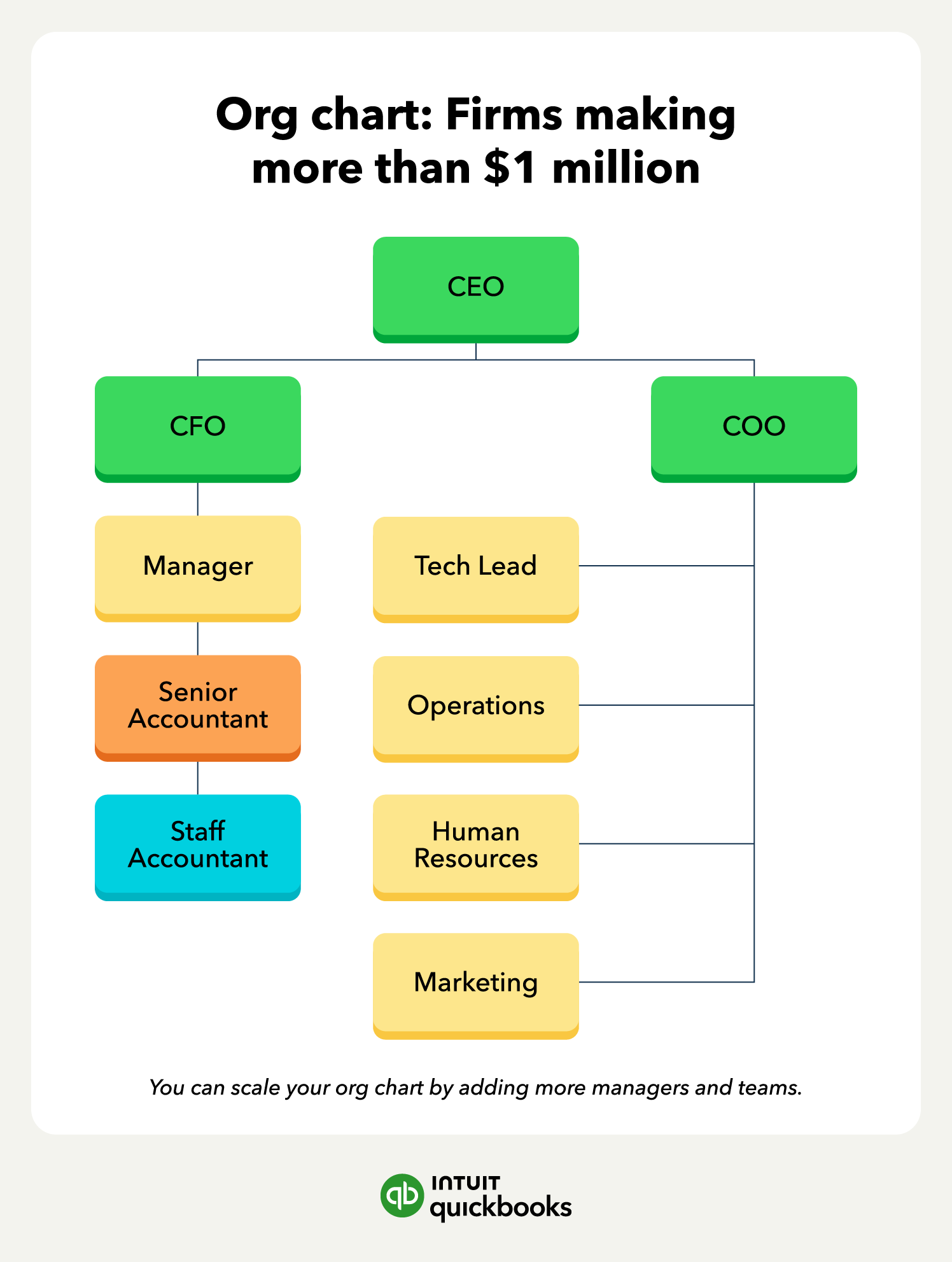

That brings us to the topic of this article: organizational structure. After all, isn’t step one of hiring a new individual knowing where you’ll put them? Getting your people and processes aligned before hiring ensures both a smooth transition and more stability for that new hire you’ve worked so hard to attract.

So before you put out that job req and bring a new team member into the fold, let’s take a moment to self-reflect and consider how a different structure might be more efficient for your firm and—by extension—your CAS offering.